After the wealth effect disappears, will the myth or tragedy of decentralization remain?

Ethereum is moving toward Layer 1 scaling and privacy, while the U.S. equities clearing engine DTCC, which oversees $100 trillion, is beginning its transition on-chain. This signals a promising new wave in crypto may be on the horizon.

However, the profit strategies of institutions and retail investors are fundamentally different.

Institutions have a high tolerance for time and volatility. Their decade-long investment horizons and leveraged arbitrage on small spreads are far more reliable than the retail dream of thousandfold returns in a single year. In the coming cycle, we’re likely to see a unique scenario: on-chain growth, institutional inflows, and retail investors under pressure all happening simultaneously.

This shouldn’t come as a surprise—BTC spot ETFs and DATs, the disappearance of Bitcoin’s four-year cycle and altcoin seasons, and the shift of Korean investors from crypto to equities have repeatedly validated this pattern.

After October 11, centralized exchanges became the last line of defense for project teams, venture capitalists, and market makers, officially entering “garbage time.” The greater their market influence, the more conservative their approach—ultimately eroding capital efficiency.

The lack of value in altcoins and the meme coin craze are just side notes in a path weighed down by its own inertia. Moving on-chain is inevitable, but the resulting world will differ from the free and prosperous vision many once imagined.

We hoped the wealth effect would offset the numbness brought by losing faith in decentralization. Let’s hope we don’t lose both freedom and prosperity.

This will be my final discussion of concepts like decentralization and cypherpunk. The old stories of freedom and betrayal have been left behind by the relentless march of progress.

