Southeast Asia Non-USD Stablecoin Market Report Q2 2025: XSGD Dominates, Political and Regulatory Diversity, DEX Trading Volume Plummets, But Active Addresses and User Engagement Rise Steadily, Revealing the Potential and Challenges of Local Stablecoins i

First of all, thanks to Jay Jo from Tiger Research Reports for offering the advice, counsel, and input that shaped this article.

TL;DR:

- SGD-Pegged Stablecoin dominances: XSGD, the sole SGD-pegged stablecoin issuer, dominates Southeast Asia’s local stablecoin market, supported by partnerships with Grab and Alibaba.

- Market Metrics: Operates on 8+ EVM chains with 8 issuers and 5 native currencies, achieving US$136M DEX volume in Q2 2025 (led by Avalanche and SGD), down 66% from Q1’s US$404M.

- Regulatory Advances: Singapore’s MAS progresses stablecoin framework for SGD and G10 currency-pegged SCS; Indonesia and Malaysia launch regulatory sandboxes.

- Cross-Border Trade: With only 22% of SEA trade occurring intra-regionally in 2023, USD reliance creates costly delays and fees. Local stablecoins could streamline settlements by offering instant, low-cost transfers—further accelerated through ASEAN BAC’s regional QR payment initiatives.

- Financial Inclusion: Over 260M people in SEA remain underbanked or unbanked. Non-USD stablecoins, when integrated into super-app wallets like GoPay or MoMo, could expand affordable financial access—powering remittances, microtransactions, and everyday digital payments

South East Asia (SEA), with a combined GDP of $3.8 trillion and a population of 671 million [1] [2], stands as the world’s fifth-largest economic bloc, rivaling and boasting 440 million internet users, driving digital transformation [3]

Amid this economic dynamism, non-USD stablecoins and digital currencies pegged to regional currencies or baskets offer a transformative tool for SEA’s financial ecosystem. By reducing reliance on the US dollar, these stablecoins can enhance cross-border trade efficiency, stabilize intra-regional transactions, and foster financial inclusion across diverse economies

This article explores why non-USD stablecoins are critical for SEA’s financial institutions and policymakers aiming to shape a resilient, integrated economic future.

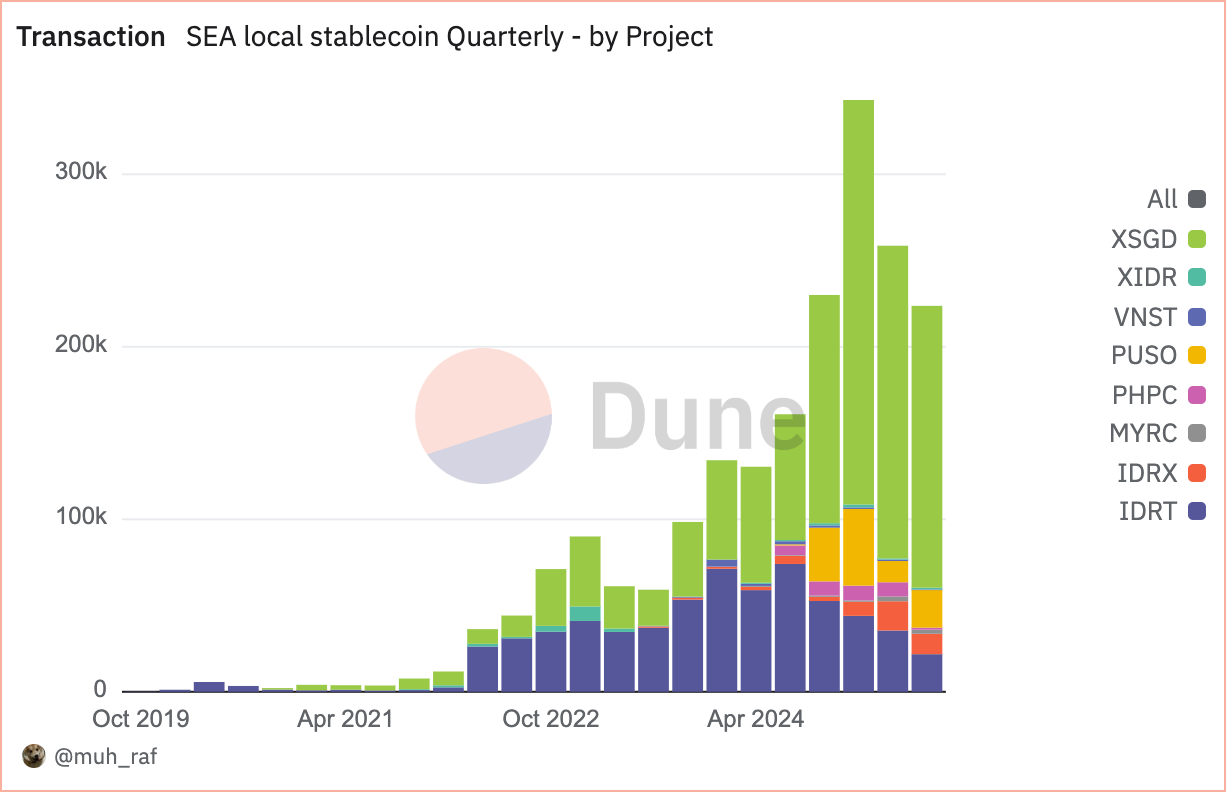

Transactions

Source: https://dune.com/queries/5728202/9297229

Since January 2020, the adoption of non-USD stablecoins in Southeast Asia (SEA) has surged, with the number of projects growing from two to eight by 2025. This growth is fueled by increasing transaction volumes and the use of diverse blockchain platforms.

In Q2 2025, non-USD stablecoins in SEA recorded 258,000 transactions, with Singapore Dollar (SGD)-pegged stablecoins, particularly XSGD, dominating at 70.1% of the market share, followed by Indonesian Rupiah (IDR)-pegged stablecoins (IDRT and IDRX) at 20.3%. This reflects strong regional economic activity and regulatory support [4], underscoring their pivotal role in the SEA digital economy

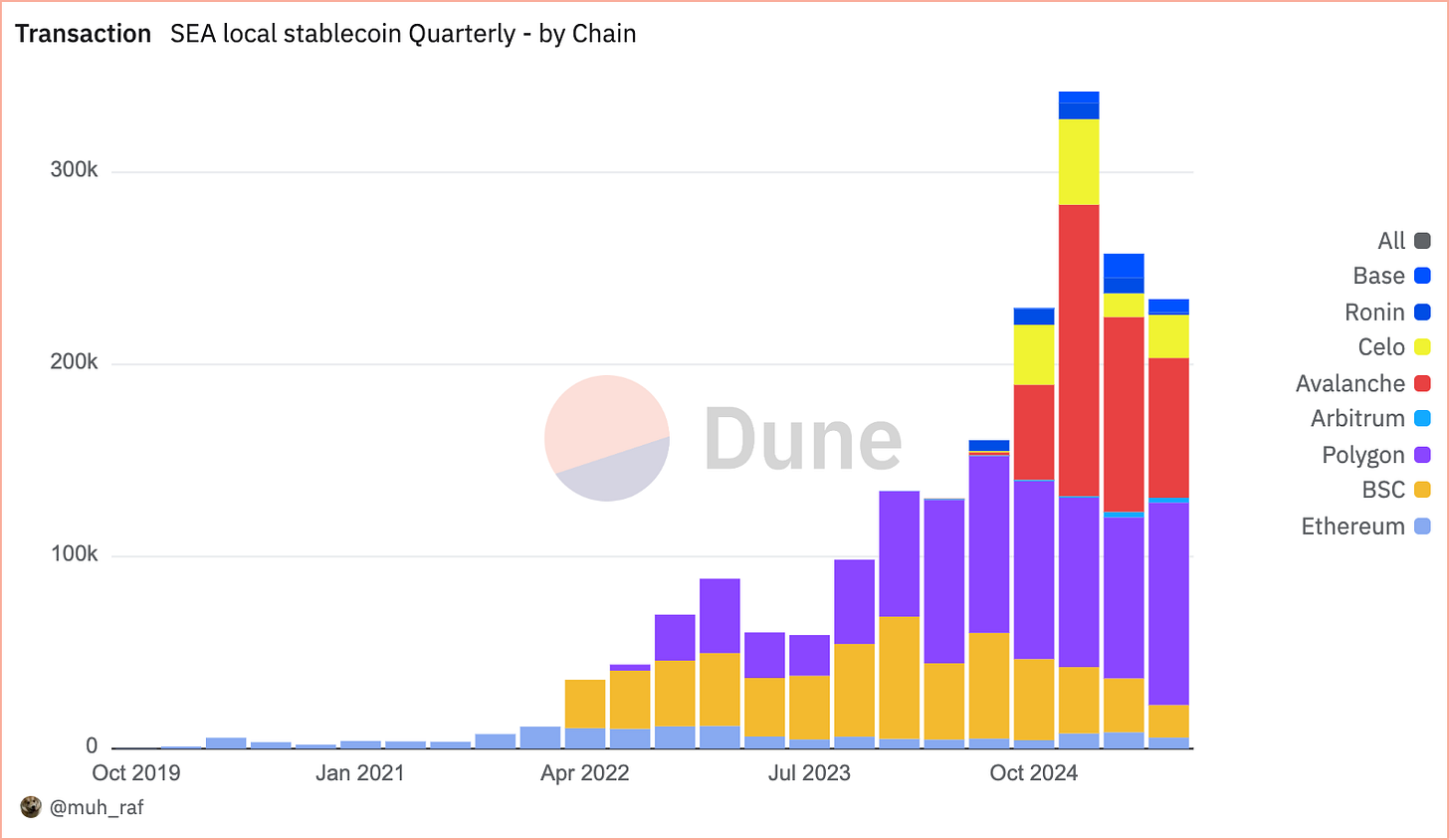

Source : https://dune.com/embeds/5728202/9297229

Over the past four years, since 2020, SEA non-USD stablecoin transactions have surpassed 1 million, driven by increasing adoption and strong exposure to EVM-based chains, which have consistently led market share growth quarter after quarter. In the second quarter of 2025, Avalanche holds the leading position in transaction share with a (101 K) 39.4 % market share, followed by Polygon at (83 K) 32.5 percent and Binance Smart Chain at (28 K) 10.9 percent.

The rapid rise of Avalanche is primarily due to the XSGD project, which is currently the only stablecoin operating on the Avalanche chain and has gained significant traction since its launch. XSGD is a stablecoin pegged 1:1 to the Singapore Dollar and issued by StraitsX. StraitsX is a Major Payment Institution licensed by the Monetary Authority of Singapore (MAS).

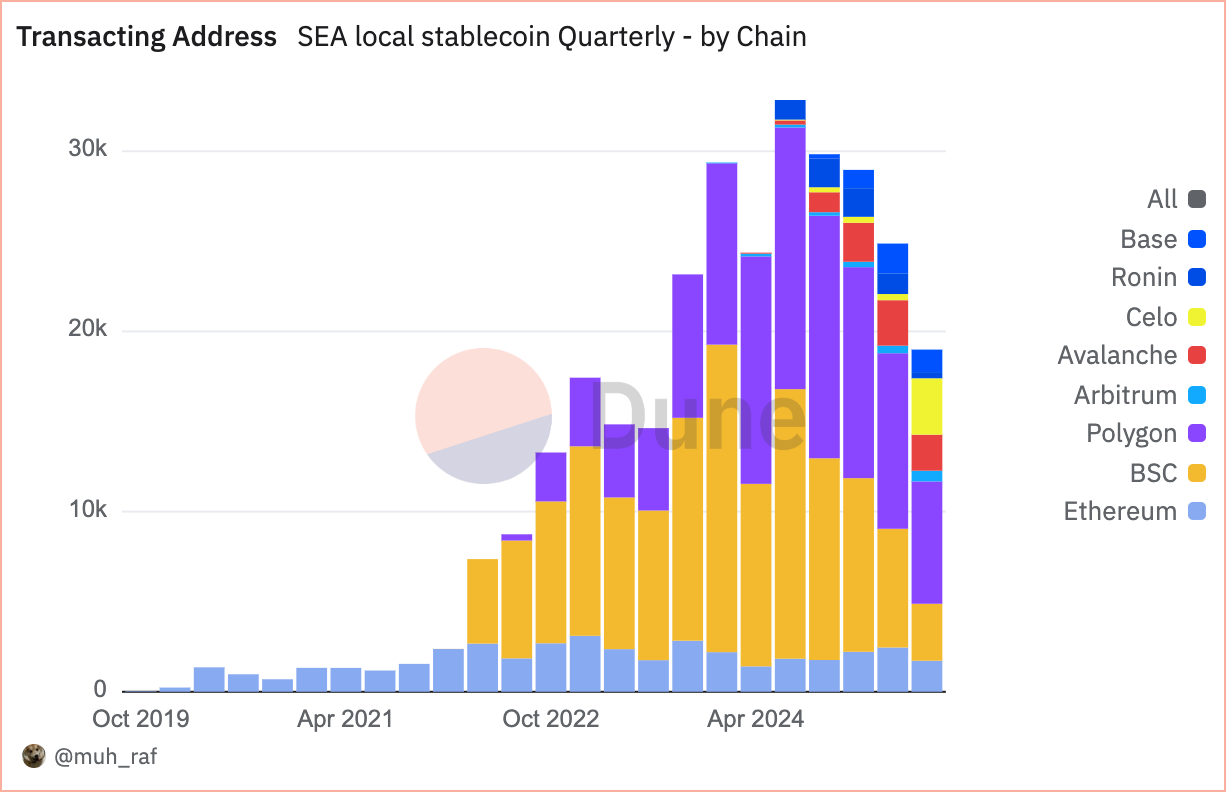

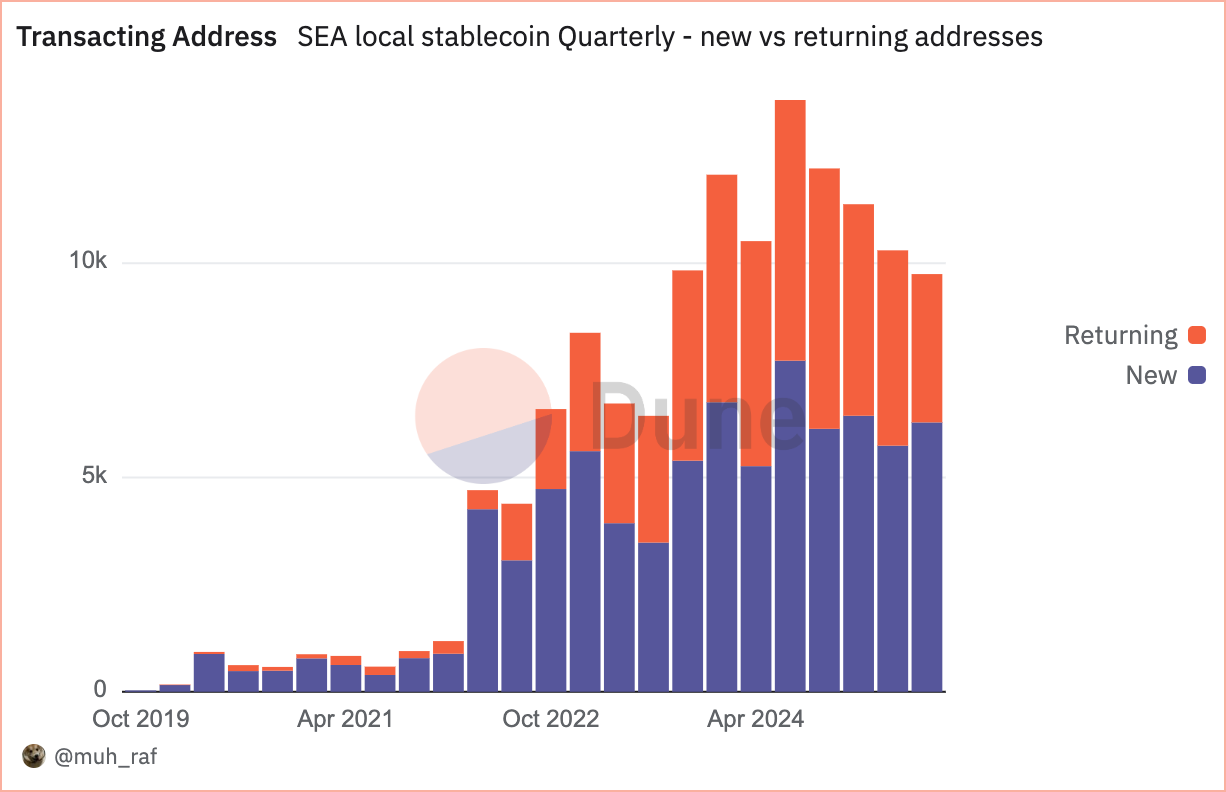

Active Address

Source : https://dune.com/queries/5728541/9297706

Since Q2 2025, non-USD stablecoins in SEA have experienced significant adoption, marked by a remarkable spike of over 10,000 active (Transacting) addresses Steady adoption 4,558 returning address and 5,743 new address.

Source: https://dune.com/queries/5728383/9297467

Unlike number of transaction , which show overall activity levels, Active (Transacting) addresses reflect user participation and adoption. For SEA non-USD stablecoins Q2 2025, Polygon leads with at (9.7 K) 39.2%, followed by Binance Smart Chain (BSC) at (6.5 K) 23.1%, and Avalanche at (2.5 K) 10.1%

Notes: In the ‘grouped by chain’ view, addresses making stablecoin transactions on multiple chains (e.g., Polygon and Base) are counted as unique per chain, resulting in a higher total than the ‘ungrouped’ view, which removes multichain duplicates.

DEX Volume

Source: https://dune.com/queries/5748360/9327460

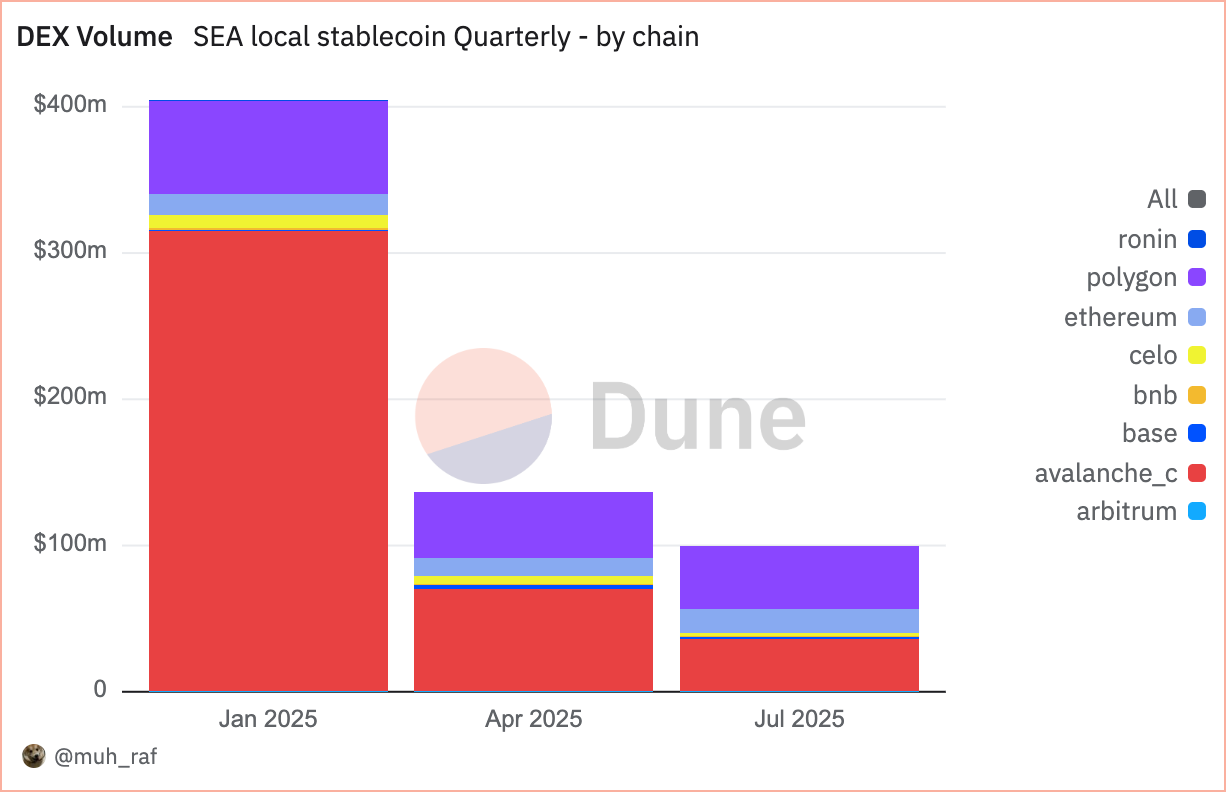

DEX trading volume in Q2 2025 fell 66% to US$136M from Q1’s US$404M. Avalanche led with 51% (US$69M), followed by Polygon at 33% (US$45M), and Ethereum at 9% (US$12M). The decline underscores a shift toward scalable blockchains, with Avalanche and Polygon dominating.

Source: https://dune.com/queries/5748398/9327527

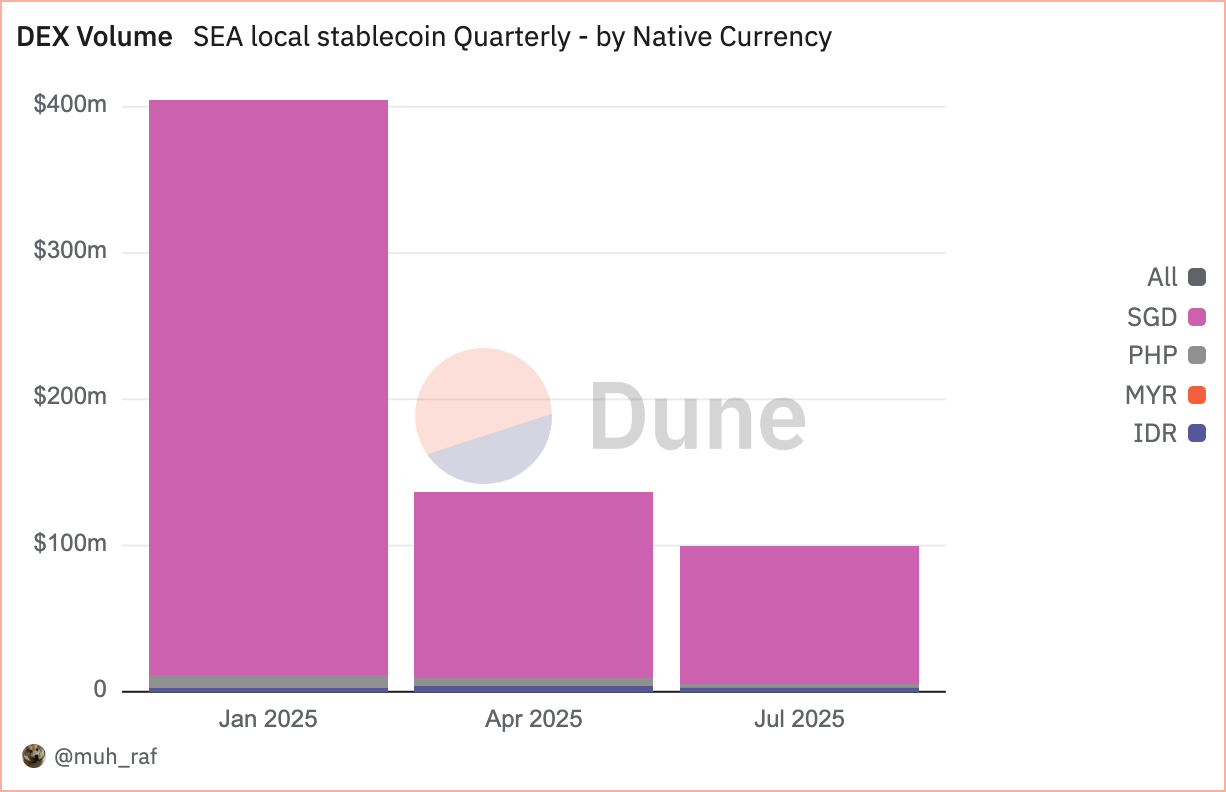

As mentioned before, Q2 2025 DEX trading volume by native currency reached US$132M, led by SGD-pegged stablecoins dominating Southeast Asia’s non-USD stablecoin market. SGD-based assets comprised 93.1% (US$127M), followed by PHP at 3.9% (US$5M) and IDR at 2.7% (US$3.6M). This underscores SGD’s commanding role in regional DEX activity.

SEA Stablecoins: Opportunities and Challenges

Opportunities

1. Enhancing Cross-Border Trade Efficiency

SEA’s intra-regional trade accounts for 22% of its total trade in 2023 [5], yet transactions often route through USD-based correspondent banking, incurring fees and delays of 2 days [6]. Stablecoins pegged to SEA currencies offer a more efficient alternative, enabling near-instantaneous settlement at lower costs. Building on this, the ASEAN Business Advisory Council (BAC) has adopted cross-border QR payments with local currency settlement. Collaboration between the BAC and an SEA stablecoin issuer could further reduce remittance fees and enhance exchange rates [7]

2. Promoting Financial Inclusion

With 260 million of SEA’s population underbanked or unbanked [8], non-USD stablecoins can bridge gaps in financial access. Mobile-based stablecoin wallets, integrated with platforms like Indonesia’s GoPay or Vietnam’s MoMo, enable low-cost remittances and microtransactions.

Challenges

1. Regulatory Uncertainty and Fragmentation

The SEA region’s diverse regulatory frameworks create uncertainty for stablecoin issuers and users. Disparate policies across countries, such as Singapore’s progressive stance versus stricter regulations in others, may lead to compliance challenges and uneven adoption.[4]

Recommendation: SEA policymakers should collaborate on a harmonized regulatory framework for stablecoins, establishing clear guidelines on licensing, consumer protection, and anti-money laundering (AML) compliance to foster trust and consistency.

2. Market Volatility and Currency Peg Risks

Stablecoins pegged to regional currencies are vulnerable to local currency volatility, which could undermine their stability and user confidence. Insufficient reserve backing or mismanagement could further exacerbate risks.

Recommendation: Stablecoin issuers should maintain transparent, fully-backed reserves that are audited regularly by independent third parties. Diversifying pegs to currency baskets could also mitigate volatility risks.

Conclusion

In Q2 2025, Southeast Asia’s non-USD stablecoin market, led by XSGD, the sole SGD-pegged issuer, gained significant traction, driven by partnerships with Grab and Alibaba. Operating across 8+ EVM chains with 8 issuers and 5 native currencies, the market recorded US$136M in DEX volume, primarily on Avalanche and SGD, though down 66% from Q1’s US$404M. Singapore’s MAS advanced its stablecoin framework for SGD and G10 currencies, while Indonesia and Malaysia introduced regulatory sandboxes.

This growth underscores non-USD stablecoins’ potential to enhance cross-border trade and financial inclusion in Southeast Asia, but regulatory fragmentation, currency volatility, cybersecurity risks, and uneven digital infrastructure demand careful management for sustainable progress.

Disclaimer:

- This article is reprinted from [rafi’s Substack]. All copyrights belong to the original author [RAFI]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?