2025 TAO Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: TAO'nun Piyasadaki Konumu ve Yatırım Potansiyeli

Bittensor (TAO), kurulduğu günden itibaren merkeziyetsiz makine öğrenimi alanında öncü bir ağ olarak öne çıkıyor. 2025 yılı itibarıyla Bittensor’un piyasa değeri 4,29 milyar dolara ulaştı; dolaşımdaki toplam token miktarı yaklaşık 9.597.491 ve fiyatı 447,1 dolar civarında seyrediyor. "Yapay Zeka destekli blockchain" olarak nitelenen bu varlık, makine öğrenimi modellerinin iş birliğiyle geliştirilmesinde giderek daha önemli bir rol üstleniyor.

Bu makalede, Bittensor'un 2025-2030 dönemindeki fiyat eğilimleri; geçmiş performans, piyasa arz-talep dengeleri, ekosistem gelişimi ve makroekonomik faktörler ışığında profesyonel fiyat tahminleri ve yatırımcılara yönelik stratejik öneriler ile kapsamlı biçimde ele alınacaktır.

I. TAO Fiyat Geçmişi ve Mevcut Piyasa Durumu

TAO Tarihsel Fiyat Gelişimi

- 2023: TAO piyasaya sürüldü, fiyatı 100,93 dolardan başladı

- 2023: 5 Eylül’de, 21,428 dolarla tüm zamanların en düşük seviyesine geriledi

- 2024: 11 Nisan’da, 795,6 dolarla rekor seviyeye ulaştı

- 2025: Belirgin dalgalanmalar yaşandı, fiyat 300-500 dolar aralığında hareket etti

TAO Mevcut Piyasa Durumu

15 Ekim 2025 itibarıyla TAO’nun fiyatı 447,1 dolar, 24 saatlik işlem hacmi ise 22.866.572,92 dolar seviyesinde. Token, son 24 saatte yüzde 5,67’lik artış, son bir haftada ise yüzde 35,65’lik güçlü yükseliş gösterdi. TAO’nun piyasa değeri 4.291.038.226 dolar ile küresel kripto para piyasasında 35. sırada yer alıyor.

Mevcut fiyat, 11 Nisan 2024’teki 795,6 dolarlık zirveden yüzde -43,8 gerilemiş durumda; ancak 5 Eylül 2023’teki 21,428 dolarlık dip seviyenin oldukça üzerinde. Dolaşımdaki token miktarı 9.597.491 adet, toplam arz ise 21.000.000; bu da dolaşımdaki arz oranının yüzde 45,70 olduğunu gösteriyor.

TAO’nun farklı zaman dilimlerindeki performansı dengeli bir tablo sunuyor: kısa ve orta vadede güçlü kazançlar (1 saatte yüzde 1,42, 30 günde yüzde 28,19), ancak son yılda yüzde -28,99’luk bir düşüş yaşandı. Bu, token’ın yükseliş trendinde olduğunu fakat önceki düzeltmeleri henüz tam olarak telafi edemediğini gösteriyor.

Piyasada TAO için temkinli bir iyimserlik hakim; son fiyat artışları, Bittensor projesine ve merkeziyetsiz makine öğrenimi ağına olan ilginin yeniden arttığına işaret ediyor.

