Is This Bull Market Over? A Deep Dive into the ‘Changes’ and ‘Constants’ of Bitcoin’s Four-Year Cycle

I. Introduction: The Evolving Dynamics of Bitcoin’s Market Cycles

Bitcoin halves its supply growth roughly every four years, a mechanism that has long shaped the ebb and flow of the crypto market. Yet, following the fourth halving in April 2024, both Bitcoin’s price and the broader crypto landscape have exhibited patterns unlike any seen before. Traditionally, a halving signals the end of a bear market, and a new bull run typically peaks within a year. However, the 2024–2025 cycle has confounded many investors: while Bitcoin reached record highs, the market lacked the widespread mania of previous cycles. Instead, the rally was gradual and subdued, volatility narrowed, and skepticism grew over whether the four-year cycle still holds.

What sets this cycle apart? Which elements of the four-year cycle theory remain relevant? What factors have shifted the tempo of this cycle? Against a backdrop of shifting macro conditions, institutional inflows, and muted retail sentiment, what lies ahead for Bitcoin? This analysis unpacks the current halving cycle’s market behavior, explores the evolution of cyclical trends and their drivers, and looks ahead to price trajectories through late 2025 and into 2026—offering investors a comprehensive, insightful perspective.

II. Current Bitcoin Halving Cycle: Performance and Key Features

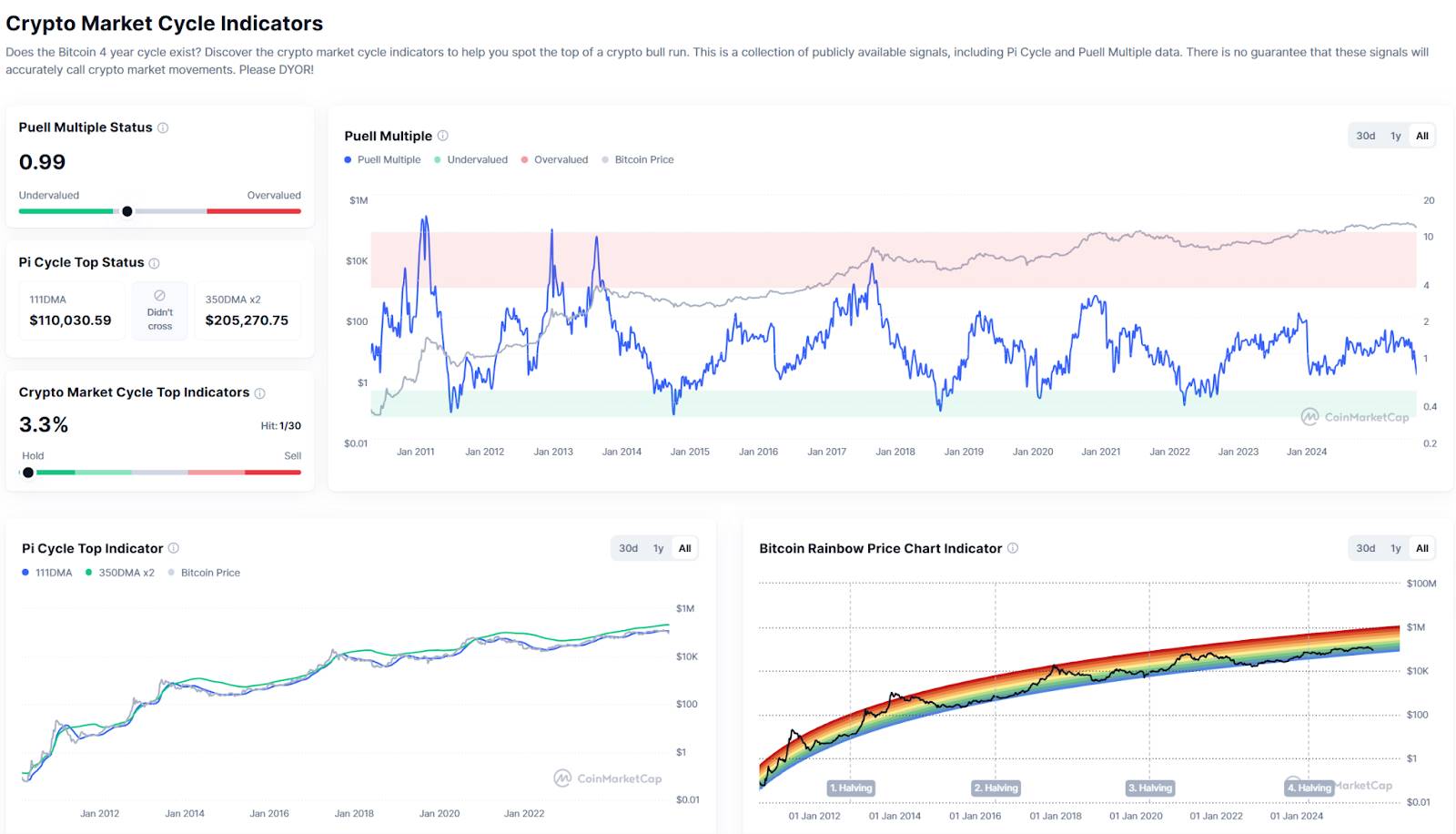

Source: https://coinmarketcap.com/charts/crypto-market-cycle-indicators/

On April 19, 2024, Bitcoin completed its fourth block reward halving, reducing rewards from 6.25 BTC to 3.125 BTC. Historically, halvings occur at the tail end of bear markets, with bull markets unfolding over the following 12–18 months. The 2024–2025 cycle, however, features both familiar rhythms and notable departures from the past.

