Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

CCAF researchers confirmed the transition of Bitcoin miners to "green" energy.

The share of sustainable energy sources in Bitcoin mining reached 52.4% compared to 37.6% in 2022. This data is provided in the report by the Cambridge Centre for Alternative Finance (CCAF).

In the current indicator, 42.6% comes from renewable sources, 9.8% from nuclear power. The share of natural gas increased from 25% to 38.2%, while the use of coal generation fell from 36.6% to 8.9%.

Researchers collected data through a survey of 49 mining companies that control about 48% of the cryptocurrency’s hash rate. The respondents’ headquarters are located in 17 jurisdictions, and mining operations are conducted in 23 countries.

Experts noted that the focus of the research on North American companies (75.4% of the surveyed activity was attributed to the USA ) somewhat distorts the overall picture. However, CCAF specialists believe that the results accurately reflect the trends and issues in the industry.

According to the survey, miners have the greatest concerns about:

As the main risk management strategies, respondents named:

The most significant obstacles to business expansion are the insufficient potential of available sites for large-scale cryptocurrency mining (47%) and delays in the supply of ASIC miners (45%).

In this regard, industry participants also pointed out the lack of access to debt financing (40%) and equity (36%).

At the same time, 41% of surveyed companies are traded on the exchange.

Hashrate growth = efficiency of ASIC miners

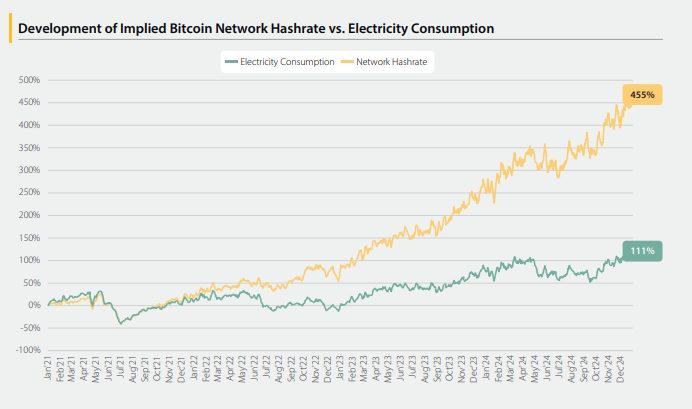

Researchers estimated the annual electricity consumption of Bitcoin miners at 138 TWh. Since January 2021, the figure has increased by 111%, while the hash rate has grown by 455%.

The gap in dynamics is due to the increase in energy efficiency of mining equipment, which accelerated with the onset of the ASIC era. By the end of 2024, the average energy consumption rate for the global fleet of installations reached 23.7 J/TH.

Next-generation models already provide 12 J/TH, and chip releases with 10 J/TH are announced for 2025, experts noted.

They characterized the situation in the market for new miners as an oligopoly. According to them, it is almost completely controlled by Bitmain ( with a share of 82%), MicroBT (15%), and Canaan (2.1%). The segment of firmware for installations is more fragmented.

Data: CCAF.

According to analysts at Coin Shares, by the end of 2024, Canaan has dropped out of this trio. The company’s place has been taken by Bitdeer, the former CEO of Bitmain, Jihan Wu, with a share of 7%, the same as MicroBT.

Environmental damage is a contentious issue

According to estimates by researchers from CCAF, annual CO₂ emissions related to mining reached 39.8 million tons. This corresponds to ~0.08% of the global total and is comparable to Slovakia’s figure. However, the majority of survey participants stated that they are taking measures to offset their impact on climate change.

Experts added approximately 2300 tons of electronic waste in the form of decommissioned miners for the year 2024 to the carbon footprint. However, companies assured that a significant portion of the used equipment is sold on the secondary market or recycled.

In a study published in April, researchers from the Harvard T.H. Chan School of Public Health accused Bitcoin mining of contributing to additional atmospheric pollution from particulate matter.

They found that connecting equipment even exclusively to environmentally friendly sources raises the overall demand for electricity. This is responded to by so-called backup capacities, which, due to technological features, are represented by gas and coal generation. As a result, harmful emissions are increasing, often in regions far from data centers.

In a comment for The Block, mining sustainability expert Daniel Batten described the research methodology as “deeply flawed.” In his opinion, the conclusions were tailored to make Bitcoin mining “look bad.”

“This article is a throwback to an earlier generation of academic work that employed flawed methodologies and selective data — an approach that was debunked by Sy and Vranken in 2023. Policymakers and regulators should not take it seriously,” said Batten.

The Institute of Digital Asset Research also refuted the conclusions of Harvard scholars. The institution noted:

Recall that a bill was introduced in the U.S. Senate establishing regional restrictions on emissions for cryptocurrency mining facilities and AI data centers.