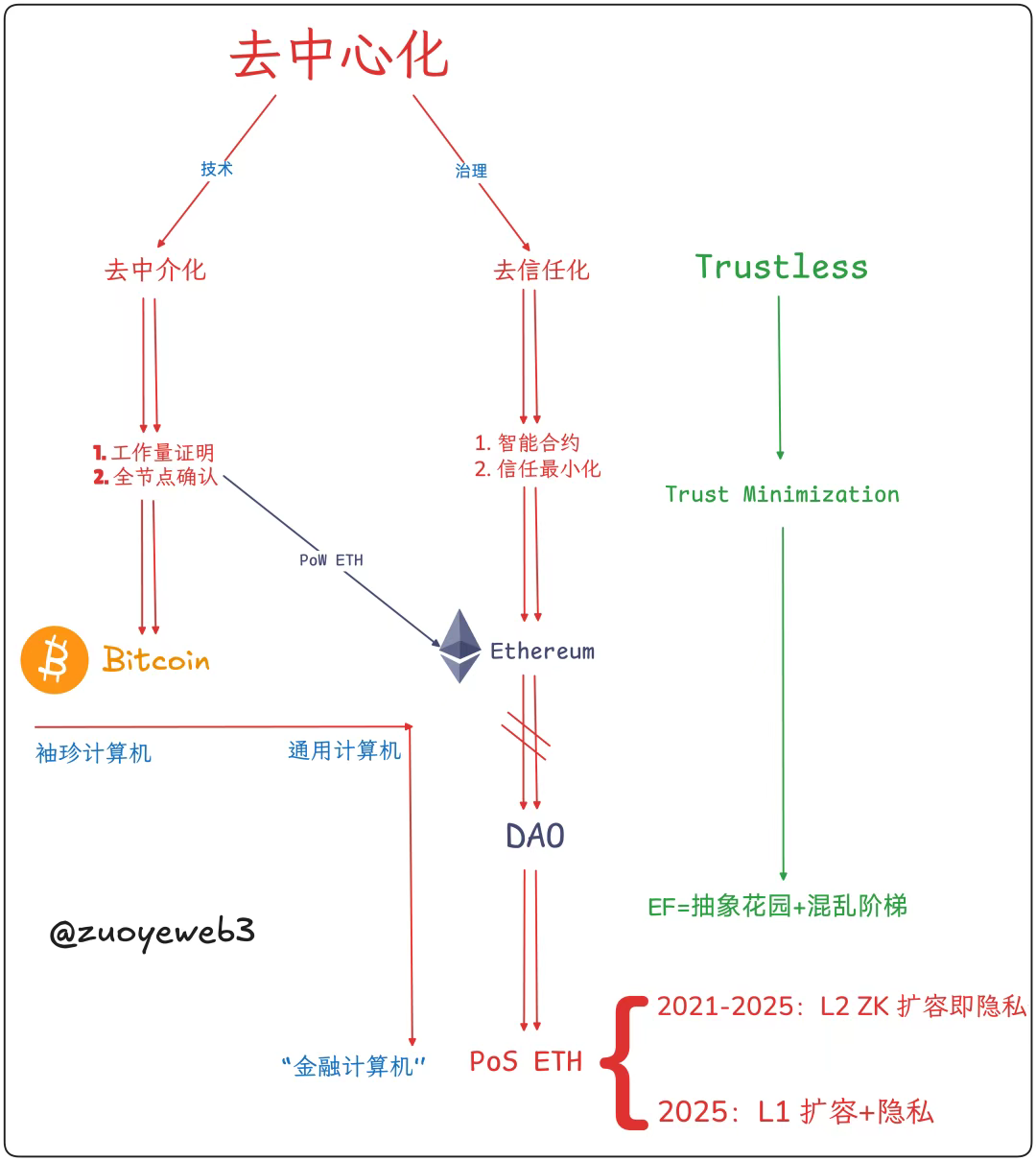

Decentralization: The Birth of the Pocket Computer

DeFi was never built on the ideology or architecture of Bitcoin.

Nick Szabo, who created “smart contracts” in 1994 and first proposed Bit Gold in 1998 (refined in 2005), also inspired Bitcoin’s Proof of Work and timestamping mechanisms.

Szabo once called Bitcoin a pocket computer and Ethereum a universal computer. But after the 2016 DAO incident—when Ethereum rolled back its transaction history—Szabo became a vocal critic.

During the 2017–2021 Ethereum bull run, Szabo was seen as an outdated contrarian.

On one hand, Szabo sincerely believed Ethereum surpassed Bitcoin by achieving greater disintermediation, with full implementation of PoW and smart contracts.

On the other hand, Szabo saw Ethereum’s trustless governance reforms—through DAOs—as pioneering global, efficient collaboration among strangers.

This lets us define what decentralization really means: technical disintermediation—pricing and transaction consensus; governance trust minimization—reducing reliance on trust.

Image description: Components of decentralization

Image source: @ zuoyeweb3

- Disintermediation: No dependence on gold or government—computational work becomes proof of individual Bitcoin production;

- Trust minimization: No dependence on social relationships—openness under minimum trust principles drives network effects.

Satoshi Nakamoto was influenced by Bit Gold but didn’t fully embrace smart contracts. Favoring simplicity, he retained some opcode combinations for complex actions but focused on peer-to-peer payments.

This is why Szabo saw promise in Ethereum’s PoW era—full smart contracts and “self-restraint.” Of course, Ethereum faced Layer 1 scaling challenges similar to Bitcoin. Vitalik eventually chose Layer 2 scaling to protect the integrity of Layer 1.

This “damage” refers mainly to the full node size crisis. Once Satoshi stopped optimizing, Bitcoin raced toward mining hardware and hashpower competition, effectively excluding individuals from production.

Image description: Blockchain node sizes

Image source: @ zuoyeweb3

Vitalik resisted for a time. Before surrendering to a data center chain model in 2025, he switched to Proof of Stake but still tried to preserve individual nodes.

Proof of Work is often equated with hashpower and energy consumption, forming its cost base. But in the early cypherpunk movement, PoW and timestamps worked together to confirm transaction times, building consensus and mutual recognition.

So, Ethereum’s move to PoS fundamentally excludes individual nodes from production. Combined with “zero-cost” ETH accumulated from ICOs, VCs have invested billions into the EVM+ZK/OP Layer 2 ecosystem, amassing huge institutional cost bases. ETH DAT now serves as an institutional OTC exit.

After the failure of technical disintermediation, node explosion was contained, but mining pools and hashpower clusters took over. Ethereum cycled through Layer 1 (sharding, sidechains) to Layer 2 (OP/ZK) and back, ultimately embracing large nodes.