- Price Action: New Highs, Moderate Gains. On halving day, Bitcoin closed near $64,000. In the months that followed, price action remained volatile but trended upward: by mid-November 2024, Bitcoin topped $90,000; after the U.S. presidential election and a string of positive headlines, it broke the $100,000 milestone on December 5, 2024, setting a new record. In 2025, Bitcoin continued to climb, reaching an all-time high of around $126,270 on October 6, 2025—about 18 months post-halving, echoing the timing of previous cycles. Yet, this rally was slower and more tempered, lacking the parabolic blow-off of past cycle peaks. From the 2022 bear market low (~$15,000), Bitcoin’s peak represented a 7–8x gain, but from the halving ($64,000), the increase was less than 2x. By comparison, the 2017 bull run saw nearly 20x gains from the bottom, and 2021 saw about 3.5x. This cycle’s ascent was clearly more restrained, marking a “slow bull” trend.

- Market Sentiment and Volatility: Calm Prevails. Despite new highs, the market did not experience the widespread retail frenzy of earlier cycles. In late 2017 and 2021, bull market tops were marked by mass enthusiasm and a proliferation of altcoins. This time, even as Bitcoin crossed $100K, public sentiment remained cool, without the runaway FOMO of 2017 or the NFT and Dogecoin hype of 2021. On-chain data show that capital concentrated in Bitcoin and major coins, with dominance nearing 60%, while speculative altcoins lagged. Volatility dropped significantly, with annualized figures falling from above 140% in earlier years. Even during the second half of 2025’s correction, volatility rose only modestly, and the market lacked the wild swings of past cycles—making for a measured, steady uptrend.

- Multi-Stage, Moderate Rally—No Blow-Off Top. Unlike prior cycles, the 2024–2025 bull market peak was not a single, explosive event. From late 2024 through mid-2025, Bitcoin repeatedly consolidated near $100K before pushing higher: in January, MicroStrategy’s large purchase announcement sent prices to $107K; after the August peak, weak U.S. PPI data triggered a sharp drop from $124K to below $118K. The final rally in early October pushed prices to $126K, but there was no late-cycle mania: the peak was quickly followed by aggressive selling, with Bitcoin dropping nearly 30% in six weeks to a seven-month low near $89,000 by mid-November. This cycle’s uptrend was marked by repeated highs without explosive acceleration, and the ensuing correction was swift and steep.

