#WaitOrAct

Should You Trade Bitcoin Now or Wait?

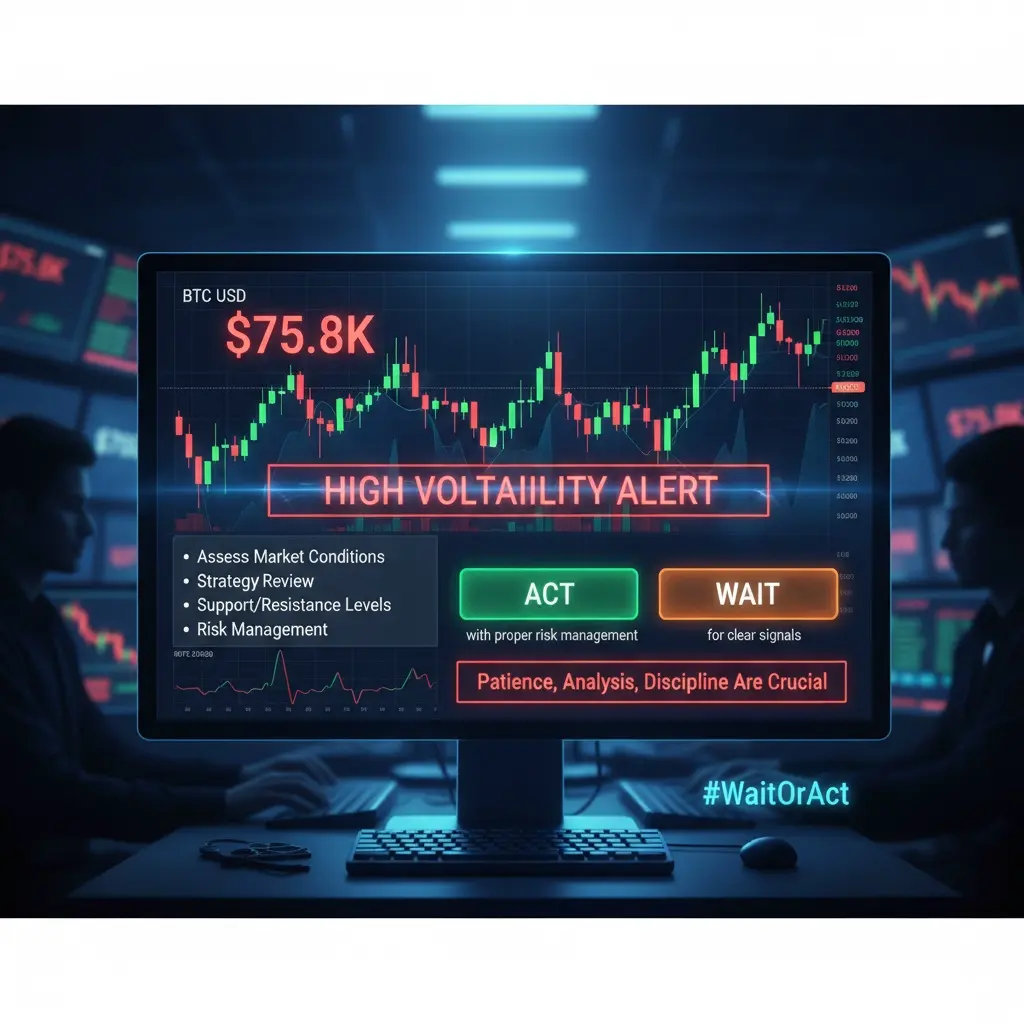

Bitcoin (BTC) is currently around $75,800 USDT, showing a corrective phase with high volatility and uncertainty. Many traders are wondering: “Should I act now or wait?”

1. Understand the Current Market Situation

Before making any trade, you need to know what the market is doing:

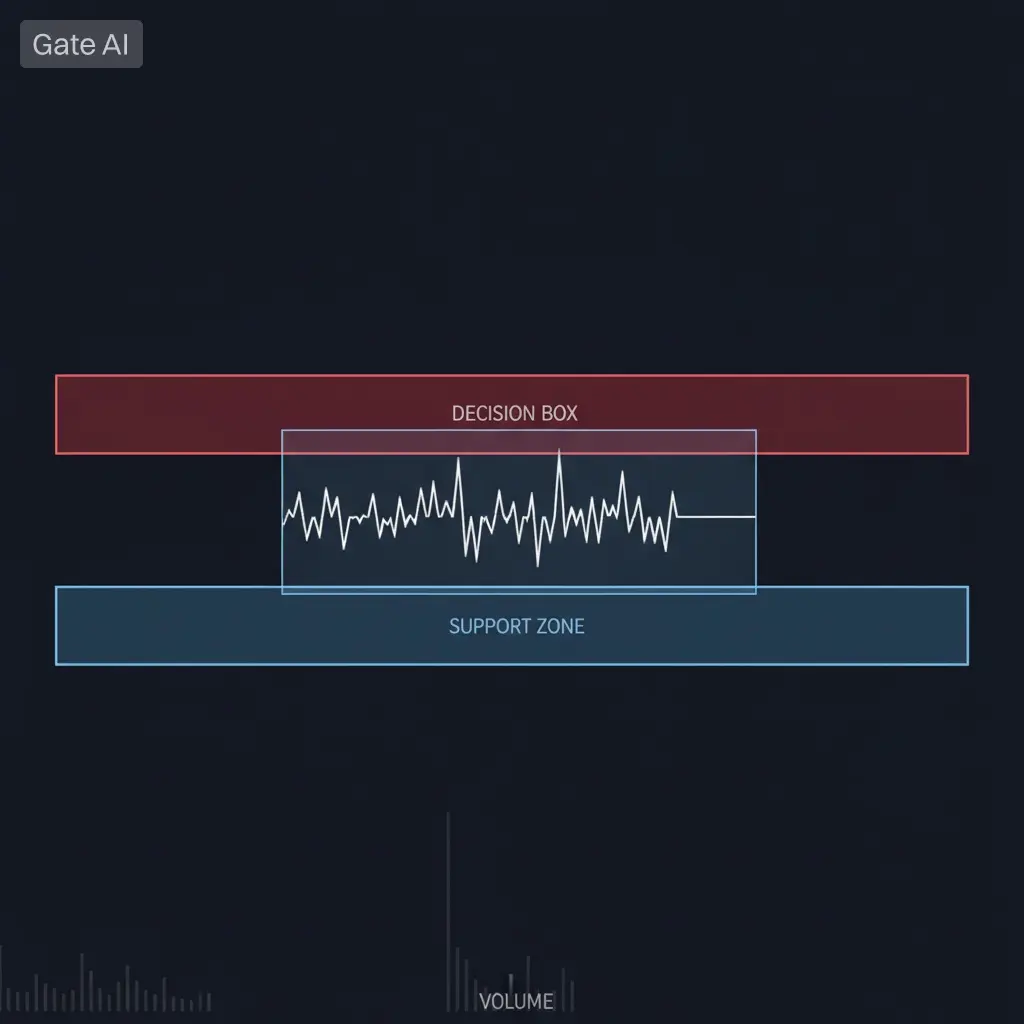

BTC is testing key support levels around $75,000–$76,000, which could act as a safety zone.

The market is volatile, meaning prices can swing up or down quickly.

Sentiment is cautious; many traders and institutions are hesitant to take big positions right now.

This means entering a trade without clear signals is risky. Sometimes the best action is to observe.

2. Align Your Trading Style

Your personal strategy matters:

Scalpers: Focus on small, short-term price moves and can act if intraday signals look favorable.

Swing Traders: Usually wait for trend confirmations or clear bounce signals from support or resistance.

Position Traders: Often wait for larger market trends or macroeconomic signals, like Fed announcements, before making big moves.

Trading without following your style can lead to stress and mistakes.

3. Analyze Key Levels and Indicators

Use technical tools to make better decisions:

Identify support and resistance zones to know where the price might bounce or reverse.

Watch momentum indicators like RSI or moving averages to see if BTC is oversold or overbought.

Consider fundamental triggers, like regulatory news or institutional inflows, which can move BTC suddenly.

4. Risk Management Is Essential

Never risk money you cannot afford to lose. For BTC:

Set stop-loss levels to limit potential losses.

Decide on position size based on your risk tolerance.

Have take-profit targets to lock in gains when opportunities arise.

Risk management is what separates consistent traders from emotional gamblers.

5. Psychological Readiness

Trading is as much mental as it is technical:

Are you ready to handle a losing trade without panic?

Can you stick to your plan without overreacting to sudden price moves?

Patience is often more profitable than impulsive action, especially in volatile markets like BTC.

6. Timing: When to Wait and When to Act

Waiting: Often the smarter choice if BTC is unstable or support is being tested. This avoids unnecessary losses.

Acting: Can be considered if your analysis, signals, and risk management align—for example, if BTC bounces strongly off a key support level and your stop-loss is defined.

Conclusion

Deciding whether to trade BTC now or wait is not about luck—it’s about strategy. Observing the market, following your trading style, managing risk, and maintaining the right mindset are key.

Patience plus preparation beats impulsive moves.

Should You Trade Bitcoin Now or Wait?

Bitcoin (BTC) is currently around $75,800 USDT, showing a corrective phase with high volatility and uncertainty. Many traders are wondering: “Should I act now or wait?”

1. Understand the Current Market Situation

Before making any trade, you need to know what the market is doing:

BTC is testing key support levels around $75,000–$76,000, which could act as a safety zone.

The market is volatile, meaning prices can swing up or down quickly.

Sentiment is cautious; many traders and institutions are hesitant to take big positions right now.

This means entering a trade without clear signals is risky. Sometimes the best action is to observe.

2. Align Your Trading Style

Your personal strategy matters:

Scalpers: Focus on small, short-term price moves and can act if intraday signals look favorable.

Swing Traders: Usually wait for trend confirmations or clear bounce signals from support or resistance.

Position Traders: Often wait for larger market trends or macroeconomic signals, like Fed announcements, before making big moves.

Trading without following your style can lead to stress and mistakes.

3. Analyze Key Levels and Indicators

Use technical tools to make better decisions:

Identify support and resistance zones to know where the price might bounce or reverse.

Watch momentum indicators like RSI or moving averages to see if BTC is oversold or overbought.

Consider fundamental triggers, like regulatory news or institutional inflows, which can move BTC suddenly.

4. Risk Management Is Essential

Never risk money you cannot afford to lose. For BTC:

Set stop-loss levels to limit potential losses.

Decide on position size based on your risk tolerance.

Have take-profit targets to lock in gains when opportunities arise.

Risk management is what separates consistent traders from emotional gamblers.

5. Psychological Readiness

Trading is as much mental as it is technical:

Are you ready to handle a losing trade without panic?

Can you stick to your plan without overreacting to sudden price moves?

Patience is often more profitable than impulsive action, especially in volatile markets like BTC.

6. Timing: When to Wait and When to Act

Waiting: Often the smarter choice if BTC is unstable or support is being tested. This avoids unnecessary losses.

Acting: Can be considered if your analysis, signals, and risk management align—for example, if BTC bounces strongly off a key support level and your stop-loss is defined.

Conclusion

Deciding whether to trade BTC now or wait is not about luck—it’s about strategy. Observing the market, following your trading style, managing risk, and maintaining the right mindset are key.

Patience plus preparation beats impulsive moves.