The Most Exciting Crypto Product Battle of 2025: Who Will Have the Last Laugh?

The “meme launchpad war” between pump.fun and Letsbonk.fun is shaping up as one of crypto’s most captivating stories of the year. Now in early September, pump.fun has reclaimed the upper hand in this dynamic competition.

Looking back at how the “meme launchpad war” began, the catalyst was pump.fun’s outstanding performance throughout 2024 and into early this year, which inspired many project teams to seek a share of the action.

This is not merely a clash between asset issuance platforms. The launch of PumpSwap by pump.fun transformed the competition into a full-scale asset issuance plus trading platform rivalry, pitting pump.fun directly against Raydium.

Honeymoon Period

pump.fun and Raydium were long intertwined in a mutually beneficial relationship. Before PumpSwap existed, pump.fun was the go-to meme coin issuance platform, and any new meme coin reaching a $69,000 market cap would migrate to Raydium for trading.

This migration process often confused newcomers with talk of “internal” versus “external” markets—the same coin would have two distinct contract addresses, stemming from these transitions.

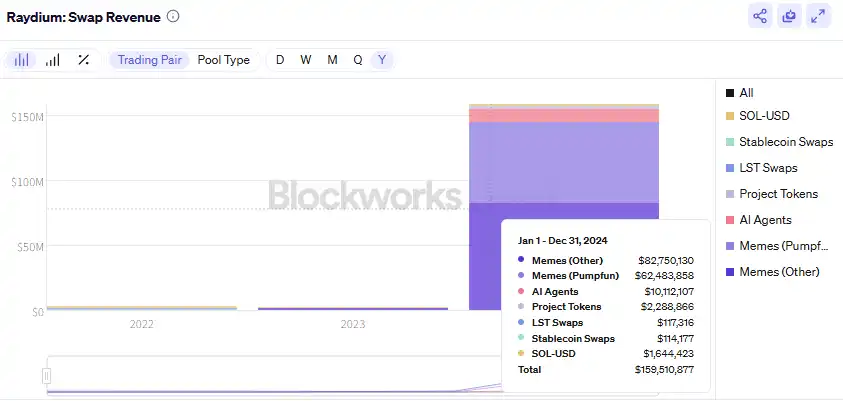

2024 marked a golden age for both platforms. Per Blockworks, Raydium’s trading fee revenue for the year reached around $160 million—over five times that of 2023. Meme coin trading alone contributed about $145 million, accounting for more than 90% of Raydium’s annual revenue. Of that, meme coins originating from pump.fun generated roughly $62.5 million, representing 43% of meme token revenue and 39% of total platform revenue.

For Raydium, pump.fun was like a rapidly growing “money printer” providing upstream liquidity, while Raydium reliably captured downstream value. Each platform benefited from its side of the ecosystem.

Going Separate Ways

This honeymoon persisted until late February.

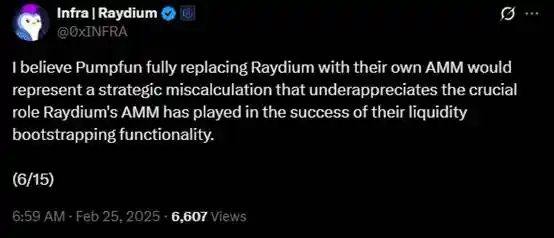

On February 24, a Twitter user spotted pump.fun testing its own AMM liquidity pool. The next day, Raydium core contributor @0xINFRA released a lengthy, critical thread. The pointed tone emphasized Raydium’s role in pump.fun’s rise, stressed Raydium’s independence from pump.fun, and culminated in the following sharp observation:

“pump.fun replacing Raydium with its own AMM is a strategic mistake.”

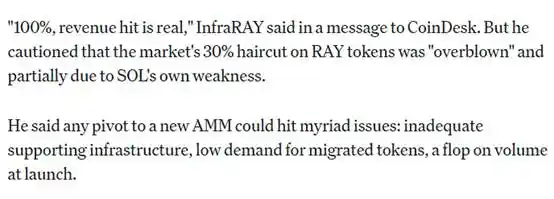

In a statement to CoinDesk, @0xINFRA maintained that the split wasn’t all bad for Raydium, while raising concerns about pump.fun: “Any new AMM is likely to encounter numerous issues—lack of infrastructure, low demand for token migration, declining trading volume.”

The news hit Raydium’s token price hard—$RAY plunged nearly 30%, dropping from $4.20 below $3, with the downturn persisting until mid-April, when it briefly reached as low as $1.50.

On March 21, pump.fun officially introduced PumpSwap, ending the division between internal and external trading pools for its tokens. Just two days prior, on March 19, Cointelegraph reported that Raydium was about to launch its own launchpad, LaunchLab.

Raydium’s official announcement lagged, arriving on April 16 when LaunchLab was finally unveiled.

The two biggest beneficiaries of the 2024 Solana meme coin boom began to square off, each encroaching on the other’s turf.

Clash of Titans

You might ask, why didn’t Raydium’s LaunchLab make waves, and why is the main battle between pump.fun and Letsbonk.fun?

The answer: Letsbonk.fun was built using Raydium’s “Plug & Play SDK,” essentially making it a customized Raydium LaunchLab variant.

Defillama data shows that in April, May, and June, PumpSwap exceeded Raydium in total and net fee income. But in July, when Letsbonk.fun overtook pump.fun, Raydium’s monthly total fee income jumped to 2.76 times the previous month, with net fee income surging to 4.66 times. Meanwhile, PumpSwap’s July totals were only about 30% of Raydium’s, and net fees just 18%.

pump.fun has recently promoted new tokens from its ecosystem on Twitter and created the Glass Full Foundation for direct token purchases. PumpSwap’s success as a trading venue is closely linked to the pump.fun issuance platform, since, at present, PumpSwap relies largely on tokens it mints itself.

While many on-chain investors lament the harsh conditions of today’s meme markets, pump.fun-backed tokens have shown resilience amid broader crypto volatility. Whether it’s $USDUC, $NEET, or $TOKABU, these meme coins each spent significant time in the $1–3 million market cap range, allowing sufficient time for entry before reaching $30 million and higher.

