Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

Trending Topics

View More11.96K Popularity

36.83K Popularity

47.65K Popularity

14.21K Popularity

9.95K Popularity

Pin

Clearing Map: Revealing the Liquidity Secrets of the Crypto Assets Derivation Market

Introduction

In the highly volatile cryptocurrency market, traders face significant risks, especially the liquidation risk in leveraged trading. The Liquidation Map is an advanced tool that visually displays the locations of potential liquidation events, helping traders better understand market liquidity and price movements. As the market continues to evolve, the Liquidation Map has become an essential tool for many professional traders.

View the liquidation map now:

What is a liquidation map?

The liquidation map is a charting tool that displays the price levels at which potential liquidation events may occur in the cryptocurrency futures market. Liquidation events happen when a trader’s margin is insufficient to maintain their leveraged position, leading the exchange to forcibly close the position. This situation is especially common during rapid price fluctuations.

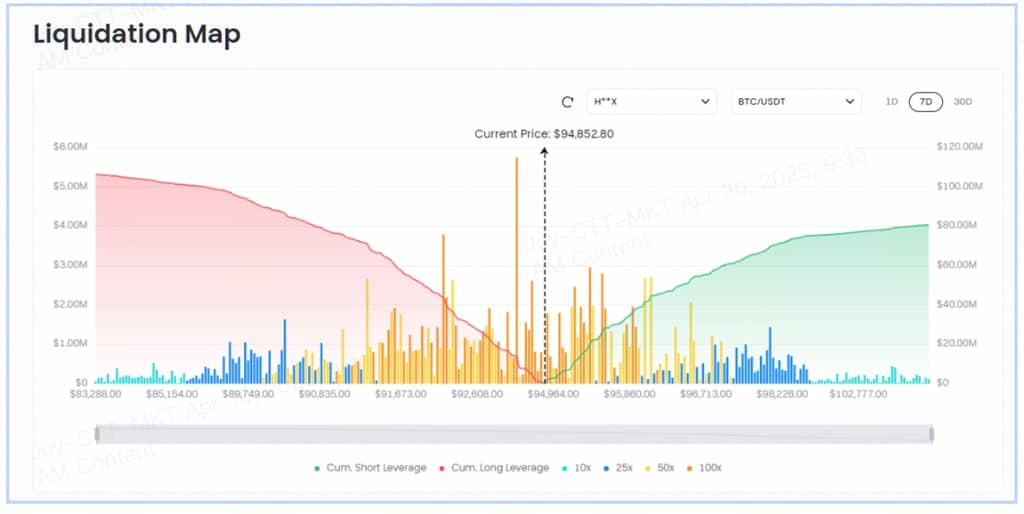

On the liquidation map, the X-axis represents the mark price, while the Y-axis represents the relative strength of the liquidation. The liquidation chart does not show the exact number of contracts to be liquidated or the exact value of the liquidated contracts. The bars on the liquidation chart actually represent the importance, or strength, of each liquidation cluster relative to nearby liquidation clusters.

The liquidation map predicts potential liquidation price points by analyzing market data and different leverage multiples, and presents this information graphically. These graphics typically show liquidation clusters, which are areas where a large number of potential liquidation orders are concentrated within a specific price range. The density and height of the liquidation clusters indicate that the impact on market prices can be quite significant when prices reach these levels.

For example, the Coinglass liquidation map not only shows the current market liquidation distribution but also provides historical data and a heatmap feature to help traders identify high liquidity areas. Of course, Gate also provides access to the relevant liquidation map.

The Principle of Generating the Liquidation Map

The generation of the liquidation map is based on the following key factors:

Specifically, the liquidation map calculates the potential liquidation quantities at each price level and displays them using variations in color or density. For example, the Coinglass liquidation heatmap uses a color gradient (from purple to yellow) to indicate the intensity of liquidation levels, with yellow areas representing a large number of predicted liquidation levels and higher liquidity.

