Post content & earn content mining yield

placeholder

CryptoHaoGe

Last night, Bitcoin's overall market showed a narrow range of fluctuation, with prices repeatedly moving within the $82,500-$83,500 range, failing to break through effectively. From a technical perspective, after touching near the upper boundary of $83,500, the price was repeatedly pressured downward, indicating strong selling pressure in this area and short-term market momentum leaning bearish.

Currently, the price has fallen back to around $82,700. If it continues to be unable to effectively hold above $83,500, the consolidation pattern may tilt toward a bearish trend. The next key support l

Currently, the price has fallen back to around $82,700. If it continues to be unable to effectively hold above $83,500, the consolidation pattern may tilt toward a bearish trend. The next key support l

BTC-1,53%

- Reward

- like

- Comment

- Repost

- Share

I TOLD YOU!!Everyone laughed at me, saying rates wouldn’t be cut anymore in 2026I said that the next Fed chair will CUT rates at least 100bps by the end of yearThis is SUPER bullish for crypto

- Reward

- like

- Comment

- Repost

- Share

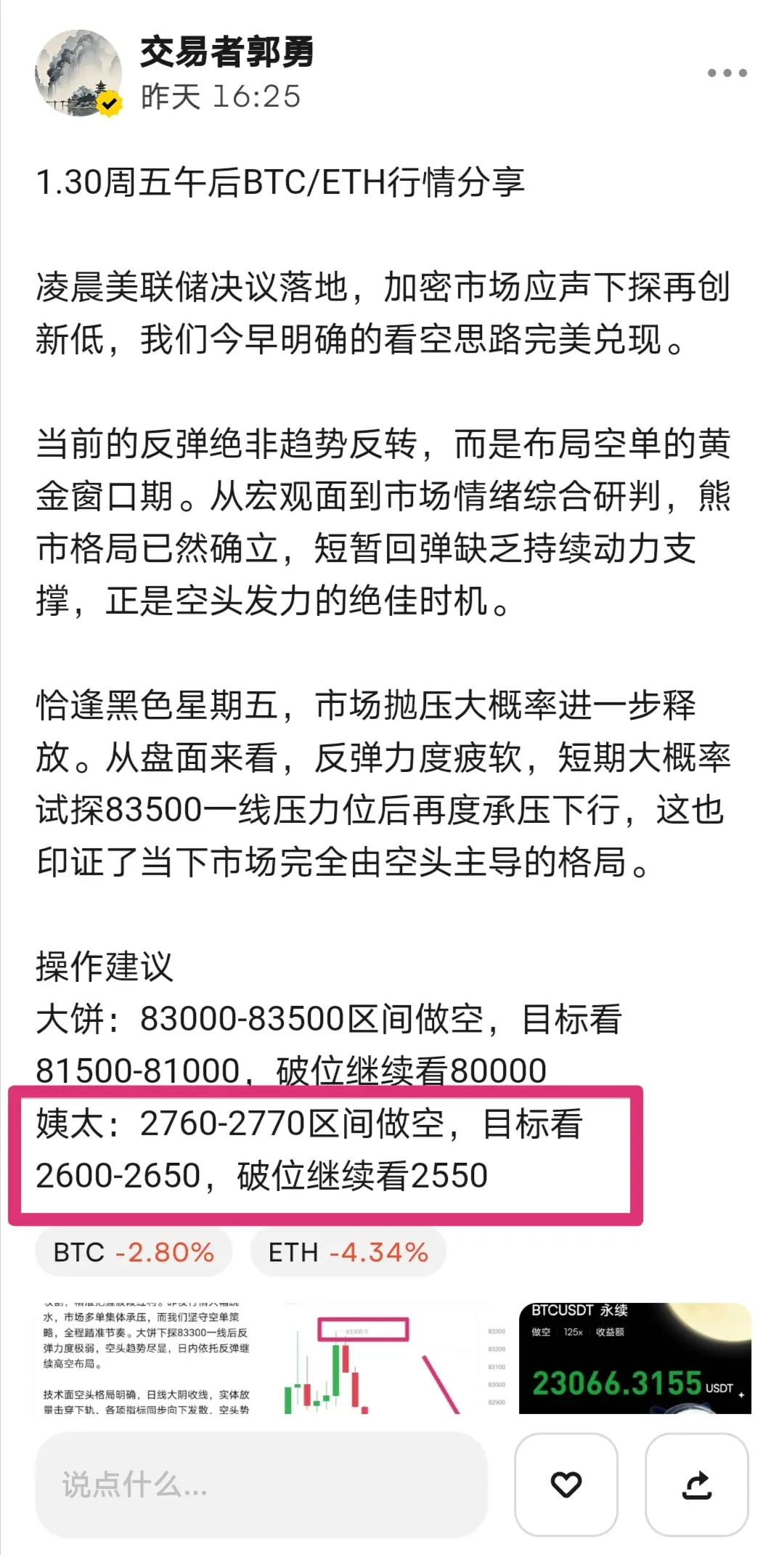

The market is too sluggish, I'm out. Enter at 2742, exit at 2712, capturing a 30-point move, pocketing 3000 profit, a small bite of meat. I thought there would be a big wave today, but unexpectedly, it was a big dump. The market is volatile. Take advantage when it's favorable, operate steadily. If you're unsure or not confident, follow Lao Guo. Strength will help you double your holdings.

View Original

- Reward

- like

- 9

- Repost

- Share

PrayingToBuddha :

:

Still went too earlyView More

㎡

扑街

Created By@ListeningToOthers'Stories

Listing Progress

0.00%

MC:

$3.23K

Create My Token

⚠️ #تحذير

Markets in the United States may experience some volatility if the US Senate approves the nomination of Kevin Warsh as Chair of the Federal Reserve, as investors adjust to his leadership style, according to Chief Investment Officer Richard Sabershtein.

🔸 Sabershtein says: "Markets may see fluctuations as investors get used to the new president's speech and message to the markets. It is natural to see volatility during a transitional period in the Federal Reserve chairmanship."

🔸 Sabershtein indicates that the appointment of Donald Trump as US President to Warsh does not change his

View OriginalMarkets in the United States may experience some volatility if the US Senate approves the nomination of Kevin Warsh as Chair of the Federal Reserve, as investors adjust to his leadership style, according to Chief Investment Officer Richard Sabershtein.

🔸 Sabershtein says: "Markets may see fluctuations as investors get used to the new president's speech and message to the markets. It is natural to see volatility during a transitional period in the Federal Reserve chairmanship."

🔸 Sabershtein indicates that the appointment of Donald Trump as US President to Warsh does not change his

- Reward

- 1

- Comment

- Repost

- Share

The entire crypto market cap is only $2.8 trillionThe crypto market is an ant right now, and so many people on my time line are bearishHigher

- Reward

- like

- Comment

- Repost

- Share

🔥 Trump announced Kevin Warsh as a candidate for FED Chair, and it is very likely that Warsh will become the new FED Chair. Warsh does not see #Bitcoin as a competitor to the dollar but considers it a valuable asset, meaning he likes crypto. However, the only thing that doesn't sit well with me is that this guy is a supporter of tight monetary policy, so he doesn't think the same as Trump financially. I don't understand why they nominated this person.

BTC-1,53%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

#SEConTokenizedSecurities #SEConTokenizedSecurities

Most commentary around tokenized securities is soft, recycled, and intellectually lazy.

People shout “future of finance” without asking the only question that matters: who controls it.

Let’s strip the fantasy away.

Tokenization is not freedom by default.

It is infrastructure. And infrastructure always serves power before ideals.

The SEC stepping into tokenized securities is neither bullish nor bearish on its own.

Anyone celebrating it as “mass adoption confirmed” is farming engagement, not understanding risk.

Here’s the hard truth most won’t

Most commentary around tokenized securities is soft, recycled, and intellectually lazy.