Objectively, Bitcoin lost “personalized” smart contracts and hashpower; Ethereum lost “personalized” nodes but retained smart contracts and ETH’s value capture.

Subjectively, Bitcoin achieves minimal governance but relies on a few developers’ good faith to maintain consensus. Ethereum abandoned the DAO model and shifted toward centralized governance (in theory, no—but in practice, Vitalik can steer the Ethereum Foundation and ecosystem).

This isn’t about favoring ETH or BTC. Both sets of early investors succeeded financially, but neither shows signs of returning to decentralization.

Bitcoin is unlikely to support smart contracts; Lightning Network and BTCFi are still payment-focused. Ethereum kept smart contracts but abandoned PoW’s price benchmark, and—beyond trust minimization—opted for centralized governance, a historical reversal.

History will judge right and wrong.

The Middleman Economy: The Fall of the World Computer

Where there’s organization, there’s infighting; where unity is promoted, centralization and bureaucracy follow.

Token pricing mechanisms fall into narrative and demand categories. For example, Bitcoin’s narrative is peer-to-peer electronic cash, but demand is for digital gold. Ethereum’s narrative is “world computer,” but ETH demand is for Gas Fees.

The wealth effect favors Proof of Stake. Staking on Ethereum requires ETH, and using DeFi also requires ETH. ETH’s value capture strengthens PoS’s rationale, making Ethereum’s move away from PoW correct under real-world demand.

Narratively, the transaction volume × Gas Fee model resembles SaaS and Fintech, failing to match the grand “compute everything” vision. When non-DeFi users leave, ETH’s value cannot be sustained.

Ultimately, no one uses Bitcoin for transactions, but someone always wants Ethereum to compute everything.

