Why 99% of Tokens Die and The 1% That Build Ecosystems Live Forever

Most of the tokens I believed in and bought during the last cycle no longer exist.

Each cycle gives birth to thousands of tokens, each promising to transform the game. But when the bull fades, only a handful remain.

By the next cycle, most tokens are dead, the charts are empty, Discord is silent, and the teams have vanished.

What happened?

The truth is simple: tokens die because they never evolve beyond speculation.

They live fast, pump hard, and burn out faster.

But the ones that build ecosystems those become immortals

The harsh truth is that you cannot There are no

The Death Trap of Most Tokens

Most tokens don’t die from lack of hype they die from lack of economy.

They launch with:

- No native demand drivers.

- No token sinks.

- No identity or retention loops.

- No real reason for users to stay once rewards dry up.

It’s the same pattern for every cycle:

Farm → Dump → Exit → Ghost Town.

Liquidity farms attract mercenaries, not citizens.

Points and airdrops attract hunters, not believers.

And when the incentives stop, so does the community

The harsh truth is that you cannot build an economy on temporary greed.

The three Pillars of Token Survival

The difference between a dying token and a living ecosystem comes down to three core layers:

→ Incentive loops

→ User retention

→ Real economy layers.

Let me explain further

1. Incentive Loops: The Internal Engine of Survival

Incentive loops are the heartbeats of sustainable ecosystems.

They create feedback cycles where:

User participation → grows the network → increases token utility → drives demand → attracts more users.

When that loop is designed right, value compounds naturally.

Examples:

- GMX rewards stakers with real revenue from traders, aligning users with protocol growth.

- Berachain ties liquidity provision directly to consensus, creating a self-reinforcing proof-of-liquidity loop.

- Ronin lets players earn, spend, and reinvest, turning gamers into micro-economies.

Tokens that live forever don’t just “reward holders” they make users part of the engine.

Each action someone takes strengthens the ecosystem’s body, not just its price.

2. User Retention: Turning Farmers into Citizens

This is where most projects fail.

They confuse user acquisition with user retention.

They can pay people to join but not convince them to stay.

The 1% that survive understand something deeper:

People don’t stay for yield they stay for identity.

When a protocol gives users a place to belong, a status to earn, or a reputation to build, it shifts from “platform” to “nation”.

- idOS is building identity rails that anchor users across ecosystems.

- Base turns builders into citizens through culture and recognition.

- Friend.tech showed how reputation, social status, and emotional ownership can create massive on-chain stickiness.

The strongest retention systems are not about farming

They’re about belonging.

Your users should feel like if they leave, they lose part of themselves.

That’s when you’ve built a real network.

3. Real Economy Layers: Where Tokens Gain Purpose

Speculation creates attention.

Utility creates gravity.

When tokens integrate into real economic layers, they stop being chips and start becoming currencies of coordination.

This is where the 1% truly separate themselves:

- Solana’s memecoins and payments created a self-sustaining user economy.

- Arbitrum’s DAO funding loop created builders, not beggars.

- BNB’s token became an access pass for trading, gas, and launchpads.

These layers connect speculation → utility → coordination → sustainability.

When tokens move value, access networks, govern treasuries, and enable payments, they stop being projects they become nations with economies.

The Lifecycle of a Living Token

Let’s visualise it.

- Narrative Phase: The token launches with a clear story.

- Utility Phase: Early adopters use it not just trade it.

- Retention Phase: Community forms loops around it (staking, governance, identity).

- Expansion Phase: The ecosystem starts generating its demand for new projects, integrations, or use cases.

That’s when a token stops needing hype to survive.

It becomes self sustaining.

The Death Spiral of 99%

The other 99% follow this exact death path:

- Launch hype → everyone apes in.

- No real use → the token becomes a pure speculation chip.

- Liquidity exits → holders dump, whales rotate.

- Community dies → silence.

- Token fades → the next narrative replaces it.

Their graphs all look the same

A mountain peak followed by an endless downhill slope.

That’s not bad luck.

That’s bad design.

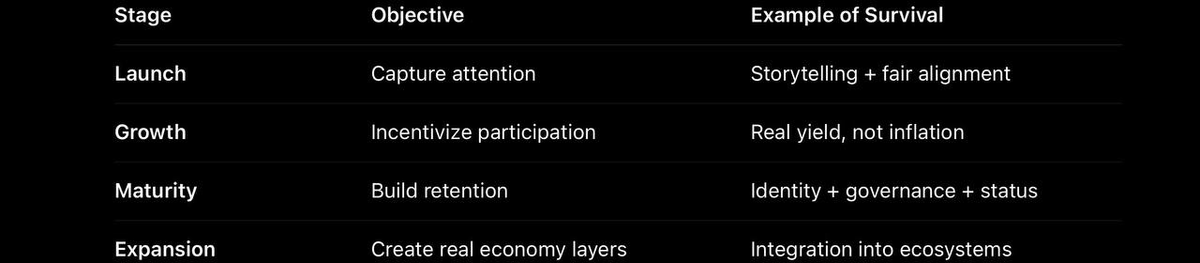

The 1% Playbook

Here’s a framework every founder and investor should internalise:

Conclusion

Every cycle burns the weak and crowns the strong.

Narratives come and go ecosystems remain.

These are the new meta of good tokens emerging soon

https://x.com/TheDeFISaint/status/1977290279007797424

Thanks for reading

Like, retweet and follow if you love this.

Disclaimer:

- This article is reprinted from []. All copyrights belong to the original author [**]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?