Post content & earn content mining yield

placeholder

DragonSoars

The "On-Chain Gold Largest Long" fully closed its PAXG long position at an average price of $4,865, previously opened at approximately $4,415.

On January 22, according to Coinbob's popular address monitoring, influenced by the decline in gold price per ounce overnight and this morning, dropping below $4,800 briefly, the "On-Chain Gold Largest Long" whale on Hyperliquid completely closed its 5x leveraged PAXG long position. The position recorded a profit of $675,000, with an initial size of about $7.3 million and an average price of $4,415. After closing, the address increased its holdings in X

On January 22, according to Coinbob's popular address monitoring, influenced by the decline in gold price per ounce overnight and this morning, dropping below $4,800 briefly, the "On-Chain Gold Largest Long" whale on Hyperliquid completely closed its 5x leveraged PAXG long position. The position recorded a profit of $675,000, with an initial size of about $7.3 million and an average price of $4,415. After closing, the address increased its holdings in X

PAXG-1,05%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

January 22 Midday Analysis

BTC: The bottoming out and rebound have completed the gap fill, and the Asian session stabilized above the 90,000 level, indicating clear short-term buying interest. After two consecutive days of downward movement followed by two days of upward correction, the bulls increased volume to push higher and test resistance. Short-term rebound demand is evident, but the trend has not undergone a fundamental reversal.

The key resistance level above is 91,000. Patience is required to wait for the right entry point, and aggressive chasing is strictly prohibited. Until the tren

View OriginalBTC: The bottoming out and rebound have completed the gap fill, and the Asian session stabilized above the 90,000 level, indicating clear short-term buying interest. After two consecutive days of downward movement followed by two days of upward correction, the bulls increased volume to push higher and test resistance. Short-term rebound demand is evident, but the trend has not undergone a fundamental reversal.

The key resistance level above is 91,000. Patience is required to wait for the right entry point, and aggressive chasing is strictly prohibited. Until the tren

- Reward

- like

- Comment

- Repost

- Share

If we are not like-minded, you cannot understand my efforts; if we cannot resonate at the same frequency, I also cannot feel your contributions! But I accept all beautiful blessings and empathy! After all, we live in the same country, strive on the same peaceful land, and enjoy the cycle of the sun and moon. Regarding success, you and I may have different definitions. I respect your choices, and please forgive my flamboyance. Breaking 3 zeros is my goal, after all, on the road to happiness, you and I leave footprints together! Love and trust should not be betrayed,

Believe in the power of fa

View OriginalBelieve in the power of fa

- Reward

- like

- Comment

- Repost

- Share

嫣然基金

嫣然基金

Created By@XiaoliangIsGoingToSu

Listing Progress

0.00%

MC:

$3.43K

Create My Token

Liquidation is not the end; going to zero can also lead to rebirth. The crypto world teaches you not the myth of getting rich overnight, but to respect the cycles when dripping blood to add positions, and to see human greed clearly when reviewing your trades. Every loss is refining your understanding—remember the pain of this moment, as it will become your strongest chip in the future bull market. Let's build our own leek alliance together.

View Original

MC:$3.5KHolders:2

0.19%

- Reward

- like

- Comment

- Repost

- Share

How far na.\n\nHope all is well.\n\nJust checking on you 🥹🥹🥹🥹

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

good$LINK - SPOT CALL\n\nENTER AT CMP\n\nSL - 9.87\n\nTp - 16 - 20 - 24

- Reward

- like

- Comment

- Repost

- Share

Today, coins are volatile; they might go up or down, so please be cautious when trading, whether in futures or spot markets.

View Original

- Reward

- 2

- Comment

- Repost

- Share

#JapanBondMarketSell-Off

📈 Japan Bonds Surge — Global Ripples Incoming?

Japan’s bond market just saw a sharp sell-off, with 30Y and 40Y yields jumping over 25 bps after the government signaled an end to fiscal tightening and plans to boost spending. This is a big move in a market that’s long been ultra-stable.

🔍 Key Implications

1️⃣ Global rate influence

Japan’s long-term yields often anchor Asian and global bond markets. A surge here could push US and European yields higher, especially in longer maturities.

2️⃣ Risk asset sentiment

Rising yields = higher discount rates = potential pressure

📈 Japan Bonds Surge — Global Ripples Incoming?

Japan’s bond market just saw a sharp sell-off, with 30Y and 40Y yields jumping over 25 bps after the government signaled an end to fiscal tightening and plans to boost spending. This is a big move in a market that’s long been ultra-stable.

🔍 Key Implications

1️⃣ Global rate influence

Japan’s long-term yields often anchor Asian and global bond markets. A surge here could push US and European yields higher, especially in longer maturities.

2️⃣ Risk asset sentiment

Rising yields = higher discount rates = potential pressure

- Reward

- 3

- 1

- Repost

- Share

ybaser :

:

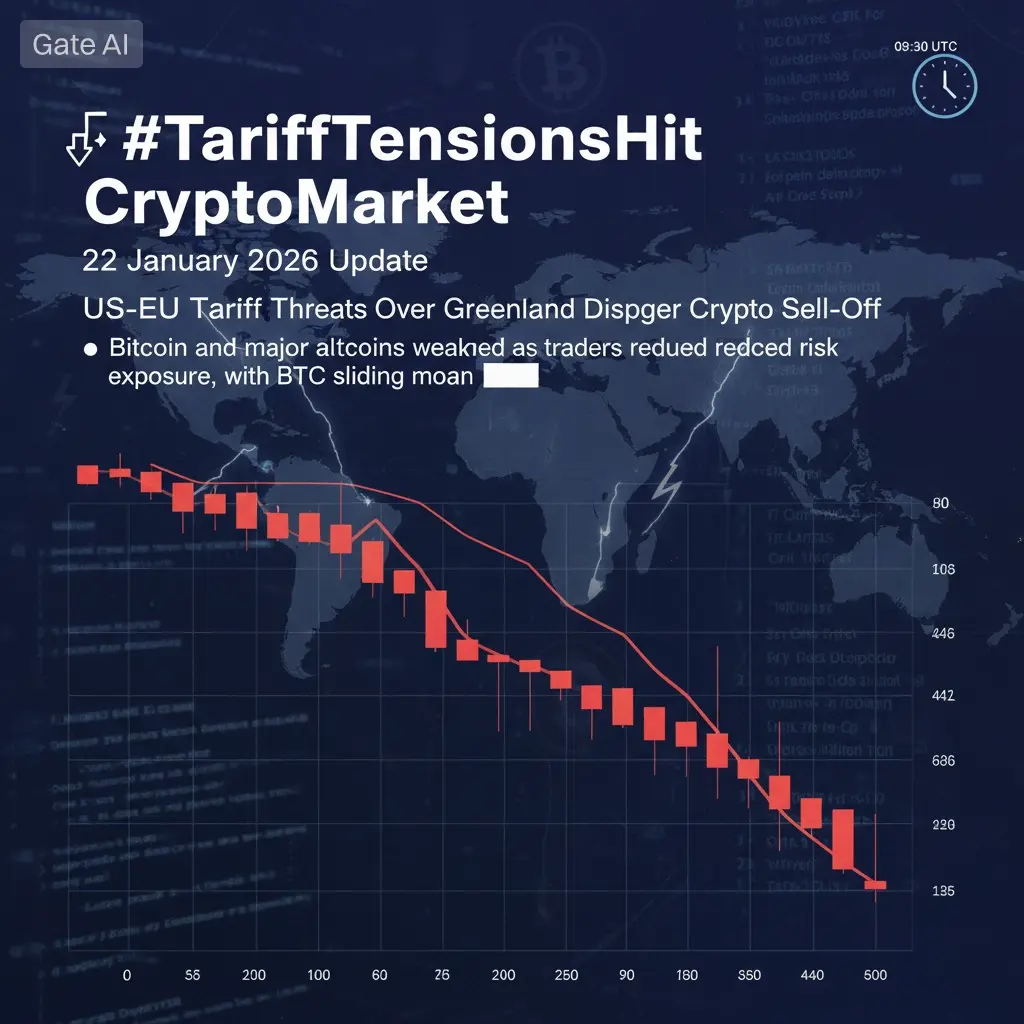

Happy New Year! 🤑#TariffTensionsHitCryptoMarket

⚠️ Tariff Talk Returns — Is BTC Reacting or Repricing?

Renewed tariff threats have reignited risk-off sentiment, and Bitcoin’s recent price action tells the story: a sharp pullback following a brief relief surge. The key question now is whether markets are pricing in real escalation — or simply overreacting to headlines.

🔍 What’s Actually Happening?

