2025 RWAINC Fiyat Tahmini: Yapay Zeka Tabanlı Blockchain Teknolojisinin Geleceğinde Yolculuk

Giriş: RWAINC’nin Piyasa Konumu ve Yatırım Değeri

RWA Inc. (RWAINC), web3 dünyasında ilk geniş kapsamlı Gerçek Dünya Varlığı (RWA) ekosistemi olarak piyasaya yön vermektedir. 2025 yılı itibarıyla RWAINC’nin piyasa değeri 2.356.789,63 $’a ulaşmış, dolaşımdaki arzı yaklaşık 332.785.884 token ve fiyatı ise 0,007082 $ düzeyinde seyretmektedir. “Geleneksel finans ile blokzincir arasında köprü” olarak anılan bu varlık, gerçek varlıkların tokenleştirilmesinde giderek daha önemli bir rol üstlenmektedir.

Bu makalede, 2025–2030 döneminde RWAINC fiyat eğilimleri; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişmeleri ve makroekonomik etkenler doğrultusunda profesyonel fiyat tahminleri ve yatırımcılar için pratik yatırım stratejileriyle detaylı biçimde değerlendirilecektir.

I. RWAINC Fiyat Geçmişi ve Güncel Piyasa Durumu

RWAINC Tarihsel Fiyat Seyri

- 2024: Proje lansmanı, fiyat 4 Aralık’ta 0,14542 $ ile tüm zamanların en yükseğine ulaştı

- 2025: Piyasa düzeltmesi, fiyat 21 Mayıs’ta 0,00457 $ ile en düşük seviyeyi gördü

- 2025: Kademeli toparlanma, güncel fiyat 0,007082 $ civarında dengelendi

RWAINC Güncel Piyasa Durumu

15 Ekim 2025 itibarıyla RWAINC, 0,007082 $ seviyesinden işlem görüyor. Token, son yılda yüksek oynaklık yaşadı ve 24 saatlik işlem hacmi 21.384,51 $ oldu. RWAINC’nin piyasa değeri 2.356.789,63 $ ile kripto para piyasasında 2.257. sırada bulunuyor. Fiyat son 24 saatte %6,97, son bir yılda ise %86,82 oranında değer kaybetti. Dolaşımdaki arz 332.785.884 RWAINC olup toplam arzın %33,28’ine (1.000.000.000 token) karşılık geliyor. Son dönemdeki düşüşe rağmen RWAINC’nin 72.163 cüzdanlık küçük ancak sadık bir yatırımcı tabanı mevcut.

Güncel RWAINC piyasa fiyatını görüntüleyin

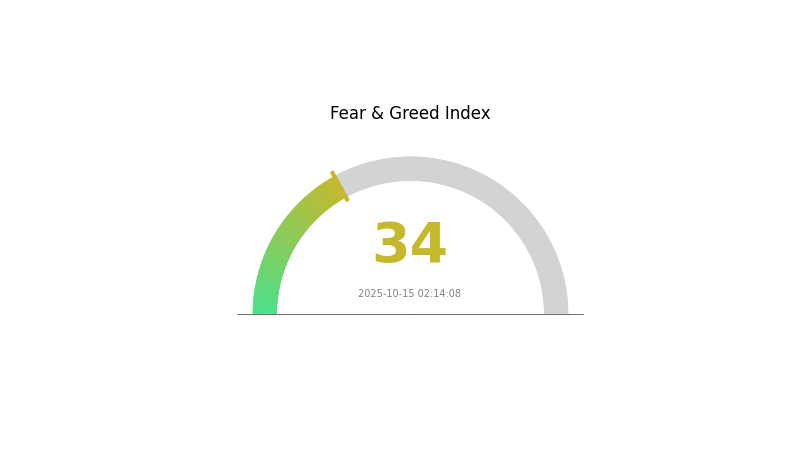

RWAINC Piyasa Duyarlılık Göstergesi

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku ve Açgözlülük Endeksi'ni görüntüleyin

Kripto piyasası şu anda korku evresinde; duyarlılık endeksi 34 seviyesinde. Bu durum, yatırımcıların temkinli davrandığını ve güvenli liman arayışında olduklarını gösteriyor. Deneyimli yatırımcılar ise bu gibi dönemleri sıklıkla “başkaları açgözlüyken kork, başkaları korkakken açgözlü ol” prensibiyle alım fırsatı olarak yorumlar. Ancak, bu yüksek oynaklıktaki ortamda yatırım kararı öncesi kapsamlı araştırma yapmak ve risk toleransınızı iyi değerlendirmek şarttır.

