Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Futures Mall

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

Trending Topics

View More9.31K Popularity

90.1K Popularity

63.86K Popularity

19.04K Popularity

37.15K Popularity

Pin

Get Liquidated analysis: Over 100,000 people globally were liquidated within 24 hours, with a total amount reaching $257 million.

Introduction

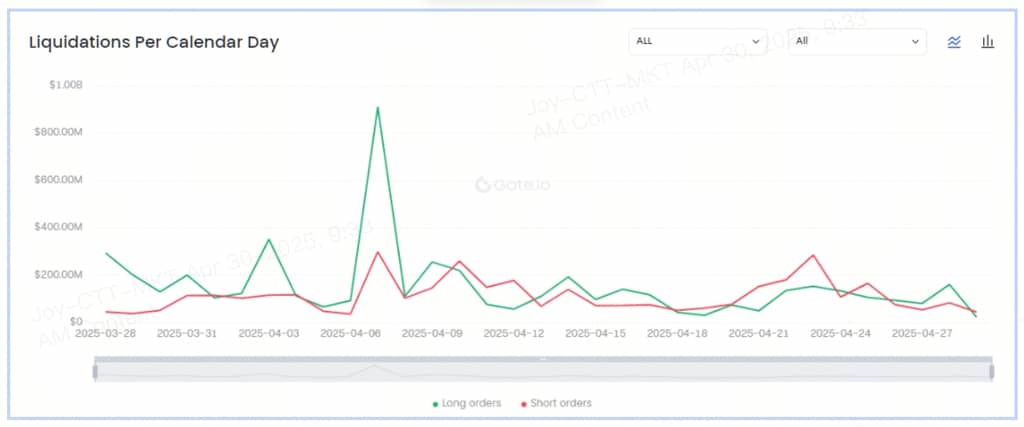

On April 29, 2025, the global cryptocurrency market experienced a slight wave of liquidation. According to Coinglass data, a total of 108,119 investors around the world were liquidated in the past 24 hours, with a total liquidation amount of $257 million. While the data is not shocking, it is a reminder that investors need to pay more attention to risk management in volatile markets.

This article will conduct a multi-level data analysis to delve into the main characteristics of this liquidation event, the major cryptocurrencies involved, the market driving factors, and the implications for investors. We hope that a comprehensive analysis of market dynamics will provide investors with practical risk management advice and insights into future market trends.

Check liquidation data immediately:

Liquidation Overview: General Data Analysis

In the past 24 hours, there have been a total of 108,119 liquidation events in the global cryptocurrency derivatives market, with a total liquidation amount reaching 257 million USD.

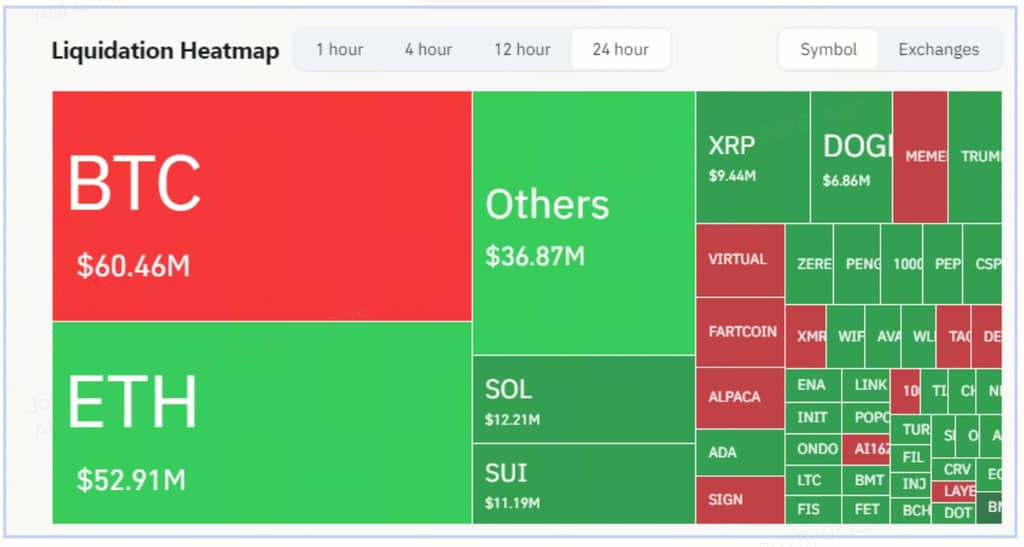

In this liquidation wave, the distribution of the liquidation amounts for major cryptocurrencies is as follows:

Specifically for Gate.io, the liquidation data is shown in the figure below, which is basically consistent with the overall network data ratio.

Analysis of Market Volatility and Liquidation Reasons

The occurrence of liquidation events is usually related to market volatility and specific event-driven factors. Although the overall market has seen relatively small fluctuations in the past 24 hours, localized price jumps and event-driven speculation have intensified the scale of liquidations.

In addition, the rapid changes in market sentiment have also intensified liquidations. For example, some investors may leverage due to short-term positive news (such as XRP ETF), but fail to foresee the complexity of market dynamics, resulting in their positions being liquidated.

Investor Coping Strategies: Risk Management Recommendations

In the face of frequent liquidation events, investors need to adopt the following risk management strategies to reduce losses:

Future Outlook: Market Trend Forecast

The volatility of the cryptocurrency market is expected to continue, especially the volatility of AI, Meme, and SUI ecosystem-related tokens may far exceed that of other sectors, and liquidation events will remain a norm in derivatives trading. Here are a few key predictions for future market trends:

Conclusion

The cryptocurrency market is known for its high leverage and high volatility, and liquidation is the norm. Through data analysis, we found that market fluctuations, event-driven factors, and leveraged trading are the main reasons for liquidations. In the future, investors need to cope with market uncertainties by controlling leverage, setting stop-loss orders, and diversifying investments.

Risk Warning: The content of this article is for reference only and does not constitute any investment advice. Investing in cryptocurrency derivatives involves high risk and may result in financial loss. Investors should bear the risk themselves.

Author: Charle A., Gate.io researcher *This article only represents the author’s views and does not constitute any trading advice. Investing involves risks, and decisions should be made with caution. *The content of this article is original and the copyright belongs to Gate.io. If reprinted, please indicate the author and source, otherwise legal responsibility will be pursued.