- Partial Adherence to the Four-Year Cycle: Timing and Trajectory. Despite the unusual features, the cycle’s timing and path still broadly fit the classic “four-year cycle” mold. Bitcoin bottomed near $16,000 at the end of 2022, about a year after the previous peak ($69,000 in November 2021); the April 2024 halving marked the end of the bear; and the October 2025 top came about 18 months after the halving—similar to the timing of major peaks in 2013, 2017, and 2021. Thus, the broad “halving → bull market → top → bear” pattern remains. As one analysis notes: “From the April 2024 halving to the $125K high in October 2025 took nearly 18 months. By this measure, the cycle still follows the historic pattern: halving marks the bottom, a peak follows about a year later, then a correction.”

In sum, while the market reached new highs post-halving and the overall timing matched expectations, the texture of the rally and the experience of participants were markedly different. As a result, more investors are questioning whether Bitcoin’s four-year cycle is losing its predictive power. So, which parts of the traditional cycle theory still hold—and what’s changing?

III. Is the Four-Year Cycle Theory Still Reliable?

Beneath the surface turbulence, the core logic of Bitcoin’s four-year cycle endures. Halving-driven supply constraints continue to underpin long-term price appreciation, and investor psychology still cycles between greed and fear—albeit in a more muted fashion this time.

- Enduring Impact of Supply Contraction. Each Bitcoin halving reduces new supply, providing the fundamental driver behind previous bull markets. Even as total supply nears 94% of its cap and each halving’s marginal effect shrinks, the market’s sense of “scarcity” persists. In previous cycles, post-halving bullish conviction was strong, with many investors choosing to hold rather than sell. This cycle is no different: the April 2024 halving cut daily new issuance from 900 to 450 coins, and despite price swings, most long-term holders stayed put, unwilling to sell simply because gains were less dramatic. Supply contraction still tightens the market, though its price impact is less forceful than before.

- On-Chain Metrics Still Follow Cyclical Patterns. Bitcoin investors continue to exhibit classic “accumulation—profit-taking” behavior, with on-chain indicators echoing historical cycles. For example, MVRV (market value to realized value) typically falls below 1 at bear bottoms and rises to overheated levels in bull runs. In 2024, MVRV peaked at around 2.8, then fell below 2 during early 2025’s correction. SOPR=1 is the bull-bear dividing line: below 1 means most are selling at a loss, above 1 means most are taking profits. In the 2024–2025 bull run, SOPR mostly stayed above 1—mirroring previous cycles. Similarly, the RHODL ratio hit cycle highs in 2025, signaling a late-stage market and possible topping. Overall, MVRV, SOPR, RHODL, and other on-chain metrics still follow historical cycles; while their absolute values shift, the greed-fear pattern remains visible on-chain.

- Historical Data: Returns Shrink, Trend Persists. On a macro level, shrinking cycle returns are a natural result of market maturation—not evidence that the cycle is broken. Historically, each cycle’s peak return has diminished: 2013’s high was about 20x the previous peak, 2017 was also about 20x over 2013, but 2021 only rose about 3.5x from 2017. In this cycle, from the $69,000 peak in 2021 to $125,000 in 2025, the gain was just 80% (0.8x). Diminishing returns are to be expected as the market grows and new capital has less impact. This is a sign of maturity, not of cycle failure.

Bottom Line: The fundamental drivers of Bitcoin’s four-year cycle—supply contraction and recurring investor psychology—are still at work. Halvings still mark supply-demand inflection points, and the market continues to swing between fear and greed. Yet, a host of new factors are disrupting and reshaping the cycle’s outward appearance, making its rhythm harder to predict.

IV. Why Is the Cycle Out of Balance? Surging Variables and Narrative Fragmentation

If the halving cycle’s core logic remains, why is this cycle so hard to read? The answer: the once-dominant halving rhythm has been disrupted by a host of new forces, creating a much more complex landscape.

