# PreciousMetalsPullBack

10.74K

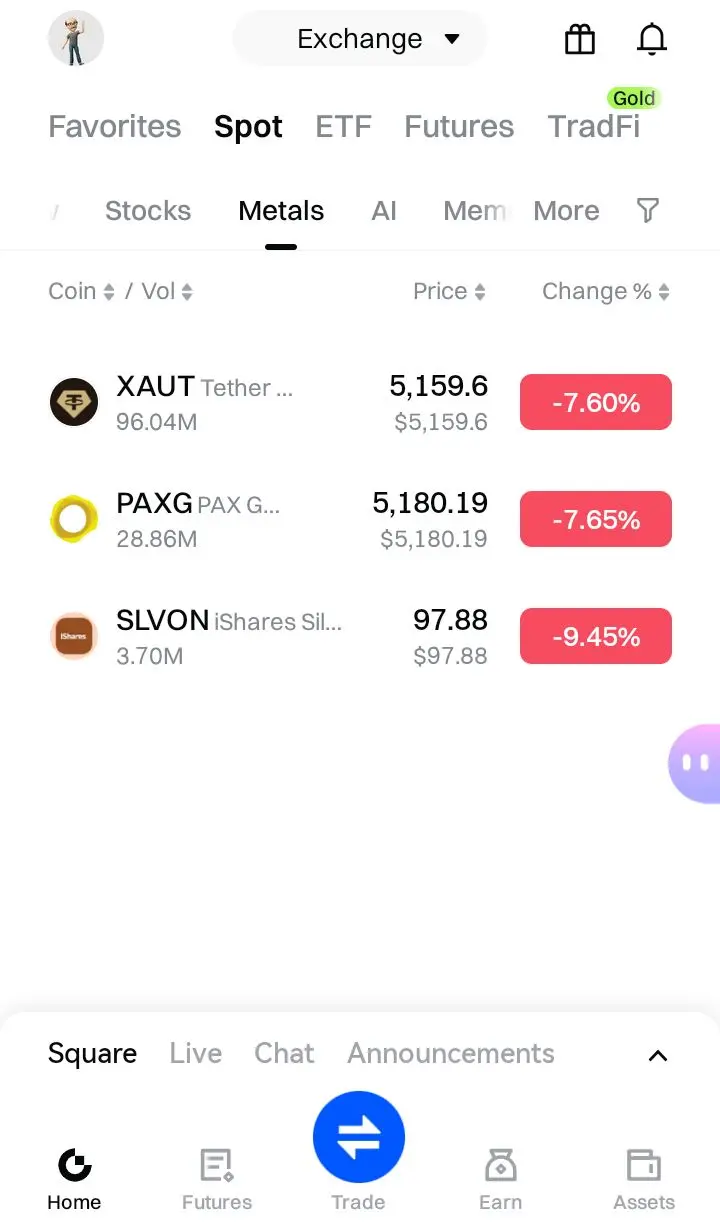

Risk assets fell overnight. Gold slid $300 to $5,155/oz, and silver dropped up to 8% to $108.23/oz. Are you buying the dip or cutting exposure? Share your Gate TradFi metals strategy!

Crypto_Boom2

🚨 Crypto Market Wiped Out Overnight! 🚨

💥 Total crypto market cap crashes below $3 TRILLION

📉 Crypto-related stocks dump nearly 10% in one session

This wasn’t noise — it was a liquidity shock.

Leverage flushed. Weak hands shaken. Fear activated.

But here’s the truth traders miss 👇

🔥 Extreme fear = future opportunity forming

🧠 Smart money watches, waits, and prepares

Markets don’t end in panic —

They reset before the next big move 💣

Follow for real market structure, not hype 💎

The next trend rewards the prepared, not the emotional ❤️#PreciousMetalsPullBack $BTC

💥 Total crypto market cap crashes below $3 TRILLION

📉 Crypto-related stocks dump nearly 10% in one session

This wasn’t noise — it was a liquidity shock.

Leverage flushed. Weak hands shaken. Fear activated.

But here’s the truth traders miss 👇

🔥 Extreme fear = future opportunity forming

🧠 Smart money watches, waits, and prepares

Markets don’t end in panic —

They reset before the next big move 💣

Follow for real market structure, not hype 💎

The next trend rewards the prepared, not the emotional ❤️#PreciousMetalsPullBack $BTC

BTC-6,03%

- Reward

- 1

- Comment

- Repost

- Share

#PreciousMetalsPullBack Bitcoin continues to face heavy pressure as global markets move deeper into a risk-off phase. After dropping sharply on January 29, BTC fell to an intraday low near $83,383, marking its weakest level since November. Although a minor bounce followed, Bitcoin remains trapped in the $84,000–$85,000 range, representing a 33% decline from the October peak near $126,000.

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

BTC-6,03%

- Reward

- 6

- 4

- Repost

- Share

BeautifulDay :

:

Happy New Year! 🤑View More

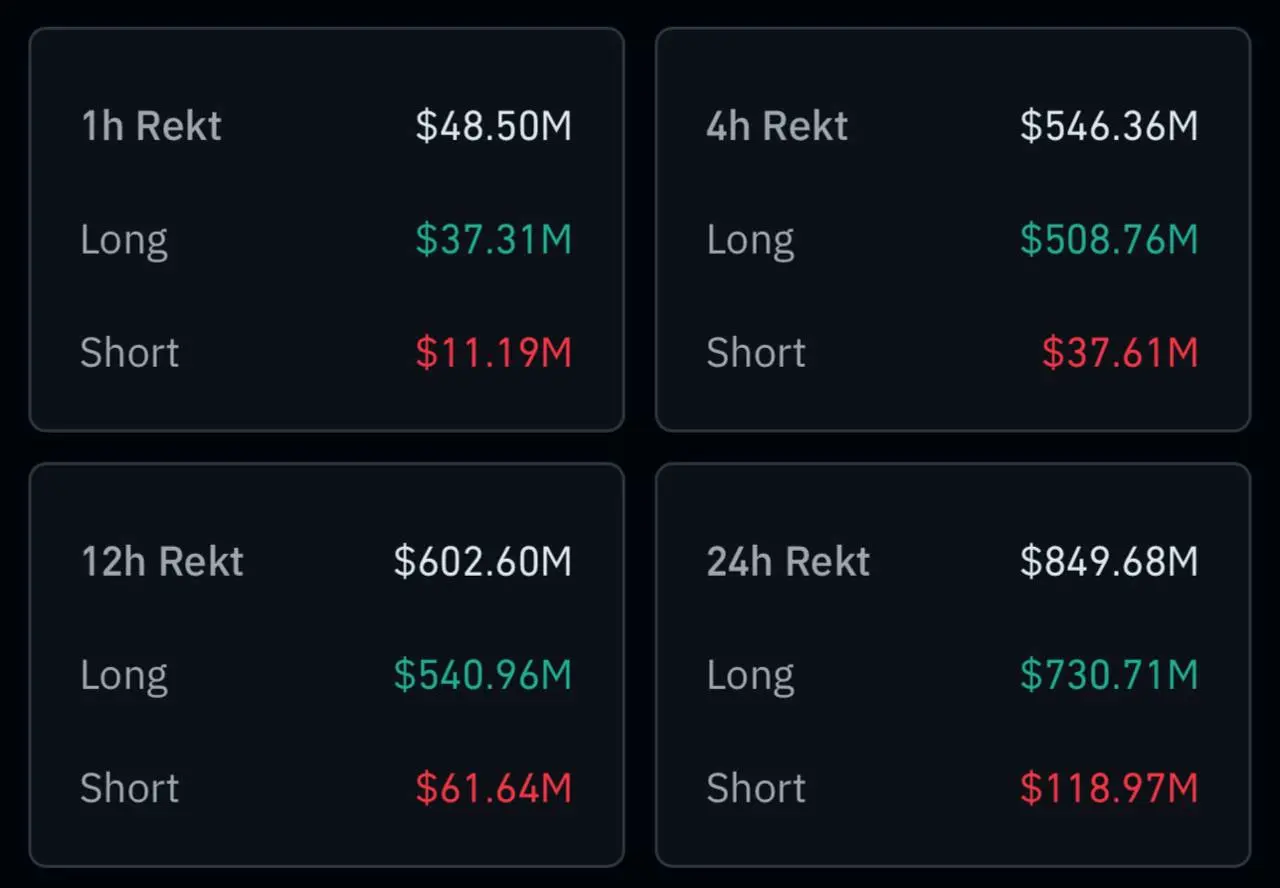

According to Coinglass data, $508,760,000 in LONG positions were liquidated in 4 hours.

BTC below $84,000.

#PreciousMetalsPullBack #GateLiveMiningProgramPublicBeta

BTC below $84,000.

#PreciousMetalsPullBack #GateLiveMiningProgramPublicBeta

BTC-6,03%

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

Happy New Year! 🤑#PreciousMetalsPullBack Bitcoin continues to face heavy pressure as global markets move deeper into a risk-off phase. After dropping sharply on January 29, BTC fell to an intraday low near $83,383, marking its weakest level since November. Although a minor bounce followed, Bitcoin remains trapped in the $84,000–$85,000 range, representing a 33% decline from the October peak near $126,000.

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

BTC-6,03%

- Reward

- 8

- 14

- Repost

- Share

Discovery :

:

DYOR 🤓View More

#PreciousMetalsPullBack 1. The "Dual Engine" Demand

Unlike gold, which is primarily a monetary hedge, silver’s value in 2026 is being driven by a powerful "dual engine":

Industrial Scarcity: With silver prices breaking past $100/oz earlier this year, the demand from green tech (solar PVs alone consume ~125 Moz annually) and AI data centers has created a persistent supply deficit.

Monetary Hedge: As gold nears $5,000/oz, tokenized silver has become the "high-beta" alternative for investors looking for safe-haven protection with more aggressive upside.

2. Tokenization as a De-correlator

Traditio

Unlike gold, which is primarily a monetary hedge, silver’s value in 2026 is being driven by a powerful "dual engine":

Industrial Scarcity: With silver prices breaking past $100/oz earlier this year, the demand from green tech (solar PVs alone consume ~125 Moz annually) and AI data centers has created a persistent supply deficit.

Monetary Hedge: As gold nears $5,000/oz, tokenized silver has become the "high-beta" alternative for investors looking for safe-haven protection with more aggressive upside.

2. Tokenization as a De-correlator

Traditio

DEFI-4,63%

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

Happy New Year! 🤑#PreciousMetalsPullBack #贵金属行情下跌 #贵金属巨震 Markets reminded everyone of a brutal truth today: there is no such thing as a one-way trade.

BTC and ETH collapsed hard.

Altcoins didn’t “correct” — they bled.

US equities slid in unison, risk appetite vanished overnight.

And while crypto traders panicked, gold did something far more dangerous — it shook out weak hands.

Gold plunged nearly $300 to $5,155/oz, silver dropped up to 8% to $108.23/oz.

This wasn’t a random dip. This was forced liquidation + leverage unwind after weeks of crowded long positioning.

Let’s be clear:

If you think this move means “

BTC and ETH collapsed hard.

Altcoins didn’t “correct” — they bled.

US equities slid in unison, risk appetite vanished overnight.

And while crypto traders panicked, gold did something far more dangerous — it shook out weak hands.

Gold plunged nearly $300 to $5,155/oz, silver dropped up to 8% to $108.23/oz.

This wasn’t a random dip. This was forced liquidation + leverage unwind after weeks of crowded long positioning.

Let’s be clear:

If you think this move means “

- Reward

- 5

- 2

- Repost

- Share

ybaser :

:

very good information to readView More

#CryptoMarketPullback

Markets are cooling off after a strong run — and that’s completely normal. 📉

A crypto pullback doesn’t mean the trend is broken; it often means the market is resetting, shaking out weak hands, and building a healthier base.

For patient investors, pullbacks are moments to reassess, not panic. Smart money watches structure, support levels, and on-chain signals while emotions run high.

Corrections create opportunities. Discipline creates results. 🚀

#PreciousMetalsPullBack

#CryptoMarketPullback

Markets are cooling off after a strong run — and that’s completely normal. 📉

A crypto pullback doesn’t mean the trend is broken; it often means the market is resetting, shaking out weak hands, and building a healthier base.

For patient investors, pullbacks are moments to reassess, not panic. Smart money watches structure, support levels, and on-chain signals while emotions run high.

Corrections create opportunities. Discipline creates results. 🚀

#PreciousMetalsPullBack

#CryptoMarketPullback

- Reward

- 6

- 5

- Repost

- Share

AylaShinex :

:

Buy To Earn 💎View More

#PreciousMetalsPullBack Bitcoin dropped 6.4% to $83,383 on January 29, 2026, due to five consecutive days of ETF outflows totaling $1.137 billion, capital rotation into surging precious metals (gold $5,600, silver $120), US rare earth tariff announcements spiking volatility above 40, and bearish options market positioning with 97% of calls out-of-the-money.

What is the Bitcoin price now?

Bitcoin is trading at $84,233-84,623 as of Thursday, January 29, 2026, after hitting an intraday low of $83,383, the lowest level since November, representing a 33% decline from October's $126,000 peak.

Why is

What is the Bitcoin price now?

Bitcoin is trading at $84,233-84,623 as of Thursday, January 29, 2026, after hitting an intraday low of $83,383, the lowest level since November, representing a 33% decline from October's $126,000 peak.

Why is

BTC-6,03%

- Reward

- like

- Comment

- Repost

- Share

$XAUT is trading around $5,133 after getting rejected hard near $5,637. Sellers are clearly in control and momentum is weak. This zone is critical — either buyers defend here for a bounce, or we see another sharp drop.

$XAUT #PreciousMetalsPullBack #CryptoMarketPullback #MiddleEastTensionsEscalate #TokenizedSilverTrend

$XAUT #PreciousMetalsPullBack #CryptoMarketPullback #MiddleEastTensionsEscalate #TokenizedSilverTrend

XAUT-8,55%

- Reward

- like

- Comment

- Repost

- Share

#PreciousMetalsPullBack The January 29-30, 2026 Market Rout: A Sharp Correction Amid Geopolitical Heat and Leverage Unwind

On January 30, 2026, global risk assets endured a violent flush, with an estimated $8 trillion in paper wealth erased across equities, crypto, and commodities in under 24 hours.

This was not a full-blown crash but a high-velocity deleveraging event triggered by escalating U.S.-Iran tensions, aggressive CME margin increases, persistent Fed hawkishness, and looming tariff risks.

Key Price Action (as of late January 30, 2026):

Bitcoin (BTC): Closed around $82,000–$82,350 aft

On January 30, 2026, global risk assets endured a violent flush, with an estimated $8 trillion in paper wealth erased across equities, crypto, and commodities in under 24 hours.

This was not a full-blown crash but a high-velocity deleveraging event triggered by escalating U.S.-Iran tensions, aggressive CME margin increases, persistent Fed hawkishness, and looming tariff risks.

Key Price Action (as of late January 30, 2026):

Bitcoin (BTC): Closed around $82,000–$82,350 aft

- Reward

- 2

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

10.74K Popularity

26.5K Popularity

352.73K Popularity

31.94K Popularity

52.03K Popularity

862 Popularity

19.21K Popularity

8.72K Popularity

82.76K Popularity

29.82K Popularity

20.97K Popularity

26.92K Popularity

8.87K Popularity

16.02K Popularity

206.34K Popularity

News

View MoreU.S. President Trump: Any candidate for Federal Reserve Chair will perform excellently

26 m

U.S. Democratic Senator: No Republican should agree to Wosh's nomination until Trump halts the Federal Reserve investigation

27 m

Economist: Wosh's succession expectations have been priced in, and the downside risk for the dollar remains

38 m

Danske Bank: Wosh's nomination supports the US dollar

44 m

Gate DEX's Meme Go launches "Weekly Trading Check-in" incentive event

45 m

Pin