2025 PUNDU Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: PUNDU’nun Piyasa Konumu ve Yatırım Değeri

Solana blokzinciri üzerinde çalışan bir meme token olan PUNDU (PUNDU), piyasadaki varlığını sürdürdüğü günden bu yana kripto para dünyasında dikkat çekiyor. 2025 itibarıyla PUNDU’nun piyasa değeri 3.392.950 $’a ulaşırken, yaklaşık 775.000.000 adet dolaşımdaki arzıyla 0,004378 $ civarında işlem görüyor. “Panda Meme Token” olarak bilinen bu varlık, meme tabanlı kripto paralar ve sosyal token deneyleri alanında giderek daha fazla önem kazanıyor.

Bu makale, PUNDU’nun 2025’ten 2030’a kadar olan fiyat trendlerini; geçmiş hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörlerle birleştirerek, yatırımcılar için profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. PUNDU Fiyat Geçmişi ve Mevcut Piyasa Durumu

PUNDU’nun Tarihsel Fiyat Gelişimi

- 2024: PUNDU piyasaya sürüldü, 26 Mart 2024’te 0,086 $ ile tüm zamanların en yüksek seviyesine ulaştı

- 2025: Piyasa düşüşüyle birlikte fiyat, 7 Nisan 2025’te 0,001761 $ ile en düşük seviyesini gördü

PUNDU’nun Güncel Piyasa Durumu

13 Ekim 2025 tarihi itibarıyla PUNDU, 0,004378 $ seviyesinden işlem görmekte ve 24 saatlik işlem hacmi 16.261,61 $’dır. Token, son 24 saatte %14,27 oranında değer kazanarak kısa vadede yükseliş eğilimi gösterdi. Ancak daha uzun vadede, PUNDU’nun performansı olumsuz olup son 7 günde -%14,21 ve son 30 günde -%19,42 düşüş gösterdi.

PUNDU’nun mevcut piyasa değeri 3.392.950 $ olup, kripto para piyasasında #2015 sırada yer alıyor. Dolaşımdaki arzı 775.000.000 token ve toplam arzı 999.967.975 adettir; bu da dolaşım oranının %77,5 olduğu anlamına gelir.

PUNDU’nun tam seyreltilmiş değeri 4.377.859,83 $’dır ve bu rakam mevcut piyasa değerine yakın olduğundan, toplam arzın büyük kısmının zaten dolaşımda olduğunu gösterir.

Mevcut PUNDU piyasa fiyatını görüntülemek için tıklayın

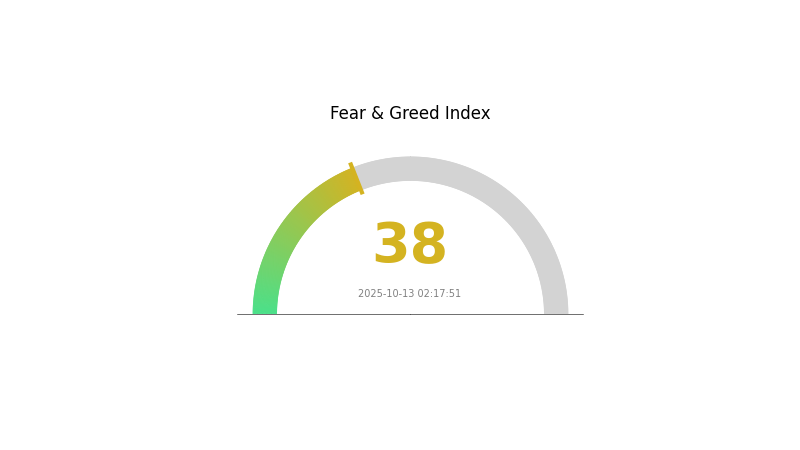

PUNDU Piyasa Duyarlılığı Endeksi

13 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Mevcut Korku ve Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında duyarlılık hâlâ temkinli; Korku ve Açgözlülük Endeksi 38 seviyesinde ve yatırımcılar arasında korku hakim. Piyasa şu an belirsizlik ve olası satış baskısı ile karşı karşıya. Bu dönemlerde bazı yatırımcılar düşük fiyatlardan varlık biriktirmeyi tercih ederken, bazıları daha net piyasa sinyalleri bekler. Dalgalı piyasada yatırımcıların detaylı araştırma yapmaları ve risk toleranslarını göz önünde bulundurmaları gerekir.

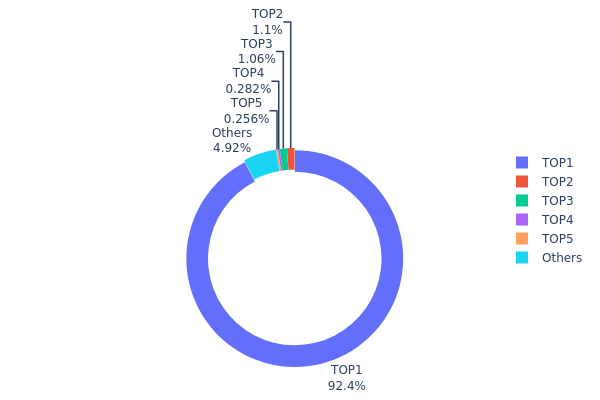

PUNDU Varlık Dağılımı

PUNDU’nun adres varlık dağılımı verileri, sahiplikte yüksek yoğunlaşma olduğunu gösteriyor. En büyük adres, toplam arzın %92,38’ini yani 920.088.930 PUNDU tokenı elinde bulunduruyor. Bu aşırı yoğunlaşma, piyasa merkezileşmesi ve olası fiyat manipülasyonu açısından ciddi riskler doğuruyor.

Sonraki dört büyük adres toplam arzın yalnızca %2,68’ini tutuyor; bireysel oranlar %0,25 ile %1,10 arasında değişiyor. Diğer tüm adresler ise toplam arzın sadece %4,94’üne sahip. Bu dengesiz dağılım, PUNDU’nun sahiplik yapısında merkeziyetsizliğin zayıf olduğunu ve baskın adresin başlatacağı büyük hareketlere karşı volatilite riskinin yüksek olduğunu gösteriyor.

Böylesine yoğunlaşmış bir sahiplik, piyasa istikrarını zayıflatabilir ve yaygın benimsenmeyi engelleyebilir. Ayrıca, zincir üstü yönetişim olması halinde token’ın yönetimi tek bir adresin kontrolüne geçebilir; bu da projenin merkeziyetsizlik iddiası ve sürdürülebilirliği açısından kaygı yaratır.

Mevcut PUNDU Varlık Dağılımını görüntülemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 920088,93K | 92,38% |

| 2 | u6PJ8D...ynXq2w | 10965,00K | 1,10% |

| 3 | KFgTgH...wTrPkZ | 10516,75K | 1,05% |

| 4 | ASTyfS...g7iaJZ | 2811,18K | 0,28% |

| 5 | 8gfunQ...N6CX91 | 2552,34K | 0,25% |

| - | Diğerleri | 48952,81K | 4,94% |

II. PUNDU’nun Gelecekteki Fiyatını Etkileyen Temel Faktörler

Kurumsal ve Balina Hareketleri

- Kurumsal Benimseme: Bazı şirketler kripto paraları benimsemeye başladı, ileride PUNDU da dahil edilebilir.

- Devlet Politikaları: Ulusal düzenleyici politikalar, PUNDU dahil kripto para fiyatlarında etkili olabilir.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankası politikaları, PUNDU dâhil kripto piyasasını etkileyecek.

- Enflasyondan Korunma: Enflasyonist ortamda PUNDU’nun performansı fiyat üzerinde etkili olabilir.

- Jeopolitik Faktörler: Uluslararası gelişmeler kripto piyasasını ve PUNDU’yu etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: DApp ve ekosistem projelerinin gelişimi, PUNDU’nun benimsenmesi ve fiyatını artırabilir.

III. 2025-2030 İçin PUNDU Fiyat Tahmini

2025 Öngörüsü

- İhtiyatlı tahmin: 0,0032 $ - 0,00438 $

- Nötr tahmin: 0,00438 $ - 0,00475 $

- İyimser tahmin: 0,00475 $ - 0,00512 $ (olumlu piyasa duyarlılığı ve artan benimsenme ile)

2027-2028 Öngörüsü

- Piyasa evresi beklentisi: Artan volatiliteyle büyüme dönemi

- Fiyat aralığı öngörüsü:

- 2027: 0,0044 $ - 0,00585 $

- 2028: 0,00533 $ - 0,00729 $

- Önemli katalizörler: Teknolojik gelişmeler, piyasa kabulü ve olası iş birlikleri

2029-2030 Uzun Vadeli Öngörü

- Temel senaryo: 0,00645 $ - 0,00694 $ (istikrarlı büyüme ve benimsenme ile)

- İyimser senaryo: 0,00694 $ - 0,00791 $ (olumlu piyasa koşulları ve artan kullanım ile)

- Dönüştürücü senaryo: 0,00791 $ üzeri (kripto piyasasında ve PUNDU ekosisteminde aşırı olumlu gelişmeler halinde)

- 31 Aralık 2030: PUNDU 0,00791 $ (potansiyel zirve fiyat, piyasa dinamiklerine bağlı)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,00512 | 0,00438 | 0,0032 | 0 |

| 2026 | 0,00599 | 0,00475 | 0,00394 | 8 |

| 2027 | 0,00585 | 0,00537 | 0,0044 | 22 |

| 2028 | 0,00729 | 0,00561 | 0,00533 | 28 |

| 2029 | 0,00742 | 0,00645 | 0,00336 | 47 |

| 2030 | 0,00791 | 0,00694 | 0,00617 | 58 |

IV. PUNDU için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

PUNDU Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Yüksek volatilite riskini tolere edebilenler

- Operasyon önerileri:

- Belirli aralıklarla PUNDU’ya yatırım yaparak ortalama maliyet yöntemi (DCA)

- Hedef portföy oranı belirleyip düzenli olarak dengelemek

- PUNDU’yu güvenli, saklama olmayan bir cüzdanda tutmak

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve potansiyel giriş/çıkış noktalarını belirlemek için

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım bölgelerini tespit etmek için

- Dalgalı alım-satımda önemli noktalar:

- Trend değişimlerini öngörmek için işlem hacmini izlemek

- Olası kayıpları sınırlamak için kesin stop-loss emirleri kullanmak

PUNDU Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-2’si kadar

- Agresif yatırımcılar: %3-5 arası

- Profesyonel yatırımcılar: Risk toleransına göre %10’a kadar

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: PUNDU’yu diğer kripto varlıklar ve geleneksel yatırımlarla dengelemek

- Stop-loss emirleri: Potansiyel kayıpları sınırlamak için

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Donanım cüzdanı ile uzun vadeli saklama

- Güvenlik önlemleri: İki aşamalı doğrulama, güçlü şifre, özel anahtarları çevrimdışı tutma

V. PUNDU için Olası Riskler ve Zorluklar

PUNDU Piyasa Riskleri

- Yüksek volatilite: Meme coin’lerde aşırı fiyat hareketleri yaşanabilir

- Düşük likidite: Büyük işlemlerde fiyat kayması oluşabilir

- Piyasa duyarlılığı: Sosyal medya ve fenomenlerin etkisi oldukça büyüktür

PUNDU Düzenleyici Riskler

- Belirsiz düzenleyici ortam: Meme coin’lere yönelik inceleme riski

- Borsadan çıkarılma riski: Düzenleyici endişeler nedeniyle alım-satım platformlarından çıkarılma olasılığı

- Vergi etkileri: Değişen vergi yasaları, PUNDU işlemlerini ve varlıklarını etkileyebilir