Güncel TAO piyasa fiyatını görüntülemek için tıklayın

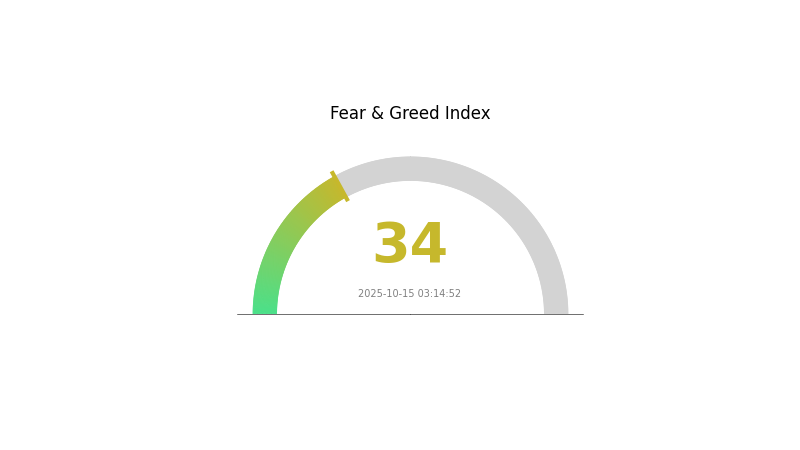

TAO Piyasa Hissiyatı Göstergesi

15 Ekim 2025 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksi’ni görüntülemek için tıklayın

Kripto piyasasında hissiyat temkinli kalırken, Korku ve Açgözlülük Endeksi 34 seviyesinde ve piyasada korkunun hakim olduğunu gösteriyor. Bu, yatırımcıların ihtiyatlı davrandığını ve yeni alım fırsatlarını değerlendirdiğini gösterir. Böyle dönemlerde detaylı araştırma yapmak ve maliyet ortalaması yöntemiyle yatırım yapmak önemlidir. Unutmayın, piyasa korkusu genellikle büyük fiyat hareketlerinden önce gelir. Bilgilerinizi güncel tutun, riskinizi yönetin ve Gate.com’un gelişmiş işlem araçlarını kullanarak belirsizlikleri aşın.

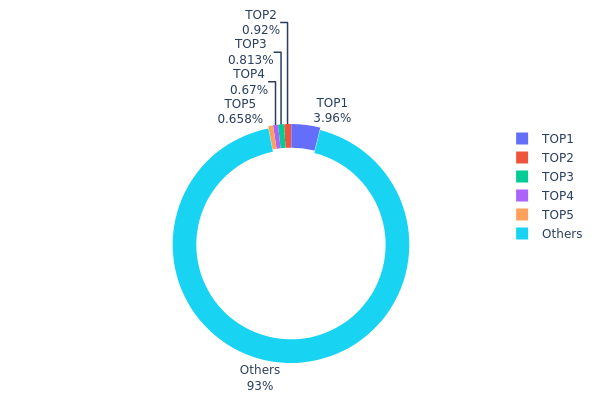

TAO Varlık Dağılımı

TAO'nun adres bazlı varlık dağılımı verileri, güçlü bir merkeziyetsizlik yapısı ortaya koyuyor. En büyük adres toplam arzın yüzde 3,96’sına sahipken, onu izleyen dört adresin her biri yüzde 1’in altında tutara sahip. İlk 5 adresin kontrol ettiği oran yüzde 7; kalan yüzde 93’lük pay ise diğer adresler arasında dağılmış durumda.

Bu dağılım, TAO için sağlıklı bir merkeziyetsizlik seviyesi anlamına gelir. Az sayıda adreste yoğunlaşma olmaması, piyasa manipülasyonu riskini azaltır ve istikrarı artırır. Bu çeşitlilik, fiyat hareketlerinin daha doğal oluşmasını sağlar; tek bir varlığın piyasayı yönlendirmesi önlenir.

Mevcut adres dağılımı, TAO’nun zincir üstü yapısının güçlü ve merkeziyetsiz olduğunu gösteriyor. Bu özellik, merkeziyet riski düşük ve demokratik yönetim yapısı arayan yatırımcılar için cazip bir avantaj sunar.

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 5Hd2ze...86pg4N | 832.43K | 3,96% |

| 2 | 5DZku2...yas47M | 193.28K | 0,92% |

| 3 | 5FRqwe...hnhq7r | 170.80K | 0,81% |

| 4 | 5GhMqy...mRY4XZ | 140.65K | 0,66% |

| 5 | 5FqBL9...Lxoy2s | 138.10K | 0,65% |

| - | Diğerleri | 19524.74K | 93% |

II. TAO’nun Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Blok Ödülü Yarılanması: TAO'nun fiyatı, yeni token üretimini azaltan blok ödülü yarılanmalarından etkilenir.

- Geçmiş Eğilimler: Arzda yaşanan değişiklikler, TAO'nun fiyatında kayda değer dalgalanmalara yol açmıştır.

- Güncel Etki: Yaklaşan yarılanmanın, arz enflasyonunun azalması nedeniyle TAO fiyatını artırması bekleniyor.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: TAO'nun yapay zeka sektöründeki büyük şirketler tarafından benimsenmesi fiyat üzerinde güçlü etki yaratabilir.

