Kaff

Aucun contenu pour l'instant

Kaff

Paradex vient d'annoncer leur $DIME token avec le plan d'airdrop, donc je regarde les 5 principaux DEX perpétuels par volume sur 7 jours :1/ Hyperliquid | $74B volume | 25,15 millions de dollars de frais2/ Aster | 34,88 milliards de dollars de volume | 6,83 millions de dollars de frais3/ Lighter | 30,7 milliards de dollars de volume | 1,7 million de dollars de frais4/ EdgeX | 30,2 milliards de dollars de volume | 8,46 millions de dollars de frais5/ Extended | 16,2 milliards de dollars de volume | 1,8 million de dollars de fraisMalgré que les 3 premiers aient déjà lancé leurs tokens, EdgeX et E

Voir l'original- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

L'or et l'argent ont fait parler d'eux ces dernières semaines. Si vous ne savez pas où échanger ces types de matières premières, HL est une bonne plateforme. HIP 3 OI a connu une croissance rapide depuis le début de la tendance. Au cours du mois dernier, HIP 3 a généré à lui seul 18,4 milliards de dollars de volume. – Environ 1 milliard de dollars de volume pour les perpétuels sur l'argent – Plus de 100 millions de dollars de revenus ajoutés. Avec cette dynamique forte, le $HYPE reviendra-t-il à la tendance ?

HYPE-0,16%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

J'ai lu beaucoup sur le codage de vibe aujourd'hui.\n\nMon intuition me dit que cela pourrait être l'une des compétences professionnelles les plus précieuses pour la prochaine décennie. Qu'en pensez-vous ?\n\nJe commence à m'y plonger plus profondément maintenant et à sauvegarder quelques bonnes lectures. Je partagerai une fois que j'aurai terminé !

Voir l'original- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

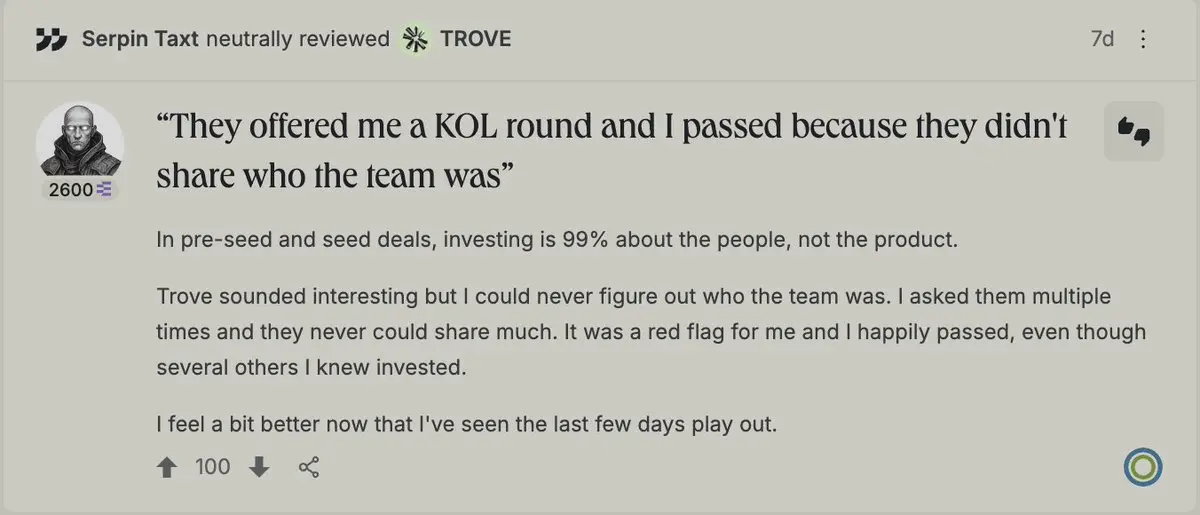

À propos de $TROVE dumped > 95% dans la première heure de mise en vente 👇🏻

J’ajoute une étape supplémentaire avant de me lancer dans une prévente : « Lire quelques avis sur @ethos_network ! »

Voir l'originalJ’ajoute une étape supplémentaire avant de me lancer dans une prévente : « Lire quelques avis sur @ethos_network ! »

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

Le récit sur la confidentialité sera partout cette année.

Si $ZEC et $XMR sont vos seuls favoris, vous cherchez probablement au mauvais endroit pour le multiple.

le vrai mouvement concerne la confidentialité sur laquelle les marchés peuvent réellement trader. @Aptos | $APT joue dans cette voie.

mais pas une confidentialité lente. #Aptos essaie de construire une confidentialité performante pour une thèse simple :

→ si les institutions passent en chaîne en grand volume, elles ne peuvent pas évoluer dans un monde où chaque solde, intention et ordre fuit en temps réel.

les primitives de confide

Voir l'originalSi $ZEC et $XMR sont vos seuls favoris, vous cherchez probablement au mauvais endroit pour le multiple.

le vrai mouvement concerne la confidentialité sur laquelle les marchés peuvent réellement trader. @Aptos | $APT joue dans cette voie.

mais pas une confidentialité lente. #Aptos essaie de construire une confidentialité performante pour une thèse simple :

→ si les institutions passent en chaîne en grand volume, elles ne peuvent pas évoluer dans un monde où chaque solde, intention et ordre fuit en temps réel.

les primitives de confide

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

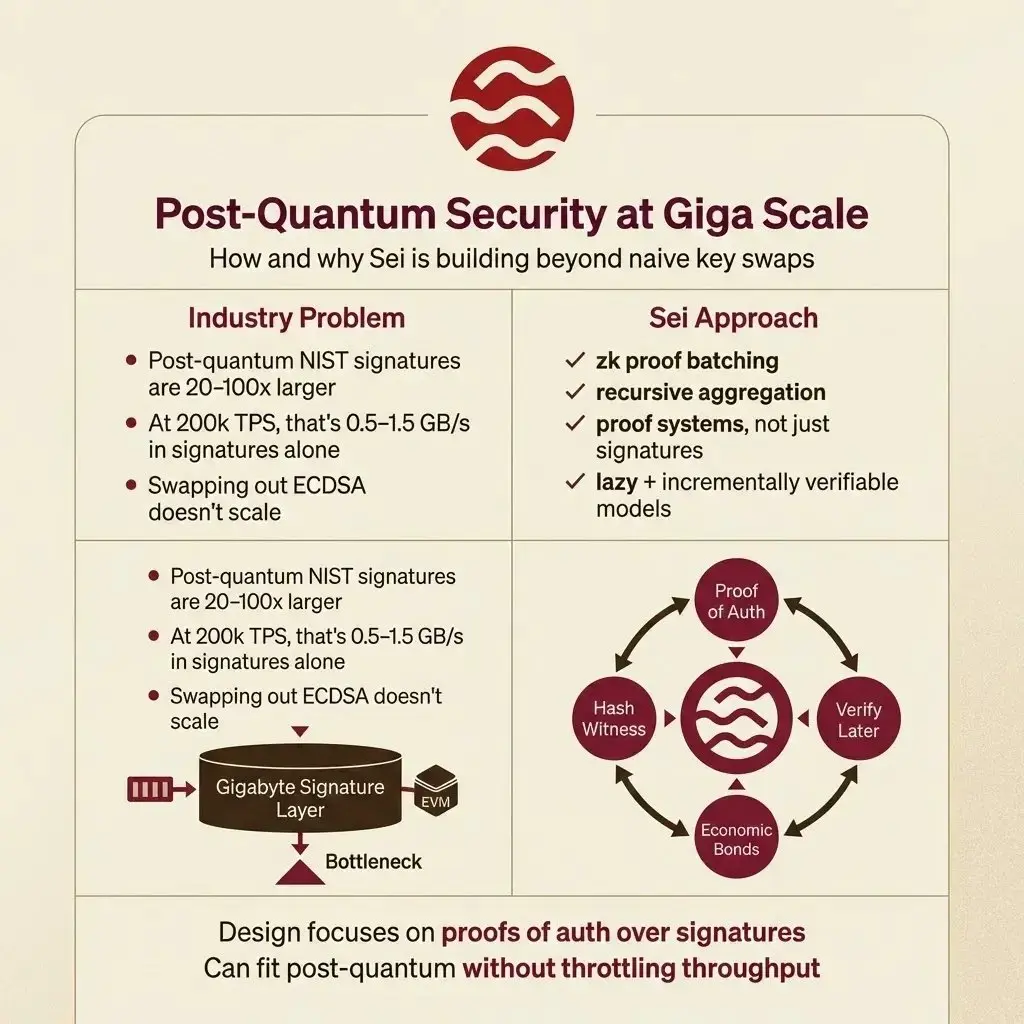

#Sei Giga et le problème que la plupart des chaînes ne conçoivent pas encore

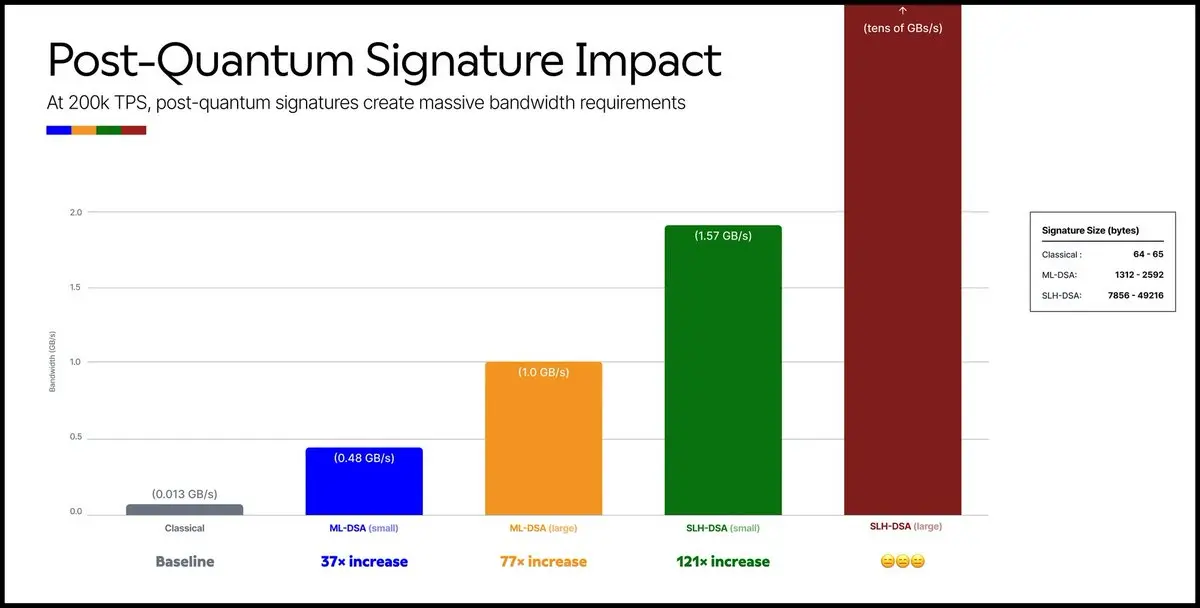

Je ne considère pas le risque quantique dans la crypto comme un simple échange de clés futur où il suffirait de nouvelles signatures et bibliothèques.

Ce cadre s’effondre complètement une fois que l’on regarde les chaînes à haute performance.

À l’échelle Giga, la sécurité post-quantique est un problème systémique :

– Les signatures ECDSA actuelles font environ 64 octets

– Les signatures NIST post-quantum passent à 1,3 KB–8 KB+

– À 200k TPS, cela représente environ 0,5 à 1,5 Go par seconde en données de signature uniqu

Voir l'originalJe ne considère pas le risque quantique dans la crypto comme un simple échange de clés futur où il suffirait de nouvelles signatures et bibliothèques.

Ce cadre s’effondre complètement une fois que l’on regarde les chaînes à haute performance.

À l’échelle Giga, la sécurité post-quantique est un problème systémique :

– Les signatures ECDSA actuelles font environ 64 octets

– Les signatures NIST post-quantum passent à 1,3 KB–8 KB+

– À 200k TPS, cela représente environ 0,5 à 1,5 Go par seconde en données de signature uniqu

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

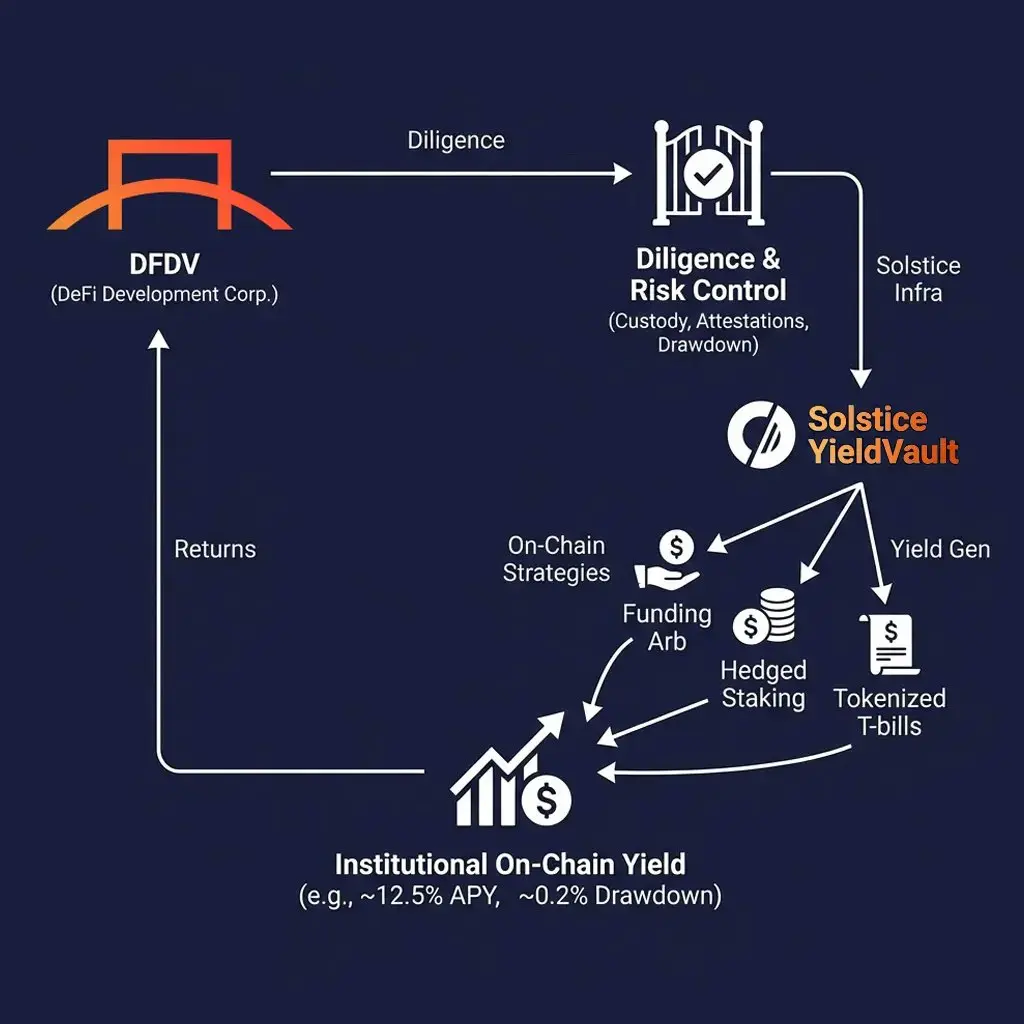

une entreprise cotée au Nasdaq ne déploie le capital de sa trésorerie en chaîne qu'après avoir effectué des tests de résistance sur la garde, les attestations, le contrôle des retraits et la survie opérationnelle.