People shout “future of finance” without asking the only question that matters: who controls it.

Let’s strip the fantasy away.

Tokenization is not freedom by default.

It is infrastructure. And infrastructure always serves power before ideals.

The SEC stepping into tokenized securities is neither bullish nor bearish on its own.

Anyone celebrating it as “mass adoption confirmed” is farming engagement, not understanding risk.

Here’s the hard truth most won’t

- Reward

- 3

- Comment

- Repost

- Share

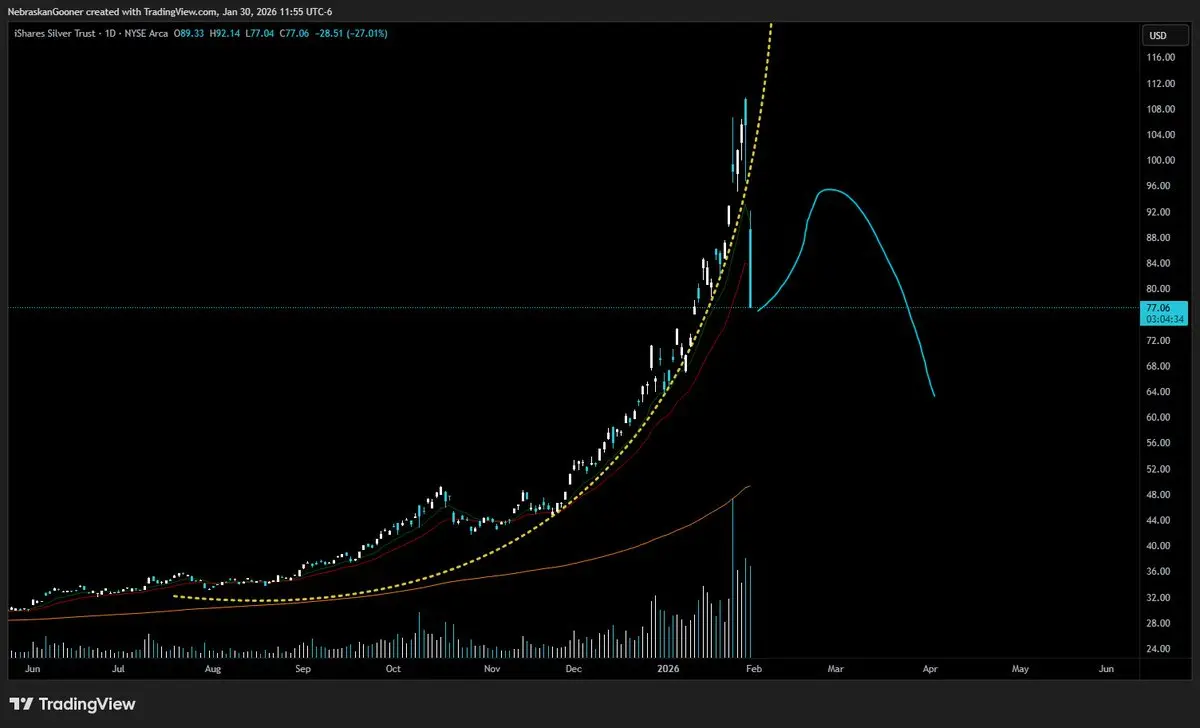

$SILVERParabolic breakdown. Usually leads to a strong reversion at some point then death.

- Reward

- like

- Comment

- Repost

- Share

#MiddleEastTensionsEscalate #MiddleEastTensionsEscalate

Markets don’t react to headlines.

They react to risk repricing — and right now, that repricing is quietly underway.

Middle East tensions are no longer a “breaking news” event. They’ve evolved into a structural uncertainty layer sitting on top of global markets. Missiles, shipping routes, energy chokepoints — none of this is new. What is new is how capital is starting to reposition before the panic phase.

Let’s be clear:

This isn’t about sympathy trades.

