How do City Protocol and Mocaverse's "IP micro-strategies" bring IP into the era of cash flow?

Repost of original title: “A Comprehensive Guide to the IP Capital Market: How City Protocol and Mocaverse’s ‘IP Micro-Strategy’ is Ushering IP into the Era of Cash Flow”

I. Web3’s New Inflection Point: From Storytelling to Asset Management

If Web3’s defining word for 2021 was “innovation,” for 2022 “speculation,” and for 2023 “adjustment,” then 2025 will undeniably be about “assetization.” From real-world assets (RWA) moving on-chain to the renewed financialization of blue-chip NFTs, the market has cycled back to its core principle: how to generate sustainable, on-chain returns.

At this crossroads, Animoca Brands’ Mocaverse and City Protocol have co-launched a structurally innovative project: $MOCASTR (Moca Strategy Token).

This mechanism token is anchored to high-value Mocaverse intellectual property (IP) assets and drives yield cycles through an on-chain strategy treasury. It isn’t just a “coin”—it’s an actively managed digital asset strategy engine designed for long-term growth.

City Protocol has set an ambitious goal for this experiment: “Bring cultural IP into programmable financial cycles.” From an investor’s perspective, it’s a significant structural innovation for the NFT market.

II. Mechanism Analysis: A Self-Compounding On-Chain Strategy Engine

City Protocol’s IP Strategy Module is a tokenized strategy system built for IP ecosystems. The logic is direct: tokenomics channel community funds into the treasury, which then deploys on-chain strategies to build long-term IP value. It’s not a passive asset pool—it’s a tokenized IP strategy execution layer.

MOCASTR is the module’s inaugural token—the starting point for the entire flywheel.

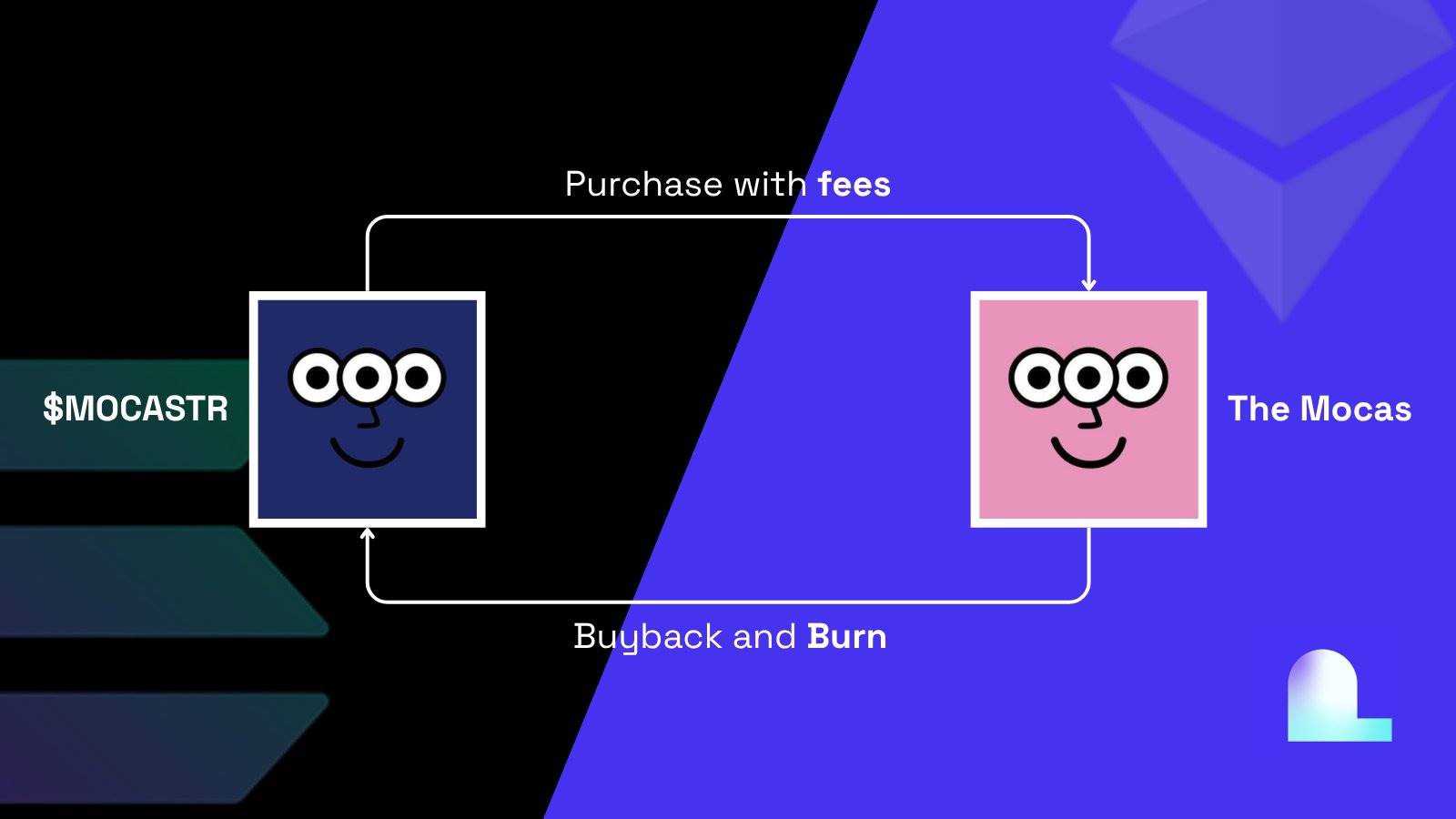

MOCASTR’s design revolves around three core steps: fee injection, treasury strategy execution, and profit reinvestment.

Each transaction incurs a 2.5% fee, with 80% automatically routed into the treasury. The treasury leverages on-chain data interfaces to monitor Mocaverse NFT market metrics—floor price, trading depth, and volatility. When undervaluation is detected, the IP Strategy executes NFT buybacks; these assets are later relisted at roughly a 1.2x floor price premium.

After completing the “buy low, sell high” loop, profits split: part is used to buy back and burn $MOCASTR, creating a deflationary effect; the remainder stays in the treasury, expanding its operating capacity for the next cycle.

This forms a self-driving closed loop: fee injection → NFT buyback → premium resale → profit return → token burn → treasury expansion. The structure is akin to automated market makers (AMMs), but the underlying asset has shifted from trading pairs to value conversion between NFTs and tokens.

The core innovation: users don’t need to trade NFTs directly—they can share in Mocaverse ecosystem returns simply by holding $MOCASTR. NFTs evolve from static collectibles to yield-generating assets, with the token acting as the vehicle for sharing the value creation process.

This structure is reminiscent of MicroStrategy’s “hold-to-flywheel” approach, but MOCASTR is building a collective, token-level treasury model—not a corporate finance loop. It transforms IP market value management from a brand-centric action to a shared, participatory, and tokenized on-chain logic.

III. Flywheel Dynamics: Token, Treasury, IP, and Market Resonance

The MOCASTR flywheel is a four-layer cyclical system:

- Token Layer: All transaction fees continuously fuel the treasury, serving as the base energy source.

- Treasury Layer: City Protocol’s IP Strategy manages funds and transparently executes IP-related actions on-chain, including maintaining Mocaverse NFT market depth, supporting joint initiatives, or ecosystem proposals.

- IP Layer: Mocaverse boosts influence via brand, community, and cross-ecosystem collaboration, amplifying both IP value expectations and the market impact of treasury expenditures.

- Market Layer: As Mocaverse’s value grows, $MOCASTR’s market awareness rises, bringing new liquidity and trading activity that further increase transaction fees and reinforce the treasury.

Fundamentally, this system leverages market volatility as a driver for IP appreciation. The treasury is the energy reservoir; the token, the transmission shaft; IP, the growth engine; and the market, the feedback loop. These four components interlock, creating a transparent and self-sustaining growth mechanism.

Historically, IP value in the NFT market was confined to the “collectible era”—ownership, display, and social interaction;

With MOCASTR, IP enters the “treasury era”—managed, utilized, and compounded.

IV. Mocaverse and City Protocol: The Synergy of Narrative and Execution

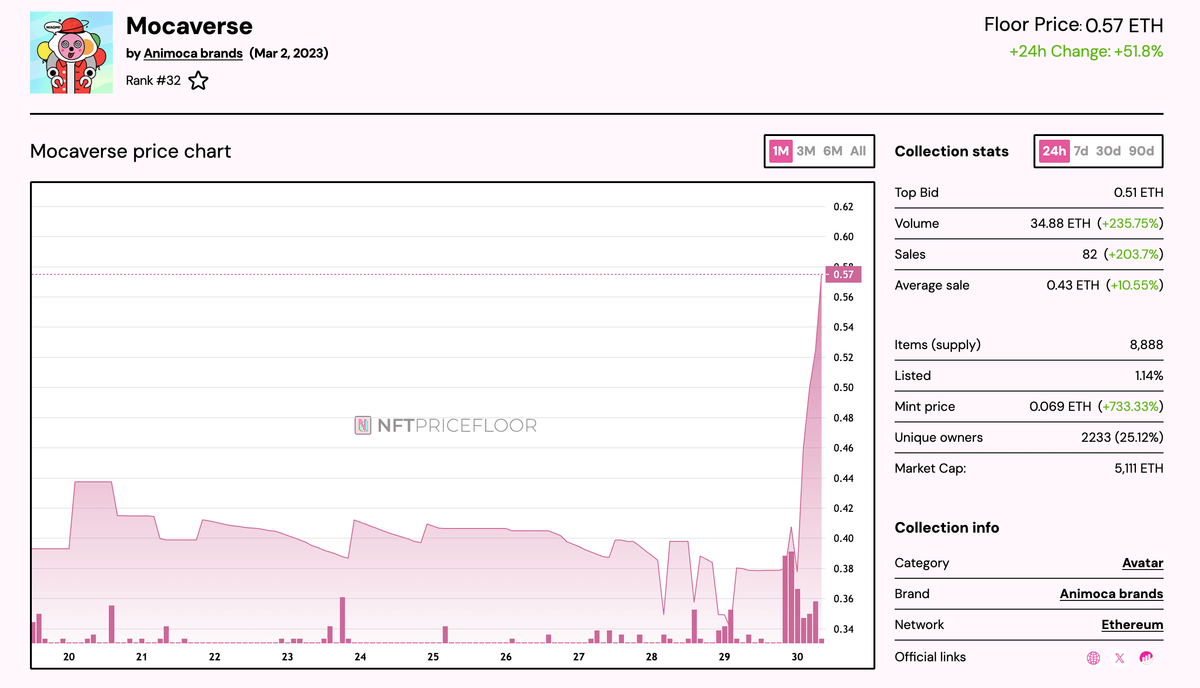

$MOCASTR launched on the Solana mainnet on October 29. Thanks to its buyback strategy and rapid execution, the project delivered exceptional market performance in a short period. Within 48 hours, the treasury bought back 40 Mocaverse NFTs, lifting the collection’s floor price by around 15%.

During the first strategy cycle, MOCASTR posted an annualized yield of roughly 20%, providing tangible cash flow support for the token’s value. Raydium and Jupiter liquidity pools saw over $300,000 in initial depth on launch day, with market cap reaching the $2–3 million range within hours.

Mocaverse is Animoca Brands’ flagship identity and culture ecosystem, integrating over 540 projects and 700 million on-chain wallets since 2023. Its 8,888 Moca NFTs represent four key archetypes—Dreamers, Builders, Angels, Connectors—combining cultural symbolism, governance, reputation, and points systems.

These NFTs are a manifestation of Animoca’s long-term strategy across social, gaming, and identity verticals, giving MOCASTR a strong asset and community base.

Since securing investment from Jump Crypto, Dragonfly, CMT Digital, and others in 2024, City Protocol has focused on “on-chain IP financialization,” introducing the DAT (Digital Asset Treasury) architecture for sustainable asset growth. This treasury system channels Mocaverse’s ecosystem energy into direct capital flow and market momentum.

MOCASTR’s launch marks the first formal fusion of Mocaverse and City Protocol—culture and finance, storytelling and execution, IP and capital—fully united in a smart contract.

The partnership roles are well-defined: Mocaverse delivers the core assets and cultural moat, while City Protocol provides the algorithmic engine and fund management infrastructure. MOCASTR bridges the two, serving as the prototype for future on-chain IP financialization.

This model showcases a new ecosystem structure:

IP strategy is now tradable and governable, embodied in a token.

Notably, Animoca founder Yat Siu personally purchased a Mocaverse NFT that was bought back and resold by the City Protocol treasury post-launch. The market views this as a validation of the system, rather than merely a symbolic gesture: IP holders and DeFi protocols are forging a new “liquidity contract.”

V. Why Is This Model Essential for the Market?

The NFT market is now in a prolonged “post-hype” phase. Blue-chip IP prices have stabilized, new capital is scarce, and DeFi integrations have consistently failed. The ecosystem’s core challenge is not a lack of narrative, but a lack of structural momentum.

MOCASTR’s late October launch quickly made it a focal point in the on-chain ecosystem. Within 48 hours, the treasury executed multiple cycles, driving up Mocaverse NFT floor prices and trading depth. At the same time, Animoca founder Yat Siu’s community engagement provided strong external trust for the flywheel.

More importantly, MOCASTR led to both quantitative growth and a resurgence of market sentiment.

Numerous crypto KOLs, NFT investors, and on-chain researchers took to social media to analyze MOCASTR’s mechanism—how it enables NFTs to leverage “compounding financial logic,” and how cultural assets are finally resonating with DeFi growth models.

This has reignited the NFT investor community, shifting focus from surface-level art and trading to building yield structures and endogenous financial cycles for IP.

City Protocol’s IP Strategy Module delivers precisely this momentum—not just financial operations, but a sustainable growth structure.

It allows IP projects to move beyond one-time sales, securing ongoing support through strategy treasuries;

It transforms token holders from speculators into active participants and beneficiaries of IP growth.

The long-term potential of this model:

● IP value is capped only by brand and culture;

● The treasury provides ongoing cash flow and market support;

● The token connects users to mechanisms, making the community a growth engine;

● The entire system forms a sustainable “culture × capital” synergy.

MOCASTR’s success marks the NFT market’s first “strategy-driven growth engine”—a shift away from emotion-based speculation venues.

VI. Looking Ahead: The Programmability of IP Assets

City Protocol has indicated this partnership is just the start of a “strategy series.” The official focus remains on refining the IP Strategy. Future directions include optimizing treasury execution, improving cross-IP collaboration, and expanding on-chain governance.

What’s clear is that MOCASTR has already proven:

- IP can be managed with treasury logic akin to corporate assets;

- Cultural assets can be tokenized to enter on-chain capital cycles;

- The market can generate new returns and consensus by participating in these cycles.

No matter which asset class the IP Strategy Module targets next, the “tokenized strategy treasury” model is set to become the NFT market’s next big narrative after GameFi and RWA.

VIII. Conclusion: Returning IP’s True Value to Cash Flow

The arrival of MOCASTR may mark a pivotal shift in NFT economic models.

For the past two years, debates around NFT value have focused on whether it can generate endogenous yield; MOCASTR provides a verifiable solution.

The NFT strategy model powered by MOCASTR enables cultural assets to operate with financial logic for the first time;

City Protocol’s IP Strategy Module systematizes and replicates this logic—crucial for the NFT market to rebound and redefine growth.

IP, as a cultural asset, is now being inscribed into on-chain economics. Tokens are more than just exchange mechanisms—they’re governance units and tools for value creation. When the treasury generates returns, IP grows, and tokens give back, the flywheel spins on.

MOCASTR’s significance isn’t about its current price—it’s about giving NFTs their first “treasury strategy.” This could be the starting point for Web3 cultural assets to achieve autonomy and financial sustainability.

For Mocaverse, this means long-term ecosystem value is now quantified and amplified; for DeFi, it offers a brand-new strategy template—IP-driven, self-reinforcing returns, and transparent treasury execution.

When holders become treasury shareholders, not mere collectors;

When animated characters and story worlds deliver stable cash flow;

The doors to a “cultural capital market” may truly be opening via cryptography.

Statement:

- This article is reprinted from [TechFlow], original title: “A Comprehensive Guide to the IP Capital Market: How City Protocol and Mocaverse’s ‘IP Micro-Strategy’ is Ushering IP into the Era of Cash Flow,” copyright belongs to the original author [ TechFlow ]. If you have objections to this reprint, please contact the Gate Learn Team ), and the team will process your request promptly.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Without explicit mention of Gate), translated articles may not be copied, distributed, or plagiarized.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?