PUNDU Teknik Riskler

- Akıllı sözleşme açıkları: Sözleşmede hata veya istismar riski

- Ağ yoğunluğu: Solana ağındaki sorunlar işlemleri aksatabilir

- Cüzdan uyumluluğu: SPL token’larını tam destekleyen cüzdan kullanmaya dikkat edilmeli

VI. Sonuç ve Eylem Önerileri

PUNDU Yatırım Değeri Değerlendirmesi

PUNDU, meme coin sektöründe yüksek riskli ama yüksek kazanç potansiyeline sahip bir seçenektir. Kısa vadede ciddi kazanç fırsatı sunabilse de, uzun vadeli değeri belirsizdir ve spekülatiftir. Yatırımcılar PUNDU’ya temkinli yaklaşmalı, meme token’ların volatil doğasını dikkate almalıdır.

PUNDU Yatırım Önerileri

✅ Yeni başlayanlar: Portföyün küçük bir kısmıyla sınırlı yatırım, hatta hiç yatırım yapmamak ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle kısa vadeli alım-satım fırsatları değerlendirebilir ✅ Kurumsal yatırımcılar: Yalnızca yüksek riskli tahsisler için, aşırı temkinli yaklaşılmalı

PUNDU Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com ve diğer destekleyen borsalarda mevcut

- Limit emirleri: İstenilen seviye fiyatlardan pozisyon açmak için kullanılabilir

- DCA stratejisi: Volatiliteyi dengelemek için zaman içinde kademeli PUNDU birikimi

Kripto para yatırımları son derece yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre hareket etmeli, profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular (SSS)

2025’te kripto fiyat tahmini nedir?

2025 yılında Bitcoin’in 60.000 $, Ethereum’un 3.000 $ ve Solana’nın 100 $ seviyelerine ulaşması bekleniyor. Diğer kripto varlıklar da ciddi büyüme gösterebilir.

2030 için XRP fiyat tahmini nedir?

2030’da XRP’nin 90 $ ile 120 $ arasında olması öngörülüyor. Bu tahmin, önemli bir büyüme aşamasına işaret ediyor. Öngörüler güncel piyasa eğilimlerine dayanıyor.

En yüksek fiyat tahmini hangi kripto parada?

Bitcoin için en yüksek fiyat tahmini bulunuyor; 2025’te 122.937 $’a ulaşması bekleniyor. Chainlink ise 59,67 $ ile önemli bir artış öngörüyor.

2025 için PI fiyat tahmini nedir?

Mevcut piyasa eğilimlerine göre PI fiyatı Ekim 2025’te 0,239 $ seviyesine ulaşacak. Bu öngörü, Pi Network ekosisteminin güncel gelişmelerine ve büyüme sürecine dayanıyor.

2025 POPCAT Fiyat Tahmini: Dijital Kedi Ekonomisinde Gelecek Piyasa Trendleri ve Yatırım Potansiyelinin Değerlendirilmesi

2025 BOME Fiyat Tahmini: Dalgalı Ekonomide Piyasa Trendleri ve Yatırım Fırsatlarında Yol Almak

2025 PNUT Fiyat Tahmini: Gelişen Dijital Varlık Ekosisteminde Büyüme Potansiyeli ve Piyasa Dinamiklerini Değerlendirme

2025 MYRO Fiyat Tahmini: Gelişen Kripto Para Ekosisteminde Büyüme Potansiyeli ve Piyasa Trendlerinin Analizi

XAI gork (GORK) iyi bir yatırım mı?: Açıklanabilir Yapay Zeka pazarında GORK Tokenlarının potansiyelini ve risklerini analiz etmek

dogwifhat (WIF) iyi bir yatırım mı?: Son dönemin en popüler meme coin’inin potansiyeli ve riskleri üzerine değerlendirme

EVM Blockchain’ını Anlamak: Detaylı Bir Rehber

Blockchain Teknolojisinde EVM'nin Rolünü Anlamak