MegaETH: A High-Performance, Undervalued New Chain Paving a New Paradigm for Ethereum Expansion

Source: https://www.megaeth.com/

In recent years, the Ethereum ecosystem has continued to expand, but its mainnet throughput and confirmation speeds remain limited. As demand for real-time interactions surges in decentralized finance (DeFi), blockchain gaming, and AI agents, the industry has started exploring “real-time blockchain” solutions. MegaETH was created to address these needs, positioning itself as an Ethereum Layer 2 network for the “Web3 real-time interaction era.” Its goal is to deliver Web2-level transaction speeds and millisecond latency while maintaining security and compatibility. The project launched its testnet in March 2025, claiming block times as low as 10 milliseconds and peak TPS exceeding 100,000, backed by top investors including Ethereum founder Vitalik. With this, the concept of high-performance Layer 2 has been redefined: MegaETH aims to evolve blockchain from a “settlement layer” into a true “execution layer,” providing infrastructure for next-generation high-frequency trading and real-time applications.

MegaETH Project Overview

MegaETH’s core vision is to become Ethereum’s performance acceleration layer, enhancing network speed through architectural design while upholding Ethereum’s security and ecosystem compatibility. The team reportedly includes experienced blockchain professionals: co-founder and CEO Shuyao Kong was formerly Global Business Director at ConsenSys, CTO Lei Yang holds a PhD from MIT, and Technical Partner Yilong Li earned his PhD from Stanford. In June 2024, MegaETH raised approximately $20 million in seed funding led by Dragonfly, with participation from Figment Capital, Robot Ventures, and others. While this round and investor backing have increased attention, they do not guarantee ultimate success. These funds and endorsements offer initial support for MegaETH’s high-performance strategy. According to the founders, the goal is to make MegaETH a “general-purpose real-time computing and interaction layer” for Ethereum—though this remains a vision to be tested through future testnet and mainnet deployments.

Technical Architecture Deep Dive

Source: https://www.megaeth.com/research

MegaETH thoroughly optimizes the Ethereum execution environment at its foundation to pursue extreme performance. It features a fully EVM-compatible execution environment, with the development team making major changes to standard Ethereum architecture. Specifically, MegaETH identifies and resolves bottlenecks in traditional EVMs: tests show that the current Rust-based EVM client (reth) can only process about 14,000 TPS on a single thread, and simple parallelization only doubles performance at best. To address this, MegaETH introduces two key optimizations: First, it adopts an improved data structure—using a memory-efficient Verkle Trie instead of the Merkle Patricia Trie—to significantly accelerate state access and proof generation. This further boosts execution efficiency by reducing redundant read/write operations within blocks and merging state access within the same block to minimize unnecessary computation. Second, the team demonstrated an experimental Sequencer using around 100GB of RAM, allowing most on-chain state to reside in memory for lower access latency—eliminating delays caused by SSD access. This setup increases state access speed by about 1,000x, with a dedicated block propagation protocol enabling rapid network-wide sync and lowering hardware requirements for regular nodes.

On the execution model side, MegaETH uses an asynchronous parallel execution engine that breaks the single-thread bottleneck. Sequencer nodes process transactions in optimistic parallel fashion, leveraging multithreading and asynchronous scheduling; their design targets block confirmations at millisecond speed (10ms per block). Security is ensured via a hybrid Rollup architecture: Sequencers quickly bundle transactions during execution, while verification employs ZK dispute resolution designed to be much faster than traditional Optimistic Rollups (team estimates verification can be completed within hours—far quicker than the usual seven-day window). MegaETH utilizes EigenDA for its data availability layer, achieving linear scaling via erasure-coded sharding; current EigenDA V2 test environments report throughput of about 40–50MB/s. The Sequencer regularly submits transaction data to EigenDA for distribution and storage by multiple operators, with data availability proofs published on Ethereum via verification contracts. In case of disputes, observers can reconstruct blocks and submit fraud proofs using zkVMs—imposing penalties on Sequencers for violations. Additionally, MegaETH has introduced an improved state structure (SALT), discussed within the community, and native Chainlink oracles to greatly enhance state access efficiency and data retrieval speed. In summary, MegaETH innovates across software, hardware, and protocol layers to push EVM performance to its limits while maintaining full compatibility with existing Solidity ecosystems.

Presale & Funding

Source: https://sale.megaeth.com/

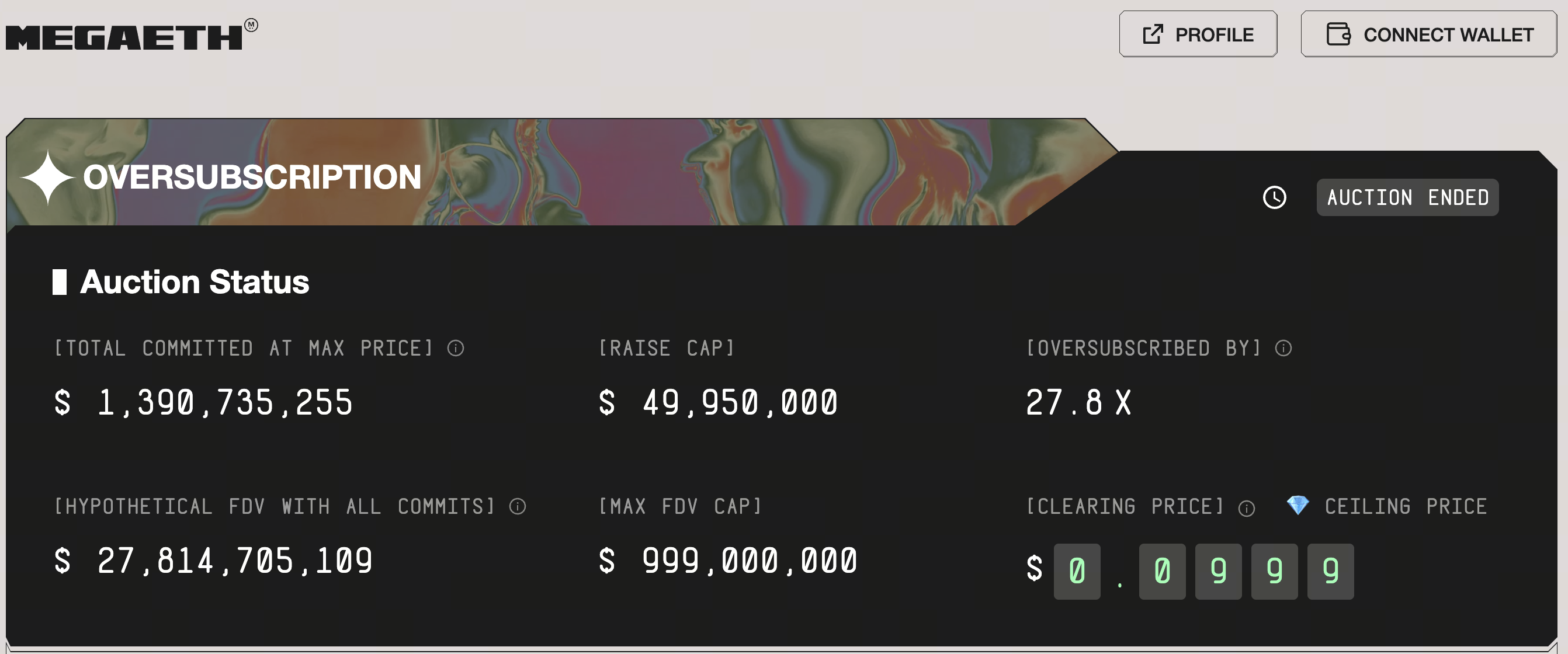

MegaETH’s fundraising and token sale have attracted significant market attention. The project’s token supply totals 10 billion MEGA tokens, with 5% (500 million tokens) offered via public auction. The community sale will be held on Sonar—a platform founded by Cobie—in October 2025 using an English auction format: starting price $0.0001 per token (FDV $1 million), capped at $0.0999 per token (FDV $999 million), with minimum bid per transaction at $2,650 and maximum at $186,282. The sale saw approximately $1.39 billion in demand—an oversubscription of about 27.8x. Winning bidders receive tokens at the final uniform clearing price; lower bids are refunded. After the public sale, MegaETH has raised over $30 million in early rounds—including the $20 million seed round in June 2024 (led by Dragonfly) and $10 million community round on Echo in December. These funds support ongoing development and ecosystem growth.

From a valuation perspective, market expectations for MegaETH are high. Based on community estimates from the initial NFT sale and early funding rounds, valuations mostly fall within several hundred million dollars; after stage-one NFT fundraising, FDV was estimated at about $540 million. On the eve of the sale, major exchanges and prediction markets valued MegaETH in the hundreds of millions; Polymarket data at the time showed an 86% probability of reaching a $2 billion FDV on day one. However, compared to other major Layer 2s—Arbitrum FDV ~$3.2 billion, OP ~$2 billion, StarkNet ~$1.2 billion, zkSync Era ~$800 million—MegaETH’s ability to break past $2 billion FDV remains uncertain. Overall, the presale hype and capital scale clearly demonstrate strong market interest in “high-performance Ethereum execution layers.”

For more details on presale allocations: https://x.com/NamikMuduroglu/status/1986059469470445964

MegaETH Tokenomics

The economic model for MegaETH (MEGA) revolves around three principles: fixed supply, low initial circulation, and priority for ecosystem incentives—with the goal of ensuring ample resources early on while avoiding excessive inflation.

Fixed Supply & Distribution Structure

MEGA has a total supply of 10 billion tokens; public sales account for roughly 5%. The remaining tokens are allocated mainly for:

- Team & core contributors

- Early investors

- Foundation & ecosystem incentive pool

This structure reserves more resources for ecosystem growth—aligning with typical early-stage strategies for high-performance L2s.

Low Initial Circulation

Public sales are the main source of early market liquidity; other allocations remain largely locked up. Low initial circulation helps reduce selling pressure at launch but may lead to greater short-term price volatility.

Token Utility

MEGA serves three main functions within the network:

- Gas payments: MEGA is used as MegaETH’s native gas token

- Node staking: Sequencers or validators must stake tokens to participate in the network

- Governance & ecosystem incentives: Used for community rewards and protocol governance

Unlock Schedule

Team and investor allocations typically follow multi-year linear vesting schedules with cliff periods of about 6–12 months—similar to OP, ARB, and other mainstream L2s.

Overall, MegaETH’s tokenomics are traditional and robust—focusing on long-term ecosystem growth rather than short-term fundraising or aggressive inflation. As mainnet launches, staking incentives and gas demand will be key factors driving token value capture.

Comparing Other High-Performance L2s

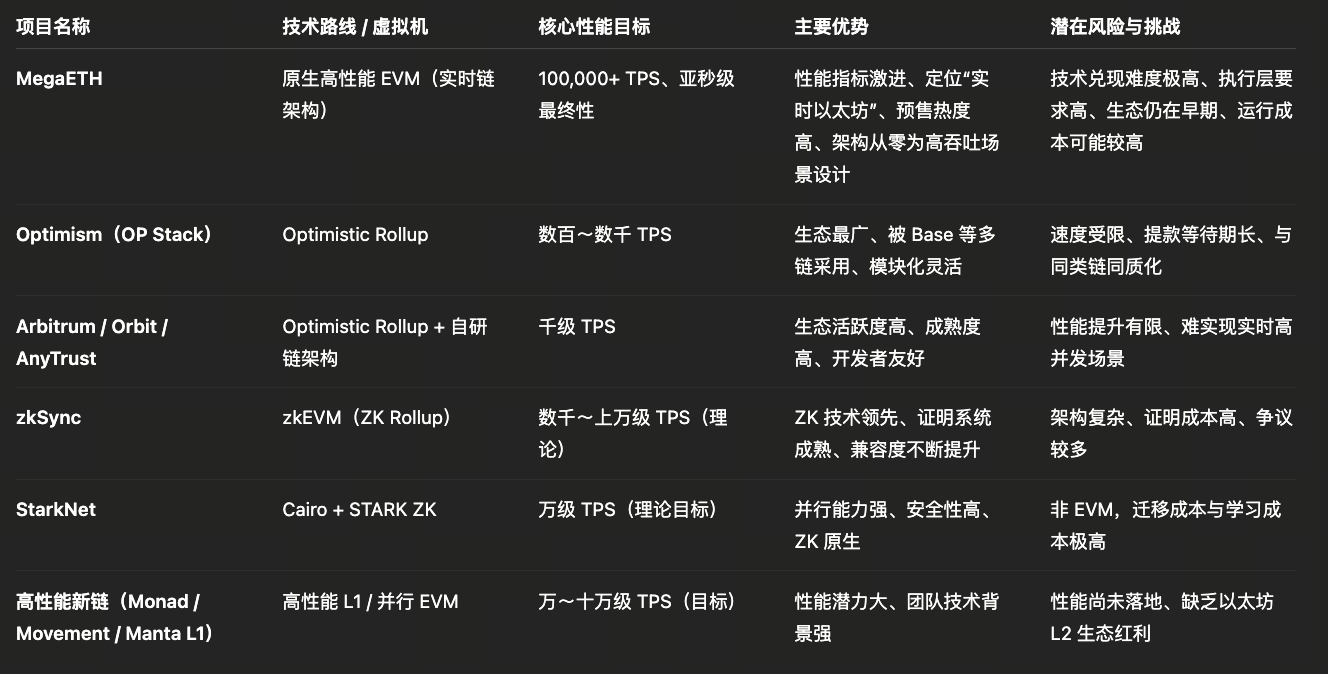

MegaETH isn’t alone in pursuing ultra-low latency and high throughput; competitors each take different technical approaches:

- Monad: An independent Layer 1 chain developed by the Gnosis team focused on parallel execution and software optimization. Monad seeks “efficient EVM” compatibility through superscalar pipelining and parallel transaction processing—with target TPS around 10,000 and block times of ~400ms. In contrast, MegaETH leverages Ethereum mainnet as L2 targeting over 100,000 TPS with sub-millisecond block times. MegaETH emphasizes extreme performance via massive computational power and multi-tier node architecture; Monad focuses more on consensus algorithms and parallel logic to enhance decentralization.

