2025 HAPPY Fiyat Tahmini: Dijital Varlık Piyasa Trendlerinin ve Gelecek Perspektiflerinin Analizi

Giriş: HAPPY'nin Piyasa Konumu ve Yatırım Potansiyeli

HappyCat (HAPPY), viral bir kedi videosundan esinlenen bir meme token olarak kripto para sektöründe lansmanından beri büyük ilgi görmektedir. 2025 yılı itibarıyla HAPPY'nin piyasa değeri 3.037.533 ABD Doları'na ulaşmış, yaklaşık 3.333.186.743 adet dolaşımdaki token ile fiyatı 0,0009113 ABD Doları seviyesinde seyretmektedir. "Neşeli Kedi Tokenı" olarak da anılan HAPPY, meme coin ve sosyal token ekosisteminde giderek daha etkin bir rol üstlenmektedir.

Bu makalede, HAPPY'nin 2025-2030 dönemi fiyat hareketleri, tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik koşullar ışığında kapsamlı bir analiz sunulacak; profesyonel fiyat tahminleri ile yatırımcılara yönelik uygulanabilir stratejiler paylaşılacaktır.

I. HAPPY Fiyat Geçmişi ve Güncel Piyasa Durumu

HAPPY'nin Tarihsel Fiyat Gelişimi

- 2024: Proje lansmanı, fiyat 16 Kasım'da 0,04723 ABD Doları ile tüm zamanların en yüksek değerine (ATH) ulaştı

- 2025: Piyasa gerilemesi, fiyat 7 Nisan'da 0,000377 ABD Doları ile tüm zamanların en düşük değerine (ATL) indi

HAPPY Güncel Piyasa Durumu

14 Ekim 2025 tarihi itibarıyla HAPPY, 0,0009113 ABD Doları fiyatından işlem görüyor ve 24 saatlik işlem hacmi 43.703,51 ABD Doları. Son 24 saatte token %0,97 düşüş gösterdi. Piyasa değeri 3.037.533,08 ABD Doları ve genel kripto piyasasında 2.087. sırada bulunuyor. Dolaşımdaki HAPPY sayısı 3.333.186.743 olup, bu miktar aynı zamanda toplam ve maksimum arzı ifade ediyor. HAPPY, tüm zamanların en yüksek değerinin %98,07 altında ve en düşük seviyesinin %141,72 üzerinde. Token, son bir hafta %25,6 ve son bir ayda %38,15 oranında değer kaybı ile farklı zaman dilimlerinde negatif eğilim sergiledi. Mevcut piyasa hissiyatı, 38 VIX ile korku olarak öne çıkıyor.

Güncel HAPPY piyasa fiyatını görmek için tıklayın

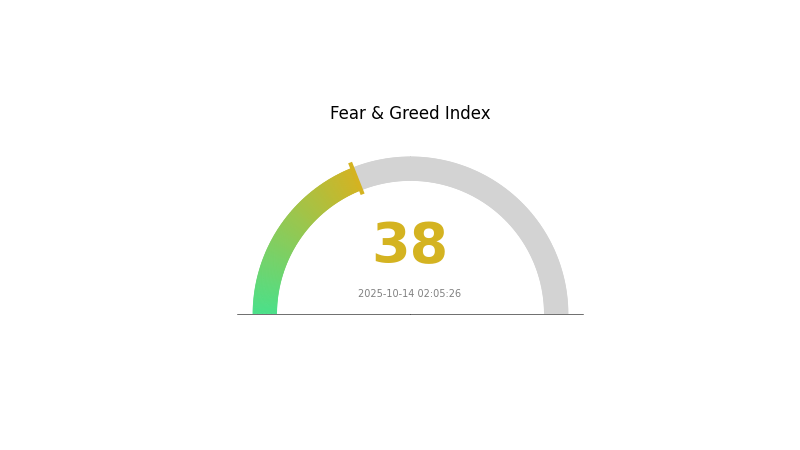

HAPPY Piyasa Hissiyatı Göstergesi

14 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasası şu anda korku halinde; Korku ve Açgözlülük Endeksi 38 seviyesinde. Bu, yatırımcıların temkinli yaklaştığını ve piyasa belirsizliğinin hakim olduğunu gösteriyor. Böyle dönemlerde, bazı yatırımcılar "başkaları açgözlü olduğunda kork, başkaları korktuğunda açgözlü ol" yaklaşımını benimseyerek alım fırsatı görse de, yatırım kararı öncesi detaylı araştırma yapmak ve kendi risk toleransınızı göz önünde bulundurmak önemlidir. Gate.com'da güncel kalın, akıllı işlem gerçekleştirin.

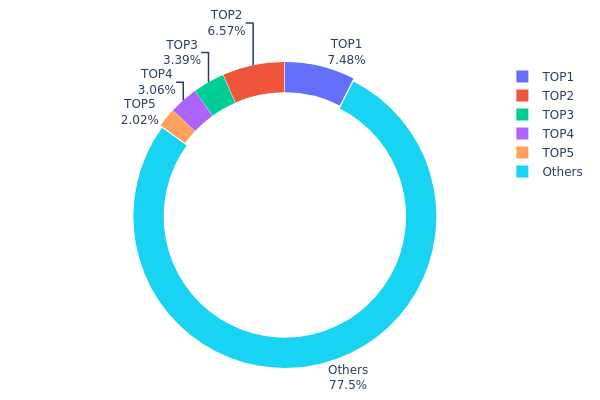

HAPPY Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, HAPPY tokenlarının farklı cüzdanlar arasında nasıl paylaşıldığını gösterir. Analiz, orta derecede yoğunlaşmış bir dağılım yapısına işaret ediyor. İlk 5 adres toplam arzın %22,5'ini elinde bulunduruyor; en büyük sahip %7,47 oranında paya sahip. Bu seviye, hiçbir adresin arzın çoğunluğunu kontrol etmediği dengeli bir dağılıma işaret ediyor.

Üst seviye sahipler kayda değer paya sahip olsa da, HAPPY tokenlarının %77,5'inin diğer adreslerde bulunması, geniş bir dağıtım ve yaygın sahiplik yapısı anlamına geliyor. Bu yapı, tek bir varlığın piyasada büyük çaplı fiyat manipülasyonu riskini azaltarak istikrar sağlayabilir. Yine de, üst seviye sahiplerin koordineli hareketleri piyasa dinamiklerini etkileyebilir.

Adres dağılımı, HAPPY için orta düzeyde merkeziyetsizlik göstermekte. Bu, karar alma gücünün dağıtılmasına ve ekosistemde bireysel büyük sahiplerin etkisinin azalmasına katkı sağlıyor. Ancak, sahiplik yoğunluğundaki değişimleri izlemek, piyasanın davranışı ve uzun vadeli istikrarı için kritik öneme sahiptir.

Güncel HAPPY Varlık Dağılımı için tıklayın

| Sıra | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 2Ejnns...z2Ps3e | 249.295,80K | 7,47% |

| 2 | 5Q544f...pge4j1 | 219.051,81K | 6,57% |

| 3 | u6PJ8D...ynXq2w | 113.114,92K | 3,39% |

| 4 | CXejtJ...zoEVtH | 101.964,00K | 3,05% |

| 5 | ASTyfS...g7iaJZ | 67.388,48K | 2,02% |

| - | Diğerleri | 2.582.060,15K | 77,5% |

II. HAPPY'nin Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Sabit Arz: HAPPY'nin maksimum arzı sabittir; bu kıtlık yaratır ve fiyatın uzun vadeli değerlenmesini destekleyebilir.

- Tarihsel Eğilim: Geçmiş yarılanma süreçlerinde, arz enflasyonunun azalması nedeniyle fiyat artışları gözlemlenmiştir.

- Güncel Etki: Yaklaşan yarılanmanın, yeni arzın azalmasıyla fiyatları yukarı itmesi bekleniyor.

Kurumsal ve Büyük Yatırımcı Etkileri

- Kurumsal Varlıklar: Büyük kurumlar HAPPY varlıklarını artırıyor; bu, varlığa yönelik güvenin güçlendiğini gösteriyor.

- Kurumsal Benimseme: Birçok Fortune 500 şirketi, HAPPY'yi değer saklama aracı olarak bilançosunda bulunduruyor.