How to Use the Liquidation Map

Traders can use the liquidation map for the following strategies:

In addition, the liquidation map can help traders identify “magnetic zones,” which are areas where prices may be attracted due to a large number of liquidation orders. Once the price reaches these areas, it may trigger a chain reaction, resulting in rapid price fluctuations.

The Role of the Liquidation Heatmap

The liquidation heatmap is a specific form of the liquidation map, which displays the intensity of liquidation levels through a color gradient. The deeper the color, the more potential liquidation events at that price level, indicating higher liquidity.

For example, in the Coinglass liquidation heatmap, the yellow areas represent a large number of predicted liquidation levels, allowing traders to gauge the potential direction and intensity of price movement. By analyzing the heatmap, traders can identify support and resistance levels, optimizing their trading strategies.

It is worth noting that the liquidation heat map predicts where the liquidation levels will open, but it does not predict where they will close. Therefore, the actual number of liquidations may be less than the predicted value. Traders should use it in conjunction with other technical indicators and market dynamics for comprehensive analysis.

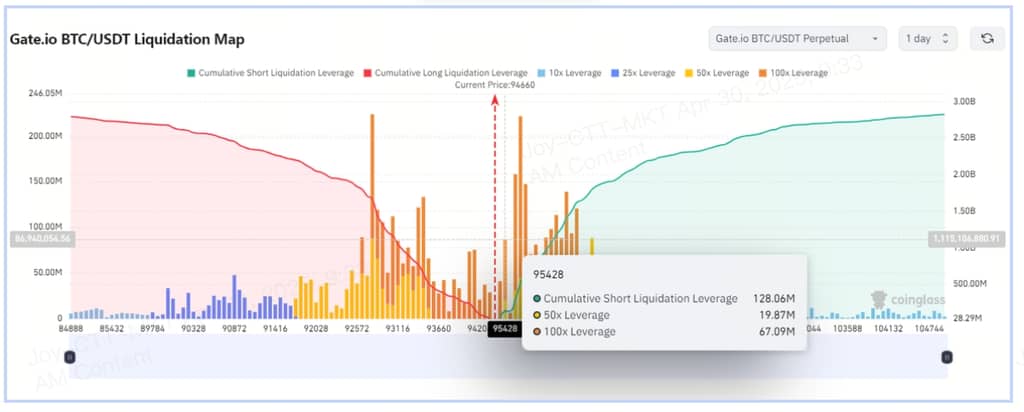

Case Study: Liquidation Map Data on Gate.io

From the observation point of the writing date, as shown in the figure below, according to Gate.io’s liquidation map, the current price of the BTC perpetual contract is $94,660. The figure shows that if the coin price rises to $95,428, several high-leverage short positions totaling $128 million will be liquidated.

Although there is currently little overall volatility in the market, localized events are likely to trigger brief and intense price fluctuations. If the aforementioned short positions are liquidated, it could lead to a further increase in prices.

Of course, liquidation maps are essentially data-based forecasting tools, and the actual number of liquidations may be less than predicted, but market behavior is ultimately driven by human nature. Factors such as emotional trading, herd effect, etc., can cause the prediction of the liquidation map to be skewed. Therefore, when using the liquidation map, traders should make decisions based on their own psychological state and risk appetite.

Conclusion

The liquidation map, as a powerful analytical tool, provides cryptocurrency derivatives traders with a unique perspective, helping them better understand market liquidity and risk distribution. By utilizing the liquidation map, traders can develop more effective trading strategies and improve their success rates.

However, it is worth noting that the clearing map is just one of many analytical tools, and exchanges may provide more refined clearing map data in the future, even integrating AI algorithms to help traders predict market behavior more accurately.

Risk Warning: The content of this article is for reference only and does not constitute any investment advice. Investing in cryptocurrency derivatives involves high risks and may result in financial losses. Investors should bear the risks themselves.

Author: Charle A., Gate.io researcher *This article only represents the author’s views and does not constitute any trading advice. Investment involves risks, and decisions should be made cautiously. *The content of this article is original and copyrighted by Gate.io. If you need to reprint it, please indicate the author and source, otherwise legal responsibility will be pursued.