2025 LOT Fiyat Tahmini: Blockchain Oyun Tokenlerinin Geleceğinde Yol Haritası

Giriş: LOT’un Piyasadaki Konumu ve Yatırım Potansiyeli

League of Traders (LOT), Güney Kore’nin önde gelen sosyal alım-satım platformu olarak, kurulduğu günden bu yana kripto alım-satım deneyimini oyunlaştırıyor. 2025 yılı itibarıyla LOT’un piyasa değeri 2.752.500 $’a ulaşmış, yaklaşık 150.000.000 dolaşımdaki token ile fiyatı 0,01835 $ seviyesinde seyretmektedir. “Oyunlaştırılmış alım-satım token’ı” olarak bilinen LOT, sosyal alım-satım ve kripto eğitiminde giderek daha merkezi bir rol üstleniyor.

Bu makale, LOT’un 2025-2030 dönemindeki fiyat eğilimlerini kapsamlı şekilde analiz ederek, geçmiş fiyat hareketleri, arz-talep dengesi, ekosistem gelişimi ve makroekonomik dinamikler ışığında profesyonel fiyat tahminleri ve yatırım stratejileri sunacaktır.

I. LOT Fiyat Geçmişi ve Güncel Piyasa Durumu

LOT Geçmiş Fiyat Seyri

- Haziran 2025: LOT, 0,04947 $ ile tüm zamanların en yüksek fiyatına ulaşarak proje için önemli bir eşik atladı

- Ekim 2025: Fiyat, sert bir düşüşle 0,01614 $ ile en düşük seviyesini gördü

- 14 Ekim 2025: LOT fiyatı toparlanma göstererek şu anda 0,01835 $ seviyesinden işlem görüyor

LOT Güncel Piyasa Görünümü

14 Ekim 2025 itibarıyla LOT, 0,01835 $ seviyesinden işlem görmekte ve 24 saatlik işlem hacmi 16.081,22 $’dır. Son 24 saatte fiyat %0,32 gerilemiştir. LOT’un piyasa değeri 2.752.500 $ olup, genel kripto para sıralamasında 2.160. sıradadır.

Güncel fiyat, zirvesinden %62,91 daha düşük, dip seviyesinden ise %13,69 daha yüksek noktadadır. LOT, son bir haftada %5,08 düşerken, son 30 günde %8,86 yükselmiştir. Yıl başından bu yana ise %18,99 değer kazanmıştır.

Dolaşımdaki LOT miktarı 150.000.000, toplam token arzı ise 1.000.000.000’dur ve dolaşım oranı %15’tir. Tam seyreltilmiş piyasa değeri 18.350.000 $’dır.

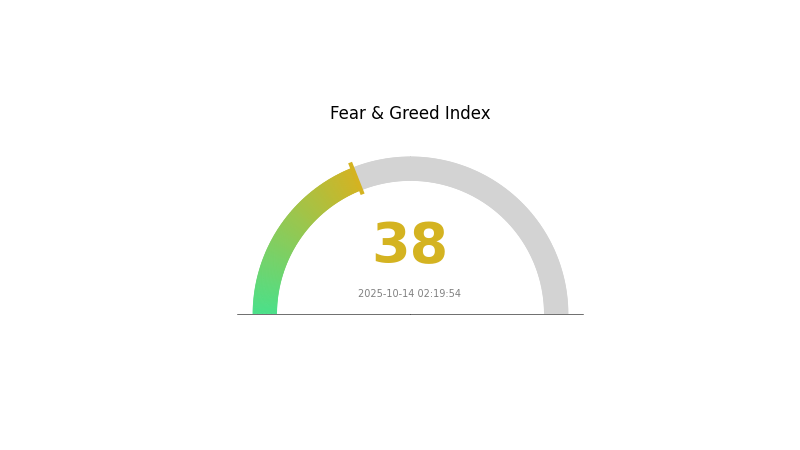

Piyasa duyarlılığı LOT için temkinli olup, Korku ve Açgözlülük Endeksi’nin 38 seviyesinde olması genel kripto piyasasında “korku” havasının hâkim olduğunu göstermektedir.

Güncel LOT piyasa fiyatını görüntüleyin

LOT Piyasa Duyarlılık Göstergesi

14 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Kripto piyasasında duyarlılık hâlâ temkinli; 38 seviyesindeki endeks piyasada belirgin bir korku olduğunu gösteriyor. Bu, yatırımcıların riskten kaçındığını ve kararsız hareket ettiğini, dolayısıyla karşıt strateji uygulayanlar için fırsat doğabileceğini işaret ediyor. Ancak, belirsizlik ortamında kapsamlı analiz yapmak ve riskleri dikkatli yönetmek şart. Piyasa duyarlılığının hızla değişebileceğini unutmayın; sürekli bilgi sahibi olun ve stratejinizi güncelleyin.