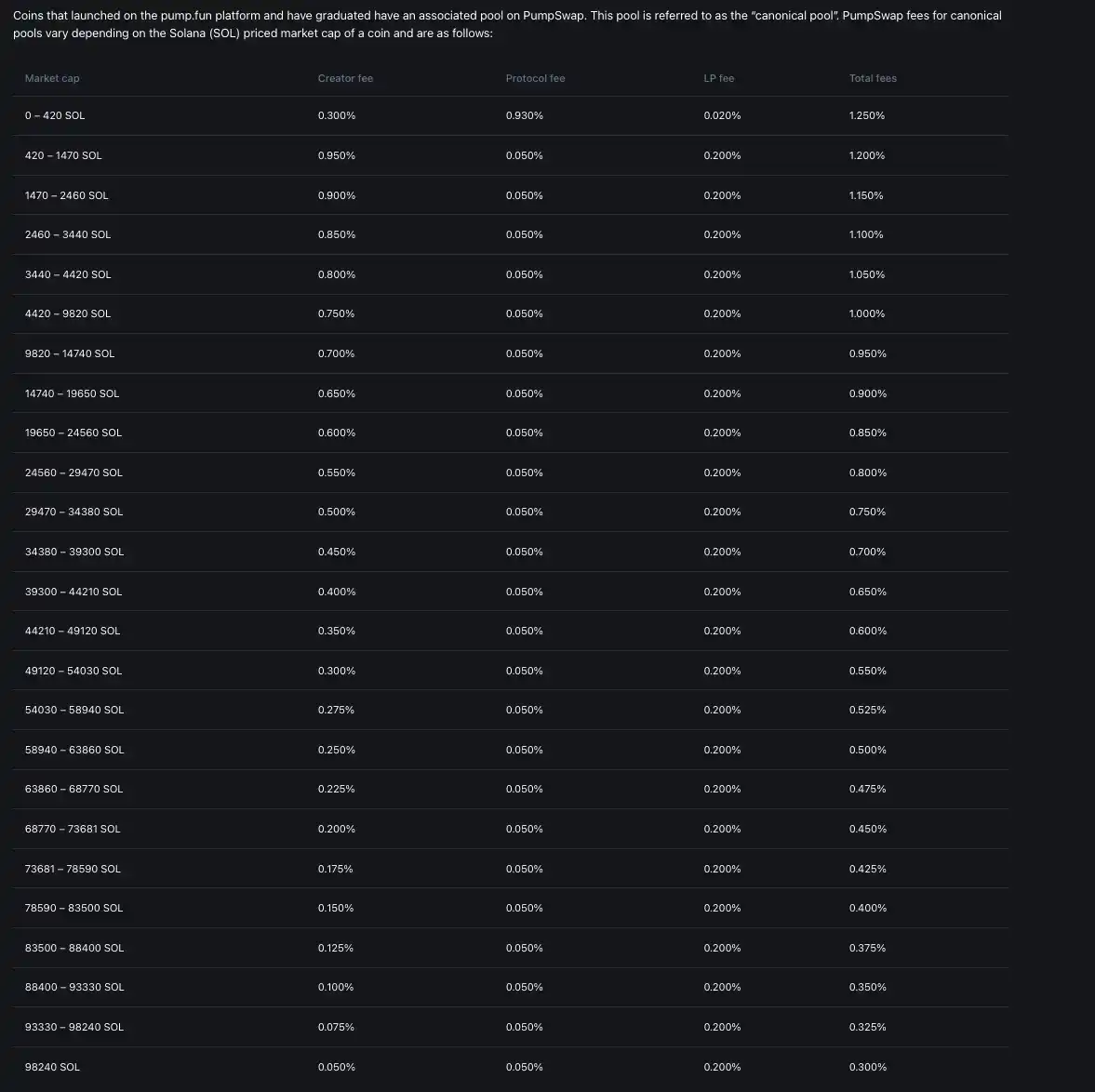

Last week, pump.fun unveiled the “Project Ascend” update, introducing the Dynamic Fees V1 system—a major shift from the previous fixed-rate model. Now, creator fees are tiered based on token market cap: higher-cap tokens pay lower fees, while smaller projects pay more. The intent is to incentivize creators to focus on long-term growth rather than short-term profit-taking.

PumpSwap’s fee and creator payout structure by token market cap

Dynamic Fees V1 applies to all PumpSwap tokens—new and existing—while keeping fee splits for the protocol and liquidity providers unchanged. Projects without creators (“abandoned projects”) will have their fees redirected to the community. CTO projects can apply for creator fees, and Pump.fun promises to accelerate approvals.

pump.fun claims this overhaul increases potential creator earnings by tenfold. For those who build thriving token ecosystems, they can now earn recurring trading fees rather than needing to sell holdings. This move is key to tackling the notorious “pump and dump” problem in memecoin circles.

pump.fun is charting a path toward “CCM”—Creator Capital Markets. Whether by onboarding livestreamers or addressing meme coin sustainability, the goal is to attract talented content creators from platforms like Twitch and TikTok, driving a creator economy that bridges Web3 and Web2.

Letsbonk.fun, meanwhile, is taking a different tack. On September 1, WLFI’s official X account announced USD1’s launch on Solana, touting the need for a vibrant dollar: instant, permissionless, globally accessible. USD1 is backed 1:1 by reserves, and on launch day was integrated with Raydium, BONK.fun, and Kamino, bringing digital stablecoins to online capital markets. The BONK.fun X account revealed its role as WLFI’s official USD1 launchpad on Solana.

Recently, Letsbonk.fun’s flagship $USELESS was listed on Coinbase. These moves highlight Letsbonk.fun’s edge in aggregating resources and leveraging years of Solana ecosystem experience.

Each platform has developed its own unique vision, playing to its strengths. Ultimately, only time will tell which path prevails.

Conclusion

The “meme launchpad war” actually began when pump.fun and Raydium shifted from collaboration to competition. Ostensibly, it’s pump.fun versus Letsbonk.fun; in reality, it’s pump.fun plus PumpSwap versus Letsbonk.fun plus Raydium.

This intense rivalry is driving positive change—better creator rewards, new incentives for CTOs and sustained meme coin projects. Robust competition is the key to ongoing improvement.

Disclaimer:

- This article is reproduced from [BlockBeats] and all copyright remains with the original author [Cookie]. For any reprint concerns, please contact the Gate Learn team for prompt resolution.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- This article’s translations to other languages are produced by the Gate Learn team and may not be copied, distributed, or plagiarized unless referencing Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?