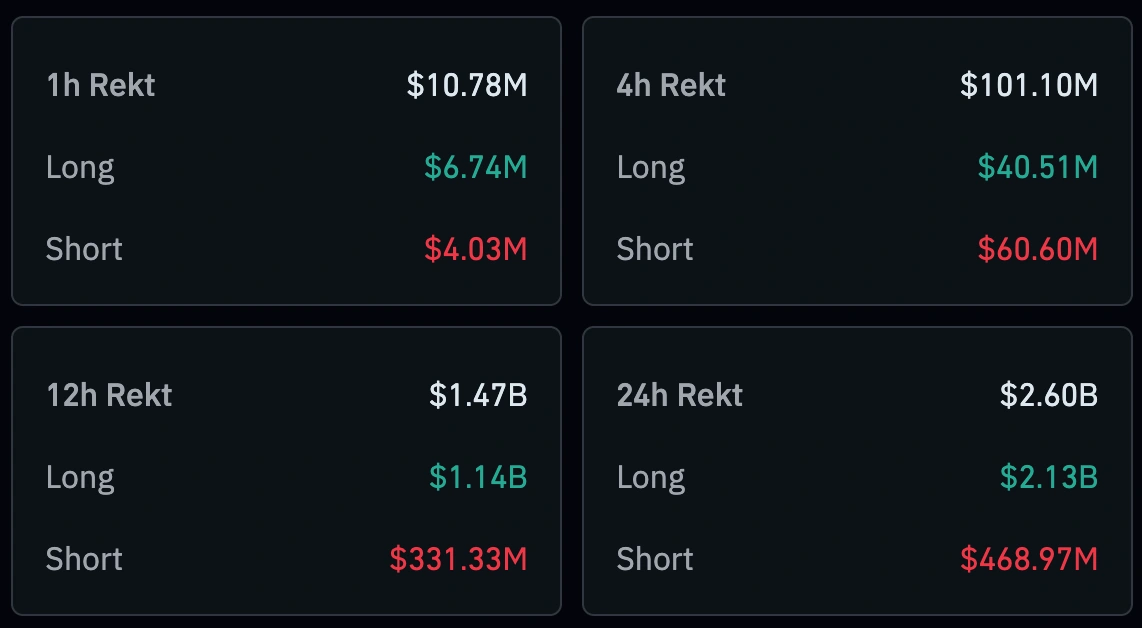

- Các quỹ ETF Bitcoin thu hút dòng chảy mới, trong khi hai đồng tiền Ethereum và XRP ghi nhận dòng chảy rút nhỏ lẻ.

