# CapitalRotation

2.19K

Trading patterns are shifting during the pullback. Where do you see capital leaning right now?

EagleEye

#CapitalRotation

Where is Capital Flowing?

Understanding the Current Rotation Amid Market Pullbacks

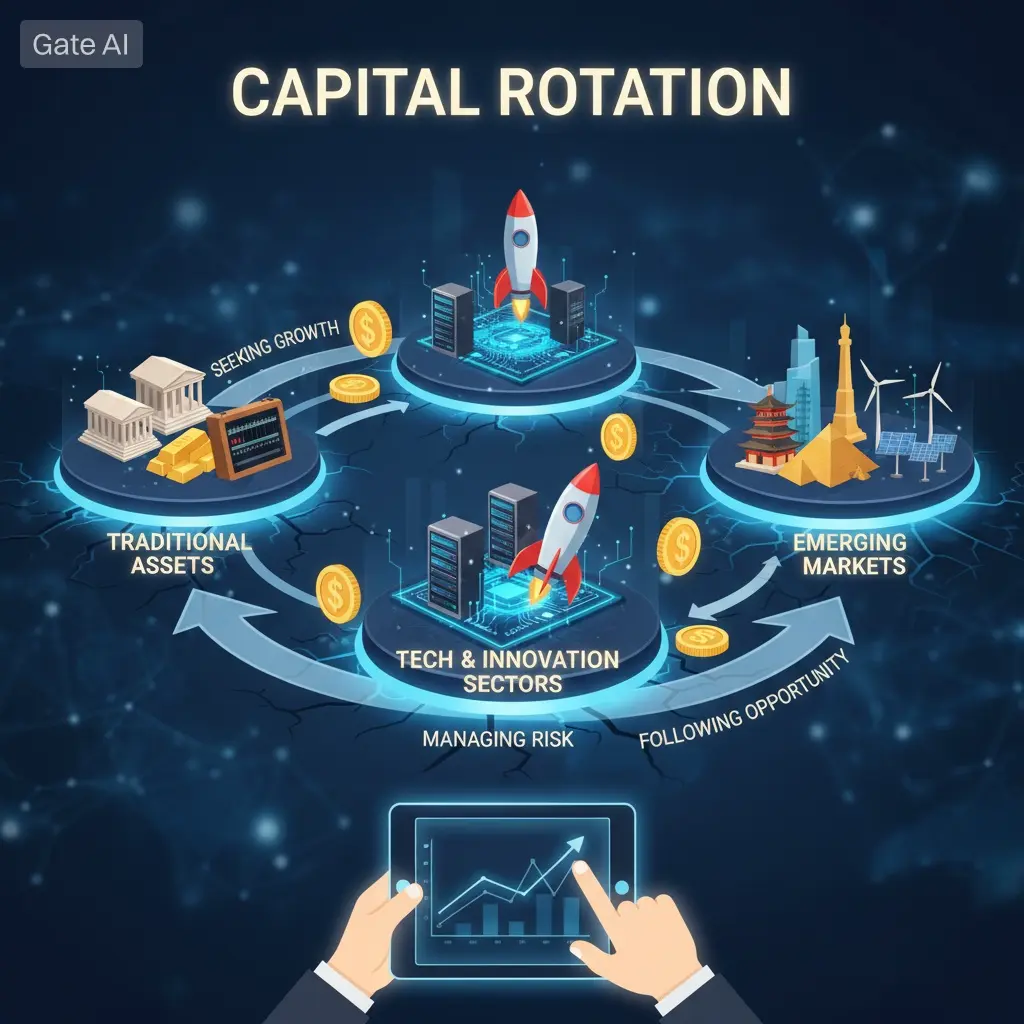

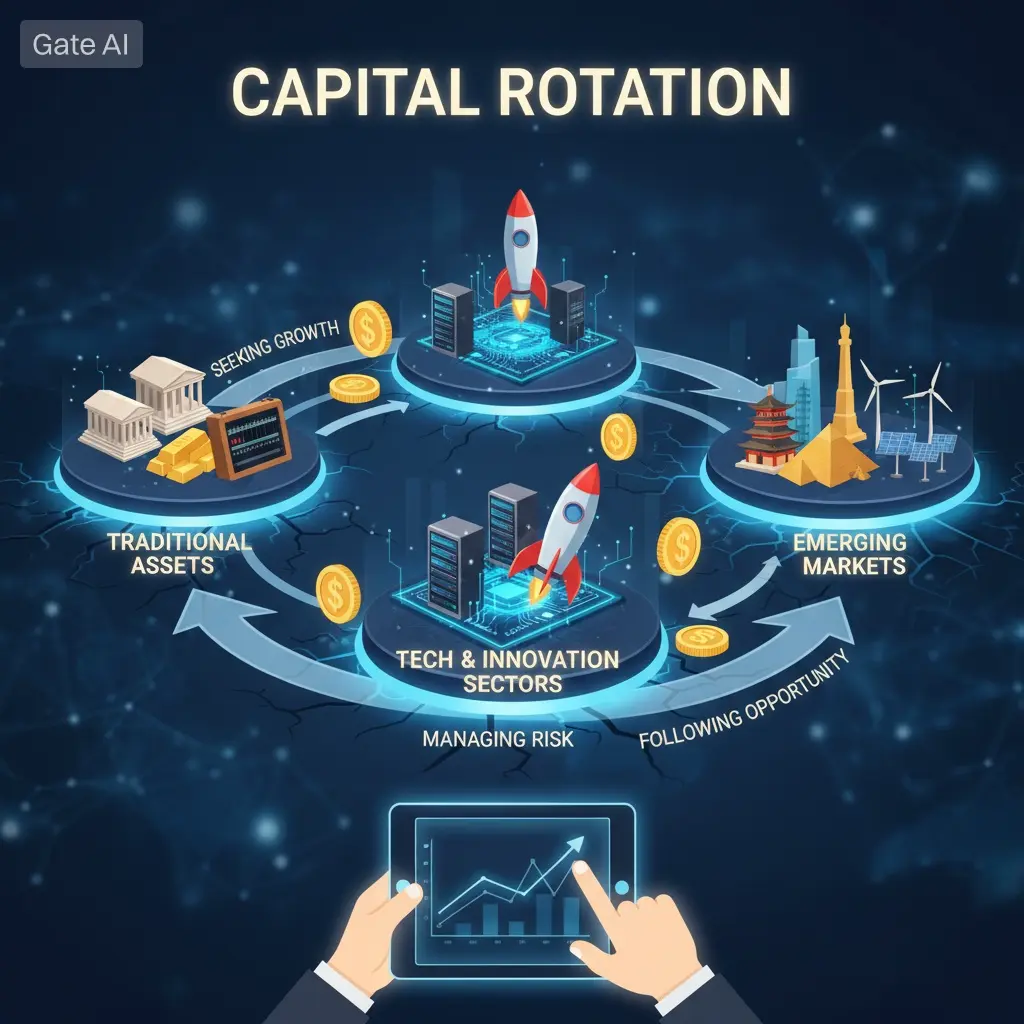

Markets are never static, and recent pullbacks have highlighted a clear shift in capital allocation across both traditional and crypto markets. What we’re witnessing is not panic, but rather a rotation of risk, where investors are re-evaluating positions, adjusting exposure, and prioritizing quality over speculation. During times of volatility, capital naturally flows from high-risk, high-beta assets toward safer, more resilient investments this is a classic defensive strategy that’s been amp

Where is Capital Flowing?