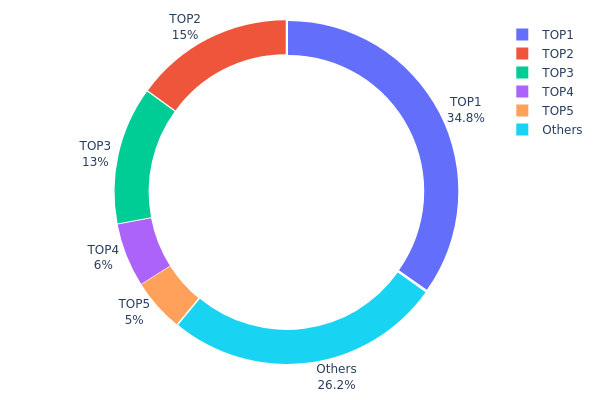

LOT Varlık Dağılımı

Adres bazlı varlık dağılımı, LOT token’larının sahiplik yoğunluğunu gösterir. Analiz, belirgin bir yoğunlaşma olduğunu ortaya koyuyor. En büyük adres, toplam arzın %34,83’ünü, ilk 5 adres ise %73,83’ünü elinde tutuyor.

Böyle bir yoğunlaşma, piyasa merkezileşmesi ve olası fiyat manipülasyonu riskini artırıyor. Bu büyük sahiplerin hareketleri, piyasada ani dalgalanmalara yol açabilir. Ayrıca, bu durum LOT ekosisteminin merkeziyetsizliğini zayıflatabilir ve ağ yönetişimi ile güvenliğini etkileyebilir.

Bununla birlikte, token’ların %26,17’si diğer adreslerde; bu da çeşitlilik sağlar. LOT’un zincir üzerindeki yapısı birkaç büyük sahip tarafından domine edilse de, küçük yatırımcıların elindeki varlıklar uzun vadeli istikrar ve daha geniş katılım açısından olumlu bir sinyal sunmaktadır.

| En Büyük | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0x4a4d...b16f36 | 348.333,33K | 34,83% |

| 2 | 0x96ec...547c29 | 150.000,00K | 15,00% |

| 3 | 0x608d...5e911b | 130.000,00K | 13,00% |

| 4 | 0xe6bc...25c740 | 60.000,00K | 6,00% |

| 5 | 0x4498...1c7759 | 50.000,00K | 5,00% |

| - | Diğerleri | 261.666,67K | 26,17% |

II. LOT’un Gelecek Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Geçmiş Seyir: Önceki fiyat hareketleri, ilerideki fiyat trendlerinde belirli bir etkiye sahiptir.

- Güncel Etki: Piyasa kapasitesinin büyümesi ve karbon nötr hedefleri, gelecek piyasa gelişimini şekillendirebilir.

Makroekonomik Ortam

- Jeopolitik Faktörler: Özellikle G10 veya OPEC ülkelerinin liderlerinin kararları fiyatlar üzerinde belirleyici olabilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Teknik Analiz: Geçmiş fiyat, hacim ve grafik modellerine dayalı olarak gelecek fiyat trendlerini öngörmek için kullanılır.

- Temel Analiz: Varlık değerini analiz etmek için finansal raporlar ve ekonomik göstergeler incelenir.

- Piyasa Duyarlılığı: Bitcoin fiyatının çekim gücü de dahil olmak üzere, duyarlılıktaki değişimler varlık yönetimi stratejilerini etkileyebilir.

III. LOT 2025-2030 Fiyat Tahminleri

2025 Öngörüsü

- Temkinli tahmin: 0,01548 $ - 0,01821 $

- Tarafsız tahmin: 0,01821 $ - 0,02030 $

- İyimser tahmin: 0,02030 $ - 0,0224 $ (olumlu piyasa şartları gerektirir)

2027-2028 Öngörüsü

- Piyasa aşaması beklentisi: Büyüme evresine geçiş potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,01438 $ - 0,02803 $

- 2028: 0,02496 $ - 0,03561 $

- Başlıca tetikleyiciler: Artan kullanım ve teknolojik yenilikler

2030 Uzun Vadeli Öngörü

- Temel senaryo: 0,02600 $ - 0,03435 $ (istikrarlı piyasa büyümesi ile)

- İyimser senaryo: 0,03435 $ - 0,04637 $ (güçlü piyasa performansı ile)

- Dönüştürücü senaryo: 0,04637 $ üzerinde (aşırı olumlu piyasa koşulları ile)

- 31 Aralık 2030: LOT 0,04637 $ (olası yeni rekor seviyeler)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,0224 | 0,01821 | 0,01548 | 0 |

| 2026 | 0,02761 | 0,0203 | 0,01279 | 10 |

| 2027 | 0,02803 | 0,02396 | 0,01438 | 30 |

| 2028 | 0,03561 | 0,026 | 0,02496 | 41 |

| 2029 | 0,03789 | 0,0308 | 0,01817 | 67 |

| 2030 | 0,04637 | 0,03435 | 0,01992 | 87 |

IV. LOT Yatırımı İçin Profesyonel Stratejiler ve Risk Yönetimi

LOT Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Yüksek risk toleranslı uzun vadeli yatırımcılar

