Enterprises going global: Structural selection and tax optimization strategies

Selecting the right corporate structure is crucial for Web3 companies seeking global expansion. The appropriate framework not only optimizes tax liabilities but also mitigates risks and increases flexibility for international operations.

Whether leveraging the low tax rates of a single-entity structure or deploying a multi-entity setup tailored to business needs, strategic design can significantly boost a company’s global competitiveness and foster sustainable growth within the Web3 ecosystem.

Given their decentralized nature, Web3 companies face distinct legal, tax, and operational hurdles when expanding globally.

Establishing the right corporate structure ensures compliance, streamlines tax efficiency, reduces risks, and enhances adaptability to different legal systems, technical infrastructures, and market demands worldwide.

I. What Is an Offshore Structure?

An offshore structure refers to the organizational and management framework crafted by a company during its globalization process. Its core purpose is to coordinate global resources, accommodate the characteristics of various markets, and enable efficient cross-border operations.

The structure’s design directly impacts a company’s global competitiveness and operational efficiency. Key considerations include not just equity structure, but also future structural adjustments, tax implications, intellectual property management, fundraising activities, and overall maintenance costs.

II. Selecting an Offshore Structure Type

Tax optimization is a primary consideration for Web3 companies structuring international operations, as evolving global tax rules increasingly influence digital assets. Hong Kong, Singapore, and the British Virgin Islands (BVI) are among the most popular jurisdictions for establishing offshore holding companies.

(1) Single-Entity Structure

1. Hong Kong

Hong Kong features a low-tax regime, which primarily includes profits tax, salaries tax, and property tax. It does not impose value-added tax (VAT) or business tax. Corporate profits up to HKD 2 million are taxed at 8.25%, while profits exceeding HKD 2 million are taxed at 16.5%. Hong Kong companies receive dividends from foreign companies—where their ownership stake exceeds 5%—without paying foreign dividend tax.

Hong Kong has established double tax treaties (DTTs) with roughly 45 countries and regions, including Mainland China, ASEAN member states, and major European markets. This broad DTT network offers extensive tax planning flexibility, especially in reducing withholding tax on cross-border dividends and interest payments.

2. Singapore

Singapore imposes a corporate income tax rate of 17%, slightly above Hong Kong’s. However, its tax regime is especially friendly to technology and R&D businesses, with multiple exemptions and deduction policies available. Singapore additionally exempts qualified foreign dividends and capital gains from taxation.

Singapore offers various tax incentives, such as the Regional Headquarters (RHQ) and Global Trader Program (GTP), creating additional tax planning options for multinational enterprises.

Singapore has DTTs with over 90 countries, including China, India, and members of the European Union—granting broad international tax planning and significant reductions in withholding tax for cross-border dividends and interest.

3. BVI (British Virgin Islands)

The British Virgin Islands (BVI) stand out for their zero-tax regime, strong privacy protection, and structural flexibility, making them a premier offshore jurisdiction for cross-border investment, asset protection, and tax optimization, especially for holding companies and crypto-related business activities.

The BVI imposes no corporate income, capital gains, dividend, or inheritance taxes—ensuring extremely low tax costs.

BVI companies do not disclose shareholder or director information to the public. Nominee services help maintain confidentiality and protect asset security.

BVI companies are internationally recognized offshore entities and are widely accepted in key financial centers such as Hong Kong, Singapore, and London. This facilitates bank account openings, as well as streamlined international payment, trade settlement, and capital movement.

Major tax rate comparison:

(2) Multi-Entity Structure

A multi-entity structure allows for optimal tax planning. Domestic companies can establish one or more intermediate holding companies in low-tax jurisdictions (e.g., Hong Kong, Singapore, BVI, Cayman Islands) to facilitate investments in target markets. This structure leverages the low tax rates and confidentiality of offshore companies to reduce total tax liabilities, protect sensitive company information, disperse parent company risk, and streamline future equity restructurings, exits, or public offerings.

Case Study 1 — Intermediate Holding Company: China → Singapore → Southeast Asia Subsidiary (e.g., Vietnam)

A Chinese parent company may invest in Vietnam through a Singaporean holding company. Since Singapore has bilateral DTTs with both China and Vietnam, dividend withholding tax can be lowered to as little as 5%—a 50% reduction compared to direct Chinese ownership (where the China-Vietnam DTT sets it at 10%).

As a mid-level holding entity, Singapore companies typically are not subject to capital gains tax on share transfers. However, direct transfer of Vietnamese subsidiary shares may be taxed at a 20% capital gains rate in Vietnam. A Singaporean intermediate structure also aligns with Western investment norms, improving asset exit liquidity.

Furthermore, Singapore companies can serve as regional headquarters, managing subsidiaries across different countries—facilitating international investment or subsequent spin-offs for public listing. With a mature financial market, Singapore holding companies can issue bonds or obtain international loans, lowering overall financing costs.

Case Study 2 — VIE Structure: BVI → Hong Kong → Operating Company

In jurisdictions with stringent Web3 regulations and high operational risk, a Variable Interest Entity (VIE) framework is commonly used. Under this structure, a BVI holding company owns a Hong Kong subsidiary, which in turn invests in the operating company—enabling indirect control via VIE contracts (as used by companies like Alibaba, Tencent Music, and New Oriental). The offshore holding company exerts operational control of the business through a series of contractual arrangements.

The BVI entity, as the parent holding company, enjoys capital gains tax exemption for future equity transfers and protects founders’ privacy.

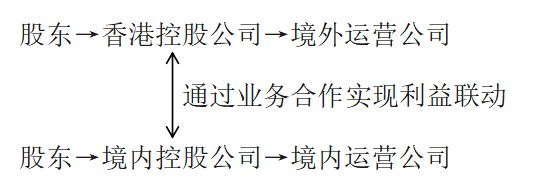

Case Study 3 — Parallel Onshore/Offshore Structure:

This structure suits environments with regulatory uncertainty, or where financing, geopolitics, licenses, or data security necessitate distinct roles for onshore and offshore entities. For example, see: Mankun Research | Web3 Startups: Is the “Front-end in Hong Kong, Back-end in Shenzhen” Model Compliant? (Hyperlink: https://mp.weixin.qq.com/s/PEdL5ArnCXOnqHov3HT4vA)

This structure generally results in a lower overall tax rate. Offshore entities can register in jurisdictions offering tax incentives (such as Hong Kong, Singapore, or the Cayman Islands), benefiting from reduced income tax rates or capital gains exemptions. Profits can be allocated strategically to capitalize on deductions and minimize overall group tax burden.

Independent Onshore/Offshore Operations: In parallel structures, domestic and overseas companies operate as separate legal entities under their respective tax systems. This allows each to pay taxes based on local rules, avoiding global income consolidation linked to parent-subsidiary shareholding relationships.

III. Conclusion

The right corporate structure is essential for global Web3 expansion. It supports tax efficiency, effective risk management, and business agility. Whether deploying a single-entity structure to leverage low tax environments or building multi-entity structures for complex international strategies, thoughtful structural design can greatly enhance competitive positioning and ecosystem growth prospects.

Disclaimer:

- This article is republished from [TechFlow], with copyright held by the original author [Crypto Miao]. If you have concerns regarding republication, please contact the Gate Learn team so we can address your concerns promptly.

- Disclaimer: The opinions expressed herein are solely those of the author and do not constitute investment advice.

- The Gate Learn team translates other language versions of this article. Unless expressly credited to Gate, reproduction, distribution, or plagiarism of these translations is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?