Understanding the Current Rotation Amid Market Pullbacks

Markets are never static, and recent pullbacks have highlighted a clear shift in capital allocation across both traditional and crypto markets. What we’re witnessing is not panic, but rather a rotation of risk, where investors are re-evaluating positions, adjusting exposure, and prioritizing quality over speculation. During times of volatility, capital naturally flows from high-risk, high-beta assets toward safer, more resilient investments this is a classic defensive strategy that’s been amp

- Reward

- 3

- 9

- Repost

- Share

Yusfirah :

:

HODL Tight 💪View More

#CapitalRotation

📊 Crypto Market Capital Rotation: Total Market, Bitcoin, and Sector Shifts (With Price Reference)

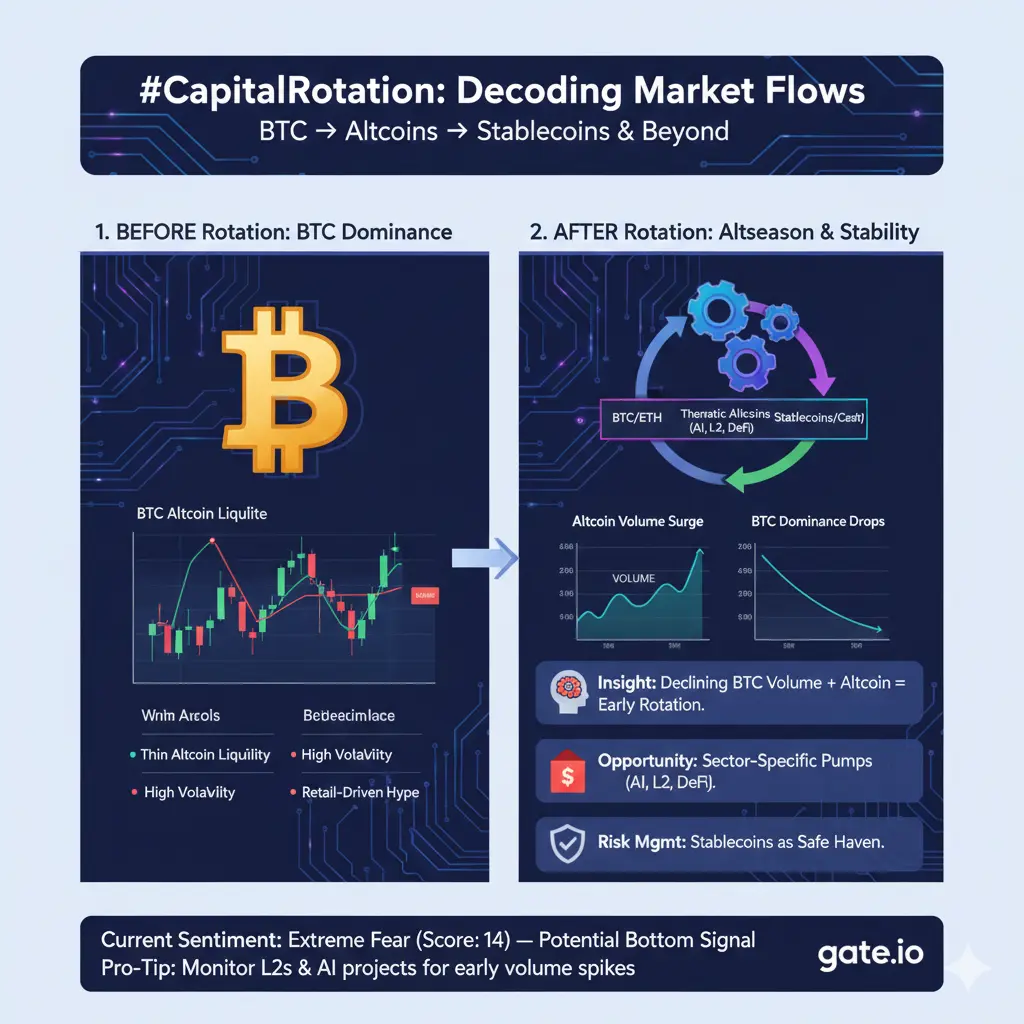

Capital rotation is one of the most powerful forces shaping crypto markets — it’s the movement of capital between Bitcoin, altcoins, stablecoins, and emerging sectors.