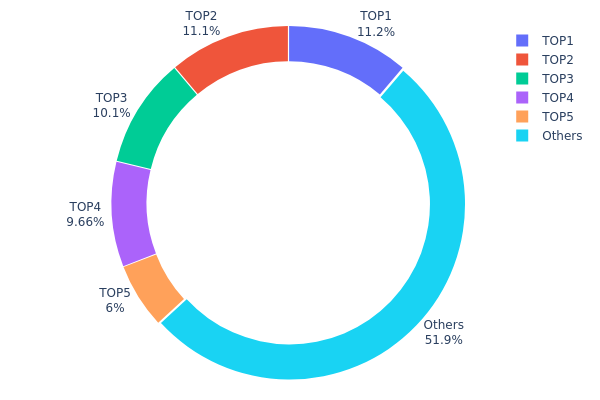

RWAINC Varlık Dağılımı

RWAINC adreslerinin varlık dağılımı, büyük sahiplerde önemli bir yoğunlaşmaya işaret ediyor. En büyük 5 adres, toplam arzın %48,04’üne sahipken, en büyük adres RWAINC tokenlerinin %11,20’sini tutuyor. Bu durum, görece merkezi bir sahiplik yapısına ve piyasada etkili olabilecek bir güç dağılımına işaret ediyor.

Böyle bir dağılım, piyasa istikrarı ve fiyat hareketliliği açısından riskler barındırıyor. Jetonların neredeyse yarısının sadece beş adreste toplanması, bu adreslerin büyük işlemlerinin fiyatlarda ciddi dalgalanmalara sebep olabileceği anlamına geliyor. Ayrıca, bu yoğunluk projenin merkeziyetsizlik iddiası ve yönetişim süreçlerine de doğrudan etki edebilir.

Bununla birlikte, RWAINC tokenlerinin %51,96’sı diğer adreslere dağılmış durumda; bu da daha geniş bir yatırımcı kitlesi olduğunu gösteriyor. Büyük sahiplerle küçük yatırımcılar arasındaki bu denge, piyasada kısmi bir direnç sağlayabilir. Yine de, üst düzey sahiplerin piyasaya etkisi ve proje gelişimi için yakından izlenmesi gereken bir unsur olmaya devam ediyor.

Güncel RWAINC Varlık Dağılımı'nı inceleyin

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xef66...a0e71e | 111.121,20K | 11,20% |

| 2 | 0x886d...c0b9af | 110.247,33K | 11,12% |

| 3 | 0x0ac6...2ca401 | 100.000,00K | 10,08% |

| 4 | 0x260d...50f23c | 95.732,27K | 9,65% |

| 5 | 0x7bac...e0a76f | 59.430,86K | 5,99% |

| - | Diğerleri | 514.808,10K | 51,96% |

2. RWAINC’nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Tokenizasyon: Gerçek varlıkların blokzincir üzerinde dijital tokenlara dönüştürülmesi süreci.

- Tarihsel Model: RWA tokenizasyonunun artan benimsenmesi, genellikle piyasa büyümesiyle örtüşmektedir.

- Güncel Etki: 2030’da 16 trilyon $’a ulaşması beklenen RWA piyasası, fiyat üzerinde olumlu baskı yaratma potansiyeline sahip.

Kurumsal ve Balina Hareketleri

- Kurumsal Varlıklar: Başlıca finans kuruluşları, RWA tokenlerini hızla benimsemekte; BlackRock gibi şirketler, varlık tokenizasyonunu finansın geleceği olarak vurguluyor.

- Kurumsal Benimseme: Circle ve Ondo Finance gibi şirketler, USD ve ABD Hazine bonosu gibi gerçek varlıkların tokenizasyonunda öncülük ediyor.

- Ulusal Politikalar: RWA tokenizasyonuna yönelik regülasyonlar ve devletin yaklaşımı, piyasa büyümesinde belirleyici olacaktır.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankalarının faiz ve enflasyon politikaları, RWA tokenlerinin yatırım cazibesini doğrudan etkiler.