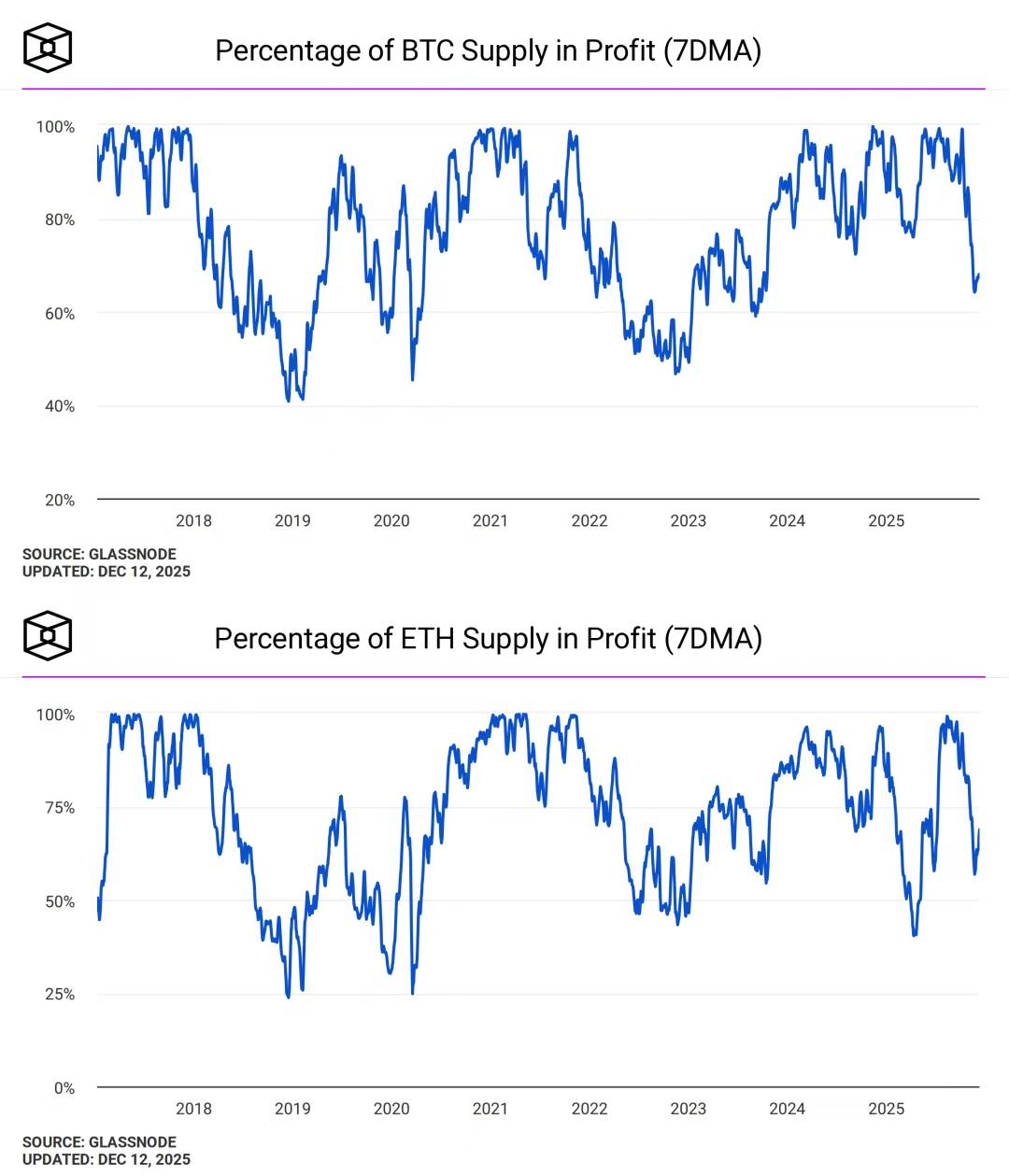

Image description: BTC and ETH address profitability

Image source: @ TheBlock__

Decentralization isn’t the same as wealth effect. After Ethereum’s move to PoS, ETH’s capital value became its sole pursuit, and price swings receive excessive market attention, further highlighting the gap between vision and reality.

In contrast, gold and Bitcoin price swings are seen as basic market sentiment. People worry about global events when gold surges, but no one doubts Bitcoin’s fundamental value when it drops.

It’s hard to say Vitalik and the Ethereum Foundation caused Ethereum’s “de-decentralization,” but the system is undeniably becoming more middleman-driven.

In 2023/24, it became trendy for Ethereum Foundation members to advise projects—Dankrad Feist with EigenLayer, for example—though few recall the DAO and the unclear roles of many core Ethereum members.

This only ended when Vitalik publicly announced he would no longer invest in Layer 2 projects, but Ethereum’s systemic bureaucratization is now inevitable.

“Middleman” doesn’t have to mean broker or other negative terms—it can mean efficiently matching and mediating needs, as the Solana Foundation did, driving development from both market and ecosystem perspectives.

For ETH and Ethereum, ETH should be the “middleman” asset, but Ethereum should remain fully open and autonomous, maintaining a permissionless public chain architecture.