Makroekonomik Ortam

- Parasal Politika Etkisi: Merkez bankalarının gevşek para politikası uygulamaları, yatırımcıların alternatif varlık olarak HAPPY'ye yönelmesini tetikleyebilir.

- Enflasyona Karşı Koruma: HAPPY, yüksek enflasyon dönemlerinde yatırımcıların ilgisini çekerek potansiyel bir enflasyon koruması sunuyor.

- Jeopolitik Faktörler: Küresel ekonomik belirsizlikler, HAPPY'nin merkeziyetsiz varlık olarak çekiciliğini artırabilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Lightning Network Genişlemesi: Lightning Network'ün büyümesi, HAPPY'nin ölçeklenebilirliğini ve işlem hızını artırıyor.

- Ekosistem Uygulamaları: HAPPY tabanlı DeFi protokolleri ve NFT platformları yaygınlaşıyor, bu da kullanım alanı ve talebi artırıyor.

III. 2025-2030 HAPPY Fiyat Tahmini

2025 Öngörüsü

- Temkinli tahmin: 0,00071 - 0,00091 ABD Doları

- Nötr tahmin: 0,00091 - 0,00108 ABD Doları

- İyimser tahmin: 0,00108 - 0,00126 ABD Doları (olumlu piyasa şartlarına bağlı)

2027 Orta Vadeli Öngörü

- Piyasa aşaması beklentisi: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,00081 - 0,00129 ABD Doları

- 2028: 0,00118 - 0,00180 ABD Doları

- Başlıca katalizörler: Artan benimseme ve piyasanın olgunlaşması

2030 Uzun Vadeli Öngörü

- Temel senaryo: 0,00152 - 0,00182 ABD Doları (istikrarlı piyasa büyümesi varsayılırsa)

- İyimser senaryo: 0,00182 - 0,00200 ABD Doları (güçlü ekosistem gelişimiyle)

- Dönüştürücü senaryo: 0,00200 - 0,00218 ABD Doları (çığır açan uygulama ve yaygın benimsemeyle)

- 2030-12-31: HAPPY 0,00218 ABD Doları (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Artış Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,00126 | 0,00091 | 0,00071 | 0 |

| 2026 | 0,00129 | 0,00108 | 0,00065 | 19 |

| 2027 | 0,00129 | 0,00119 | 0,00081 | 30 |

| 2028 | 0,00180 | 0,00124 | 0,00118 | 36 |

| 2029 | 0,00211 | 0,00152 | 0,00084 | 66 |

| 2030 | 0,00218 | 0,00182 | 0,00093 | 99 |

IV. HAPPY Yatırım Stratejisi ve Risk Yönetimi

HAPPY Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Uzun vadeli yatırımcılar ve meme coin meraklıları

- Uygulama önerileri:

- Fiyat düşüşlerinde HAPPY biriktirin

- Proje gelişmeleri ve topluluk büyümesini takip edin

- Tokenlarınızı Solana uyumlu güvenli cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını tespit etmek için

- RSI: Aşırı alım/aşırı satım durumlarını değerlendirmek için

- Kısa vadeli al-sat için önemli noktalar:

- Sosyal medya hissiyatı ve viral eğilimleri izleyin

- Sıkı stop-loss ve kar alma seviyeleri belirleyin

HAPPY Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyün %1-2’si

- Agresif yatırımcılar: Portföyün %3-5’i

- Profesyonel yatırımcılar: Portföyün %5-10’u

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımı birden fazla meme coin ve kripto varlık arasında bölün

- Stop-loss emirleri: Olası kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate web3 cüzdanı

- Soğuk saklama: Solana destekli donanım cüzdanı

- Güvenlik: İki faktörlü kimlik doğrulamayı etkinleştirin ve güçlü, özgün şifreler kullanın