- zkSync Era: Matter Labs’ zk-rollup scaling solution uses zero-knowledge proofs to compress transaction data onto Ethereum. zkSync offers strong security and decentralization but with higher runtime latency; it is currently building out zkEVM for improved compliance and openness. Unlike MegaETH’s aggressive performance targets, zkSync prioritizes low cost and usability.

- Base (Coinbase L2): Coinbase’s Layer 2 built on OP Stack architecture emphasizes tight integration with the Coinbase ecosystem and user-friendly experience; it is positioned as highly regulated and compatible but does not focus on maximum TPS metrics. Its performance sits between standard Rollups and high-performance solutions—attractiveness stems from mainstream asset support and stable security.

- Blast: Blur team’s (founder Pacman) Ethereum L2 based on Optimistic Rollup offers native yield mechanisms—combining “message mechanics + fee income” for passive returns rather than chasing extreme TPS. Blast blends liquidity mining with scaling innovation but does not target MegaETH-level performance.

- Zircuit (ZRC): Alchemy’s AI-assisted Layer 2 uses zk-rollup with AI monitoring at the Sequencer layer; Zircuit employs AI algorithms to screen mempool for malicious transactions—boosting security. Its architecture prioritizes safety and reliability versus MegaETH’s hardware-parallel approach focused on maximum throughput.

In summary, MegaETH’s technical path is driven by hardware acceleration and parallelization—emphasizing ultra-low latency and high concurrency—while competitors balance between zk proofs, parallel processing, or economic incentives.

Market Reception & Narrative

MegaETH’s emergence has quickly sparked intense market debate as it directly addresses strong industry demand for low latency and high throughput. On one hand, its “real-time blockchain” concept has won recognition from Ethereum founder Vitalik and others—seen as a direct response to previous Layer 2 performance shortcomings; on the other hand, large-scale capital investment and deep community engagement reinforce its narrative in the market. The project saw enormous popularity and price expectations during its community sale—evidence of broad market belief in “high-performance Ethereum execution layers” as a new category.

Nevertheless, MegaETH faces risks ahead. It is still early stage—the stability of its mainnet, sustained performance delivery, and long-term compatibility with Ethereum remain unproven over time. Its hardware-accelerated architecture boosts speed but raises requirements for node hardware specs and network decentralization. The token is not yet live; market pricing and liquidity are uncertain. Layer 2 competition is fierce—with multiple scaling paths now coexisting. Whether MegaETH can maintain its edge depends on whether ecosystem development keeps pace with technical progress—and whether more innovative challengers emerge. For investors and developers alike, ongoing focus on technical implementation and real user feedback will be essential for making sound long-term judgments.

Outlook

MegaETH plans to launch its mainnet in Q4 2025; according to its roadmap the testnet is now open with mainnet and token generation events expected by year-end. At launch, new MEGA tokens will unlock gradually per its economic model—users can participate in staking rewards and other ecosystem incentives. On the tech side, MegaETH will keep advancing key components like EigenDA integration and Reth client optimization—aiming to fulfill its promised performance targets. Ecosystem building is underway: MegaETH has launched the MegaMafia accelerator (supporting 15 native projects) and rolled out MegaUSD—a yield-generating stablecoin based on Ethena—to cover network transaction fees. During testnet phase it has already attracted diverse applications including DEXs (GTE), stablecoin protocols (CAP), perpetual contracts platforms (Valhalla), and trend trading protocols (Noise). Looking forward, MegaETH plans to build developer tools (like MegaForge Center) plus more financial infrastructure to foster a complete ecosystem.

Still, whether the project can deliver its ambitious performance benchmarks on schedule remains to be seen. After mainnet goes live, balancing decentralization with performance demands, ensuring efficient interoperability with Ethereum mainnet and other chains, and attracting long-term active users will all be critical challenges for MegaETH. Post-unlock market pricing and liquidity will also impact short-term results. Ultimately, MegaETH’s vision is bold with considerable potential—but it must prove itself through real-world execution.

Conclusion

MegaETH represents an extreme approach to scaling Ethereum—its engineering breakthroughs and funding momentum are redefining market expectations for Layer 2 projects. By leveraging parallel computing, memory optimization, and hybrid proof mechanisms it aims to push blockchain into the true “millisecond era.” This technical strategy precisely addresses emerging needs in DeFi high-frequency trading, blockchain gaming, decentralized AI agents—and thus commands strong attention from both industry insiders and investors.

However—as with any competitor—MegaETH faces significant uncertainty ahead. To become a true “paradigm shift” in Ethereum scaling it will need not only powerful technical validation and performance delivery but also resilience against fierce competition across multiple fronts. For now, MegaETH leads in proposing new ideas; whether it can sustain that leadership will depend on actual operation results and ecosystem development over time.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?