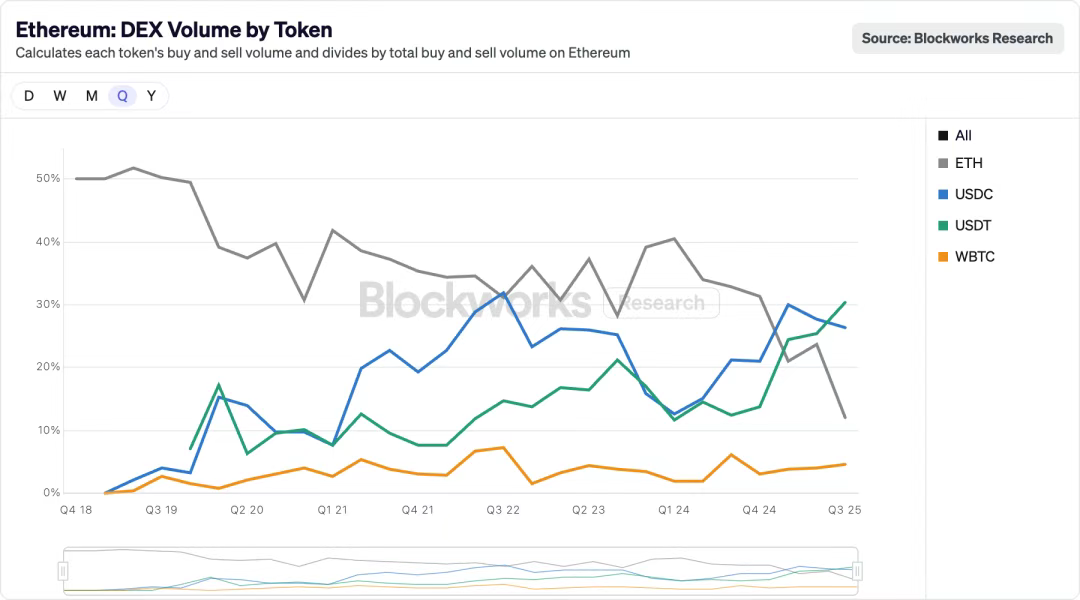

Image description: Ethereum DEX Volume by Token

Image source: @ blockworksres

Within Ethereum, stablecoins are gradually replacing ETH. Liquidity is moving on-chain via Perp DEXs, and USDT/USDC are reshaping the old landscape. The story of stablecoins replacing ETH/BTC as benchmark assets in centralized exchanges is playing out on-chain.

Yet USDT/USDC are centralized assets. If ETH can’t sustain massive application scenarios, it will only be used as an asset. With faster, cheaper transactions, Gas Fee consumption must be high enough to support ETH’s price.

Moreover, if Ethereum is to be fully open, any asset should be allowed to serve as a middleman asset. But this would severely hurt ETH’s value capture, so Layer 1 must reclaim authority from Layer 2, and Layer 1 needs to scale again. In this context, privacy can be seen as essential for institutions or as staying true to original intentions.

There are many stories here, each worth hearing, but you must choose a direction.

Full decentralization can’t achieve minimal organization, so everyone acts independently. Under the efficiency principle, systems tilt toward trust minimization, relying on Vitalik-derived order, which is no different from the extreme freedom given to black and gray markets by Sun.

We either trust Vitalik or trust Sun. Decentralization can’t establish self-sustaining order. People crave chaos internally but abhor environments lacking security.

Vitalik is a middleman, ETH is a middleman, and Ethereum will be a middleman between the traditional world and on-chain. Ethereum wants a “productless product,” but every product inevitably involves marketing, deception, and fraud. “Just use Aave” and “Just use UST” are fundamentally no different.

Only by repeating the first failed attempt can the financial revolution succeed. USDT first failed on the Bitcoin network, UST failed in buying BTC, then TRC-20 USDT and USDe succeeded.

In other words, people suffer from ETH’s decline and stagnation, and also from Ethereum’s expansion, making it impossible for retail investors to distinguish themselves from Wall Street. It should have been Wall Street buying retail’s ETH, but now people are bearing the bitter fruit of buying ETFs and DATs.

Ethereum’s limitation is ETH capital itself—production for production’s sake, production for ETH’s sake. These are two sides of the same coin, a self-evident truth. East and West don’t take each other’s bags, preferring specific ecosystems or founders. Ultimately, production is not for project tokens, but for ETH itself.

De—–>“centralization”: The Future of Financial Computing

From the Second International to LGBT, from the Black Panther Party to the Black Panthers, from Bitcoin to Ethereum.

After the DAO incident, Nick Szabo became disillusioned with Ethereum. Satoshi retreated from public view, but Ethereum’s performance is far from poor. I’m not inconsistent—criticizing Ethereum, then praising Vitalik in the next breath.

Compared to Solana, HyperEVM, and other next-generation chains, Ethereum still best balances decentralization and the wealth effect. Bitcoin’s lack of native smart contract support remains its greatest flaw.

As a ten-year-old chain, ETH and Ethereum have evolved from “opposition” to “official opposition,” periodically reviving the spirit of decentralization and cypherpunk, then forging ahead toward the reality of the financial computer’s future.

Minerva’s owl only takes flight at night. The debate between wealth effect and decentralization will be buried in Königsberg, as the harsh reality of history has already buried both narratives together.

Statement:

- This article is republished from [TechFlow]. Copyright belongs to the original author [TechFlow]. If you have any objections to this republication, please contact the Gate Learn team, who will address your concerns promptly according to established procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author alone and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is cited, translated articles may not be copied, distributed, or plagiarized.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?