2025 SOUL Fiyat Tahmini: Dijital Varlık İçin Piyasa Trendleri ve Gelecek Perspektiflerinin Analizi

Giriş: SOUL'un Piyasa Konumu ve Yatırım Değeri

Phantasma (SOUL), blokzincir teknolojisi tabanlı yeni nesil bir mesajlaşma protokolü olarak 2018'den bu yana önemli mesafe kaydetti. 2025 yılı itibarıyla Phantasma'nın piyasa değeri 2.119.189 $'a ulaşırken, yaklaşık 132.119.034 token dolaşımda bulunuyor ve fiyatı 0,01604 $ seviyesinde seyrediyor. Sıklıkla "merkezsiz içerik dağıtım sistemi" olarak nitelendirilen bu varlık, güvenli ve özel mesajlaşma ile veri paylaşımında giderek daha önemli bir rol üstleniyor.

Bu makalede, Phantasma'nın 2025-2030 yıllarındaki fiyat trendleri; geçmiş fiyat hareketleri, piyasa arz ve talebi, ekosistem gelişimi ile makroekonomik faktörler ışığında profesyonel fiyat tahminleri ve uygulamaya yönelik yatırım stratejileriyle kapsamlı şekilde analiz edilecektir.

I. SOUL Fiyat Geçmişi ve Güncel Piyasa Durumu

SOUL Tarihsel Fiyat Seyri

- 2020: 16 Mart'ta küresel piyasa çöküşü sırasında SOUL, 0,00960482 $ ile tüm zamanların en düşük seviyesini gördü

- 2021: 1 Aralık'ta boğa piyasası zirvesinde SOUL, 3,96 $ ile tüm zamanların en yüksek seviyesine ulaştı

- 2025: SOUL'da ciddi bir düşüş yaşandı ve fiyatı 0,01604 $'a geriledi

SOUL Güncel Piyasa Görünümü

15 Ekim 2025 itibarıyla SOUL, 0,01604 $ seviyesinde işlem görüyor ve zirve değerine göre %99,59 oranında değer kaybetmiş durumda. Token, tüm zaman dilimlerinde negatif fiyat hareketi gösterdi; son 24 saatte %14,27, son bir haftada %32,49 gerileme yaşandı. 30 günlük değişim -%45,41, son bir yıldaki değişim ise -%70,75 olup, uzun süren bir ayı eğilimini yansıtıyor.

SOUL'un piyasa değeri şu an 2.119.189 $ ve kripto para piyasasında 2.326'ncı sırada yer alıyor. Dolaşımdaki arzı 132.119.034,54 SOUL olup, bu rakam toplam arzın (%106,44) üzerinde. Tam seyreltilmiş değerleme 1.991.032 $ düzeyinde; bu, mevcut piyasa değerinin, tüm tokenler dolaşımda olsaydı oluşacak teorik maksimum değerden yüksek olduğunu gösteriyor.

Son 24 saatteki işlem hacmi 109.486 $ seviyesinde olup, bu rakam piyasa değeriyle kıyaslandığında düşük ve bu durum düşük likidite nedeniyle fiyat oynaklığını artırabilir.

Güncel SOUL piyasa fiyatını görmek için tıklayın

SOUL Piyasa Duyarlılığı Endeksi

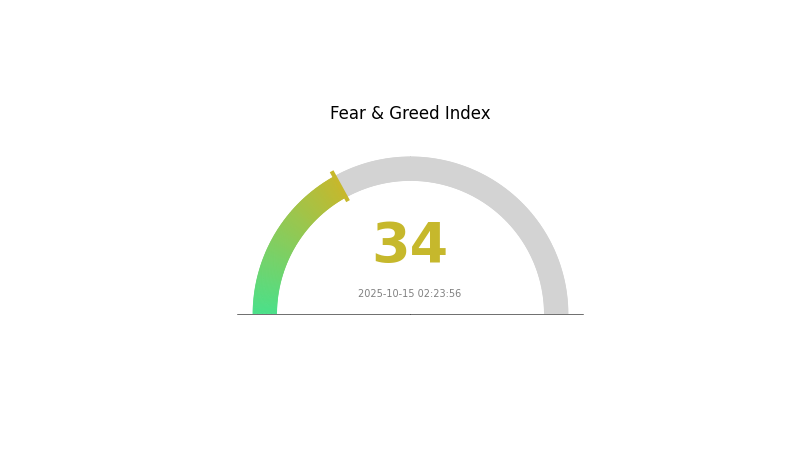

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasası, şu anda 34 seviyesindeki duyarlılık endeksiyle korku döneminde. Bu temkinli ortam, stratejik yatırımcılar için fırsatlar barındırabilir. Bazı yatırımcılar tereddüt ederken, başkaları bunu alım fırsatı olarak görebilir. Ancak piyasa duyarlılığının hızlı değişebileceğini unutmamak gerekir. Yatırım kararlarınızı almadan önce kapsamlı bir araştırma yapın ve risk toleransınızı göz önünde bulundurun. Bilgi sahibi olun ve piyasanın her iki yöne de hareket edebileceğine karşı hazırlıklı olun.