- Uygulama önerileri:

- Piyasa gerilemelerinde LOT biriktirin

- Fiyat hedefleri koyup plana bağlı kalın

- Token’ları yedekli, güvenli cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve giriş/çıkış noktalarını belirleme

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım noktalarını saptama

- Dalgalı işlem için önemli noktalar:

- Fiyat hareketinin teyidi için hacmi takip edin

- Risk yönetimi için zarar-durdur emirleri kullanın

LOT Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Esasları

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Agresif yatırımcı: Kripto portföyünün %5-10’u

- Profesyonel yatırımcı: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı farklı kripto paralara bölün

- Zarar-durdur: LOT pozisyonlarınızda kayıpları sınırlayın

(3) Güvenli Saklama Alternatifleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki aşamalı doğrulama ve güçlü şifre kullanımı

V. LOT İçin Potansiyel Riskler ve Zorluklar

LOT Piyasa Riskleri

- Yüksek oynaklık: Fiyat dalgalanmaları belirgin olabilir

- Sınırlı likidite: Büyük işlemlerde likidite sıkıntısı yaşanabilir

- Piyasa duyarlılığı: Genel kripto trendlerinden etkilenir

LOT Düzenleyici Riskler

- Belirsiz düzenleme ortamı: Sosyal alım-satım platformlarını etkileyebilecek yeni mevzuat ihtimali

- Sınır ötesi uyum: Farklı ülkelerde faaliyette zorluklar

- KYC/AML gereksinimleri: Platform kullanımını zorlaştırabilir

LOT Teknik Riskler

- Akıllı kontrat açıkları: Token sözleşmesinde hata veya istismar riski

- Platform güvenliği: League of Traders platformunda siber saldırı veya veri sızıntısı tehdidi

- Ölçeklenebilirlik sorunları: Artan kullanıcı yoğunluğunda teknik zorluklar

VI. Sonuç ve Eylem Önerileri

LOT Yatırım Potansiyeli Değerlendirmesi

LOT, sosyal alım-satım alanında kendine özgü bir fırsat sunuyor ve güçlü yatırımcı desteğine sahip. Ancak, kısa vadede yüksek oynaklık ve mevzuat belirsizliği ile karşı karşıya.

LOT Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlar ile başlayın ve platformu öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Portföyünüzün bir kısmını ayırmayı düşünün, risk yönetimini uygulayın ✅ Kurumsal yatırımcılar: Detaylı inceleme yapın; büyük pozisyon için riskten korunma stratejilerini değerlendirin

LOT Alım-Satım Yöntemleri

- Spot işlemler: Gate.com’da LOT token alım-satımı

- Stake etme: Pasif gelir için mevcut stake programlarına katılım

- Sosyal alım-satım: League of Traders platformunda token kullanımını maksimize etmek

Kripto para yatırımları son derece yüksek risk taşır. Bu makale yatırım tavsiyesi değildir. Yatırımlarınızı kendi risk toleransınıza göre dikkatle yönetin. Profesyonel finans danışmanına danışmanız önerilir. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

IOT için 2025 Fiyat Tahmini Nedir?

Mevcut trendler ışığında, IOT hissesi için 2025’te 22,13 $ ile 41,65 $ aralığında fiyat ve kayda değer büyüme potansiyeli öngörülmektedir.

En Yüksek Fiyat Tahmini Hangi Kriptoda?

2025’te piyasa analizleriyle Bitcoin’in kripto paralar arasında en yüksek fiyat beklentisine sahip olduğu öngörülüyor.

Tahmini Fiyat Nedir?

Tahmini fiyat, kripto paralar ve diğer varlıklarda olası gelirleri öngörmek ve fiyat risklerini değerlendirmek amacıyla yapılan gelecek piyasa fiyatı tahminidir.

2025’te Kriptoların Fiyat Tahmini Nedir?

Bitcoin için 60.000 $, Ethereum için 3.000 $ ve Solana için 100 $ seviyeleri bekleniyor. Bu tahminler, başlıca kripto paralarda kayda değer büyüme potansiyeline işaret ediyor.

HBAR'ın AUD Fiyat Performansı

2025 XLM Fiyat Tahmini: Olgunlaşan Kripto Ekosisteminde Stellar Lumens’in Potansiyel Büyüme Yolu

2025 TRX Fiyat Tahmini: TRON’un Yerel Kripto Parası İçin Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

2025 AIC Fiyat Tahmini: Gelişen Dijital Varlık Ekosisteminde Piyasa Trendleri ile Teknolojik Yeniliklerde Yön Bulma

2025 PORTAL Fiyat Tahmini: Yenilikçi Cross-Chain Protokolünün Piyasa Analizi ve Gelecek Büyüme Potansiyeli

2025 VIRTUAL Fiyat Tahmini: Dijital varlık için piyasa trendleri ve potansiyel büyüme faktörlerinin analizi

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması