2025 NUTS Fiyat Tahmini: Küresel Arz Sıkıntıları ve Piyasa Dalgalanmaları Belirsizliği Artırıyor

Giriş: NUTS Piyasa Konumu ve Yatırım Değeri

Thetanuts Finance (NUTS), altcoin opsiyonlarına odaklanan merkeziyetsiz bir zincir üstü opsiyon protokolü olarak, 2021’den bu yana ciddi bir gelişim kaydetmiştir. 2025 yılı itibarıyla NUTS’un piyasa değeri 3.600.743 $’dır; dolaşımdaki arzı yaklaşık 2.314.102.216 adet olup fiyatı 0,001556 $ civarındadır. “Niş opsiyon ticareti çözümü” olarak anılan bu varlık, merkeziyetsiz finans (DeFi) ve kripto türev piyasalarında giderek daha kritik bir rol üstlenmektedir.

Bu makalede, 2025’ten 2030’a dek NUTS fiyat eğilimleri; tarihsel desenler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında analiz edilerek, yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. NUTS Fiyat Geçmişi ve Güncel Piyasa Durumu

NUTS Tarihsel Fiyat Seyri

- 2024: Tüm zamanların en yüksek seviyesi, fiyat 0,0442 $’a ulaştı

- 2025: Piyasa düşüşü, fiyat 0,001287 $ ile en düşük seviyeyi gördü

NUTS Güncel Piyasa Görünümü

13 Ekim 2025’te NUTS, 0,001556 $ seviyesinden işlem görmektedir. Son 24 saatte %0,19’luk hafif bir toparlanma kaydedilmiş, işlem hacmi ise 63.993,38 $ olmuştur. Ancak, NUTS son bir haftada %3,23 değer kaybetmiş ve son bir yılda %32,6 gibi ciddi bir düşüş yaşamıştır.

NUTS’un güncel piyasa değeri 3.600.743,05 $ olup, kripto para piyasasında 1.974’üncü sıradadır. Dolaşımdaki arz 2.314.102.216,55 NUTS’tur ve bu miktar toplam 10 milyar token arzının %23,14’ünü oluşturmaktadır.

Kısa vadeli pozitif 24 saatlik hareket görülse de, yıllık bazdaki büyük gerileme uzun vadeli aşağı yönlü trendin sürdüğünü ortaya koymaktadır. Token, tüm zamanların zirvesine kıyasla şu anda %96,48 gibi büyük bir iskontoyla işlem görmekte ve piyasada ağır bir aşağı yönlü baskı olduğunu göstermektedir.

Güncel NUTS piyasa fiyatını görmek için tıklayın

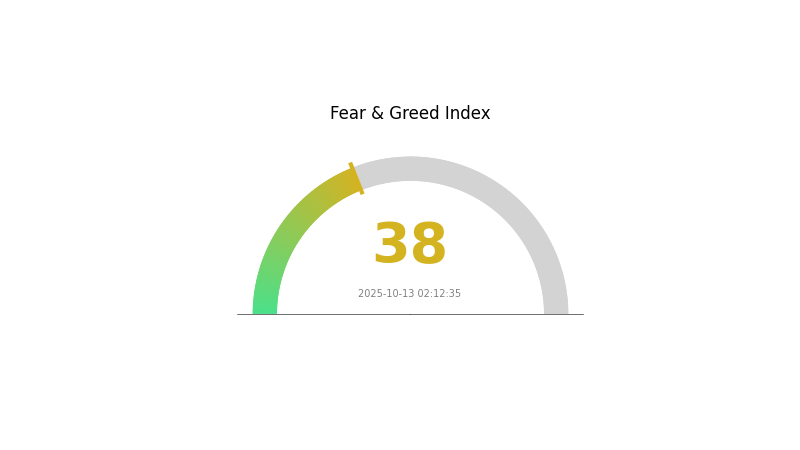

NUTS Piyasa Duyarlılık Endeksi

13 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

NUTS Korku ve Açgözlülük Endeksi 38 olarak okunmakta ve kripto piyasasında bir korku dönemine işaret etmektedir. Bu değer, yatırımcıların temkinli ve belirsiz bir tutum içinde olduğunu göstermektedir. Böyle dönemlerde, aceleci kararlar almaktan kaçınmak ve dikkatli olmak hayati önem taşır. Korku, bazı yatırımcılar için fırsat sunabilir; ancak yatırım kararı öncesinde kapsamlı araştırma yapılmalı ve risk toleransı göz önünde bulundurulmalıdır. Piyasa duyarlılığının hızla değişebileceğini unutmayın; güncel kalın ve stratejinizi buna göre ayarlayın.

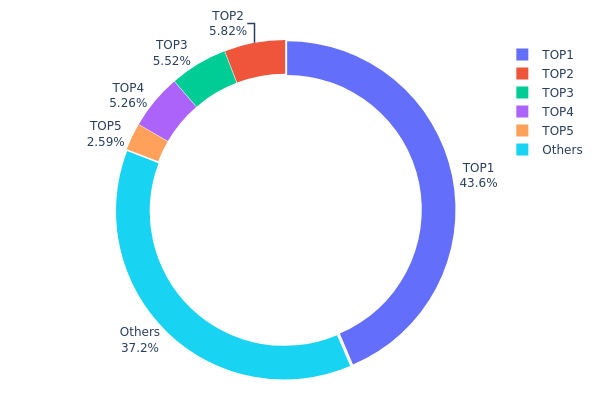

NUTS Varlık Dağılımı

NUTS’un adres dağılımı verileri, sahipliğin oldukça yoğunlaştığını göstermektedir. En büyük adres, toplam arzın %43,60’ını elinde bulundurmakta ve bu da ciddi bir merkezileşmeye işaret etmektedir. Diğer dört büyük adres, toplamda %19,17’lik bir NUTS payına sahiptir. Bu yoğunlaşma, tokenin piyasa dinamiklerinde kırılganlık oluşturabilir.

Böyle bir dağılım, piyasa manipülasyonu ve fiyat oynaklığı riskini artırır. En büyük sahibin baskın pozisyonu, NUTS fiyatında ani hareketlere yol açabilir ve piyasa istikrarını sarsabilir. Tokenların çok az sayıda cüzdanda toplanması, projenin merkeziyetsizlik ilkesini zedeleyebilir ve ekosistemde karar alma gücünün merkezileşmesine neden olabilir.

Bu düzeyde yoğunlaşma, küçük yatırımcılar arasında token dağılımının düşük olduğunu gösterir ve bu da likidite ve işlem hacmini olumsuz etkileyebilir. Büyük sahiplerin varlıklarını hareket ettirmesi, fiyat dalgalanmalarını daha da artırabilir. Yatırımcılar, bu dağılım modelinin getirdiği oynaklık riskini dikkate almalıdır.

Güncel NUTS Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf48e...3bef11 | 552.862,86K | 43,60% |

| 2 | 0xe2f7...edc17e | 73.789,43K | 5,81% |

| 3 | 0x0d07...b492fe | 69.980,48K | 5,51% |

| 4 | 0x3154...0f2c35 | 66.700,00K | 5,26% |

| 5 | 0x17e6...288205 | 32.843,97K | 2,59% |

| - | Diğerleri | 471.811,78K | 37,23% |

II. NUTS’un Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Piyasa Arzı ve Talebi: NUTS fiyatı, piyasadaki arz ve talep dengesiyle doğrudan şekillenmekte ve bu da fiyat dalgalanmalarına neden olmaktadır.

- Tarihsel Desenler: Ceviz fiyatları tarihsel olarak yüksek volatilite göstermiş, bu da üreticiler açısından fiyat ve kârlılıkta istikrarı zorlaştırmıştır.

- Mevcut Etki: İklim değişikliği, kuraklık ve doğal afetler, ceviz üretimini ve arzını olumsuz etkileyerek sıkıntı ve fiyat oynaklığına yol açabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: Kaju, ceviz ve diğer yemişlerin sağlık yararlarına dair farkındalığın artması, talebi ve dolayısıyla NUTS fiyatını olumlu etkileyebilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Emtia tabanlı bir varlık olarak NUTS, genel ekonomik eğilimler ve enflasyon oranlarından etkilenebilir.

- Jeopolitik Etkenler: Uluslararası piyasa koşulları ve ticaret politikaları, küresel ceviz piyasasını ve NUTS fiyatını etkileyebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- İşleme Teknolojisi: Ceviz işleme teknolojilerindeki gelişmeler, üretim verimliliğini ve dolayısıyla NUTS fiyatlarını etkileyebilir.

- Ekosistem Uygulamaları: Ceviz bazlı atıştırmalıkların büyümesi (%31 artış) ve sürdürülebilir ambalaj inovasyonları (katılımcıların %26’sı üzerinde etkili) ürün geliştirme stratejilerini ve NUTS talebini artırabilir.

III. 2025-2030 NUTS Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,00121 $ - 0,00156 $

- Tarafsız tahmin: 0,00156 $ - 0,00182 $

- İyimser tahmin: 0,00182 $ - 0,00209 $ (olumlu piyasa duyarlılığı ve yaygın benimseme ile)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Artan volatiliteyle birlikte potansiyel büyüme

- Fiyat aralığı tahmini:

- 2027: 0,00133 $ - 0,00269 $

- 2028: 0,00118 $ - 0,00302 $

- Başlıca katalizörler: Teknolojik gelişmeler, geniş piyasa benimsemesi ve yeni ortaklıklar

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,00237 $ - 0,00280 $ (istikrarlı büyüme ve devam eden proje geliştirmeleriyle)

- İyimser senaryo: 0,00280 $ - 0,00308 $ (hızlı benimseme ve elverişli piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,00308 $ ve üzeri (çığır açıcı kullanım alanları ve yaygın entegrasyon ile)

- 2030-12-31: NUTS 0,00308 $ (potansiyel tepe fiyat, piyasa koşullarına bağlı olarak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,00209 | 0,00156 | 0,00121 | 0 |

| 2026 | 0,00208 | 0,00182 | 0,00138 | 17 |

| 2027 | 0,00269 | 0,00195 | 0,00133 | 25 |

| 2028 | 0,00302 | 0,00232 | 0,00118 | 49 |

| 2029 | 0,00293 | 0,00267 | 0,00237 | 71 |

| 2030 | 0,00308 | 0,0028 | 0,0016 | 80 |

IV. NUTS Profesyonel Yatırım Stratejileri ve Risk Yönetimi

NUTS Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Merkeziyetsiz finans ve opsiyon ticaretiyle ilgilenen, risk alabilen yatırımcılar

- İşlem önerileri:

- Piyasa geri çekilmelerinde NUTS token biriktirin

- Thetanuts Finance’in Basic Vault’larına katılarak getiri elde edin

- Tokenlarınızı güvenli, saklama hizmeti olmayan bir cüzdanda tutun

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- RSI (Göreceli Güç Endeksi): Aşırı alım ve aşırı satım noktalarını saptamak için kullanılır

- Hareketli Ortalamalar: Trend takibi ve potansiyel giriş/çıkış noktaları için izlenir

- Kısa vadeli işlemler için dikkat edilmesi gerekenler:

- NUTS, altcoin opsiyonlarına odaklandığı için altcoin piyasa trendlerini izleyin

- Thetanuts Finance protokol güncellemeleri ve yeni özellikleri takip edin

NUTS Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü kadar

- Aggresif yatırımcılar: %5-10 arası

- Profesyoneller: Maksimum %15

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımları farklı DeFi protokollerine yaymak

- Opsiyon stratejileri: Thetanuts Finance’in opsiyon ürünleriyle risk yönetimi

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate web3 cüzdanı

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifreler ve düzenli yazılım güncellemeleri

V. NUTS için Olası Riskler ve Zorluklar

NUTS Piyasa Riskleri

- Volatilite: Altcoin piyasalarında yüksek fiyat dalgalanmaları

- Likidite: Düşük işlem hacmi fiyat istikrarını olumsuz etkileyebilir

- Rekabet: Yeni DeFi opsiyon protokolleri piyasa payını azaltabilir

NUTS Regülasyon Riskleri

- Regülasyon belirsizliği: Değişen küresel DeFi ve opsiyon ticareti düzenlemeleri

- Uyum zorlukları: Gelecekteki düzenlemelere uyumda yaşanabilecek sıkıntılar

- Bölgesel kısıtlamalar: Bazı bölgelerde kullanıcı katılımına getirilebilecek sınırlamalar

NUTS Teknik Riskleri

- Akıllı kontrat açıkları: Protokol kodunda istismar riski

- Ölçeklenebilirlik sorunları: Artan kullanıcı ve işlem hacmine yanıt verme zorluğu

- Birlikte çalışabilirlik sorunları: Zincirler arası fonksiyonlarda sınırlamalar

VI. Sonuç ve Eylem Önerileri

NUTS Yatırım Değeri Analizi

NUTS, DeFi opsiyon segmentinde özgün bir fırsat sunar ve uzun vadede büyüme potansiyeli taşır. Ancak kısa vadede yüksek volatilite ve regülasyon belirsizliği göz önünde bulundurulmalıdır.

NUTS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlarla başlayın, DeFi opsiyonlarını öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Portföyünüzün bir bölümünü NUTS’a ayırın, Thetanuts Finance ekosisteminde aktif rol alın ✅ Kurumsal yatırımcılar: Stratejik ortaklıklar ve protokol yönetimine daha büyük ölçekli katılımı değerlendirin

NUTS İşlem Katılım Yöntemleri

- Spot alım satım: Gate.com’da NUTS token alıp-hold edin

- Getiri çiftçiliği: Thetanuts Finance’in Basic Vault’larına katılarak pasif gelir elde edin

- Yönetim: Protokol karar süreçlerinde yer almak için NUTS stake edin

Kripto para yatırımları yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleransları doğrultusunda dikkatli karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

2025’te hangi meme coin patlama yapar?

Shiba Inu’nun, güçlü topluluk desteği ve viral eğilimlerle 2025’te fiyatında büyük bir artış yaşaması bekleniyor. Sürekli ilgi ve piyasa dinamikleri sayesinde popülaritesini sürdürüyor.

SEED’in 2025 fiyat tahmini nedir?

SEED için 2025 fiyat tahmini olumlu; mevcut piyasa trendleri ve teknik analizler doğrultusunda %68,70’lik potansiyel kazanç öngörülmektedir.

Kriptolar 2025’te ne kadar olur?

Bitcoin’in 60.000 $, Ethereum’un 3.000 $ ve Solana’nın 100 $ seviyelerine ulaşması bekleniyor. Diğer büyük kripto paraların da kayda değer büyüme göstermesi öngörülüyor.

Nutcoin şu anda kaç dolar?

13 Ekim 2025 itibarıyla Nutcoin, 0,15 $ seviyesinden işlem görüyor ve son 24 saatte fiyatı %5 arttı.

BANANA nedir: Dünya genelindeki beslenme alışkanlıklarını dönüştüren besleyici güç merkezi

2025 APP Fiyat Tahmini: Mobil Yazılım Maliyetlerinin Geleceğinde Yol Haritası Çizmek

2025 BANANA Fiyat Tahmini: Dijital varlıklara olan talebin artmasıyla birlikte değerinde olası yükseliş

BANANA nedir: Sadece atıştırmalık değil, çok yönlü bir tropikal meyve

EDGE nedir: Mobil internet teknolojisinin yeni nesli

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak