Top Perp DEX of 2026: Winter is Coming for CEXs

Perpetuals are a test of execution: fills, funding, and liquidations.

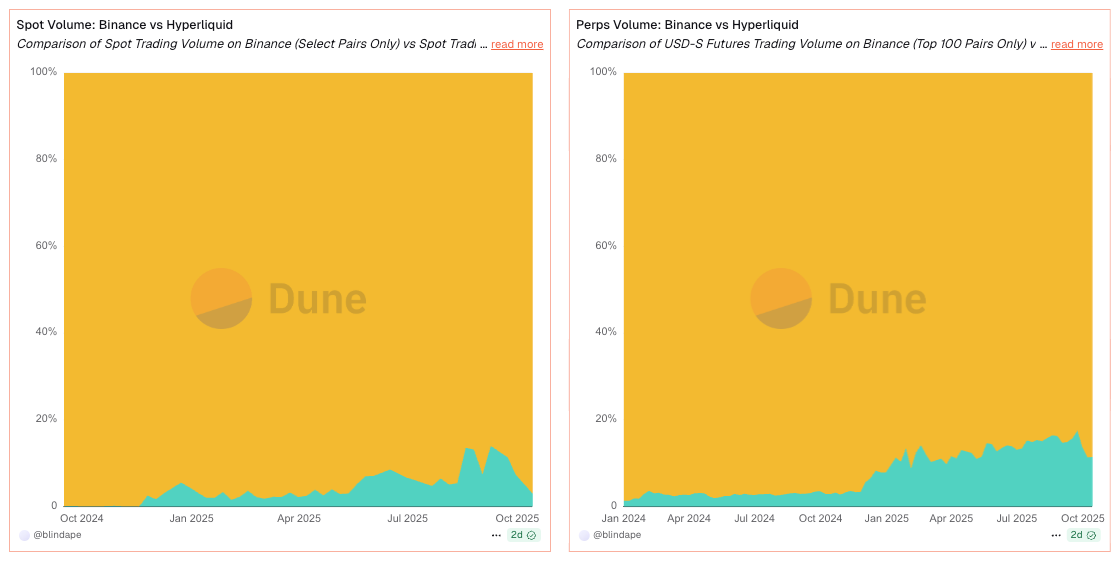

This year opens with a very public signal that the center of gravity is shifting.

In early October, Hyperliquid switched on permissionless listings (HIP-3). Builders can now list perp markets by staking 500,000 HYPE, with guardrails like validator slashing and open-interest caps. That move landed just as decentralized perps were setting fresh share highs against CEXs — fuel for the “on-chain is winning” narrative.

At the same time, CZ jumped onto X to swat down rumors about ties to Hyperliquid — and even weighed in on a widely discussed “$1B short on Hyperliquid” thread. Whether you read it as concern or simple rumor control, the fact that Binance’s founder is publicly addressing a DEX says a lot about where attention has moved.

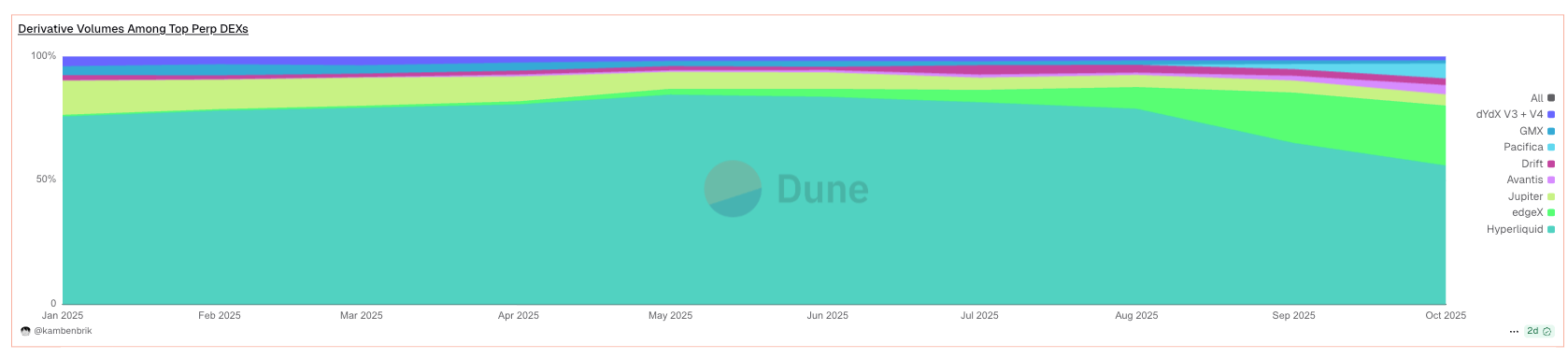

Zoom out to the market structure: by mid-2025, DEX perps reached ~20–26% of global perp volume, up from low single digits two years prior. The DEX-to-CEX futures ratio hit a record ~0.23 in Q2 2025, a clean, directional sign that liquidity and users are migrating on-chain.

Execution decides your edge

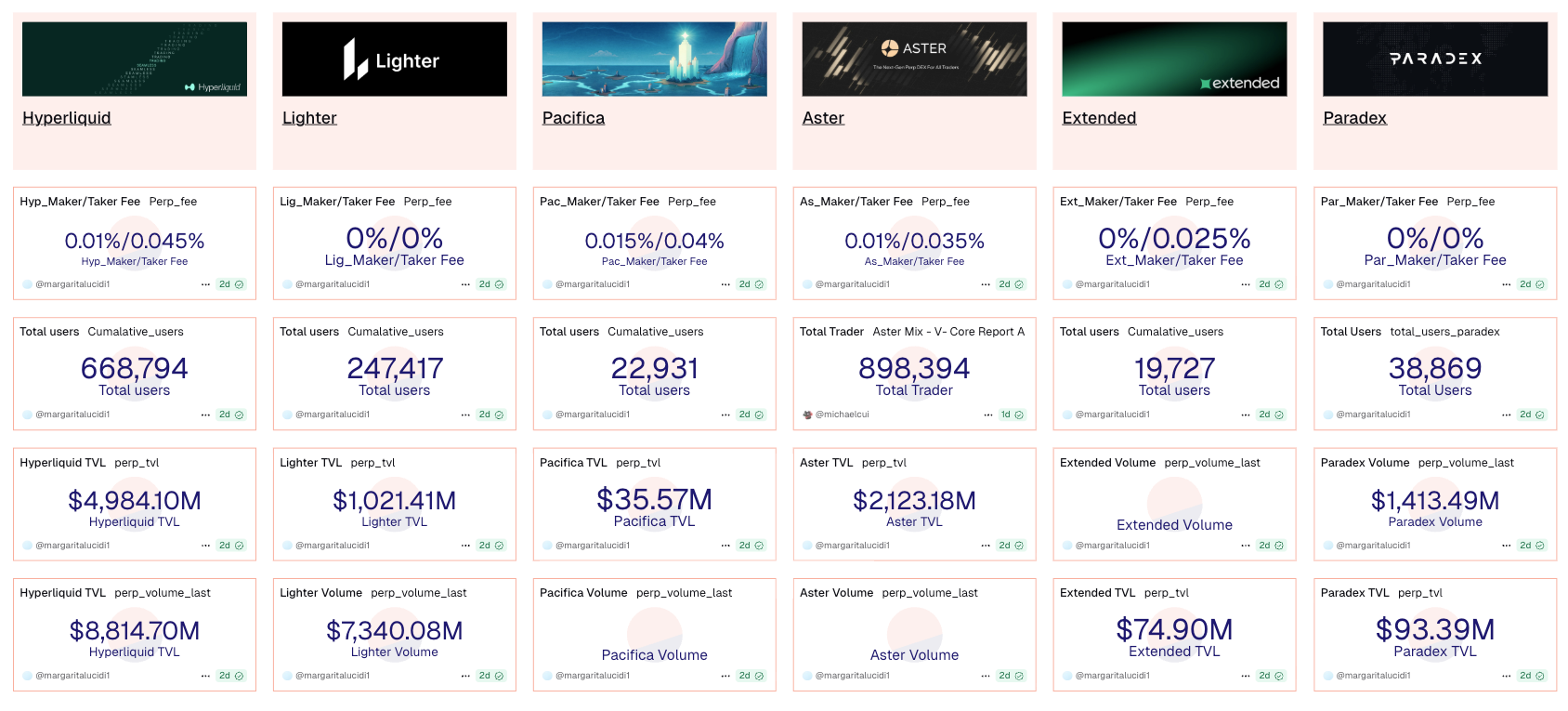

Three levers drive PnL:

- Execution & slippage (latency, depth, queueing)

- Liquidation design (mark vs index; ADL vs insurance)

- Fee surface (classic maker/taker vs zero-fee/profit-share)

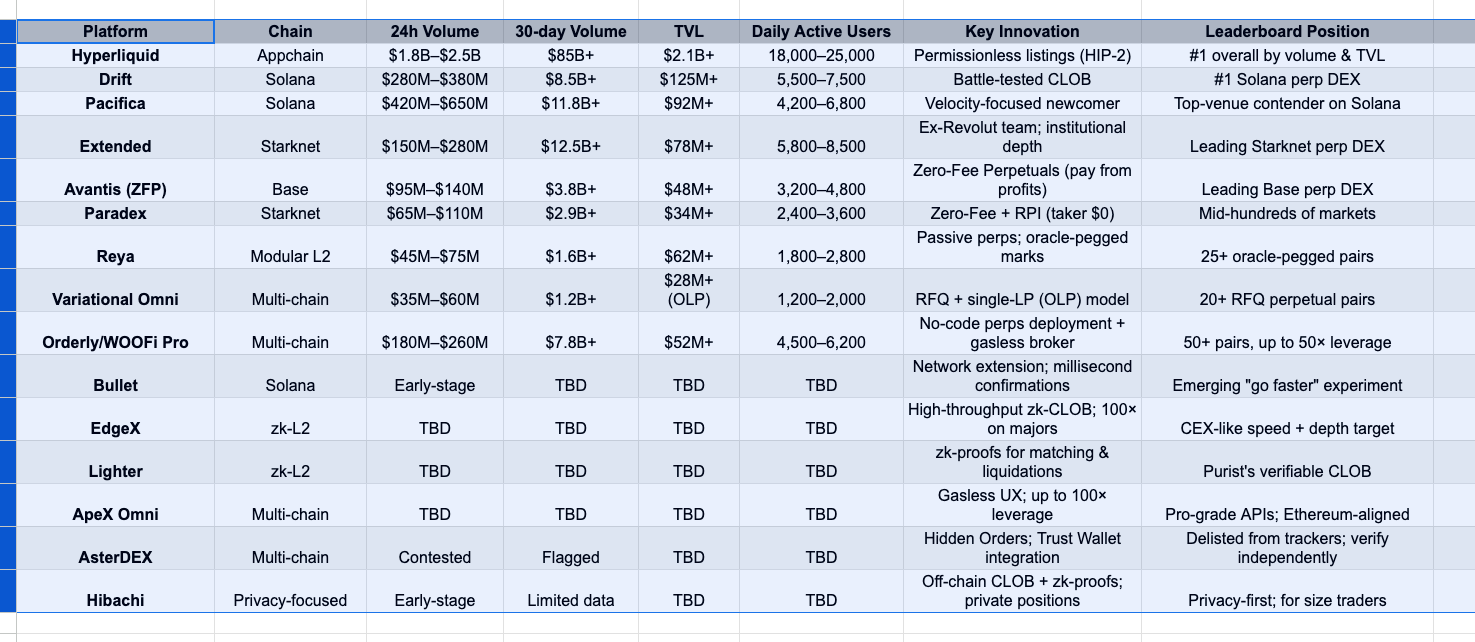

The venues below are organized by how they move those levers — with metrics woven in to explain the behavior, not dumped as tables.

Appchain CLOBs: when latency is a feature (and shows up in PnL)

Hyperliquid’s HIP-3 changed the supply side of liquidity. After listings became permissionless (with that 500k HYPE bond), long-tail markets stopped flashing and fading. You see it in open interest that holds through the first funding cycle instead of evaporating, and in day-three/day-seven liquidity that’s still there for size. That stickiness, paired with consistent top-tier daily volumes, explains why traders now plan routes assuming Hyperliquid will have depth on “niche” pairs — because it often does.

On Solana, Bullet attacks the speed side. During two-minute volatility bursts, its “network-extension” design keeps confirmations in the low-millisecond band (Celestia DA, app-specific optimizations). The practical effect is tighter realized slippage on fast clips: when SOL rips a few tenths in seconds, fills cluster closer to intent than on slower stacks. It’s not headline marketing; it’s bps saved trade after trade.

A zk take on the same idea is EdgeX. On macro prints, takers crossing the spread often get clipped by only single-digit bps because the matching engine actually preserves queue position. Over a month of news trades, that gap compounds into meaningful edge — one reason desks keep a “fast lane” tab open here.

A Solana story ties it together. When Drift posted a billion-dollar day, market makers compared same-minute fills across venues; Pacifica, even while invite-only, showed comparable impact on BTC/SOL clips in those windows. Translation: Solana’s throughput is now multi-venue, not a single outlier — use it to route by strategy rather than loyalty.

zk-L2 orderbooks: prove the engine, not just the outcome

Lighter turns “don’t trust, verify” into plumbing. Matching and liquidations are covered by ZK proofs, so price-time priority and ADL paths are state transitions you can audit, not policy copy. You feel this during pukes: liquidations fan out the way the docs say they should, and insurance usage lines up with the stress path. That’s why backtests survive contact with reality more often here.

Get Coinmonks Team’s stories in your inbox

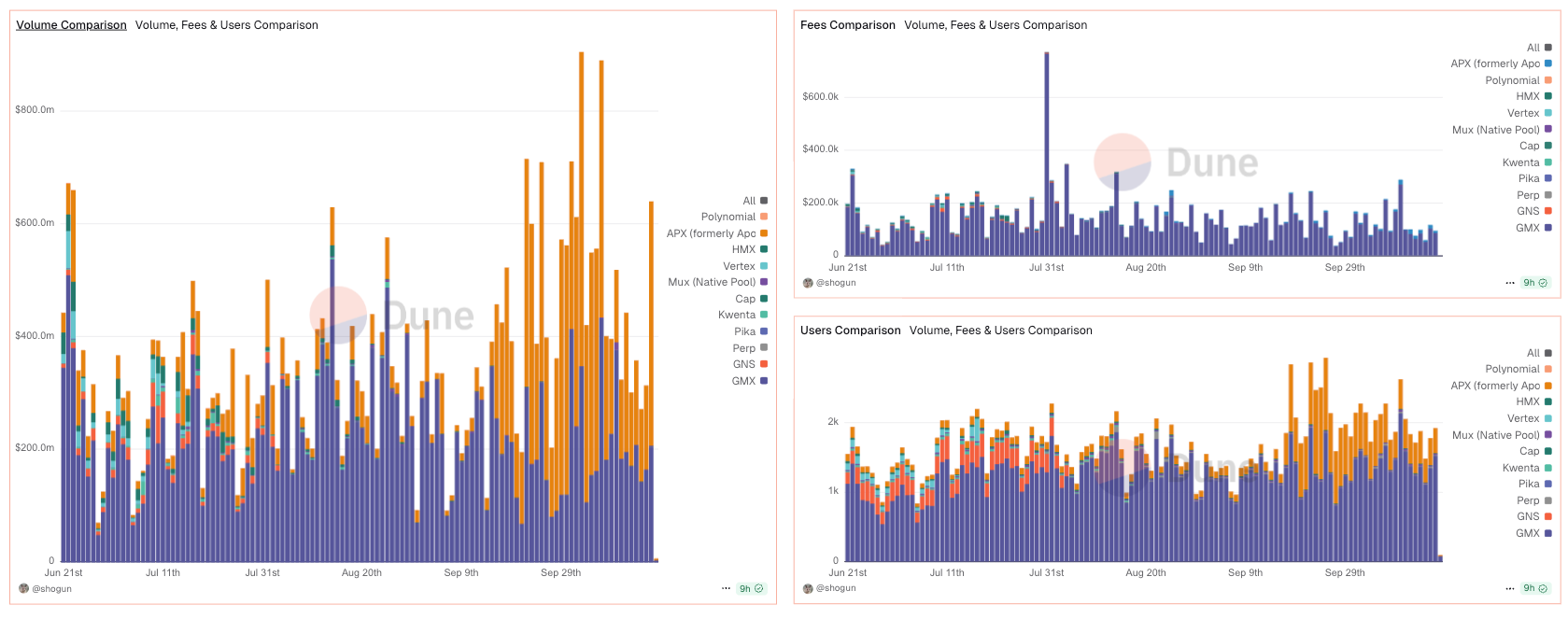

ApeX (Omni) leans into UX without sacrificing custody: gasless front end, 100× on majors, and CEX-grade APIs — backed by steady mid-nine-figure daily turnover that keeps cancel/replace latency snappy when funding flips. If you scalp, the key metric isn’t notional; it’s whether sub-second cancels still hold up as the book churns.

Fee alchemy: when “zero” actually means “different”

Two designs force a spreadsheet update:

- Avantis (Base) removes open/close/borrow and charges only from profitable exits (ZFP). Over a month of high-leverage scalps, you’ll see PnL variance tighten because fee drag stops bleeding you during chop. Analysts covering ZFP flagged it as meaningfully different from “discounts”: it changes optimal time-in-trade, especially for short-horizon flow.

- Paradex (Starknet) keeps taker at $0 via Retail Price Improvement (RPI). Whether it’s cheaper depends on spreads. In calm hours, $0 taker + improvement often beats classic maker/taker; in headline minutes, spreads widen and the calculus flips. Paradex’s own RPI threads are useful primers — and the right metric to track is effective cost per trade (spread ± improvement), not the banner.

A great X dynamic to cite: quants posted spread-adjusted cost by clip size after Paradex explained RPI. Below mid-five-figure clips, RPI often wins; above that, depth dominates fee labels. Route accordingly.

Pegged marks and passive liquidity (fewer “why was I liquidated?” moments)

Reya optimizes for clean marks rather than raw speed. By anchoring unrealized PnL to a blended oracle basket, mark-to-index gaps are smaller during spikes. You notice it as a few extra ticks of liquidation distance in chop — the difference between getting wicked out and living to fight the next candle.

RFQ when certainty beats time priority

Variational’s Omni trades the public book for RFQ with a single Omni LP that quotes, hedges across CEX/DEX/OTC, and shares MM PnL with depositors. The number that matters isn’t headline notional; it’s fill ratio at quoted size when orderbooks get thin. In two-minute BTC jags, takers reported near-full fills more often than on thin CLOBs — exactly when certainty is worth more than a bp.

The market share turn (and why it sticks)

Three data points make the structural case:

- DEX perps’ share climbed to the low-to-mid-20s% by mid-2025 — up from ~4–6% in 2024. That’s not seasonal; it’s a curve.

- The DEX-to-CEX futures ratio set a record around 0.23 in Q2 2025, echoing multiple market data sources.

- Hyperliquid’s permissionless listing and the public CZ discourse amplified the narrative right as those ratios were printing highs. The timing is unmistakable: DEXs aren’t peripheral anymore — they’re in the main conversation.

Solana’s three-track ecosystem (how to route flow)

- Drift is endurance — steady depth, cross-margin, and shallow slippage on majors during $300M-ish days. When it hit $1B+ in 24h, traders used identical clips to compare fills venue-by-venue and kept Drift as the baseline.

- Pacifica is velocity — even in invite-only beta it posted $600M+ days, with fills that held up against Drift in the same hour, making it a real alternative rather than “points volume.”

- Bullet is raw speed — the millisecond lane for event trading, where you route when bps of slippage are the entire trade.

Starknet’s CLOB cluster (not a science project anymore)

- Extended and Paradex regularly clear nine-figure days and double-digit billions on 30-day windows. What matters is the shape: Extended shows shallower slippage curves on majors than a young venue “should,” while Paradex’s $0 taker is genuinely cheaper in off-peak regimes — until spreads widen around headlines. Adapt routes in real time.

AsterDEX: features vs. depth

Hidden Orders shipped. Trust Wallet integration widened the funnel. In the same window, third-party trackers flagged suspicious volume patterns and delisted the perps feed. The grown-up stance is simple: enjoy the feature velocity, but size only after depth/OI/fees check out on your clips.

Privacy without sacrificing fills

Hibachi pairs an off-chain CLOB with Succinct-style ZK proofs and encrypted data availability on Celestia, so balances/positions stay private and provable. The KPI isn’t TVL; it’s execution quality while private — do your fills and slippage look like they should when you’re not broadcasting inventory?

Extreme leverage is a banner, not a plan

“Up to 1000×” looks exciting; a 0.10% adverse tick at that leverage is automatic liquidation. If you really must test it, keep size microscopic and stops hard. In practice, a clean 25–50× on a gasless CLOB (e.g., WOOFi Pro on Orderly) is plenty — and easier to risk-manage.

How to choose — practical, metric-aware

- Execution first. During CPI/FOMC/ETF minutes, measure realized slippage and cancel/replace latency. If milliseconds and queue position matter, appchain/zk CLOBs — Hyperliquid, EdgeX, Bullet, Lighter, ApeX — tend to win.

- Fees second. Backtest ZFP (pay from profits) vs RPI ($0 taker) by clip size and vol regime; the “cheapest” venue flips by hour, not month.

- Liquidations third. Prefer small mark-index gaps (Reya), proofed paths (Lighter), or RFQ hedging (Variational) when depth thins.

- Always verify liquidity. Use 24h/7d/30d and OI as a sanity check — then send real test orders on your pairs (not just BTC/ETH).

The 2026 stack, in one sentence

Run one speed venue (Hyperliquid / EdgeX / Bullet), one fee-model hedge (Avantis ZFP or Paradex RPI), and one chain-native option you trust (Drift/Pacifica on Solana; Extended/Paradex on Starknet). Then let latency, proofs, effective fees, and liquidation logic — measured on your clips — decide where you click Open.

Disclaimer:

- This article is reprinted from [Medium]. All copyrights belong to the original author [Coinmonks Team]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?