- Enflasyon Korumalı Özellikler: Fiziksel varlıklarla desteklenen RWA tokenleri, enflasyon dönemlerinde talebi artırabilecek koruma aracı olabilir.

- Jeopolitik Faktörler: Küresel ekonomik belirsizlikler ve siyasi gerilimler, yatırımcıların portföy çeşitlendirmek için RWA tokenlerine yönelmesine neden olabilir.

Teknolojik Gelişim ve Ekosistem Kurulumu

- DeFi Entegrasyonu: RWA tokenlerinin, kredi ve teminat amaçlı DeFi protokollerine entegrasyonu.

- Düzenleyici Uyum: RWA tokenlerinin, farklı ülkelerde yasal gerekliliklere uygunluğunu sağlayan regülasyon teknolojilerindeki ilerlemeler.

- Ekosistem Uygulamaları: Gate.com gibi platformların gelişimiyle, RWA tokenlerinin alım-satım ve yönetimi kolaylaştırılıyor.

III. 2025-2030 RWAINC Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,00567 $ – 0,00708 $

- Tarafsız tahmin: 0,00708 $ – 0,00797 $

- İyimser tahmin: 0,00797 $ – 0,00886 $ (olumlu piyasa duyarlılığına bağlı)

2027-2028 Görünümü

- Piyasa fazı: Olası büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,0088 $ – 0,0133 $

- 2028: 0,00872 $ – 0,01292 $

- Kilit katalizörler: Artan benimseme ve teknolojik yenilikler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,01212 $ – 0,01425 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,01425 $ – 0,01637 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,01581 $ – 0,01637 $ (aşırı olumlu koşullarda)

- 2030-12-31: RWAINC 0,01581 $ (muhtemel tepe fiyat)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00886 | 0,00708 | 0,00567 | 0 |

| 2026 | 0,01076 | 0,00797 | 0,0043 | 12 |

| 2027 | 0,0133 | 0,00936 | 0,0088 | 32 |

| 2028 | 0,01292 | 0,01133 | 0,00872 | 59 |

| 2029 | 0,01637 | 0,01212 | 0,01031 | 71 |

| 2030 | 0,01581 | 0,01425 | 0,01097 | 101 |

IV. RWAINC Profesyonel Yatırım Stratejileri ve Risk Yönetimi

RWAINC Yatırım Yöntemi

(1) Uzun Vadeli Saklama Stratejisi

- Hedef kitle: Gerçek varlık tokenizasyonuna odaklanan uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde RWAINC token biriktirin

- RWA Inc. ekosistemini ve regülasyon uyum süreçlerini izleyin

- Tokenlerinizi güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını tespit için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım-satım koşullarını izleyin

- Dalgalı al-sat için ana noktalar:

- Risk yönetimi için kesin stop-loss emirleri belirleyin

- Belirlenen direnç seviyelerinde kâr alın

RWAINC Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Dengeli yatırımcı: Kripto portföyünün %1–3’ü

- Agresif yatırımcı: Kripto portföyünün %5–10’u

- Profesyonel yatırımcı: Kripto portföyünün en fazla %15’i

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımları farklı RWA tokenleri ve geleneksel varlıklar arasında dağıtın

- Stop-loss emirleri: Potansiyel kayıpları sınırlayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli varlıklar için donanım cüzdanı kullanın

- Güvenlik önlemleri: İki adımlı doğrulama, güçlü şifreler ve özel anahtarların gizliliği

V. RWAINC Olası Riskler ve Zorluklar

RWAINC Piyasa Riskleri

- Yüksek oynaklık: RWAINC fiyatı önemli dalgalanmalara açık

- Sınırlı likidite: Düşük işlem hacmi kayma riskini artırır

- Piyasa duyarlılığı: Genel kripto piyasası trendlerinden etkilenir

RWAINC Regülasyon Riskleri

- Değişen mevzuatlar: RWA tokenizasyonunda yasal değişiklikler RWAINC’yi etkileyebilir

- Ülke sınırlarında uyum: Farklı regülasyonlarda hareket etme zorluğu

- Olası kısıtlamalar: Devletler RWA tokenlerine sınırlama getirebilir

RWAINC Teknik Riskler

- Akıllı sözleşme açıkları: Token sözleşmesinde hata veya istismar riski

- Blokzincir ölçeklenebilirliği: Ana ağ tıkanıklığı işlem hızını etkileyebilir

- Uyumluluk zorlukları: Diğer blokzincirlerle entegrasyonda güçlükler

VI. Sonuç ve Eylem Önerileri

RWAINC Yatırım Değeri Değerlendirmesi

RWAINC, büyüyen RWA tokenizasyon pazarında ayrıcalıklı bir fırsat sunuyor. Uzun vadede potansiyel barındırsa da, yatırımcıların kısa vadeli oynaklık ve regülasyon belirsizliğine karşı hazırlıklı olması gerekir.

RWAINC Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayıp RWA tokenizasyonu hakkında bilgi edinin ✅ Deneyimli yatırımcılar: RWAINC ve diğer kripto varlıkları dengeli şekilde portföyünüzde bulundurun ✅ Kurumsal yatırımcılar: Detaylı inceleme yaparak RWAINC’yi çeşitlendirilmiş bir RWA portföyüne dahil etmeyi değerlendirin

RWAINC İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com’da RWAINC token alım-satımı yapabilirsiniz

- DCA stratejisi: Düzenli alım talimatı vererek RWAINC biriktirin

- Staking: Sunuluyorsa RWAINC staking programlarıyla pasif gelir elde edin

Kripto para yatırımları çok yüksek risk içerir, bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk profilinize göre alın ve profesyonel finansal danışmanlardan destek alın. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

RWA kriptonun geleceği nedir?

RWA kriptonun geleceği umut verici; benimsenme oranı ve regülasyon desteği artıyor. Temel projeler, likidite ve erişim için gerçek varlıkları tokenleştiriyor. Piyasa trendleri yüksek büyüme potansiyeline işaret ediyor.

RWA Inc. kripto nedir?

RWA Inc., RWA, DePIN fayda ve hisse tokenlarının işlem gördüğü düzenlenmiş bir borsadır. Tamamen zincir bağımsızdır ve LayerZero OFT teknolojisiyle halka açık piyasa işlemlerini kolaylaştırır.

RWA kripto kaç para?

2025-10-15 itibarıyla RWA kripto fiyatı 0,007511 ABD dolarıdır. 24 saatlik işlem hacmi 435.990 ABD doları, piyasa değeri ise 3.692.247 ABD dolarıdır.

Hangi yapay zeka kripto fiyatlarını tahmin edebilir?

Crypto AI SL gibi yapay zeka tabanlı uygulamalar, gelişmiş algoritmalarla kripto fiyatlarını tahmin edebilir. Bu uygulamalar piyasa verilerini analiz ederek trend tahmini yapar ve uygulama mağazalarından edinebilirsiniz.

HOME’un Temel Göstergeleri 2030’a Kadar Nasıl Değişim Gösterecek?

TRUF nedir: Şehir peyzajını değiştiren devrim niteliğinde bir kentsel tarım yöntemi

Ücretsiz coinleri güvenli ve verimli bir şekilde nasıl alacağınıza dair rehber

Warden Protokolü: 2025'te Web3 Güvenliği için Kapsamlı Bir Rehber

SIX Token (SIX): Temel Mantık, Kullanım Durumları ve 2025 Yol Haritası Analizi

2025 Kripto Varlıklar Pazar Analizi: Web3 Gelişimi ve Blok Zinciri Trendleri

zkSync (ZK) iyi bir yatırım mı?: Katman 2 Ölçeklendirme Çözümleri ve Gelecek Perspektiflerinin Kapsamlı Analizi

TBC ve MANA: İki Önde Gelen Blockchain Yönetim Token’ının Kapsamlı Karşılaştırması

ZBU ve FIL: İki Lider Blockchain Depolama Çözümünün Ayrıntılı Karşılaştırması

Gate.com YuBiBao: Atıl Dijital Varlık Getirisi Çözümleri Rehberi ve Kripto Para Yatırım Ürünleriyle Karşılaştırma

GUSD Stablecoin: Gate.com'un Gerçek Dünya Varlıklarıyla Desteklenen Token'ına Kapsamlı Rehber