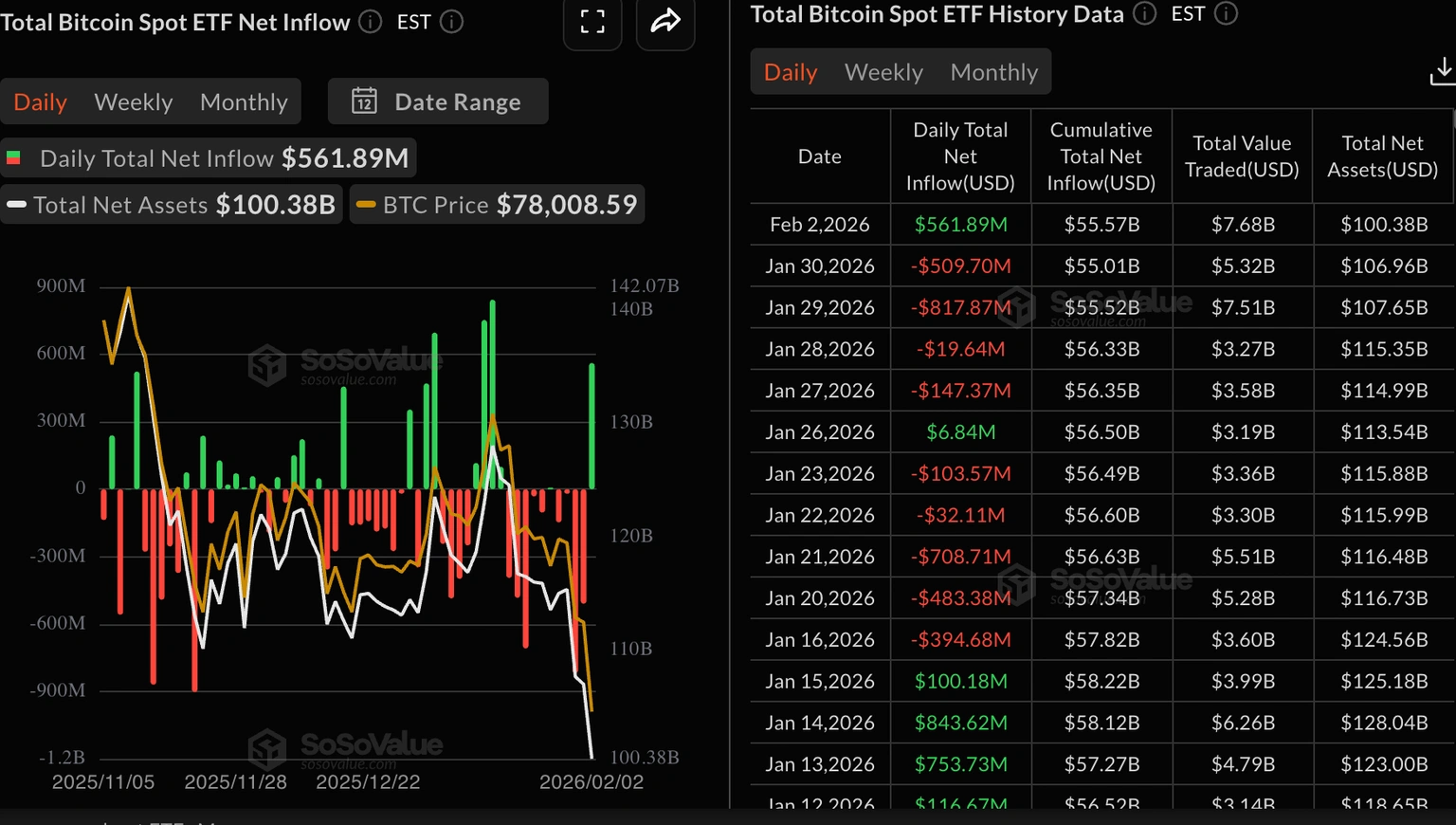

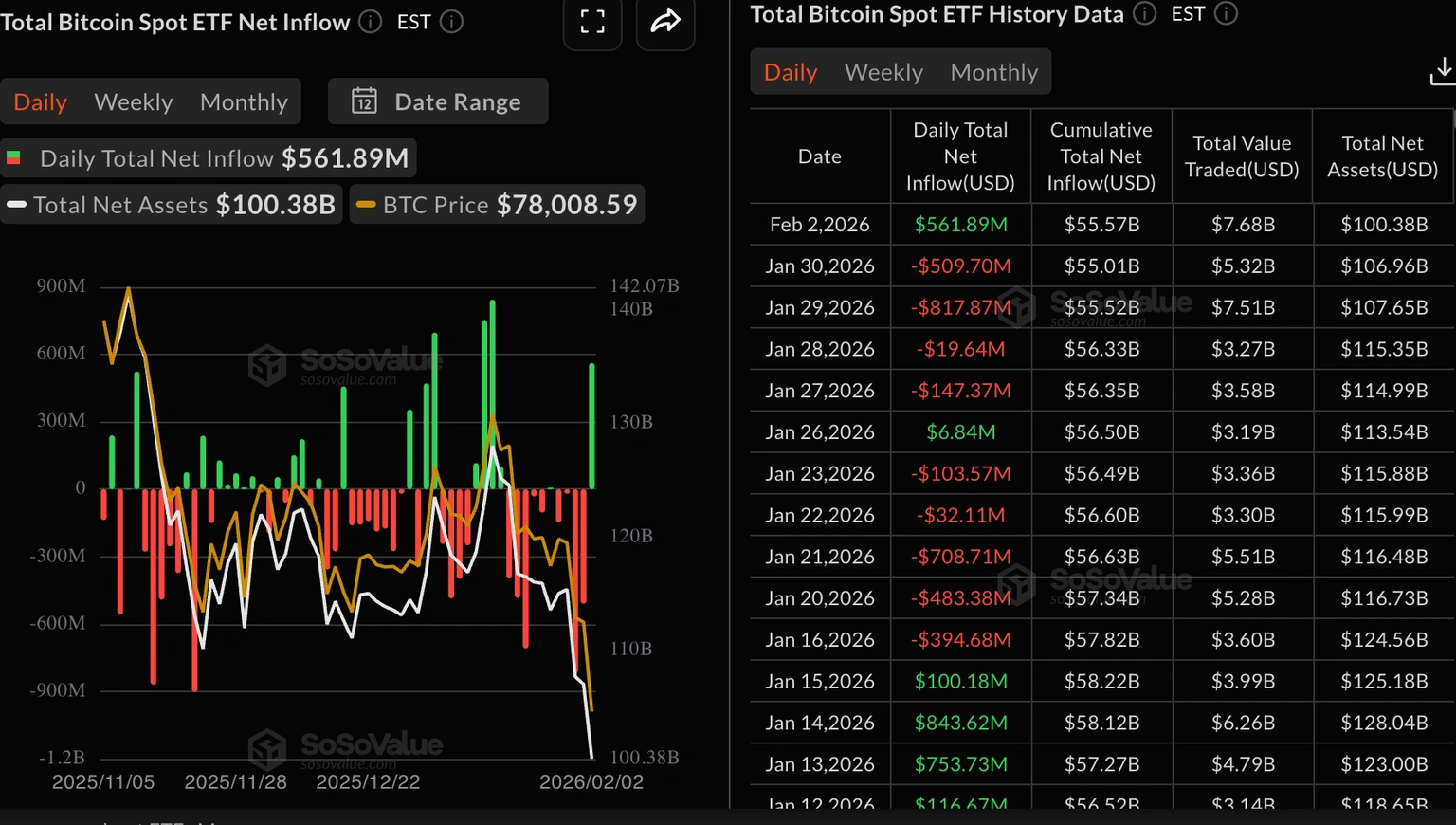

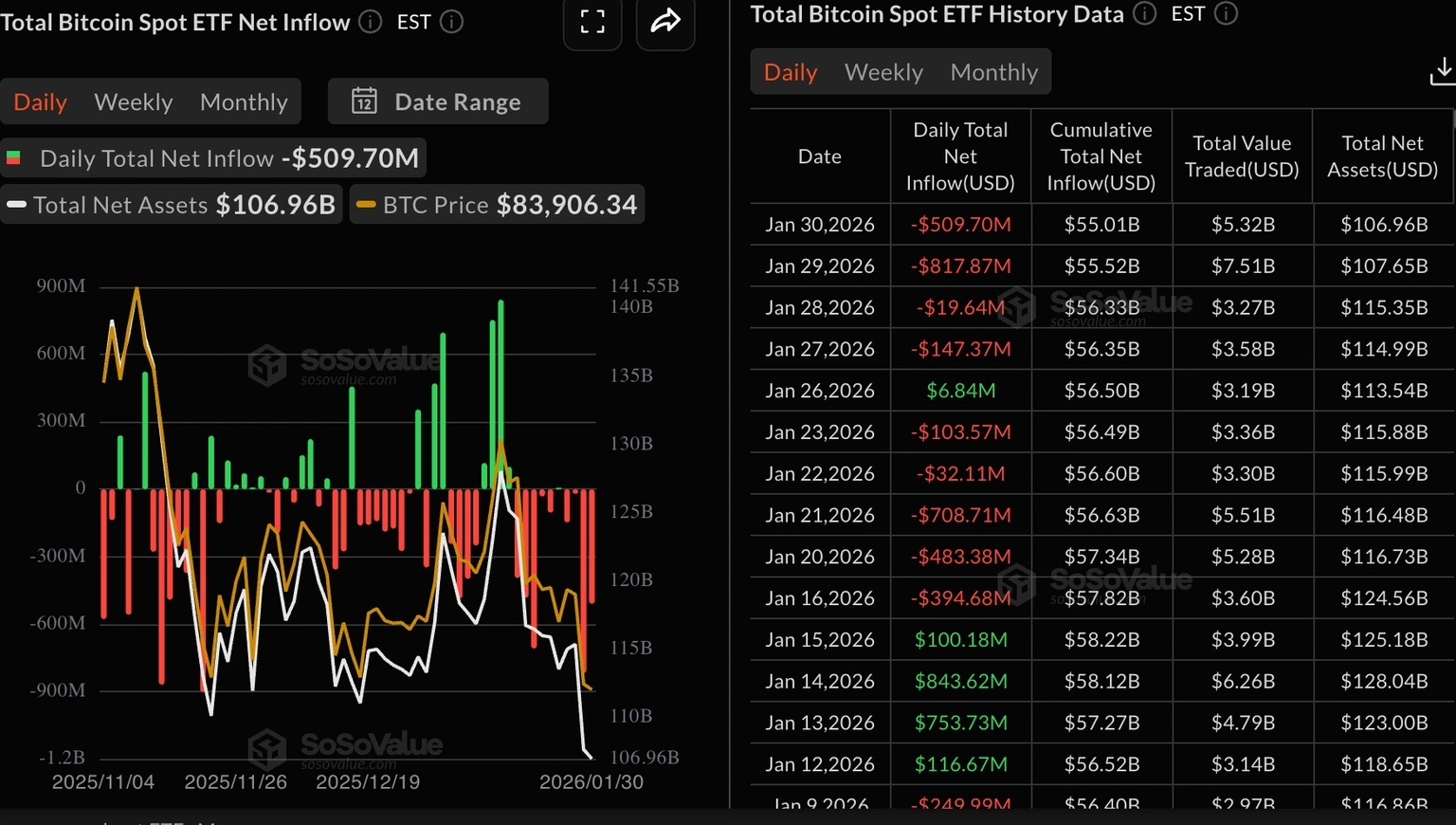

Các quỹ ETF Bitcoin giao ngay niêm yết tại Hoa Kỳ đã ghi nhận dòng tiền khoảng 562 triệu USD vào thứ Hai. Điều này đánh dấu sự trở lại của sự quan tâm của các tổ chức, chấm dứt chuỗi dòng chảy rút kéo dài bốn ngày và khiến giá Bitcoin giảm sút.

Tổng dòng chảy tiền vào hiện tại là 55.57 tỷ USD, trong khi giá trị tài sản quản lý là 100.38 tỷ USD. Dòng chảy tiền ổn định vào các quỹ ETF theo chỉ số cho thấy tâm lý tích cực trên thị trường, có thể góp phần hỗ trợ sự phục hồi của Bitcoin.

Dòng chảy quỹ ETF Bitcoin | Nguồn: SoSoValue

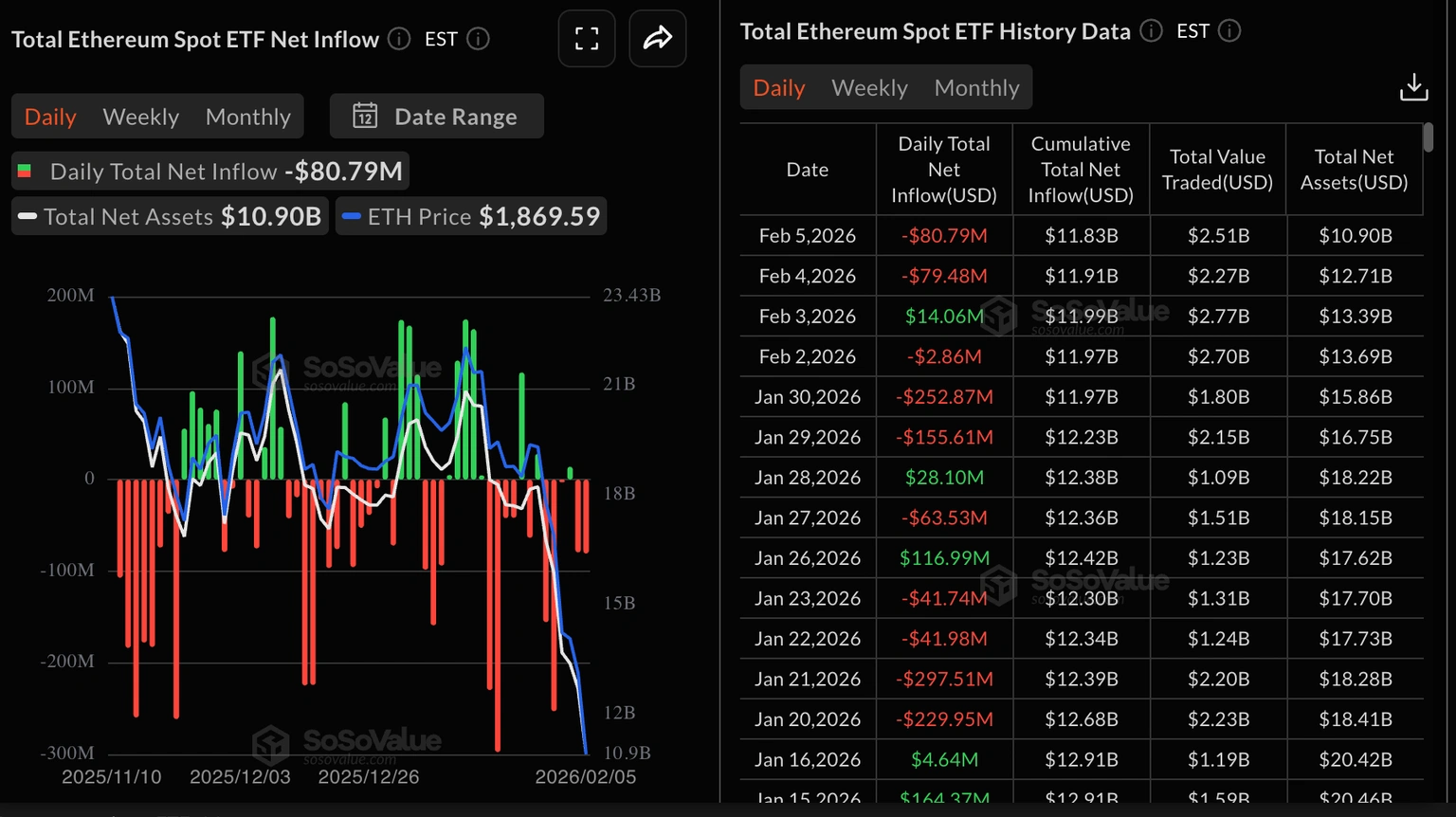

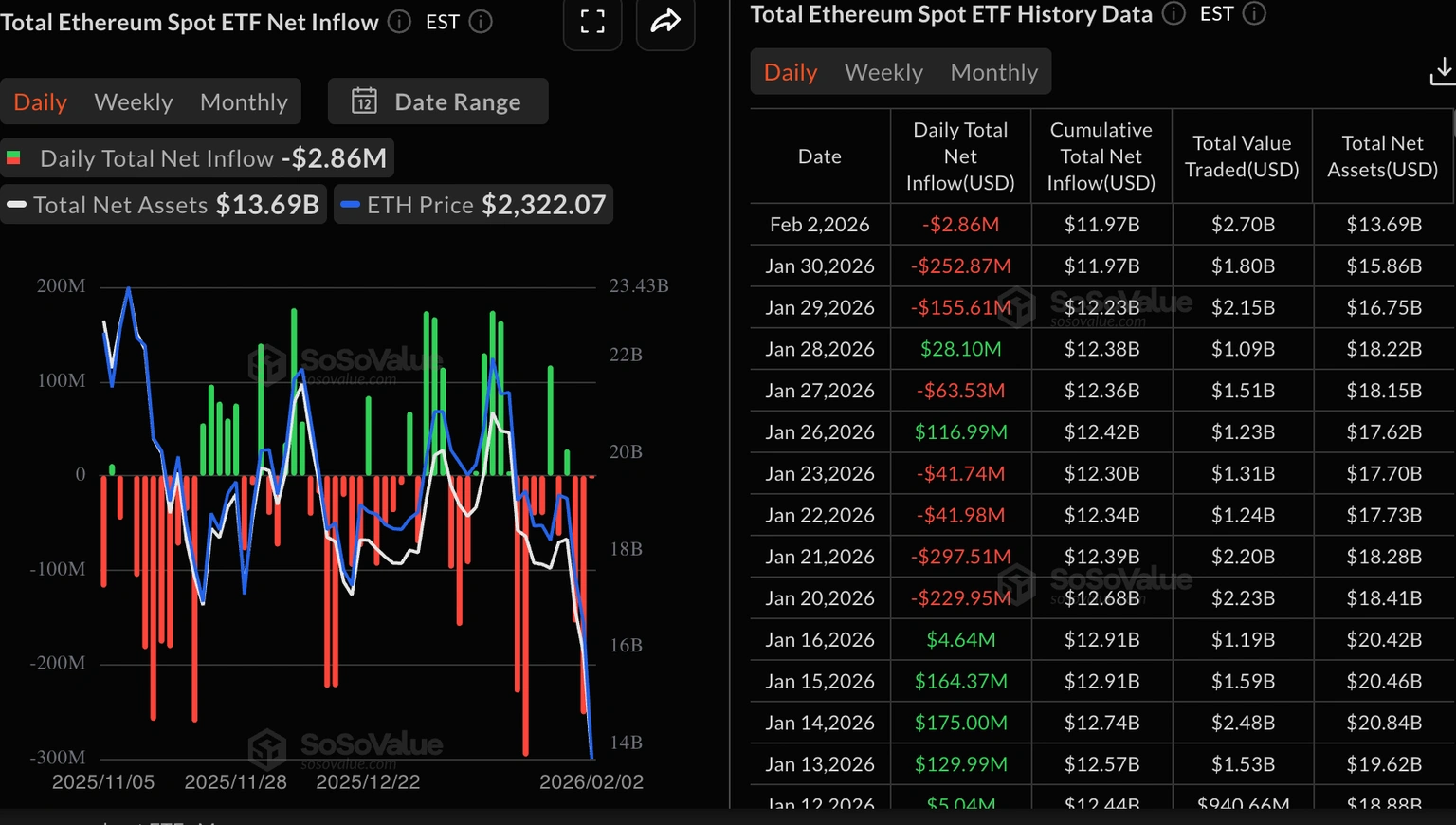

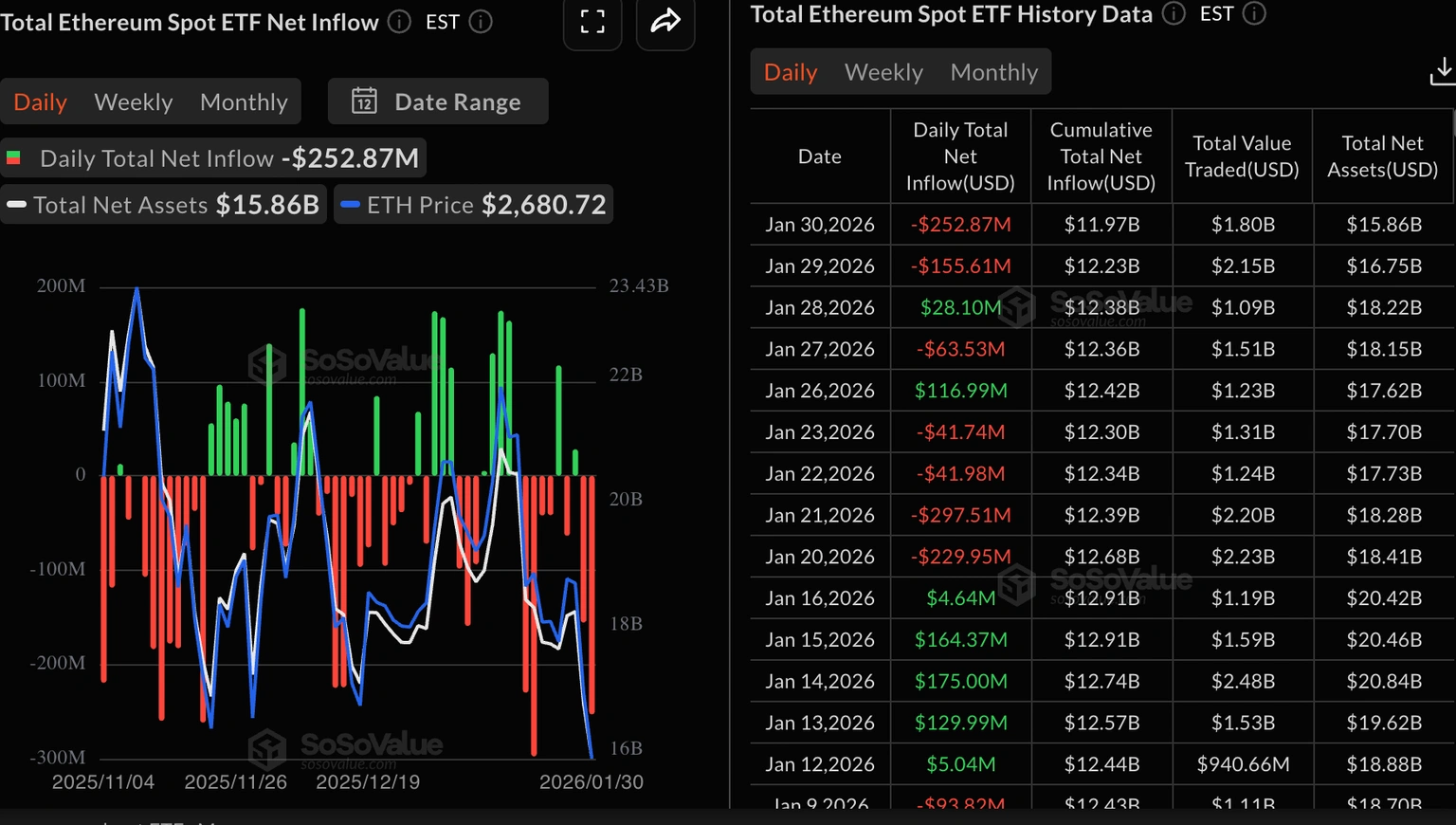

Trong khi đó, các quỹ ETF Ethereum giao ngay tiếp tục đợt rút vốn thứ ba liên tiếp, khi nhà đầu tư rút khoảng 3 triệu USD vào thứ Hai. Tổng dòng chảy vào hiện tại là 11.97 tỷ USD, với trung bình tài sản ròng là 13.69 tỷ USD. Việc dòng vốn rút ra tiếp tục có thể làm giảm tâm lý, làm chậm đà phục hồi.

Dòng chảy quỹ ETF Ethereum | Nguồn: SoSoValue

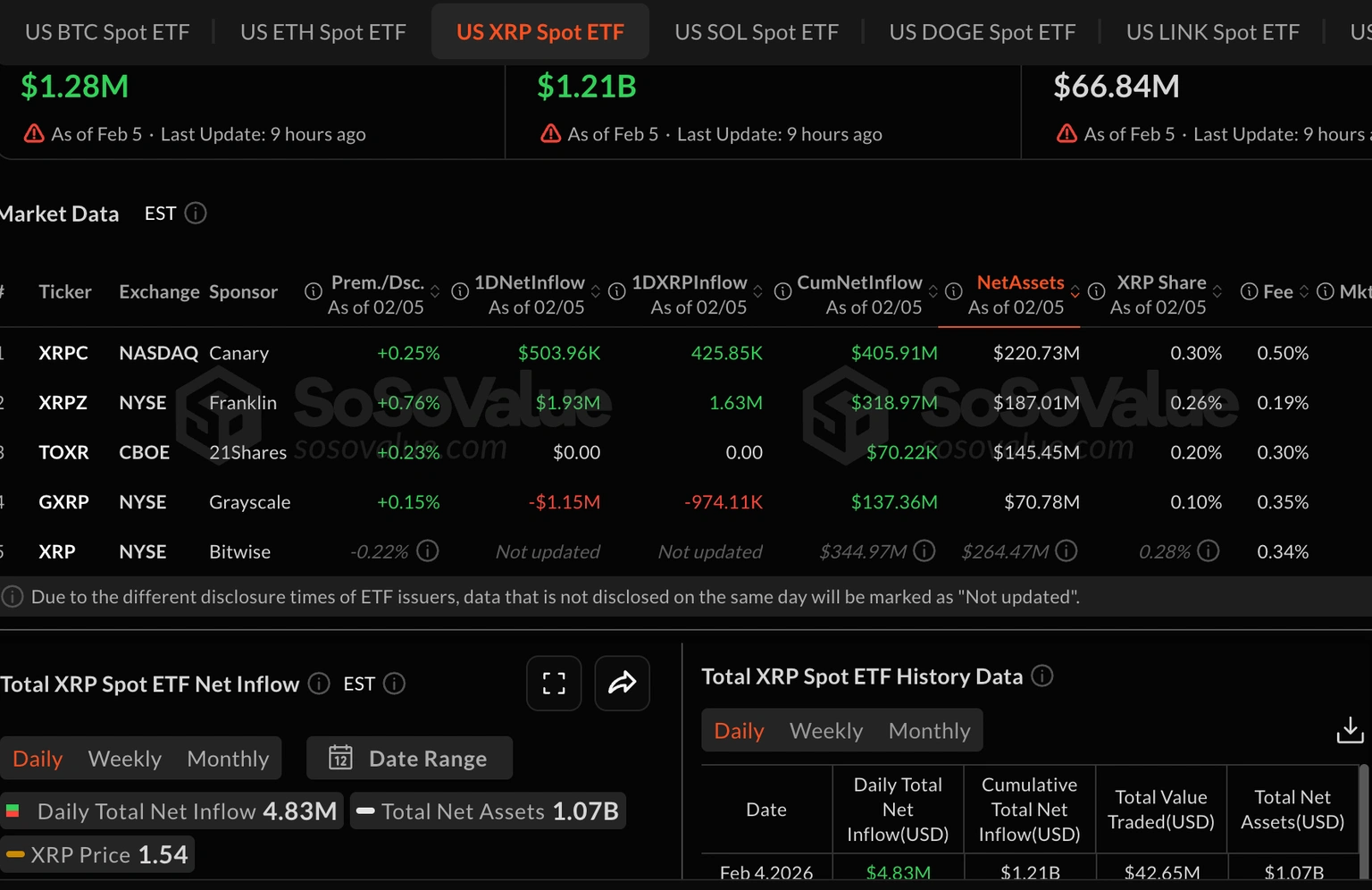

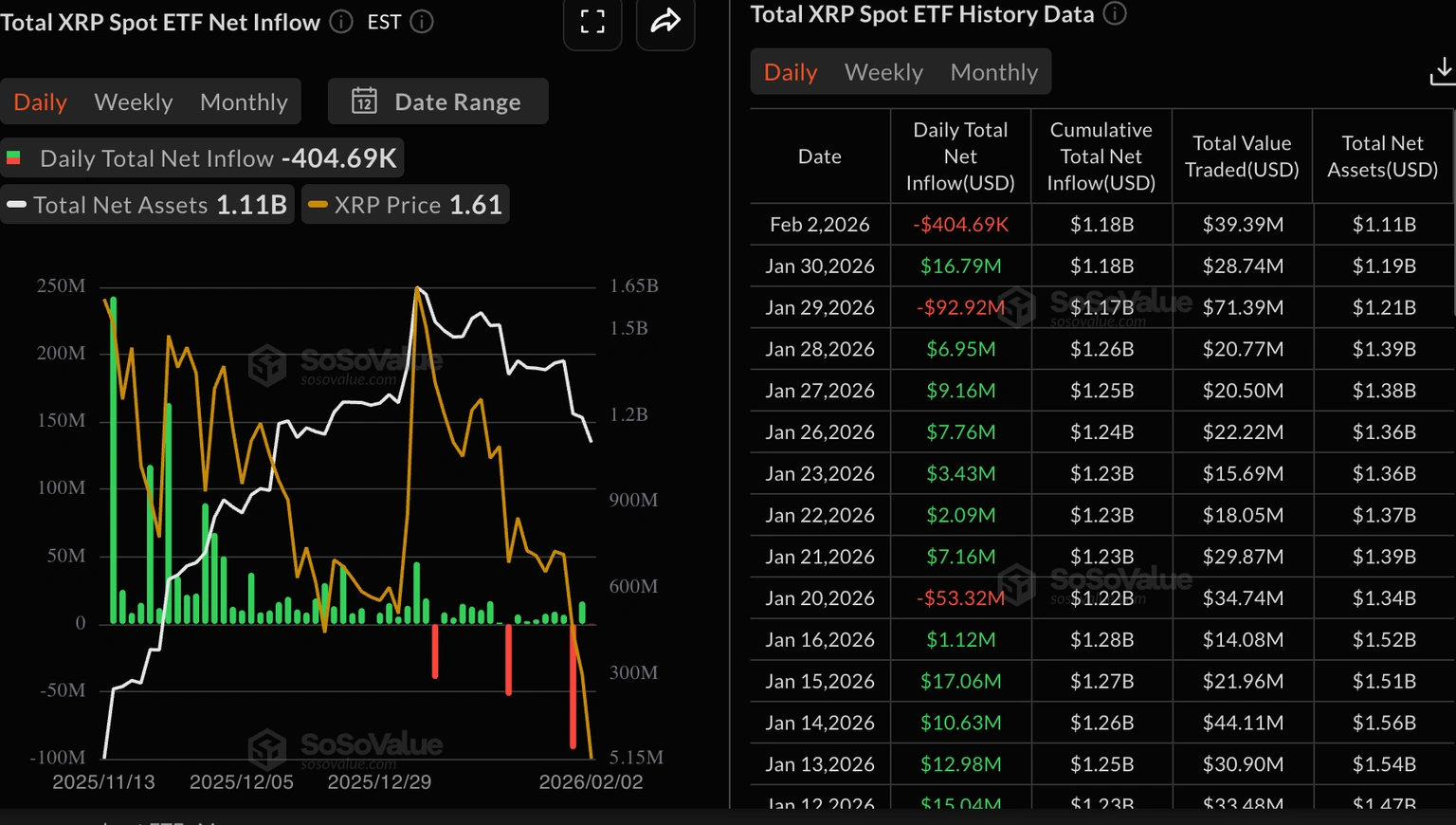

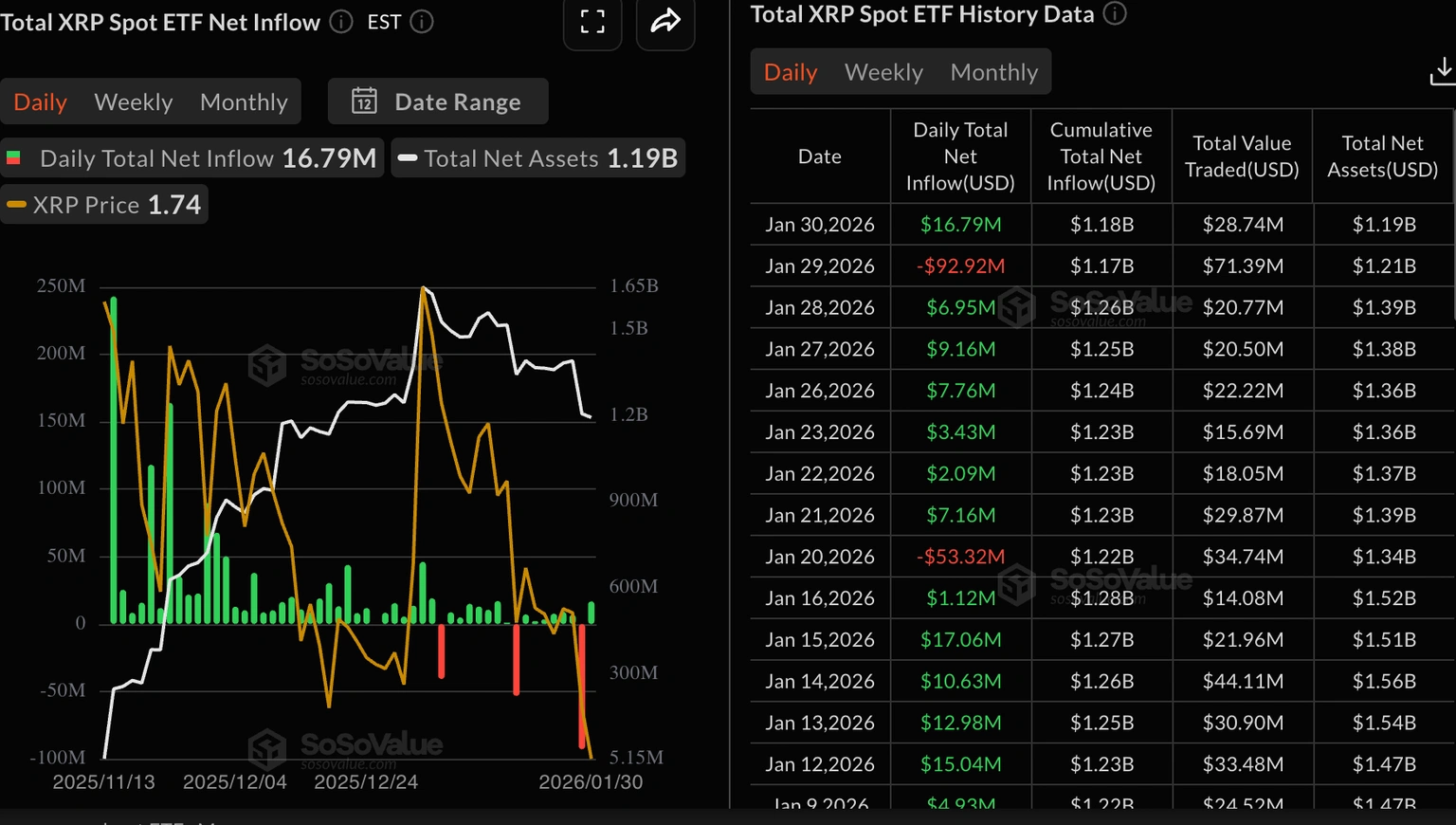

Trong khi đó, các quỹ ETF XRP ghi nhận dòng chảy rút nhỏ khoảng 405,000 USD vào thứ Hai, sau khi ghi nhận dòng chảy vào lớn khoảng 17 triệu USD vào thứ Sáu. Tổng giá trị các quỹ ETF XRP là 1.18 tỷ USD, trong khi tài sản ròng quản lý là 1.11 tỷ USD, theo dữ liệu của SoSoValue.