- Devlet Politikaları: Düzenleyici kararlar ve kamu sektörünün yapay zeka teknolojilerini benimsemesi TAO'nun değerini etkileyebilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma Özelliği: TAO'nun enflasyon dönemlerindeki performansı, hedge aracı olarak cazibesini artırabilir.

- Jeopolitik Faktörler: Uluslararası gerginlikler ve gelişmeler, merkeziyetsiz yapay zeka çözümlerine olan talebi etkileyerek TAO fiyatında değişiklik oluşturabilir.

Teknik Gelişim ve Ekosistem İnşası

- Yapay Zeka Hizmetlerinde İyileştirme: Bittensor ağındaki yapay zeka servislerinin güçlenmesi, doğrudan TAO'nun değerini artırır.

- Ekosistem Uygulamaları: Ekosistemde geliştirilecek yeni DApp ve yapay zeka çözümleri, TAO talebini artırabilir.

III. TAO 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 348,43 - 400 dolar

- Nötr tahmin: 400 - 446,7 dolar

- İyimser tahmin: 446,7 - 491,37 dolar (pozitif piyasa hissiyatı ve artan benimseme ile)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Artan benimseme ile büyüme dönemi

- Fiyat aralığı tahminleri:

- 2027: 436,53 - 649,47 dolar

- 2028: 449,09 - 815,46 dolar

- Temel katalizörler: Daha geniş blokzincir entegrasyonu ve kurumsal ilginin artması

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 703,19 - 815,7 dolar (istikrarlı piyasa büyümesi ve benimseme ile)

- İyimser senaryo: 815,7 - 1.000 dolar (güçlü piyasa ve teknolojik ilerleme ile)

- Dönüştürücü senaryo: 1.000 - 1.215,39 dolar (çığır açan uygulamalar ve kitlesel kabul ile)

- 2030-12-31: TAO 815,7 dolar (mevcut projeksiyonlara göre potansiyel ortalama fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 491,37 | 446,7 | 348,43 | 0 |

| 2026 | 595,67 | 469,04 | 281,42 | 4 |

| 2027 | 649,47 | 532,35 | 436,53 | 18 |

| 2028 | 815,46 | 590,91 | 449,09 | 31 |

| 2029 | 928,21 | 703,19 | 485,2 | 56 |

| 2030 | 1.215,39 | 815,7 | 570,99 | 81 |

IV. TAO Profesyonel Yatırım Stratejileri ve Risk Yönetimi

TAO Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Yapay zeka ve merkeziyetsiz teknolojiye uzun vadeli inananlar

- Yöntem önerileri:

- Piyasa düşüşlerinde TAO biriktirin

- Düzenli alım planlarıyla maliyet ortalaması sağlayın

- Token’ları güvenli, kendi kontrolünüzdeki cüzdanlarda tutun

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını belirleyin

- RSI: Aşırı alım ve aşırı satım durumlarını takip edin

- Dalgalı alım-satım için önemli noktalar:

- Piyasa hissiyatını ve blokzincir-yapay zeka haberlerini takip edin

- Teknik göstergelere göre giriş-çıkış noktalarını netleştirin

TAO Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Portföyün yüzde 1-3’ü

- Agresif yatırımcılar: Portföyün yüzde 5-10’u

- Profesyonel yatırımcılar: Portföyün en fazla yüzde 15’i

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Kripto ve geleneksel varlıklara yayılım yapın

- Zarar durdur emri: Olası kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate web3 cüzdanı

- Soğuk depolama: Uzun vadeli tutum için kağıt cüzdan

- Güvenlik: İki faktörlü doğrulama kullanın, özel anahtarları paylaşmayın

V. TAO için Potansiyel Riskler ve Zorluklar

TAO Piyasa Riskleri

- Yüksek oynaklık: Kripto para piyasalarında aşırı fiyat dalgalanmaları sık görülür

- Piyasa hissiyatı: Yapay zeka hype döngüleri TAO’nun piyasa değerini etkileyebilir