1️⃣ Headline-driven volatility

Tariff language hits markets fast, but details remain unclear. Crypto often reacts first, thinks later.

2️⃣ Macro positioning matters

With BTC near key resistance, leverage was elevate

⚠️ Tariff Talk Returns — Is BTC Reacting or Repricing?

Renewed tariff threats have reignited risk-off sentiment, and Bitcoin’s recent price action tells the story: a sharp pullback following a brief relief surge. The key question now is whether markets are pricing in real escalation — or simply overreacting to headlines.

🔍 What’s Actually Happening?

1️⃣ Headline-driven volatility

Tariff language hits markets fast, but details remain unclear. Crypto often reacts first, thinks later.

2️⃣ Macro positioning matters

With BTC near key resistance, leverage was elevate

BTC0,71%

- Reward

- 4

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

While a bunch of fake payment public chains are still relying on "low Gas" gimmicks to fleece users, with slow settlement speeds like snails and fluctuating transfer fees that trap users, @plasma directly pulls out a king's hand to teach a lesson! Zero-fee USD₮ instant transfers, 1000+ TPS high throughput, Paymaster contracts with gas-free payments, plus $2 billion initial stablecoin liquidity backing—each feature crushes those bragging about "payment-friendly" trash chains!

EVM compatibility allows seamless migration for developers, and trust-minimized cross-chain bridges connect the value lo

EVM compatibility allows seamless migration for developers, and trust-minimized cross-chain bridges connect the value lo

XPL1,35%

- Reward

- like

- Comment

- Repost

- Share

2024,2025 mark the largest long-term #Bitcoin supply #release in history. “Bitcoin is not only undergoing a price cycle, but potentially a #transition in who holds it and why, and long-term holder supply behavior is one of the clearest on-chain signals of that shift.”, Kripto Mevsimi\n\n#CryptoRecovery \n$BTC

BTC0,71%

- Reward

- 1

- Comment

- Repost

- Share

汗血宝马

汗血宝马

Created By@gatefunuser_22b1

Listing Progress

100.00%

MC:

$115.02K

Create My Token

Newbie: “opens X account”\n\nOn bio \n“I am a space host, collab manager, moderator, marketer, Kol, community manager” \n\nBio: 👇

- Reward

- like

- Comment

- Repost

- Share

Market Outlook & BTC Analysis

- Reward

- like

- Comment

- Repost

- Share

📉 #TariffTensionsHitCryptoMarket — 22 January 2026 Update

Global trade tensions, especially renewed US–EU tariff threats tied to the Greenland dispute, have pushed investors into risk-off mode — including in cryptocurrency markets. These tariff threats triggered volatility across stocks, bonds, and digital assets, causing sharp sell-offs and fear-driven trading early this week.

🔹 Bitcoin and major altcoins weakened as traders reduced risk exposure, with BTC sliding more than 7% at one point and broader crypto sell-offs intensifying.

🔹 Large liquidations were seen in leveraged crypto posit

Global trade tensions, especially renewed US–EU tariff threats tied to the Greenland dispute, have pushed investors into risk-off mode — including in cryptocurrency markets. These tariff threats triggered volatility across stocks, bonds, and digital assets, causing sharp sell-offs and fear-driven trading early this week.

🔹 Bitcoin and major altcoins weakened as traders reduced risk exposure, with BTC sliding more than 7% at one point and broader crypto sell-offs intensifying.

🔹 Large liquidations were seen in leveraged crypto posit

BTC0,71%

- Reward

- like

- Comment

- Repost

- Share

In this very detailed and unique analysis, we will look at the most important #Bitcoin fundamental analysis of halving cycles. I predict Bitcoin will crash to 49k or 60k in 2026, so if you are buying now for the long term as an investment (buy and hold), you can probably wait for a better price! We can statistically predict Bitcoin moves with this simple chart because it's always right and never wrong. What can we say with certainty?