SOUL Varlık Dağılımı

SOUL adreslerindeki varlık dağılımı, token yoğunlaşmasında dikkat çekici bir desen gösteriyor. Ancak, ilgili veri tablosu şu an boş olduğundan detaylı analiz mümkün değil. Yine de bu dağılımların genel etkileri değerlendirilebilir.

Sağlıklı bir token dağılımı, adresler arasında dengeli bir dağılım sunar. Bu denge, piyasa istikrarı ve fiyat manipülasyonunun önlenmesi için kritiktir. Veri eksikliği nedeniyle SOUL'un merkezileşme düzeyini ya da tokenlerin az sayıda adreste toplanıp toplanmadığını analiz etmek güçleşiyor.

Dağılım verisinin olmaması, ya hiçbir adresin anlamlı bir paya sahip olmadığı yüksek merkezsizlik durumuna ya da token tahsisinde şeffaflık eksikliğine işaret edebilir. SOUL'un piyasa yapısını ve olası oynaklığını anlamak için gerçek dağılım verisinin incelenmesi gereklidir.

Güncel SOUL varlık dağılımını görmek için tıklayın

| En Yüksek | Adres | Varlık Miktarı | Varlık (%) |

|---|

II. SOUL'un Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Halving: Yeni SOUL arzındaki olası azalma, fiyatı etkileyebilir

- Tarihsel Seyir: Geçmiş arz değişiklikleri, fiyat hareketlerine yön vermiştir

- Güncel Etki: Yaklaşan arz değişiklikleri, kıtlığı artırıp fiyatın yükselmesine yol açabilir

Makroekonomik Koşullar

- Para Politikası Etkisi: Büyük merkez bankalarının politikaları ve olası faiz indirimleri SOUL'un değerini etkileyebilir

- Enflasyondan Korunma: SOUL, enflasyon dönemlerinde değer saklama aracı olarak görülebilir

- Jeopolitik Faktörler: Küresel gerilimler ve ekonomik politikalar fiyat hareketlerinde belirleyici olabilir

Teknolojik Gelişim ve Ekosistem Oluşumu

- Blokzincir Yükseltmeleri: Ölçeklenebilirlik ve verimlilikteki gelişmeler adaptasyonu artırabilir

- Ekosistem Uygulamaları: SOUL ağı üzerinde geliştirilen DApp ve projelerin büyümesi, kullanım ve talebi artırabilir

III. 2025-2030 SOUL Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,01203 $ - 0,01604 $

- Tarafsız tahmin: 0,01604 $ - 0,01837 $

- İyimser tahmin: 0,01837 $ - 0,02069 $ (olumlu piyasa atmosferi gerektirir)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Olası büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,01218 $ - 0,02398 $

- 2028: 0,01644 $ - 0,02904 $

- Başlıca katalizörler: Benimsenme ve teknolojik ilerlemeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,0252 $ - 0,03074 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,03074 $ - 0,04366 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,04366 $+ (aşırı elverişli koşullarda)

- 2030-12-31: SOUL 0,04366 $ (potansiyel zirve fiyat)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02069 | 0.01604 | 0.01203 | 0 |

| 2026 | 0.0191 | 0.01837 | 0.01304 | 14 |

| 2027 | 0.02398 | 0.01873 | 0.01218 | 16 |

| 2028 | 0.02904 | 0.02136 | 0.01644 | 33 |

| 2029 | 0.03629 | 0.0252 | 0.01764 | 57 |

| 2030 | 0.04366 | 0.03074 | 0.01691 | 91 |

IV. SOUL İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

SOUL Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Uzun vadeye odaklı, risk alabilenler

- Uygulama önerileri:

- Piyasa düşüşlerinde SOUL biriktirin

- Kısmi kar alımı için fiyat hedefleri belirleyin

- Donanım cüzdanında güvenli saklama sağlayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalama: Trend ve dönüş noktalarını belirlemek için kullanın

- RSI: Aşırı alım/satım koşullarını izleyin

- Dalgalı alım-satım için önemli noktalar:

- Sıkı zarar-durdur emirleri belirleyin

- Belirli seviyelerde kar alın

SOUL Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: %1-2

- Agresif yatırımcılar: %3-5

- Profesyonel yatırımcılar: %5-10

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Birden fazla kripto varlığa yatırım yaparak riski dağıtın