🧠 1. What Is Capital Rotation?

Capital rotation refers to the redistribution of capital from one part of the market to another — not just random price movement, but money shifting from one asset category into another based on risk appetite, performance, sentiment, technical signals, or macro catalysts.

In crypto

📊 Crypto Market Capital Rotation: Total Market, Bitcoin, and Sector Shifts (With Price Reference)

Capital rotation is one of the most powerful forces shaping crypto markets — it’s the movement of capital between Bitcoin, altcoins, stablecoins, and emerging sectors.

🧠 1. What Is Capital Rotation?

Capital rotation refers to the redistribution of capital from one part of the market to another — not just random price movement, but money shifting from one asset category into another based on risk appetite, performance, sentiment, technical signals, or macro catalysts.

In crypto

- Reward

- 2

- 1

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊#CapitalRotation

📊 Crypto Market Capital Rotation: Total Market, Bitcoin, and Sector Shifts (With Price Reference)

Capital rotation is one of the most powerful forces shaping crypto markets — it’s the movement of capital between Bitcoin, altcoins, stablecoins, and emerging sectors.

🧠 1. What Is Capital Rotation?

Capital rotation refers to the redistribution of capital from one part of the market to another — not just random price movement, but money shifting from one asset category into another based on risk appetite, performance, sentiment, technical signals, or macro catalysts.

In crypto

📊 Crypto Market Capital Rotation: Total Market, Bitcoin, and Sector Shifts (With Price Reference)

Capital rotation is one of the most powerful forces shaping crypto markets — it’s the movement of capital between Bitcoin, altcoins, stablecoins, and emerging sectors.

🧠 1. What Is Capital Rotation?

Capital rotation refers to the redistribution of capital from one part of the market to another — not just random price movement, but money shifting from one asset category into another based on risk appetite, performance, sentiment, technical signals, or macro catalysts.

In crypto

- Reward

- 13

- 16

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

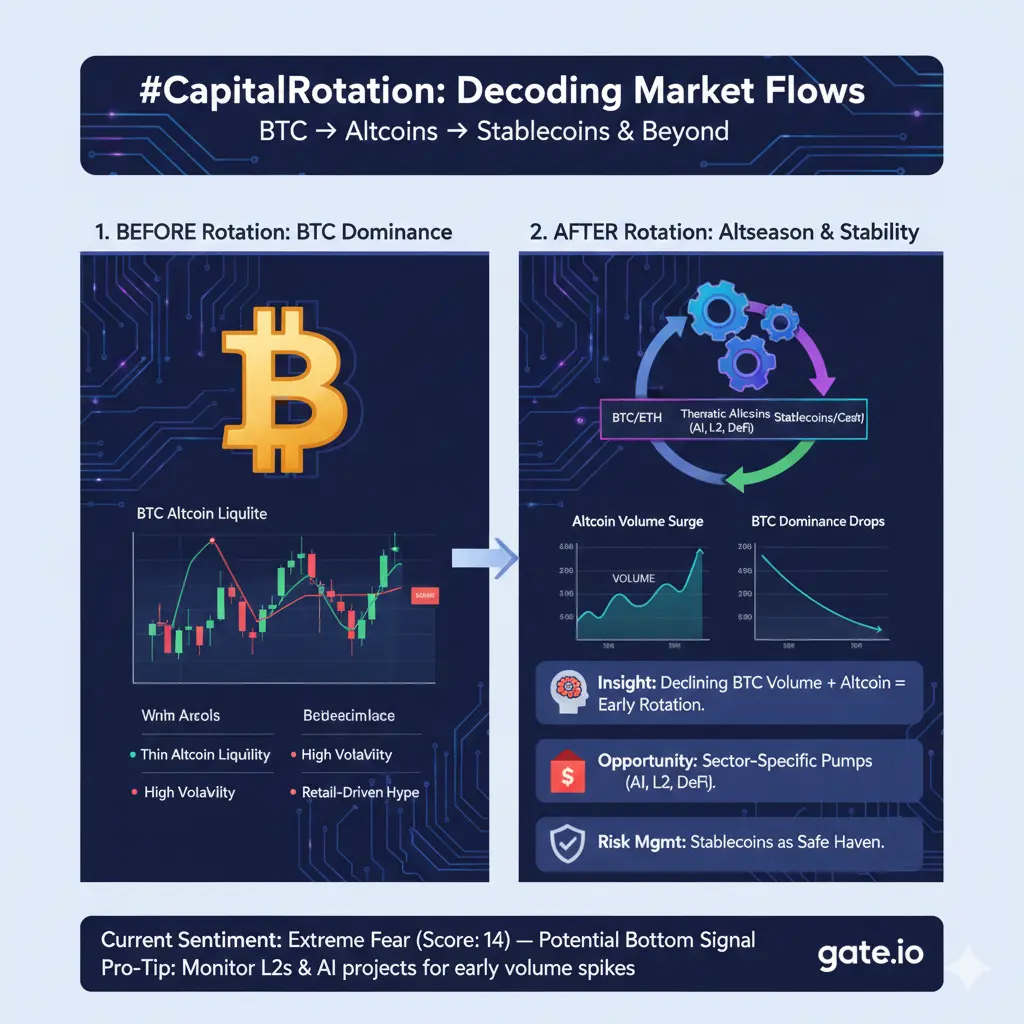

#CapitalRotation captures the flow of investor funds across different crypto assets, reflecting shifts in market sentiment, risk appetite, and sector preference. This phenomenon occurs when capital moves from one cryptocurrency or asset class to another, often in search of higher returns, diversification, or perceived safety. In early February 2026, the crypto market has been witnessing notable capital rotation from Bitcoin (BTC) into Ethereum (ETH) and several high-potential altcoins like Cardano (ADA) and Solana (SOL). Bitcoin, trading in a consolidation range of $75,000–$78,000, has seen re

- Reward

- 2

- Comment

- Repost

- Share

#CapitalRotation captures the flow of investor funds across different crypto assets, reflecting shifts in market sentiment, risk appetite, and sector preference. This phenomenon occurs when capital moves from one cryptocurrency or asset class to another, often in search of higher returns, diversification, or perceived safety. In early February 2026, the crypto market has been witnessing notable capital rotation from Bitcoin (BTC) into Ethereum (ETH) and several high-potential altcoins like Cardano (ADA) and Solana (SOL). Bitcoin, trading in a consolidation range of $75,000–$78,000, has seen re

- Reward

- 6

- 8

- Repost

- Share

HighAmbition :

:

1000x VIbes 🤑View More

#CapitalRotation

Capital rotation is becoming one of the most defining forces in the current crypto market, placing firmly in focus today. Rather than moving as a single unified wave, capital is now shifting selectively between assets, sectors, and narratives. This behavior typically emerges during periods of uncertainty or transition, where investors seek relative strength instead of broad exposure. As overall market momentum cools, the flow of capital offers valuable clues about where confidence is building and which areas are temporarily being left behind.

From a market structure standpoin

Capital rotation is becoming one of the most defining forces in the current crypto market, placing firmly in focus today. Rather than moving as a single unified wave, capital is now shifting selectively between assets, sectors, and narratives. This behavior typically emerges during periods of uncertainty or transition, where investors seek relative strength instead of broad exposure. As overall market momentum cools, the flow of capital offers valuable clues about where confidence is building and which areas are temporarily being left behind.

