2025 M Price Prediction: Analyzing Market Trends and Factors Shaping BMW's Luxury Sedan Pricing

Introduction: M's Market Position and Investment Value

MemeCore (M), as the first Layer 1 blockchain built for the Meme 2.0 era, has achieved significant recognition since its inception. As of 2025, MemeCore's market capitalization has reached $3.29 billion, with a circulating supply of approximately 1.68 billion tokens, and a price hovering around $1.96. This asset, dubbed the "viral economy pioneer," is playing an increasingly crucial role in transforming meme coins into sustainable cultural and economic assets.

This article will comprehensively analyze MemeCore's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. M Price History Review and Current Market Status

M Historical Price Evolution Trajectory

- 2025: MemeCore launched as the first Layer 1 blockchain for Meme 2.0, price reached an all-time high of $2.9647 on September 18

- 2025: Market correction, price dropped to an all-time low of $1.5569 on September 29

- 2025: Gradual recovery and stabilization, price fluctuating between $1.9 and $2.2

M Current Market Situation

As of October 15, 2025, MemeCore (M) is trading at $1.9615, experiencing a 3.12% decrease in the last 24 hours. The token's market capitalization stands at $3,289,977,297, ranking it 42nd in the overall cryptocurrency market. M's trading volume in the past 24 hours reached $579,429, indicating moderate market activity.

The current price represents a significant drop from its all-time high of $2.9647, achieved less than a month ago. However, it's still well above its all-time low of $1.5569. The token's performance over different time frames shows mixed results, with a 2.56% decrease in the last hour, a 5.12% decline over the past week, and a more substantial 20.58% drop in the last 30 days.

Despite recent short-term declines, M has shown remarkable long-term growth, with a staggering 2,767.74% increase over the past year. This suggests strong overall performance since its inception, despite recent market volatility.

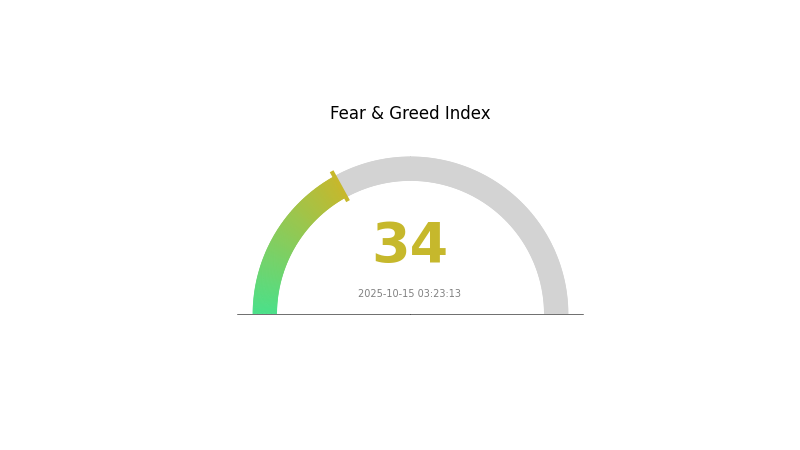

The current market sentiment for cryptocurrencies is cautious, with the VIX index at 34, indicating a "Fear" state in the market. This general market fear may be contributing to the recent price pressure on M.

Click to view the current M market price

Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment is currently in the "Fear" zone, indicating a cautious mood among investors. This fear-driven environment often presents potential buying opportunities for long-term investors. However, it's crucial to conduct thorough research and exercise caution before making any investment decisions. Remember, market sentiment can shift rapidly, and it's essential to consider multiple factors beyond just the Fear and Greed Index when evaluating market conditions.

M Holdings Distribution

The address holdings distribution chart provides valuable insights into the concentration of M token ownership. Based on the current data, we observe a notable absence of significant token holders, suggesting a highly decentralized distribution pattern for M. This lack of large individual stakeholders indicates a reduced risk of market manipulation or sudden price fluctuations caused by single-entity actions.

The even distribution of M tokens across numerous addresses contributes to a more stable market structure. It implies a diverse user base and potentially broader adoption, which can lead to more organic price movements driven by genuine supply and demand dynamics rather than the actions of a few large holders. This decentralized ownership structure also enhances the overall resilience of the M ecosystem, making it less susceptible to coordinated market actions or undue influence from whale accounts.

Click to view the current M holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing M's Future Price

Macroeconomic Environment

- Impact of Monetary Policy: Major central banks' interest rate paths are expected to be a critical variable in the short term.

- Inflation Hedging Properties: Gold has shown strength as an inflation hedge, with its price rising as inflation expectations increase.

- Geopolitical Factors: Geopolitical risks and their evolution will be a key variable affecting M's price.

Technical Development and Ecosystem Building

- ETF Inflows: Gold ETFs have become an increasingly important source of demand, with inflows reaching record levels in recent periods.

- Central Bank Purchases: Central banks are expected to continue significant gold purchases, with estimates of around 900 tons for 2025.

III. M Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $1.28 - $1.50

- Neutral prediction: $1.80 - $2.00

- Optimistic prediction: $2.20 - $2.25 (requires favorable market conditions)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $1.70 - $2.87

- 2027: $2.21 - $3.36

- Key catalysts: Increasing adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $3.50 - $4.50 (assuming steady market growth)

- Optimistic scenario: $4.50 - $5.00 (assuming strong market performance)

- Transformative scenario: $5.50 - $5.71 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: M $4.08 (potential year-end price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.2458 | 1.97 | 1.2805 | 0 |

| 2026 | 2.86674 | 2.1079 | 1.7074 | 7 |

| 2027 | 3.35788 | 2.48732 | 2.21372 | 26 |

| 2028 | 3.65325 | 2.9226 | 1.81201 | 48 |

| 2029 | 4.86613 | 3.28793 | 2.6961 | 67 |

| 2030 | 5.70784 | 4.07703 | 2.81315 | 107 |

IV. Professional Investment Strategies and Risk Management for M

M Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors and blockchain technology enthusiasts

- Operational suggestions:

- Accumulate M tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Trade with the overall market trend

- Set stop-loss orders to manage risk

M Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use two-factor authentication, regular security audits

V. Potential Risks and Challenges for M

M Market Risks

- High volatility: Meme coins are subject to rapid price swings

- Market sentiment shifts: Changes in social media trends can impact value

- Competition: New meme coins may dilute market share

M Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny of meme coins

- Cross-border restrictions: Varying regulations across jurisdictions

- Tax implications: Evolving tax policies for crypto assets

M Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: High transaction volumes may lead to delays

- Scalability challenges: Limitations in transaction processing capacity

VI. Conclusion and Action Recommendations

M Investment Value Assessment

MemeCore (M) presents a unique proposition in the evolving meme coin landscape, offering potential long-term value through its innovative viral economy model. However, short-term volatility and regulatory uncertainties pose significant risks.

M Investment Recommendations

✅ Beginners: Allocate a small portion (1-2%) of crypto portfolio, focus on education ✅ Experienced investors: Consider 3-5% allocation, actively manage positions ✅ Institutional investors: Evaluate for 5-10% allocation in high-risk crypto portfolio

M Trading Participation Methods

- Spot trading: Direct purchase and sale of M tokens on Gate.com

- Futures trading: Access to leveraged positions through Gate.com's perpetual contracts

- Staking: Participate in potential yield-generating opportunities if available

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the forecast for M stock?

Analysts predict a Hold rating for M stock. The price has recently decreased, but future performance may vary. Consult latest market reports for specifics.

What is the 12 month forecast for Moderna stock?

Based on recent projections, the 12-month forecast for Moderna stock averages $206.72, with estimates ranging from $100 to $270.

Is Macy's a good stock to buy right now?

Yes, Macy's stock appears to be a good buy. It's rated a Strong Buy with an A Value grade, suggesting it's undervalued with potential for growth.

What is the price target for M&M in 2026?

Based on analyst forecasts, the price target for M&M in 2026 is expected to range between 3,030 INR and 4,000 INR, with an average target of 3,663.89 INR.

Share

Content