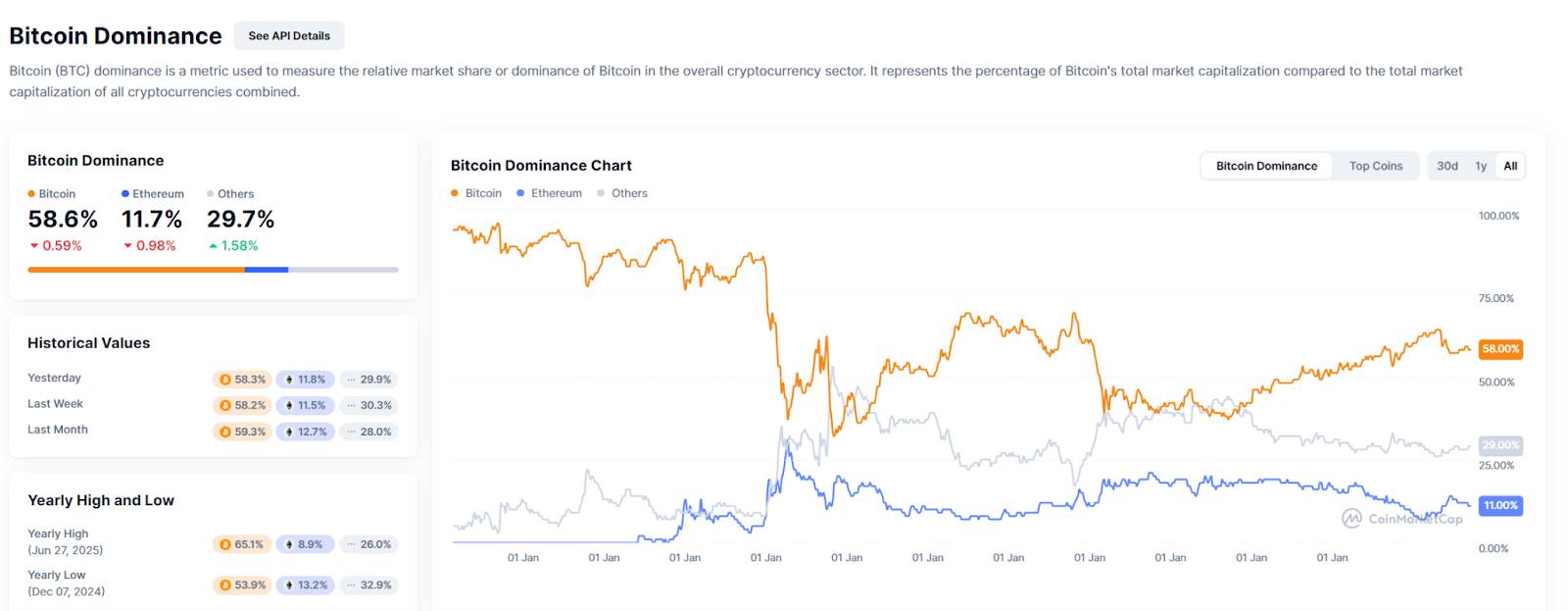

Source: https://coinmarketcap.com/charts/bitcoin-dominance/

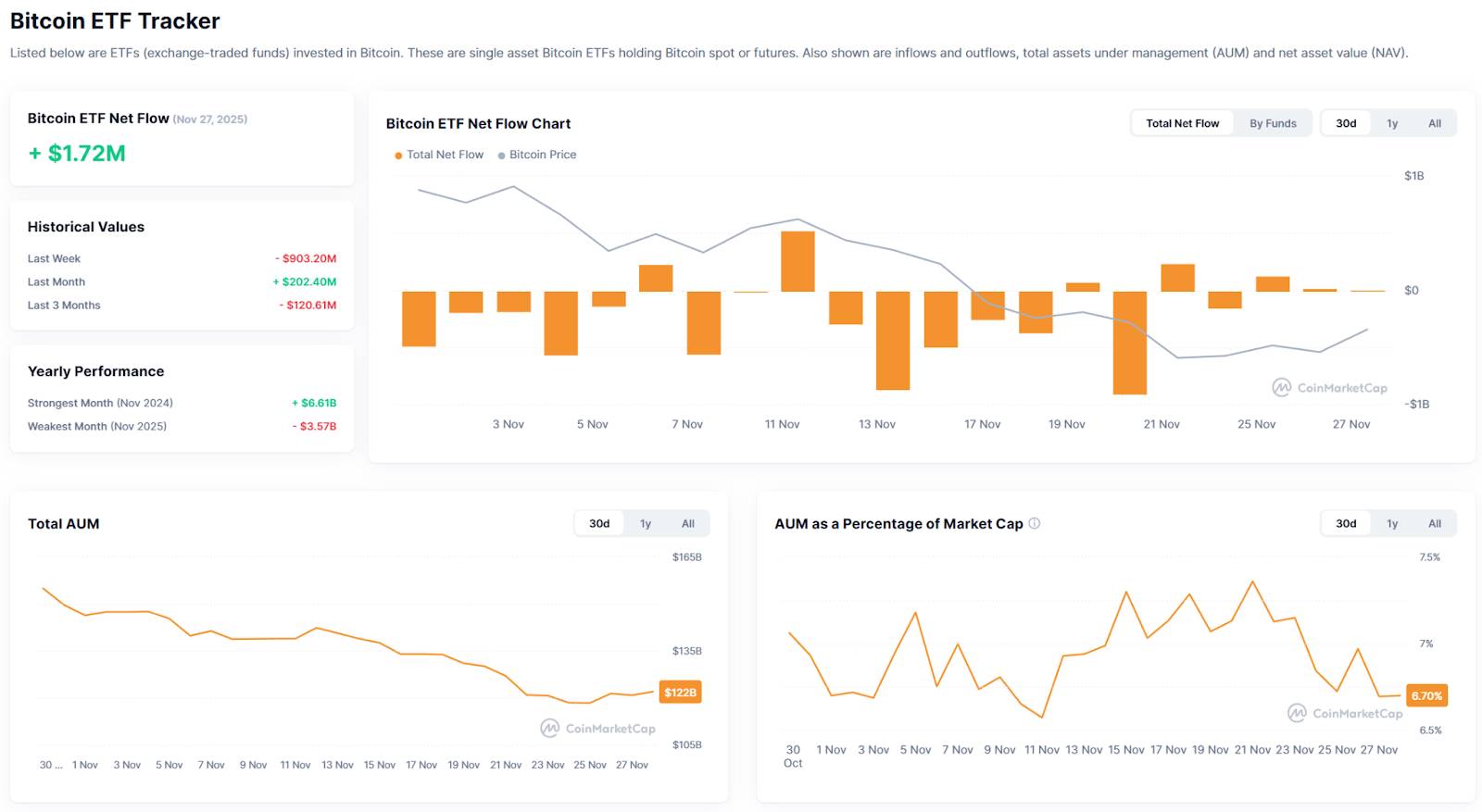

1. ETFs and Institutional Capital: Structural Shifts. Beginning in 2024, U.S. spot Bitcoin ETFs were approved and launched, ushering in massive institutional inflows and fundamentally changing the market’s retail- and leverage-driven dynamics. By October 2025, U.S.-listed spot Bitcoin ETFs held $176 billion in assets. Institutional capital not only pushed prices higher but also increased market stability: ETF investors’ average cost basis is around $89,000, now a critical support level. But when sentiment reverses, large ETF holdings can quickly become heavy selling pressure, triggering sharp liquidity shocks. Since late October 2025, as macro headwinds emerged, institutions began pulling out in size. Since October 10, U.S. spot Bitcoin ETFs have seen $3.7 billion in net outflows, $2.3 billion of which came in November. The ETF era has made the market both “more stable and more fragile”: volatility is dampened during slow bull markets, but if key support (like the $89K average cost) breaks, declines can become sudden and steep.