From a market structure standpoin

BTC1,45%

- Reward

- 4

- 8

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#CapitalRotation 📉 Market Update: Shifting Patterns During the Pullback

The market is showing a subtle but important rotation as the recent pullback unfolds. Trading patterns are no longer uniform — capital is leaning in different directions based on risk appetite, structural opportunity, and relative strength.

Key Observations:

Altcoin Divergence: Not all altcoins are moving in sync. While some are correcting sharply, others are holding key support zones or showing resilience. Selective exposure matters more than broad bets.

Bitcoin & Major Assets: BTC is consolidating around key levels. Tra

The market is showing a subtle but important rotation as the recent pullback unfolds. Trading patterns are no longer uniform — capital is leaning in different directions based on risk appetite, structural opportunity, and relative strength.

Key Observations:

Altcoin Divergence: Not all altcoins are moving in sync. While some are correcting sharply, others are holding key support zones or showing resilience. Selective exposure matters more than broad bets.

Bitcoin & Major Assets: BTC is consolidating around key levels. Tra

BTC1,45%

- Reward

- 3

- 2

- Repost

- Share

DragonFlyOfficial :

:

Buy To Earn 💎View More

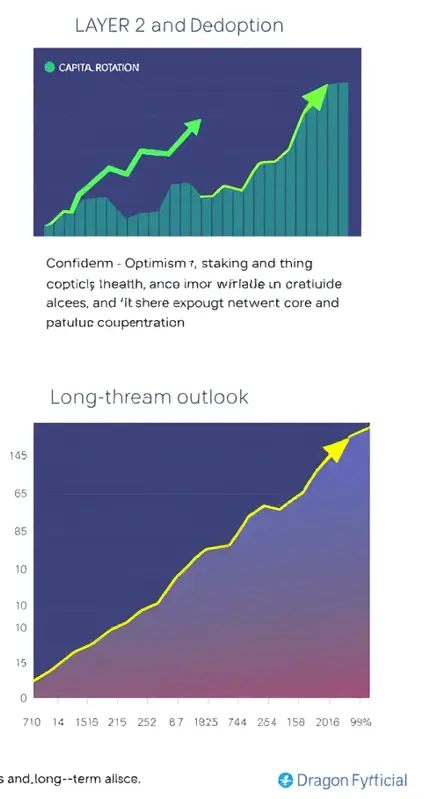

⚡ Trading Patterns Shifting During Pullback – Dragon Fly Official

Current Market Snapshot:

Markets are experiencing a pullback, with ETH and major altcoins showing choppy price action.

Trading patterns are shifting as capital rotates between assets, sectors, and risk profiles.

📉 Dragon Fly Official Analysis: Price vs Capital Flow

Price Signals (Dragon Fly Official):

Pullback is causing short-term indecision; price is testing key support zones.

Volatility is rising, creating opportunities for attentive traders.

Capital Flow & Fundamentals (Dragon Fly Official):

Capital rotation is visible: som

Current Market Snapshot:

Markets are experiencing a pullback, with ETH and major altcoins showing choppy price action.

Trading patterns are shifting as capital rotates between assets, sectors, and risk profiles.

📉 Dragon Fly Official Analysis: Price vs Capital Flow

Price Signals (Dragon Fly Official):

Pullback is causing short-term indecision; price is testing key support zones.

Volatility is rising, creating opportunities for attentive traders.

Capital Flow & Fundamentals (Dragon Fly Official):

Capital rotation is visible: som

- Reward

- 11

- 9

- Repost

- Share

DragonFlyOfficial :

:

“Markets are shifting during this pullback — where do you see capital leaning right now? I’m watching ETH and Layer-2s closely for emerging leaders. Share your perspective! 🔥View More