This is about probability, liquidity, and survival.

Energy first. Always.

Any sustaine

Markets don’t react to headlines.

They react to risk repricing — and right now, that repricing is quietly underway.

Middle East tensions are no longer a “breaking news” event. They’ve evolved into a structural uncertainty layer sitting on top of global markets. Missiles, shipping routes, energy chokepoints — none of this is new. What is new is how capital is starting to reposition before the panic phase.

Let’s be clear:

This isn’t about sympathy trades.

This is about probability, liquidity, and survival.

Energy first. Always.

Any sustaine

BTC-1,53%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Still daring to buy the dip, brothers???

Reminder that if it doesn't go above 2780 during the day and you don't go long, it wouldn't be a reminder in vain.

#GateLive直播挖矿公测开启

View OriginalReminder that if it doesn't go above 2780 during the day and you don't go long, it wouldn't be a reminder in vain.

#GateLive直播挖矿公测开启

- Reward

- 1

- 1

- Repost

- Share

合约策略鹏先生 :

:

Hold on tight, we're about to take off 🛫RTAR

星途生态

Created By@网格达人

Listing Progress

0.00%

MC:

$3.23K

Create My Token

Missing out on a lot of money😭😭😭😭😭😭😭

View Original

- Reward

- like

- Comment

- Repost

- Share

Sure looks bad out there. everywhere

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#USGovernmentShutdownRisk

The risk of a U.S. government shutdown has resurfaced as Congress faces budget impasses and political gridlock. While often temporary, such events have material effects on markets, fiscal credibility, and investor sentiment.

🔍 What’s Driving the Risk

Budget deadlock: Disagreements over spending allocations, debt ceiling adjustments, and policy riders.

Political polarization: Partisan divides delay approvals, creating uncertainty in fiscal policy.

Market sensitivity: Investors price in short-term disruptions even before a shutdown occurs.

📈 Market Implications

Treas

The risk of a U.S. government shutdown has resurfaced as Congress faces budget impasses and political gridlock. While often temporary, such events have material effects on markets, fiscal credibility, and investor sentiment.

🔍 What’s Driving the Risk

Budget deadlock: Disagreements over spending allocations, debt ceiling adjustments, and policy riders.

Political polarization: Partisan divides delay approvals, creating uncertainty in fiscal policy.

Market sensitivity: Investors price in short-term disruptions even before a shutdown occurs.

📈 Market Implications

Treas

- Reward

- 2

- Comment

- Repost

- Share

XRP On-Chain Insight: Growth in 1M+ XRP Wallets Signals Structural Accumulation

Recent on-chain data shows a gradual but notable increase in the number of wallets holding at least 1 million XRP. This marks the first sustained growth in this cohort since September 2025, following several months of contraction during XRP’s broader price decline.

It is important to frame what this data actually represents. Wallets in the 1M+ XRP range typically belong to long-term holders, early participants, funds, or high-net-worth individuals rather than short-term traders. Changes in this group tend to reflec

Recent on-chain data shows a gradual but notable increase in the number of wallets holding at least 1 million XRP. This marks the first sustained growth in this cohort since September 2025, following several months of contraction during XRP’s broader price decline.

It is important to frame what this data actually represents. Wallets in the 1M+ XRP range typically belong to long-term holders, early participants, funds, or high-net-worth individuals rather than short-term traders. Changes in this group tend to reflec

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More17.3K Popularity

31.39K Popularity

354.75K Popularity

33.57K Popularity

54.17K Popularity

News

View MoreData: If BTC breaks through $86,598, the total liquidation strength of mainstream CEX short positions will reach $1.534 billion.

2 m

Data: If ETH breaks through $2,806, the total liquidation strength of long positions on mainstream CEXs will reach $1.397 billion.

2 m

The analyst: The precious metals feast has come to an end, marking an unprecedented and unparalleled event in the market.

4 m

BTC falls below 82,000 USDT

10 m

ETH 跌破 2650 USDT

12 m

Pin