Source: https://coinmarketcap.com/etf/bitcoin/

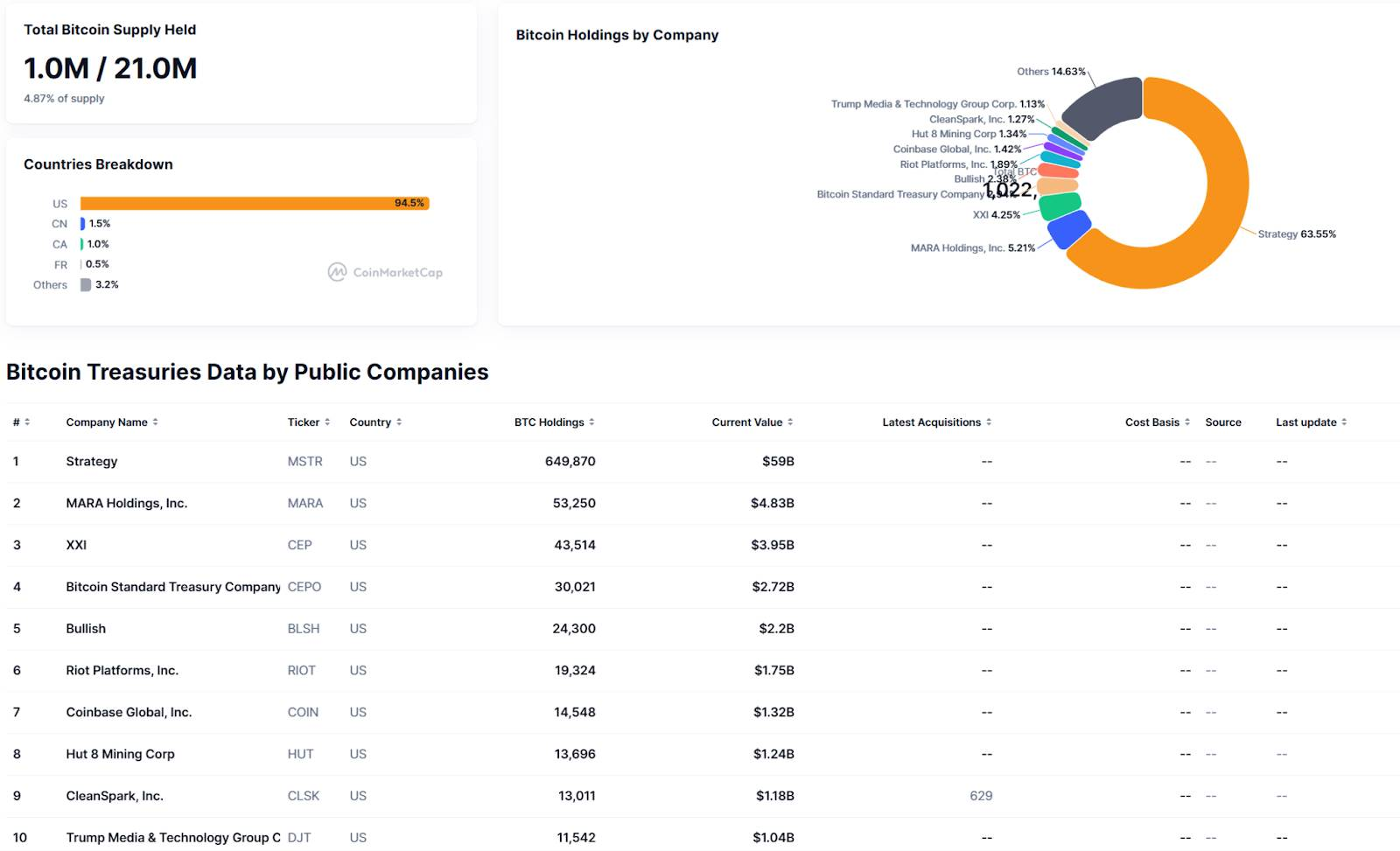

Source: https://coinmarketcap.com/charts/bitcoin-treasuries/

2. Fragmented Narratives and Rapid Theme Rotation. During the 2020–2021 bull run, DeFi and NFTs provided a unifying narrative, channeling capital from Bitcoin to riskier assets. This cycle, hot sectors have been fragmented and fleeting. Rapid narrative rotation means capital chases trends at high frequency, rarely lingering in any one sector, breaking the old “Bitcoin leads, altcoins follow” dynamic. From 2023–2025, themes cycled quickly, with no dominant throughline:

- Late 2023–early 2024: Bitcoin ETF approval hype, then a surge in Bitcoin Ordinals inscriptions;

- Mid-2024: Solana ecosystem boomed, with meme coins like Dogecoin briefly trending;

- Late 2024–early 2025: AI narratives (AI Meme, AI Agent, etc.) rotated through the spotlight;

- 2025: InfoFi, Binance Meme, new public chains, and x402 saw brief, localized booms, but none lasted.