#CapitalRotation

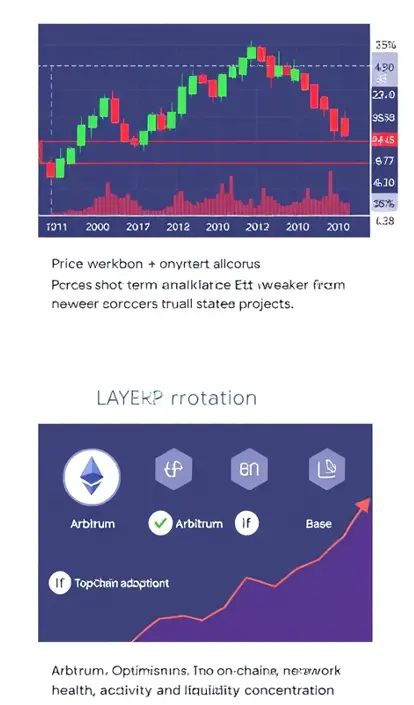

Capital rotation is the movement of liquidity from one sector of the crypto market to another. Currently, we are seeing a three-stage shift that is putting unique pressure on the market:

1. The Flight to "Quality" Yield

As global interest rates stabilize in early 2026, capital is rotating out of high-risk, low-utility "meme" coins and back into Yield-Bearing Assets. Because Ethereum offers native staking rewards (projected to be more stable following the Glamsterdam upgrade), institutional desks are rotating their stablecoin reserves back into ETH to capture the 3-4% "real" y

Capital rotation is the movement of liquidity from one sector of the crypto market to another. Currently, we are seeing a three-stage shift that is putting unique pressure on the market:

1. The Flight to "Quality" Yield

As global interest rates stabilize in early 2026, capital is rotating out of high-risk, low-utility "meme" coins and back into Yield-Bearing Assets. Because Ethereum offers native staking rewards (projected to be more stable following the Glamsterdam upgrade), institutional desks are rotating their stablecoin reserves back into ETH to capture the 3-4% "real" y

- Reward

- 6

- 6

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#CapitalRotation Shifting Flows Across Crypto Markets

Market dynamics this February are highlighting a clear theme: capital rotation. Investors and traders are increasingly reallocating positions across Bitcoin, Ethereum, and major altcoins such as XRP, DOGE, and SUI, seeking relative strength, tactical opportunities, and improved risk-adjusted returns. Understanding these flows is critical, as rotation often precedes larger trends and signals potential shifts in market leadership.

Bitcoin as the Core Anchor

BTC continues to act as the primary reserve asset and risk anchor for the crypto mark

Market dynamics this February are highlighting a clear theme: capital rotation. Investors and traders are increasingly reallocating positions across Bitcoin, Ethereum, and major altcoins such as XRP, DOGE, and SUI, seeking relative strength, tactical opportunities, and improved risk-adjusted returns. Understanding these flows is critical, as rotation often precedes larger trends and signals potential shifts in market leadership.

Bitcoin as the Core Anchor

BTC continues to act as the primary reserve asset and risk anchor for the crypto mark

- Reward

- 6

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

380.36K Popularity

9.47K Popularity

9.09K Popularity

5.07K Popularity

3.45K Popularity

6.25K Popularity

3.46K Popularity

4.08K Popularity

2.19K Popularity

43 Popularity

54.65K Popularity

69.68K Popularity

20.66K Popularity

26.96K Popularity

201.72K Popularity

News

View MoreData: The only group currently continuing to buy is the mega whales holding over 1,000 BTC. Retail investors holding less than 10 BTC have been continuously selling for a month.

3 m

Sky Protocol used a total of 8.5 million USDS to repurchase 130 million SKY in January.

9 m

India plans to explore cross-border use of digital rupees to reduce payment costs and improve trade settlement efficiency

11 m

Virtuals introduces the 60 Days framework, supporting a 60-day testing period and a reversible tokenization mechanism to enhance user flexibility and security.

14 m

Goldman Sachs: Ethereum's fundamentals are strong, with the average daily new addresses in January far surpassing the "DeFi Summer" period

14 m

Pin