@defidevcorp gère le capital via @solsticefi | $SLX est un vote sur la qualité de l'infrastructure.

quelques détails qui méritent d'attention :

– la pile de diligence est native à la finance traditionnelle : garde hors échange (Copper, Ceffu) + attestations de surcollatéralisation récurrentes

– le profil de risque correspond à la logique de la trésorerie : 100 % de mois positifs dep

@defidevcorp gère le capital via @solsticefi | $SLX est un vote sur la qualité de l'infrastructure.

quelques détails qui méritent d'attention :

– la pile de diligence est native à la finance traditionnelle : garde hors échange (Copper, Ceffu) + attestations de surcollatéralisation récurrentes

– le profil de risque correspond à la logique de la trésorerie : 100 % de mois positifs dep

DEFI-8,61%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

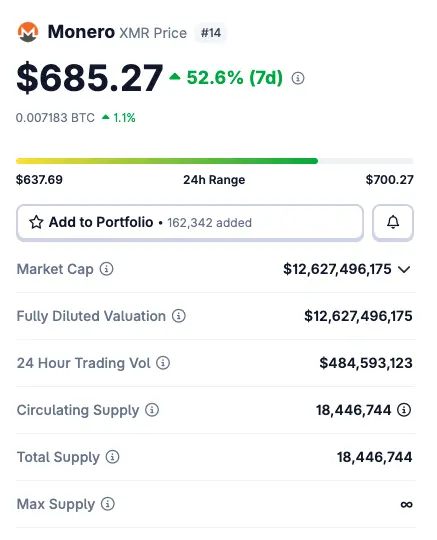

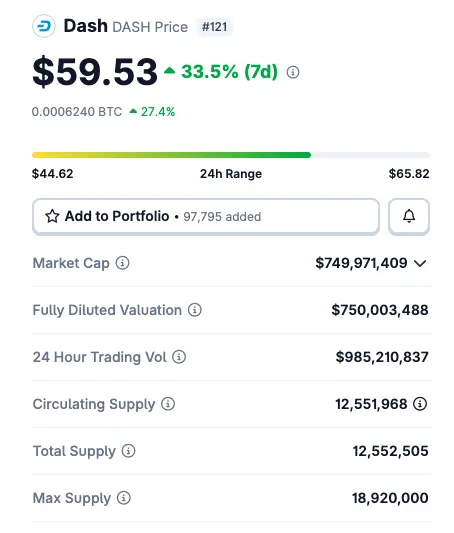

$ZEC baisser mais d'autres montent

les performances des 7 derniers jours en disent long :

– $DASH +34,6%

– $XMR +54,7%

– $ARRR +90,4%

Le méta de la confidentialité maintient une forte dynamique et ne montre aucun signe de ralentissement prochainement.

Projets de confidentialité sans token que je surveille actuellement :

– $Zama : lancement d’une vente de tokens sur coinlist et sa propre plateforme avec plus de 11K participants KYC à l’heure actuelle, inscription du token le 2 février

– @0xMiden : $25M levé des fonds auprès d’a16z, 1kx, fondateurs de Polygon, construisant son propre Miden VM po

Voir l'originalles performances des 7 derniers jours en disent long :

– $DASH +34,6%

– $XMR +54,7%

– $ARRR +90,4%

Le méta de la confidentialité maintient une forte dynamique et ne montre aucun signe de ralentissement prochainement.

Projets de confidentialité sans token que je surveille actuellement :

– $Zama : lancement d’une vente de tokens sur coinlist et sa propre plateforme avec plus de 11K participants KYC à l’heure actuelle, inscription du token le 2 février

– @0xMiden : $25M levé des fonds auprès d’a16z, 1kx, fondateurs de Polygon, construisant son propre Miden VM po

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

Sujets populaires

Afficher plus238.3K Popularité

54.42K Popularité

26.75K Popularité

20.04K Popularité

18.23K Popularité

Hot Gate Fun

Afficher plus- MC:$2.36KDétenteurs:10.00%

- MC:$0.1Détenteurs:00.00%

- MC:$2.36KDétenteurs:10.00%

- MC:$2.36KDétenteurs:10.00%

- MC:$0.1Détenteurs:10.00%

Épingler