Rapid sector rotation led to high-frequency capital chasing short-term fads, with little staying power. As a result, altcoins never saw a broad-based surge; many small- and mid-cap tokens peaked early and fell back, while Bitcoin maintained dominance despite modest gains. This “fragmented market” meant the late bull phase lacked the broad speculative handoff typical of past cycles. Thus, this cycle’s peak was driven by Bitcoin’s steady climb, not a full-blown crypto rally—making for a relatively muted market.

3. Reflexivity: Self-Fulfilling Cycle Expectations. As the “four-year halving cycle” became common knowledge, participants’ behavior began to alter the cycle’s rhythm. With everyone expecting a post-halving rally, early positioning and profit-taking became the norm. Many veterans entered early and took profits earlier than usual. ETF holders, market makers, and miners also adjusted strategy: as prices neared “theoretical highs,” they reduced exposure en masse, amplifying selling pressure. The bull market could be cut short before reaching full mania, causing cycle peaks to arrive sooner and lower than in the past.

4. Macro and Policy Variables: External Crosscurrents. Compared to previous cycles, regulation and politics—especially Fed policy and geopolitical risks—have played a bigger role than ever. After taking office, Trump rolled out pro-Bitcoin and crypto policies, but progress lagged expectations. At the end of 2024, markets bet on a new easing cycle, boosting crypto assets. But in late 2025, macro conditions shifted: U.S. inflation data wobbled, economic outlooks grew uncertain, and Fed rate-cut expectations fluctuated. In October 2025, U.S.-China tariff disputes triggered a stock selloff, raising doubts about further Fed easing. Uncertainty over rates weighed on risk assets, and Bitcoin followed risk-off sentiment lower.

5. The Dual Role of Digital Asset Treasuries (DAT). Since 2024, more institutions and public companies have added Bitcoin and other crypto assets to their balance sheets, creating Digital Asset Treasuries (DATs). Large firms like MicroStrategy kept accumulating Bitcoin as a reserve; even many unrelated smaller companies announced crypto buys to boost valuations. These institutional holders provided steady buying during the bull market, acting as a “reservoir” and helping lift prices. But DATs carry risk: most bought at high levels, so sharp price drops could trigger losses, investor pressure, or forced selling. While there’s been no large-scale selling yet, DAT holders add a new layer of concern to market bottoms. DATs reinforce Bitcoin’s “digital gold” narrative, but also tie its volatility more closely to traditional finance.

In summary: ETFs and institutional capital, fragmented narratives, reflexivity, macro policy, and DATs have all shaped the anomalous 2024–2025 cycle. A more nuanced, macro perspective is now essential. Simply applying old cycle rules is no longer enough; understanding the drivers and new market structure is key.

V. Outlook and Conclusion

As 2025 ends, Bitcoin stands at a pivotal juncture after a sharp pullback: is this the end of the bull run and the start of a bear phase, or consolidation before the next upward move? The market is split. Looking to December 2025 and into 2026, both cyclical patterns and new variables must be weighed, drawing on diverse perspectives for a rational outlook.

- Cycle Perspective: Has the Bull Peaked? Cycle theorists argue that, in line with the classic four-year pattern, October 2025’s $126K high likely marked this cycle’s top, with a prolonged correction to follow. The next major bull run may not arrive until the next halving (circa 2028). Because this peak lacked a speculative bubble, the decline may be milder. Some expect a “long, slow grind” bear market, not a sudden crash. Institutional capital may add resilience, leading to drawn-out consolidations in the $50K–$60K range. Others believe the four-year model no longer fits, that the bear began six months ago, and the market is now in its late stages. On balance, cycle analysis suggests Q4 2025 marked the bull-bear turning point, with 2026 likely to be weak but less volatile than past bear markets, possibly with a long bottoming phase.