Dòng chảy quỹ ETF XRP | Nguồn: SoSoValue

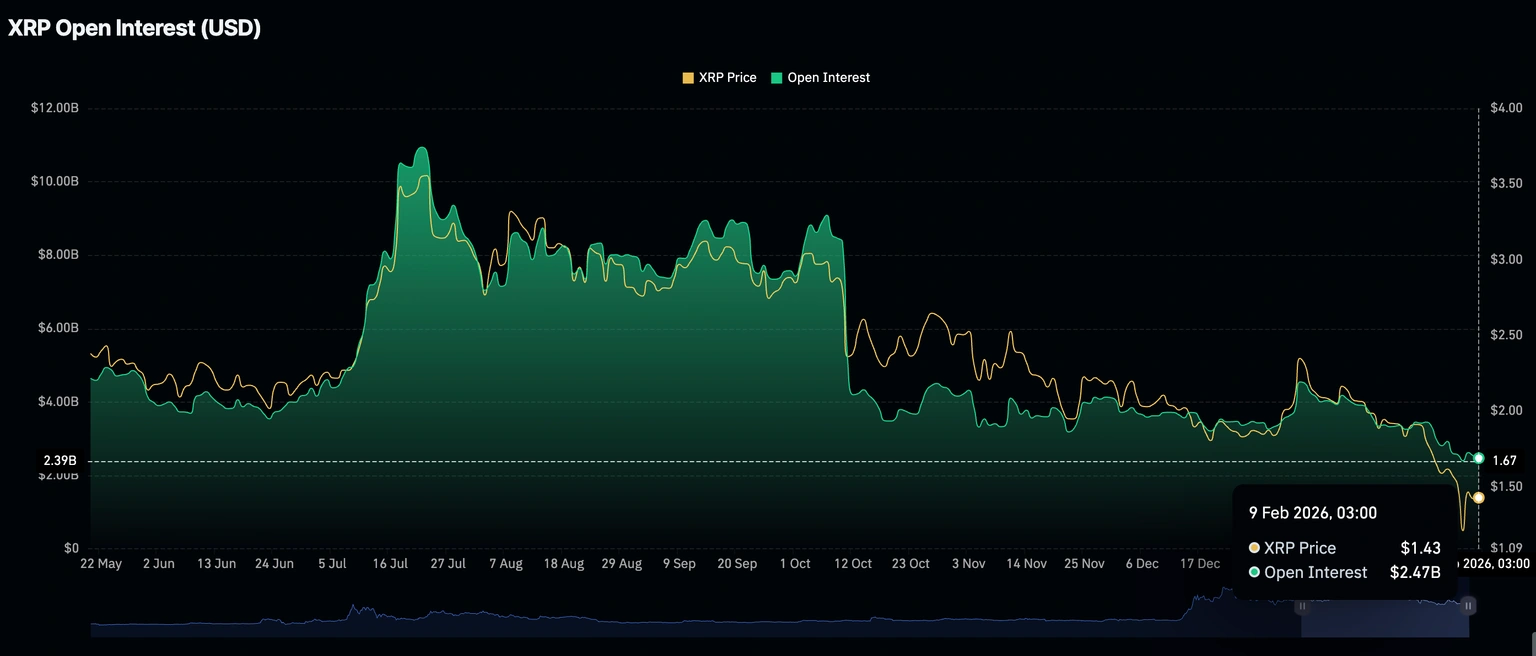

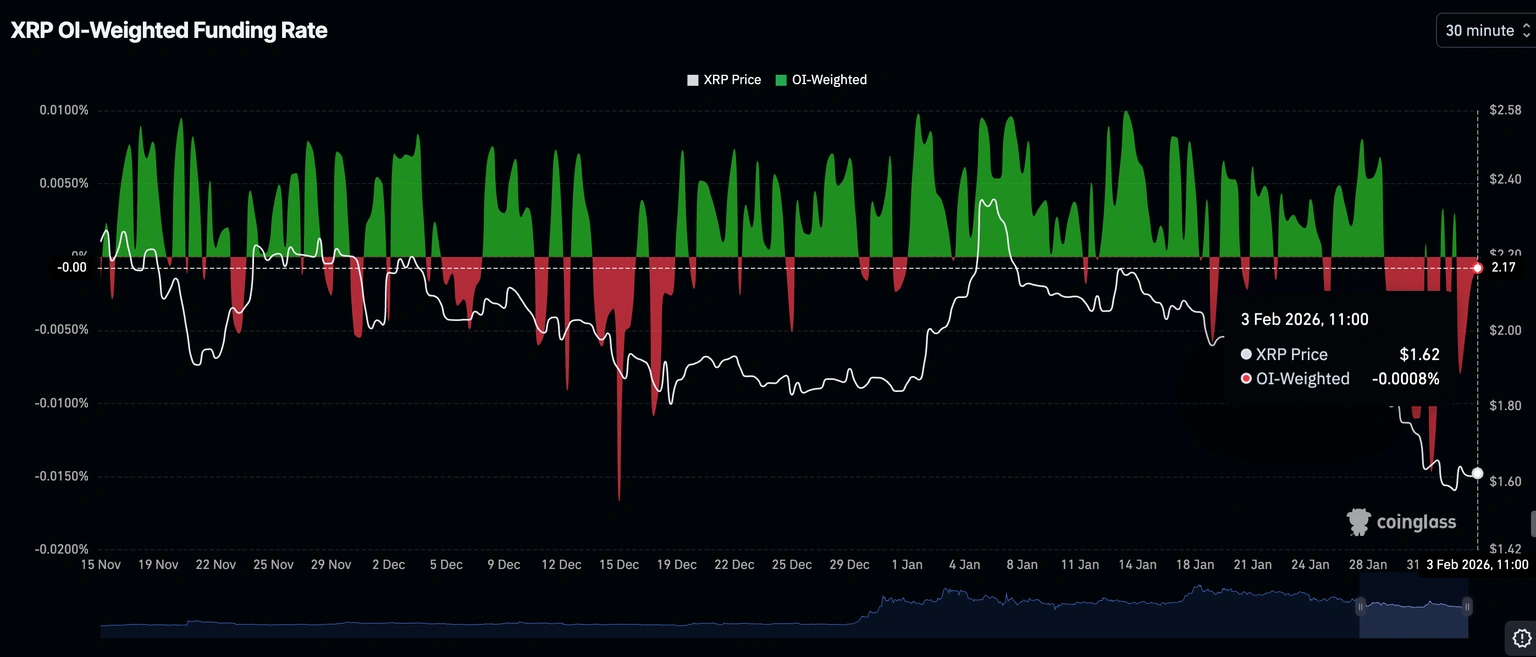

Thị trường bán lẻ vẫn còn thận trọng, các nhà giao dịch ưu tiên đóng vị thế hơn là mở vị thế mới. Dữ liệu của CoinGlass cho thấy tỷ lệ tài trợ theo lãi suất mở của XRP vẫn âm ở -0.0008% vào thứ Ba, tăng từ -0.0080% của ngày trước đó.

Để XRP duy trì xu hướng tăng, tỷ lệ tài trợ cần ổn định ở khu vực dương và tiếp tục tăng, điều này cho thấy sự quan tâm ổn định từ các nhà đầu tư cá nhân.

Tỷ lệ tài trợ XRP theo lãi suất mở | Nguồn: CoinGlass

Các quỹ ETF Bitcoin giao ngay niêm yết tại Hoa Kỳ đã ghi nhận dòng tiền khoảng 562 triệu USD vào thứ Hai. Điều này đánh dấu sự trở lại của sự quan tâm của các tổ chức, chấm dứt chuỗi dòng chảy rút kéo dài bốn ngày và khiến giá Bitcoin giảm sút.

Tổng dòng chảy tiền vào hiện tại là 55.57 tỷ USD, trong khi giá trị tài sản quản lý là 100.38 tỷ USD. Dòng chảy tiền ổn định vào các quỹ ETF theo chỉ số cho thấy tâm lý tích cực trên thị trường, có thể góp phần hỗ trợ sự phục hồi của Bitcoin.

Dòng chảy quỹ ETF Bitcoin | Nguồn: SoSoValue

Trong khi đó, các quỹ ETF Ethereum giao ngay tiếp tục đợt rút vốn thứ ba liên tiếp, khi nhà đầu tư rút khoảng 3 triệu USD vào thứ Hai. Tổng dòng chảy vào hiện tại là 11.97 tỷ USD, với trung bình tài sản ròng là 13.69 tỷ USD. Việc dòng vốn rút ra tiếp tục có thể làm giảm tâm lý, làm chậm đà phục hồi.

Dòng chảy quỹ ETF Ethereum | Nguồn: SoSoValue

Trong khi đó, các quỹ ETF XRP ghi nhận dòng chảy rút nhỏ khoảng 405,000 USD vào thứ Hai, sau khi ghi nhận dòng chảy vào lớn khoảng 17 triệu USD vào thứ Sáu. Tổng giá trị các quỹ ETF XRP là 1.18 tỷ USD, trong khi tài sản ròng quản lý là 1.11 tỷ USD, theo dữ liệu của SoSoValue.

Dòng chảy quỹ ETF XRP | Nguồn: SoSoValue

Thị trường bán lẻ vẫn còn thận trọng, các nhà giao dịch ưu tiên đóng vị thế hơn là mở vị thế mới. Dữ liệu của CoinGlass cho thấy tỷ lệ tài trợ theo lãi suất mở của XRP vẫn âm ở -0.0008% vào thứ Ba, tăng từ -0.0080% của ngày trước đó.

Để XRP duy trì xu hướng tăng, tỷ lệ tài trợ cần ổn định ở khu vực dương và tiếp tục tăng, điều này cho thấy sự quan tâm ổn định từ các nhà đầu tư cá nhân.

Tỷ lệ tài trợ XRP theo lãi suất mở | Nguồn: CoinGlass