- Zarar-durdur emirleri: Kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik: İki faktörlü kimlik doğrulama kullanın, özel anahtarları güvenli şekilde yedekleyin

V. SOUL İçin Potansiyel Riskler ve Zorluklar

SOUL Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasalarında sık görülen büyük fiyat dalgalanmaları

- Düşük likidite: Sınırlı işlem hacmi fiyat istikrarını zayıflatabilir

- Piyasa duyarlılığı: Yatırımcı psikolojisindeki hızlı değişimlere açık

SOUL Regülasyon Riskleri

- Belirsiz regülasyon ortamı: SOUL'u etkileyebilecek yeni düzenlemeler

- Ülkeler arası uyum: Farklı bölgelerde farklı regülasyonlar

- Vergilendirme: Değişen vergi kuralları SOUL sahiplerini etkileyebilir

SOUL Teknik Riskleri

- Akıllı kontrat açıkları: Protokoldeki potansiyel güvenlik zaafları

- Ağ ölçeklenebilirliği: Artan işlem yükünü yönetmedeki zorluklar

- Teknolojik eskime: SOUL'un daha yeni blokzincir teknolojilerinin gerisinde kalma riski

VI. Sonuç ve Eylem Önerileri

SOUL Yatırım Değeri Analizi

SOUL, yüksek riskli ancak yüksek potansiyelli bir yatırım sunar. Yenilikçi mesajlaşma protokolü uzun vadede değer yaratma potansiyeli taşırken, kısa vadeli volatilite ve regülasyon belirsizlikleri ciddi riskler barındırır.

SOUL Yatırım Önerileri

✅ Yeni başlayanlar: Sıkı risk yönetimiyle düşük ve deneme amaçlı pozisyonlar alın ✅ Deneyimli yatırımcılar: Net çıkış noktalarıyla maliyet ortalaması uygulayın ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın ve SOUL'u çeşitlendirilmiş portföyünüzde değerlendirin

SOUL İşlem Katılım Yöntemleri

- Spot işlem: SOUL'u Gate.com üzerinden doğrudan satın alın

- Staking: Varsa, staking imkanlarını değerlendirin

- DeFi entegrasyonu: SOUL destekli merkeziyetsiz finans protokollerine katılım sağlayın (uygunsa)

Kripto para yatırımları çok yüksek risk taşır. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk toleranslarına göre dikkatlice almalı ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alamayacağınızdan fazla yatırım yapmayın.

SSS

Solana'nın 2025 Fiyat Tahmini Nedir?

Solana'nın fiyatının 2025'te yaklaşık 364 $'a ulaşması, potansiyel olarak ise 482 $'a kadar yükselmesi bekleniyor. Bu öngörü, Solana ekosisteminde süregelen benimseme ve teknolojik ilerlemelere dayanıyor.

Soul Coin Ne Kadar?

2025 itibarıyla soul coin'in yaklaşık 0,15 $ ile 0,20 $ arasında olması ve kripto piyasasında istikrarlı büyüme göstermesi bekleniyor.

En Yüksek Fiyat Tahminine Sahip Kripto Para Hangisi?

2025'te, başlıca kripto paralar arasında Ethereum, piyasa eğilimleri ve teknolojik gelişmeler dikkate alındığında en yüksek fiyat tahminine sahip.

Shiba'nın Gelecek Fiyat Tahmini Nedir?

Shiba Inu'nun 2030'da 0,000025 $ seviyesine ulaşması bekleniyor. Büyük piyasa değeri sayesinde SHIB, önümüzdeki yıllarda güçlü büyüme ve yatırım ilgisi potansiyeline sahip.

2025 XLM Fiyat Tahmini: Olgunlaşan Kripto Ekosisteminde Stellar Lumens’in Potansiyel Büyüme Yolu

2025 DGB Fiyat Tahmini: DigiByte Kripto Para Piyasasında Yeni Zirvelere Ulaşabilir mi?

2025 QANX Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 NANO Fiyat Tahmini: Dijital Para Biriminin Büyüme Potansiyeli ve Piyasa Trendlerinin Analizi

2025 DKA Fiyat Tahmini: Piyasa Eğilimleri ve Olası Büyüme Faktörlerinin Analizi

2025 BLY Fiyat Tahmini: Bluey Token’ın Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Cysic: AI ve Dağıtık Hesaplama için Sıfır Bilgi Altyapı Platformu

ABD Bankacılık Düzenleyicisi OCC, ulusal bankaların kripto para ticareti yapmasını kolaylaştırıyor

ASTER Spot İşlem Rehberi: Anlık Fiyat Analizi ve İşlem Hacmi Bilgileri

Cantor Equity ile birleşmenin ardından Twenty One Capital Bitcoin hissesi yüzde 25 değer kaybetti

Dropee Günlük Kombinasyonu 10 Aralık 2025