- Macro Perspective: Policy Easing as a Cushion. Macro conditions in 2026 may be more favorable for Bitcoin than in 2022–2023. Major central banks ended tightening cycles in 2024–2025, and the Fed is expected to start cutting rates at the end of 2025. Markets currently price in an 85% chance of a 25bp cut in December, with more cuts expected in 2026. Low rates and ample liquidity support inflation-hedging assets like Bitcoin, so even if the cycle turns down, easing could limit downside. If so, 2026 could see a “spring in the bear market”: as rate cuts land and the economy stabilizes, risk appetite could revive and new capital may flow into crypto, sparking a rebound. Bitcoin could form a U- or L-shaped bottom: choppy consolidation in the first half, gradual recovery in the second. However, if a global recession or geopolitical shock hits, easing’s benefits could be offset by risk aversion, leading to more volatility. In short, easing makes 2026 hopeful, but recovery could be uneven.

- Market Structure: Institutional Dynamics and Rational Pricing. After 2024–2025, the market’s participant base has shifted, shaping 2026’s outlook. More institutional capital means price swings will be more data- and fundamentals-driven, less swayed by short-term sentiment. ETF cost basis (around $89K) is now a key technical level: if prices stay below it, further ETF outflows could cap rebounds; if prices recover above it, new inflows may return. For DATs, 2026 may see divergence: some Bitcoin treasury companies may reduce holdings if stock prices lag or finances weaken, but more may also buy on dips, offsetting outflows. Miners, as long-term sellers, have production costs estimated at $40K–$50K, which will help set a floor: if prices stay below cash cost for too long, miners may cut production or shut down, reducing supply and helping the market bottom. The 2026 Bitcoin market will be more mature and rational, with fewer wild booms and busts—but still plenty of trading opportunities.

Despite near-term uncertainty, leading institutions remain highly bullish on Bitcoin’s long-term prospects. ARK Invest, for example, maintains its $1.5 million target for 2030, providing a foundation of long-term confidence. In the short and medium term, however, investors are focused on Bitcoin’s actual path in 2026—a year likely to test patience and discipline.

Closing Thoughts

In summary, Bitcoin’s four-year cycle remains intact, but it is evolving. The 2024–2025 market shows that supply shocks from halving continue to drive long-term trends, but the influx of institutional capital, shifting macro conditions, and changing investor expectations have created a more complex and unpredictable cycle. At the same time, we see the rise of rational forces, improved infrastructure, and the accumulation of long-term value.

For crypto investors, this means upgrading your thinking and strategy: embrace data-driven analysis, long-term value investing, and structural opportunities. Most importantly, approach cycles rationally—stay calm during bull market euphoria, and hold your conviction during bear market lows. Bitcoin has repeatedly set new highs through multiple cycles, with its underlying value and network effects only growing. Cycles may lengthen and volatility may narrow, but the long-term uptrend remains. Each correction weeds out the weak, allowing valuable assets to accumulate; every innovation seeds new growth, propelling the crypto sector’s ongoing evolution.

About Us

Hotcoin Research is the core research division of Hotcoin Exchange, committed to translating professional analysis into actionable insights. Through “Weekly Insights” and “In-Depth Reports,” we break down market trends; our exclusive “Hotcoin Select” column (AI + expert screening) helps you identify promising assets and reduce trial-and-error costs. Each week, our analysts engage with you live to interpret market hot topics and forecast trends. We believe that a blend of insightful guidance and supportive community can help more investors navigate cycles and seize Web3 opportunities.

Disclaimer:

- This article is republished from [TechFlow]. Copyright remains with the original author [Hotcoin Research]. For any concerns regarding republication, please contact the Gate Learn team for prompt resolution in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Without explicit reference to Gate, copying, distributing, or plagiarizing this translation is strictly prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

BTC and Projects in The BRC-20 Ecosystem

What Is a Cold Wallet?

Blockchain Profitability & Issuance - Does It Matter?

What is the Altcoin Season Index?