- Rekabet: Yeni yapay zeka odaklı blockchain projeleri ortaya çıkabilir

TAO Regülasyon Riskleri

- Belirsiz regülasyon ortamı: Devletler yapay zeka ve kripto paralara daha sıkı düzenlemeler getirebilir

- Menkul kıymet olarak sınıflandırılma riski: TAO’nun alım-satım ve dağıtımını etkileyebilir

TAO Teknik Riskler

- Akıllı sözleşme açıkları: Tespit edilen zafiyetler istismar edilebilir

- Ölçeklenebilirlik sorunları: Ağ büyüdükçe yeni problemler yaşanabilir

- Merkeziyet riski: Büyük miktarda TAO’nun az sayıda elde toplanması

VI. Sonuç ve Eylem Tavsiyeleri

TAO Yatırım Değeri Değerlendirmesi

TAO, yapay zeka ile blockchain teknolojisinin kesişiminde benzersiz bir fırsat sunuyor. Uzun vadeli potansiyeli güçlü olsa da, kısa vadede volatilite ve regülasyon belirsizliği önemli riskler oluşturuyor.

TAO Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük ve düzenli yatırımlarla projeyi ve piyasadaki hareketleri öğrenin ✅ Deneyimli yatırımcılar: TAO’yu diğer kripto varlıklarla dengeli şekilde portföye ekleyin ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın ve TAO’yu çeşitlendirilmiş kripto portföyüne dahil edin

TAO Katılım Yöntemleri

- Spot alım-satım: Gate.com’da TAO token alıp satabilirsiniz

- Staking: Ağ doğrulamasına katılarak ödül kazanabilirsiniz

- Katılım: Bittensor topluluğunda ve geliştirme çalışmalarında aktif rol alın

Kripto para yatırımları yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk toleransınıza göre dikkatlice verin ve profesyonel finans danışmanlarına başvurun. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

TAO kripto ne kadar yükselebilir?

Toplanan tahminlere göre TAO, 2025’te 1.108,53 dolara ve 2030’da 954,31 dolara ulaşabilir. Gerçek fiyatlar ise değişkenlik gösterebilir.

TAO iyi bir yatırım mı?

Evet, TAO mevcut fiyatıyla (490 dolar) büyüme potansiyeli taşıyor. Güçlü performansı ve olumlu piyasa hissiyatı ile dikkat çekiyor.

2025’te Tron için fiyat tahmini nedir?

Tron’un fiyatının, kripto boğa piyasasının ikinci ayağıyla birlikte 2025’te ciddi şekilde yükselmesi bekleniyor. Artan işlem hacmi ve gelir büyümesiyle en iyi performans gösteren altcoinlerden biri olabilir.

Bittensor’un fiyatı 1.000 dolara ulaşabilir mi?

Evet, Bittensor 2026 Temmuz’a kadar 1.000 dolara ulaşabilir; bu da mevcut seviyeden yüzde 113’lük bir artış anlamına gelir. Piyasanın büyüme eğilimi bu hedefin mümkün olduğunu gösteriyor.

2025 BNKR Fiyat Tahmini: Dijital Varlık Sektöründe Piyasa Eğilimleri ve Büyüme Potansiyelinin Analizi

2025 ASP Fiyat Tahmini: Piyasa Trendleri ve Sektör Liderleri için Stratejik Öngörü

2025 ORAI Fiyat Tahmini: Oraichain Token’ın Piyasa Analizi ve Gelecek Büyüme Potansiyeli

2025 TA Fiyat Tahmini: Teknik Varlıklar için Piyasa Trendleri Analizi ve Gelecek Değerlerin Öngörülmesi

2025 TAPrice Tahmini: Piyasa Trendleri ve Token Varlıklarının Gelecekteki Değerlemesinin Analizi

2025 DNX Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Web3 Dünyasında Gerçek Varlıkların Tokenleştirilmesi Fırsatlarını Keşfedin

Lüks tutkunlarına özel, yat konseptli NFT koleksiyonlarını keşfedin

Verimli Kripto Musluk Yönetimi İçin En İyi Araçlar

Devrim niteliğindeki milyon dolarlık Layer 2 Ethereum ölçeklendirme çözümünü keşfedin

Maksimum getiri sağlamak isteyenler için en avantajlı kripto tasarruf hesapları