# Uni

1.3M

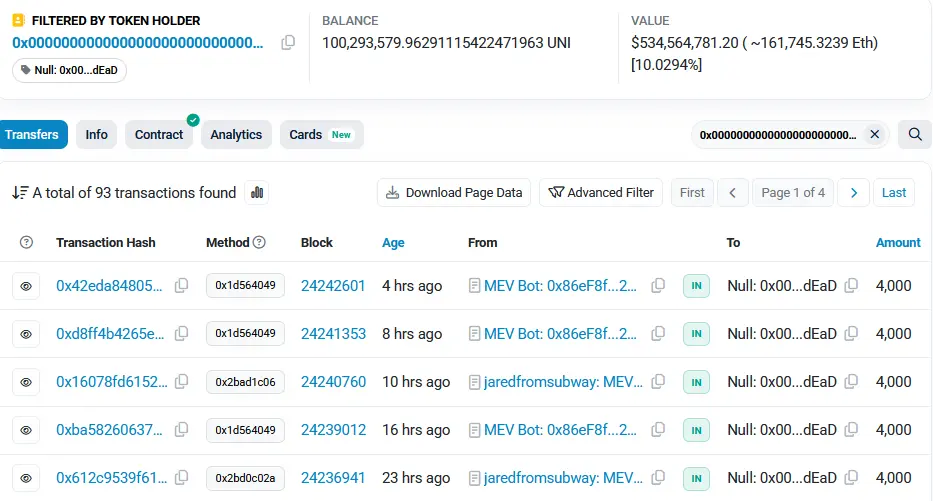

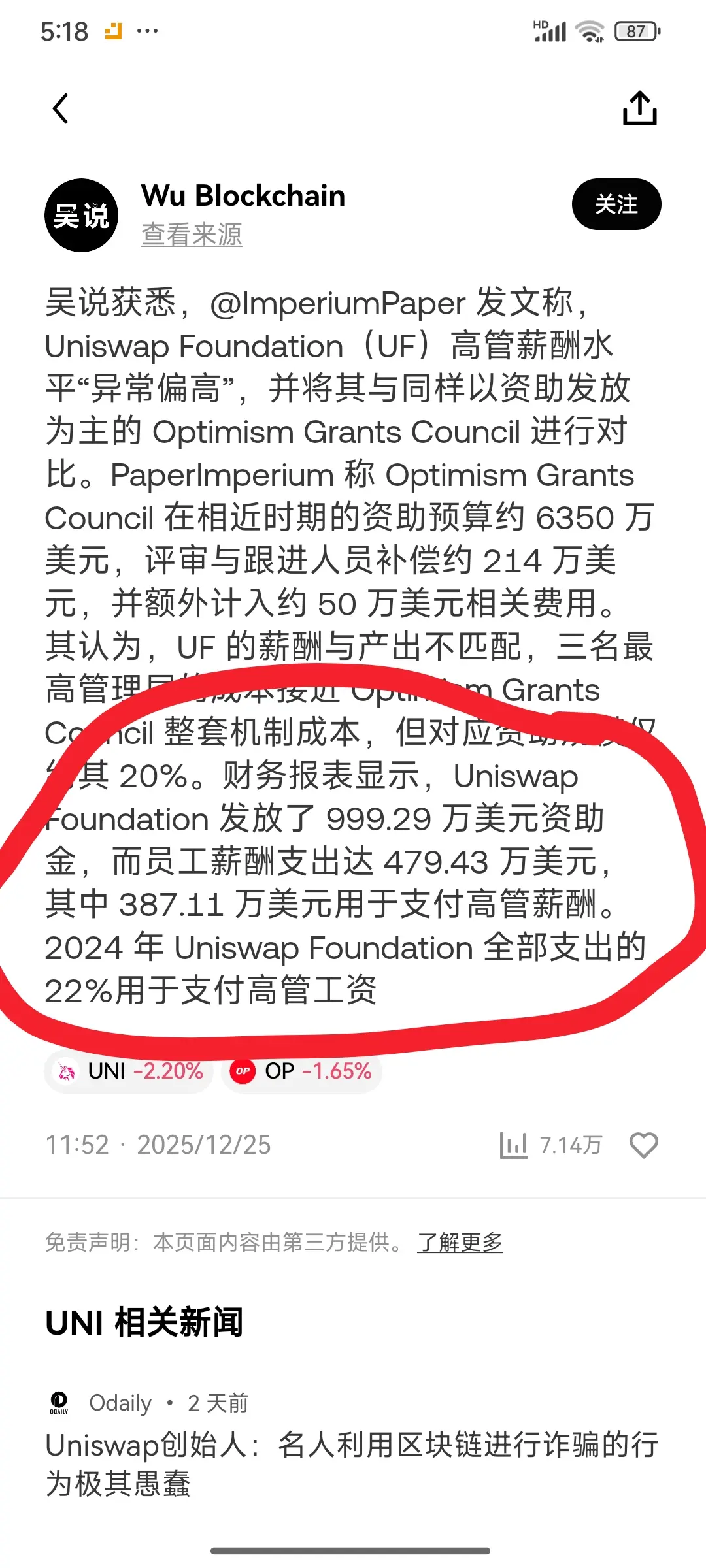

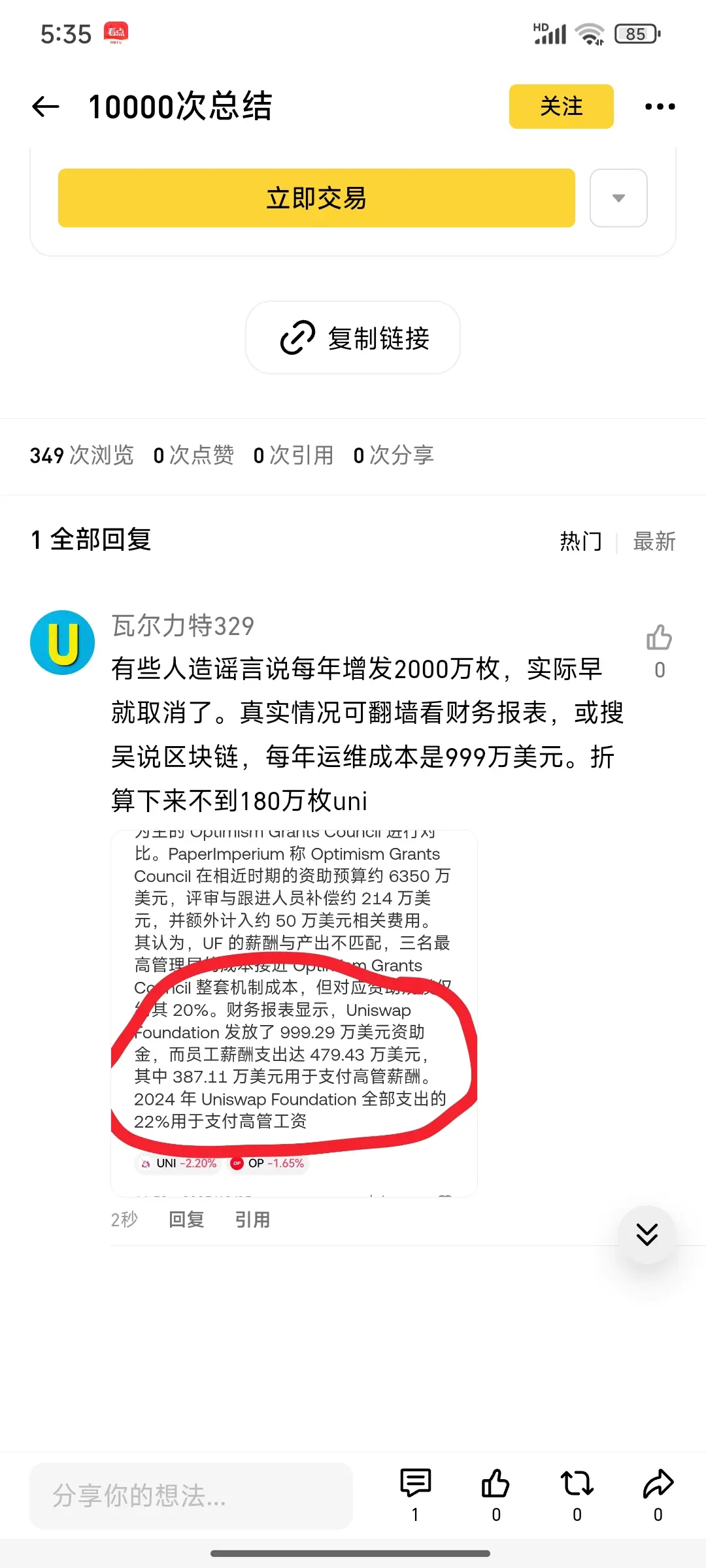

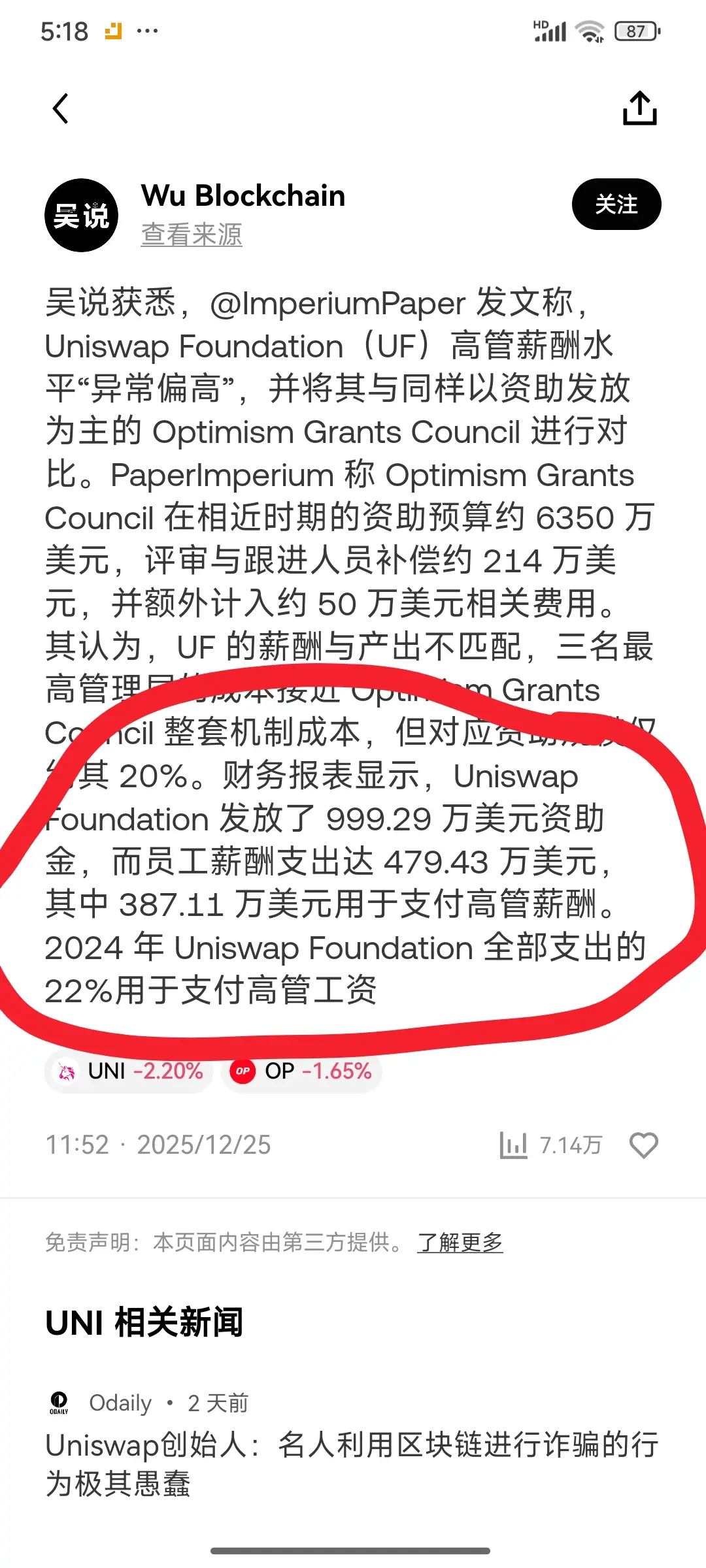

#UNI The recent decline is caused by a widely circulated rumor: an annual issuance or release of 20 million UNI. The actual situation is an annual operating cost of $9.99 million, including executive salaries of $3.87 million. Converted, 1.7 million UNI would be enough to cover it. Thanks to kmb329

UNI0,82%

- Reward

- like

- 1

- Repost

- Share

GateUser-78989d9a :

:

It's not for this reason. When a variety of coins emerge, it's clear that retail investors' power is no longer enough. The major players are also unwilling to pump. There's no longer a bull market for altcoins now.#UNI Don't believe the rumor that "20 million are issued annually for operations and maintenance." The actual amount is $9.99 million per year, including executive salaries. You can view their financial reports by bypassing the firewall or search for the influencer Wu Shuo Blockchain.

UNI0,82%

- Reward

- 2

- 1

- Repost

- Share

HaonanChen :

:

Not bad, first place, haha. That's fine, thank you. Everything the teacher said is correct.- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

kmb329 :

:

The recent decline is caused by a widely circulated rumor: an annual issuance or release of 20 million UNI. The actual situation is an annual operating cost of $9.99 million, including executive salaries of $3.87 million. Converted, 1.7 million UNI would be enough to cover it.What is the 💥 breakout range (BB)?