Statistically:

👉 Bitcoin's bull markets last for 742 to 1065 days

👉 Bitcoin's bear markets last for 364 to 413 days

👉 The correction is every time weaker, but

Statistically:

👉 Bitcoin's bull markets last for 742 to 1065 days

👉 Bitcoin's bear markets last for 364 to 413 days

👉 The correction is every time weaker, but

BTC0,71%

- Reward

- 1

- 2

- Repost

- Share

DragonFlyOfficial :

:

🌟 Amazing insight! 🙌 Really loved how you shared this — your perspective is super clear and helpful! 🚀 Keep it up, looking forward to learning more from you! 😊View More

【ETH/USDT 1H Level Technical Analysis: Decaying Downward Momentum, Entering a Rebound Phase】

From the 1-hour K-line chart of ETH/USDT, the market is shifting from a unilateral decline to a consolidation and rebound. The moving average system (MA20/50/100) remains in a bearish arrangement, exerting resistance above the price, especially as the mid-term moving averages are diverging downward, indicating that the trend bearish force has not been fully dismantled. After touching the low of 2863.86, the price rebounded, and the continuous candlestick bodies are shrinking, showing that the downward

From the 1-hour K-line chart of ETH/USDT, the market is shifting from a unilateral decline to a consolidation and rebound. The moving average system (MA20/50/100) remains in a bearish arrangement, exerting resistance above the price, especially as the mid-term moving averages are diverging downward, indicating that the trend bearish force has not been fully dismantled. After touching the low of 2863.86, the price rebounded, and the continuous candlestick bodies are shrinking, showing that the downward

ETH1,11%

- Reward

- like

- Comment

- Repost

- Share

🔥 The brand new Live browsing experience is here——

Swipe through live streams as smoothly as short videos, with more immersive analysis and more efficient market viewing.

Want to quickly discover popular live streams? Want to “look from outside the live room”?

Want to swipe all the way through and not miss any live streams that are currently broadcasting?

Gate Live App delivers! Delivers! All! Achievements!

⬆️ Update the App to v8.5.0 to experience the highlights of this upgrade

Learn more: https://www.gate.com/announcements/article/49353

View OriginalSwipe through live streams as smoothly as short videos, with more immersive analysis and more efficient market viewing.

Want to quickly discover popular live streams? Want to “look from outside the live room”?

Want to swipe all the way through and not miss any live streams that are currently broadcasting?

Gate Live App delivers! Delivers! All! Achievements!

⬆️ Update the App to v8.5.0 to experience the highlights of this upgrade

Learn more: https://www.gate.com/announcements/article/49353

- Reward

- 3

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#SpotGoldHitsaNewHigh

📈 Gold Breaks $4,800 — Momentum or Trap?

With global risk-off sentiment accelerating, spot gold has surged ~10% in just 20 days, decisively breaking above $4,800/oz. This is not a normal move — it reflects macro stress, not retail hype.

🔍 What’s Driving This Rally?

1️⃣ Geopolitical & macro uncertainty

Capital is rotating out of risk assets as investors hedge against instability.

2️⃣ Expectations of looser financial conditions

Markets are increasingly pricing future rate cuts → real yields weaken → gold benefits.

3️⃣ Strong institutional demand

Central banks and large f

📈 Gold Breaks $4,800 — Momentum or Trap?

With global risk-off sentiment accelerating, spot gold has surged ~10% in just 20 days, decisively breaking above $4,800/oz. This is not a normal move — it reflects macro stress, not retail hype.

🔍 What’s Driving This Rally?

1️⃣ Geopolitical & macro uncertainty

Capital is rotating out of risk assets as investors hedge against instability.

2️⃣ Expectations of looser financial conditions

Markets are increasingly pricing future rate cuts → real yields weaken → gold benefits.

3️⃣ Strong institutional demand

Central banks and large f

- Reward

- 4

- 3

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More49.16K Popularity

31.28K Popularity

16.47K Popularity

60.45K Popularity

345.65K Popularity

Hot Gate Fun

View More- MC:$3.45KHolders:20.00%

- MC:$3.43KHolders:10.00%

- MC:$3.43KHolders:10.00%

- MC:$3.43KHolders:10.00%

- MC:$3.43KHolders:10.00%

News

View MoreTrump Media airdrops shareholder tokens, but TRUMP tokens decline. Why is the market indifferent?

1 m

Ethereum's 2026 key inflection point approaches, Vitalik Buterin explains ETH decentralization and privacy upgrade roadmap

5 m

Circle advances UN stablecoin payment upgrade, USDC accelerates humanitarian aid and the implementation of Bermuda's "full-chain economy"

6 m

In the past 24 hours, the entire network has experienced liquidations of $603 million, with both long and short positions being wiped out.

6 m

Trump withdraws tariff threat, boosting European stocks; auto stocks lead the gains, and the FTSE 600 jumps 1.1%

8 m

Pin