V. HAPPY İçin Olası Riskler ve Zorluklar

HAPPY Piyasa Riskleri

- Yüksek oynaklık: Meme coinler aşırı fiyat dalgalanmalarıyla bilinir

- Spekülatif yapı: Fiyatlar çoğunlukla hissiyat ile şekillenir

- Piyasa doygunluğu: Meme coin sektöründe artan rekabet

HAPPY Düzenleyici Riskler

- Meme coinlere yönelik olası düzenleyici baskılar

- Çeşitli ülkelerde belirsiz yasal statü

- Alım-satım platformlarında olası kısıtlamalar

HAPPY Teknik Riskler

- Solana blokzincirinde akıllı kontrat açıkları

- Ağ tıkanıklığı nedeniyle işlem hızında düşüş

- Proje terk edilmesi veya "rug pull" riski

VI. Sonuç ve Eylem Önerileri

HAPPY Yatırım Potansiyeli Değerlendirmesi

HAPPY, meme coin piyasasında yüksek riskli ve yüksek getiri olasılığı sunan bir varlıktır. Kısa vadede önemli kazançlar mümkün olmakla birlikte, uzun vadeli değer potansiyeli spekülatif yapısı ve sosyal medya trendlerine bağımlılığı nedeniyle belirsizdir.

HAPPY Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Portföyün küçük bir kısmıyla sınırlı kalın, bilgiye odaklanın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle kısa vadeli işlem fırsatlarını değerlendirin ✅ Kurumsal yatırımcılar: Dikkatli yaklaşın, meme coin sepetinde yer verilebilir

HAPPY Alım-Satım Yöntemleri

- Spot alım-satım: Gate.com üzerinden HAPPY alıp satın

- Sosyal alım-satım: Gate.com'da başarılı HAPPY yatırımcılarını takip edin ve işlemlerini kopyalayın

- DCA stratejisi: Zaman içinde ortalama giriş fiyatı için düzenli alım planı oluşturun

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk toleransları doğrultusunda karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

2025 için kripto fiyat tahmini nedir?

Mevcut piyasa trendleri ve uzman değerlendirmelerine göre, kripto piyasasının 2025'e kadar önemli büyüme kaydetmesi ve birçok büyük kripto varlığının yeni rekor seviyelere ulaşması bekleniyor.

En yüksek fiyat tahmini hangi kripto parada?

Bitcoin (BTC), genellikle en yüksek gelecek fiyat potansiyeline sahip kripto varlık olarak öne çıkıyor; bazı analistler 2030 yılı için altı haneli seviyeleri öngörüyor.

Pepe'nin 2025 fiyat tahmini nedir?

Mevcut piyasa trendleri ve uzman analizlerine göre, Pepe'nin fiyatının 2025'te 0,0000150 ABD Doları seviyesine çıkması ve meme coin piyasasında önemli büyüme göstermesi bekleniyor.

En doğru kripto tahmin aracı hangisidir?

Piyasa trendlerini, hissiyat analizini ve tarihsel verileri bir arada kullanan yapay zeka destekli makine öğrenimi ve büyük veri analiz modelleri, günümüzde en isabetli kripto tahmin araçları olarak öne çıkmaktadır.

2025 SPX Fiyat Tahmini: S&P 500’ü Yeni Zirvelere Taşıyabilecek Temel Faktörler

2025 PUFF Fiyat Tahmini: Kripto Para Yatırımcılarına Yönelik Stratejik Piyasa Analizi ve Öngörü

2025 GOHOME Fiyat Tahmini: Küresel Gayrimenkul Yatırım Trendlerine Yönelik Piyasa Analizi ve Gelecek Öngörüsü

2025 GIGGLE Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 REKTCOIN Fiyat Tahmini: Kripto Vahşi Batısı’nda Dalgalanmayı Yönetmek

2025 SPX Fiyat Tahmini: Boğa Koşusu mu, Ayı Piyasası mı? Uzmanlar S&P 500'ün Geleceğine Dair Görüşlerini Paylaşıyor

Cysic: AI ve Dağıtık Hesaplama için Sıfır Bilgi Altyapı Platformu

ABD Bankacılık Düzenleyicisi OCC, ulusal bankaların kripto para ticareti yapmasını kolaylaştırıyor

ASTER Spot İşlem Rehberi: Anlık Fiyat Analizi ve İşlem Hacmi Bilgileri

Cantor Equity ile birleşmenin ardından Twenty One Capital Bitcoin hissesi yüzde 25 değer kaybetti

Dropee Günlük Kombinasyonu 10 Aralık 2025