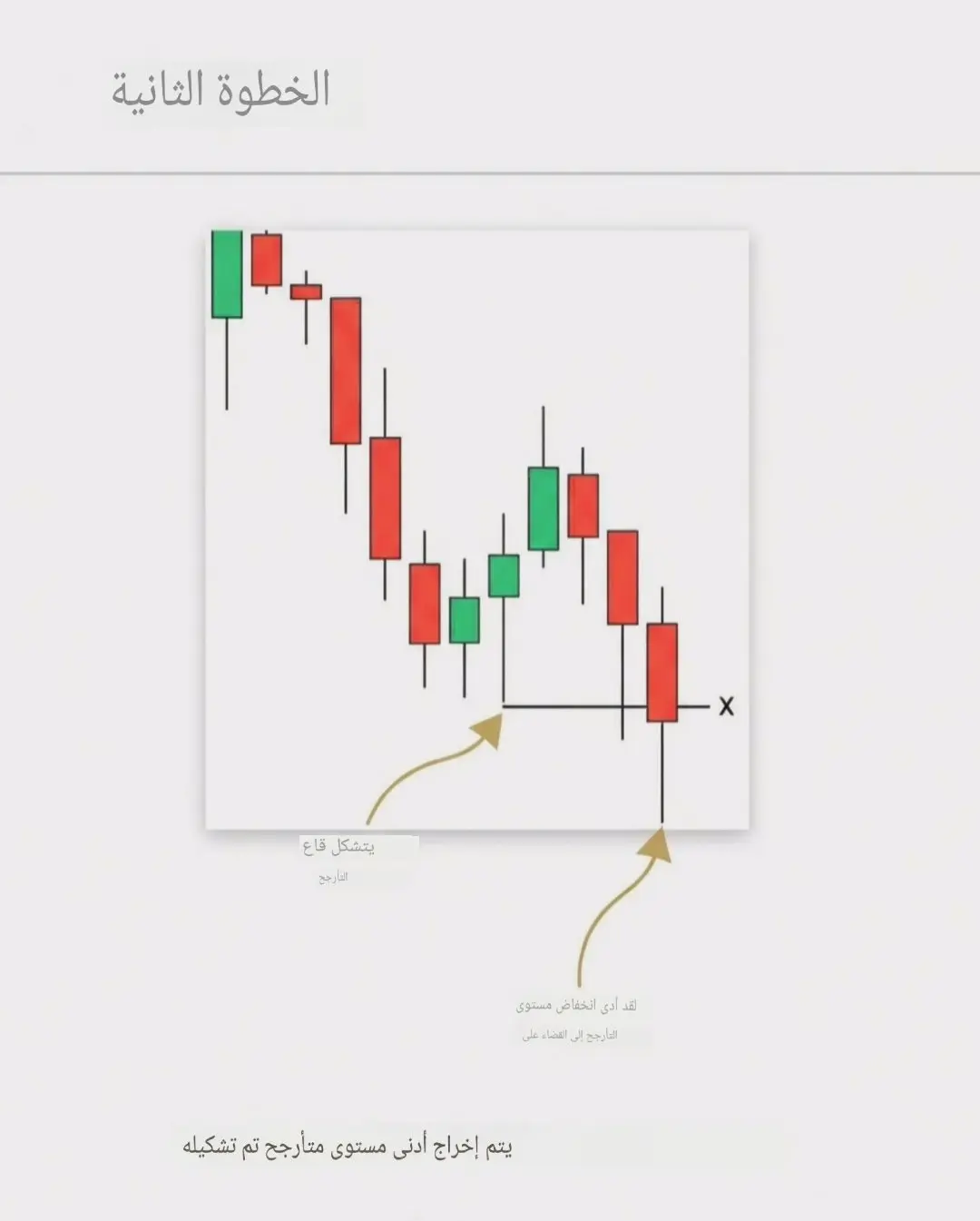

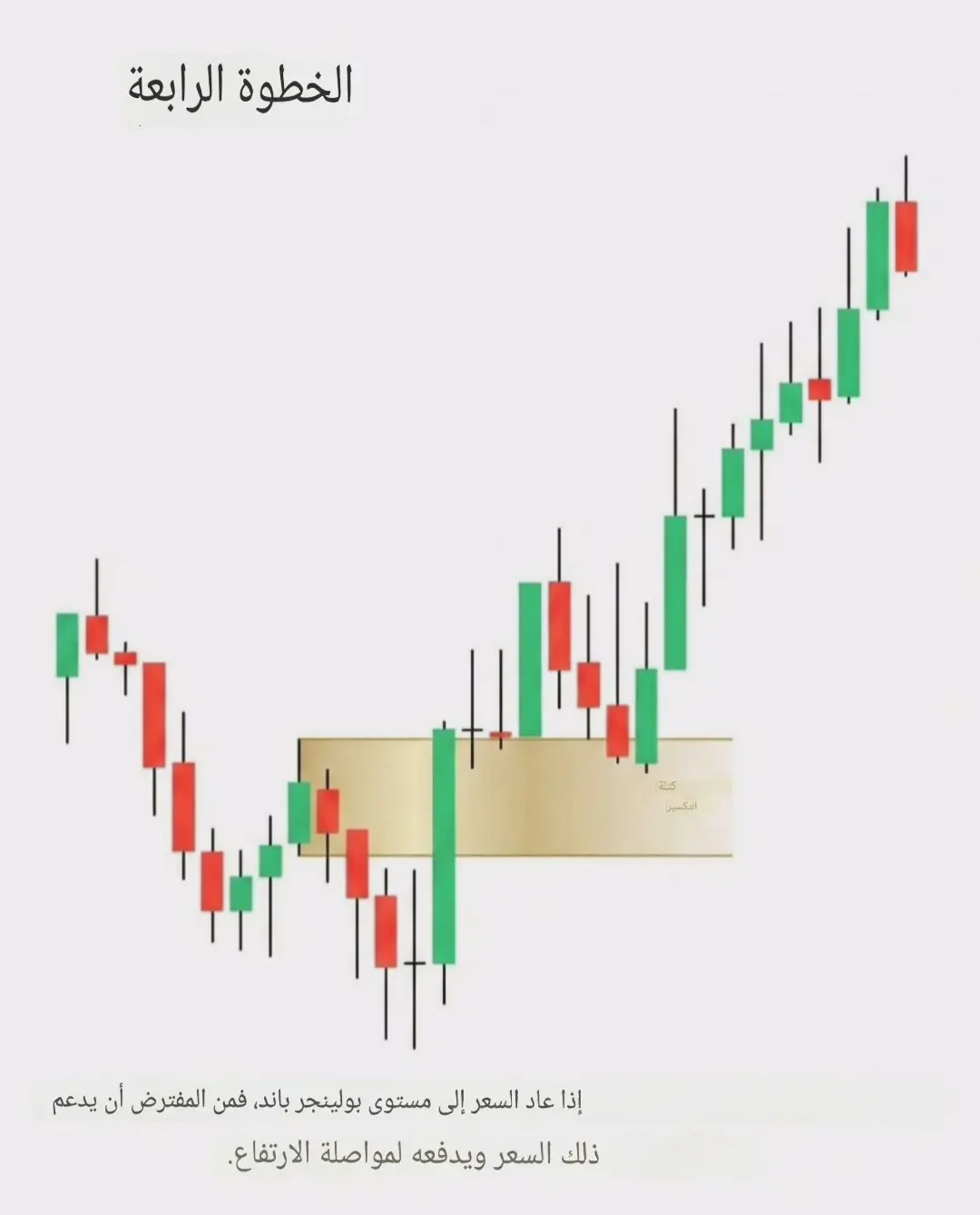

The breakout range is simply a failed order zone that reverses, then later turns into a strong support or resistance area when the price returns to it 📈📉

In short, it is the area where professional investors lost control, then the price broke through it, and when it comes back, the same area reacts strongly again ⚡

Therefore, it can be said:

Breakout ranges act as strong support and resistance zones, and they are among the most reliable PD sets in SMC setups. 🔥

Why is it important? 👇

• Helps identify the points where major traders stumble

• Acts as a hig

View OriginalThe breakout range is simply a failed order zone that reverses, then later turns into a strong support or resistance area when the price returns to it 📈📉

In short, it is the area where professional investors lost control, then the price broke through it, and when it comes back, the same area reacts strongly again ⚡

Therefore, it can be said:

Breakout ranges act as strong support and resistance zones, and they are among the most reliable PD sets in SMC setups. 🔥

Why is it important? 👇

• Helps identify the points where major traders stumble

• Acts as a hig

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

GateUser-75b3db46 :

:

PIJSChain officially announces future open source, with technology empowerment making its value stand out 📈 What is the core competitiveness of PIJS compared to BNB?

Industry experts discuss whether this wave of deployment is worth getting involved in 🤔

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

25.26K Popularity

33.62K Popularity

22.02K Popularity

6.18K Popularity

4.71K Popularity

32.45K Popularity

147.18K Popularity

5.14K Popularity

102.65K Popularity

3.77K Popularity

4.43K Popularity

1.03M Popularity

6.09K Popularity

5.75K Popularity

157.97K Popularity

News

View Moretesticle increased by 104.30% after launching Alpha, current price is 0.017375 USDT

1 m

Data: Hyperliquid platform whales currently hold positions worth $7.454 billion, with a long-short position ratio of 0.97.

29 m

A whale closed its high-position XMR long position at a loss of $896,000.

1 h

Hong Kong-listed company Yingzheng International plans to launch a compliant digital asset exchange in the short term

1 h

A "Pokémon" card shop in New York is robbed at gunpoint, losing $100,000

1 h

Pin