# BItcoin

6.64M

ELIX

RISK-ON MODE ACTIVATED 🚀

Over $140 BILLION just poured into the market in under 24 hours.

• Bitcoin surges 6.54% — adding nearly $90.5B to its market cap

• Russell 2000 climbs 1.8% — gaining close to $52B today

After the soft CPI print, capital is rotating back into high-beta plays.

Liquidity is moving. Volatility is waking up.

The risk trade is officially back. 🔥

#BTC #Bitcoin

Over $140 BILLION just poured into the market in under 24 hours.

• Bitcoin surges 6.54% — adding nearly $90.5B to its market cap

• Russell 2000 climbs 1.8% — gaining close to $52B today

After the soft CPI print, capital is rotating back into high-beta plays.

Liquidity is moving. Volatility is waking up.

The risk trade is officially back. 🔥

#BTC #Bitcoin

BTC3,62%

- Reward

- 1

- 1

- Repost

- Share

Mason_Lee :

:

LFG 🔥#BitcoinMarketAnalysis

The crypto market is currently experiencing a structured pullback after recent expansion phases. While volatility has increased, the broader question is whether this move signals a deeper correction — or simply a healthy reset before continuation.

At this stage, price action suggests cooling momentum rather than confirmed breakdown.

📊 Market Structure Analysis

After strong impulsive moves, markets naturally retrace to rebalance liquidity. What we’re seeing now includes:

Short-term lower highs on intraday timeframes

Reduced upside follow-through

Increased reaction aroun

The crypto market is currently experiencing a structured pullback after recent expansion phases. While volatility has increased, the broader question is whether this move signals a deeper correction — or simply a healthy reset before continuation.

At this stage, price action suggests cooling momentum rather than confirmed breakdown.

📊 Market Structure Analysis

After strong impulsive moves, markets naturally retrace to rebalance liquidity. What we’re seeing now includes:

Short-term lower highs on intraday timeframes

Reduced upside follow-through

Increased reaction aroun

BTC3,62%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Standard Chartered Slashes #Bitcoin 2026 Target to $100K, Warns of Potential Drop to $50K

The $800B+ global banking giant Standard Chartered has revised its end-2026 Bitcoin (BTC) price forecast downward to $100,000, a 33% cut from its previous $150,000 target (and a significant reduction from the $300,000 projection it held late last year).

In a client note released on February 12, 2026, the bank's head of digital assets research, Geoffrey Kendrick, highlighted risks of further near-term downside, with BTC potentially sliding to $50,000 (or just below) amid ongoing capitulation before any mea

The $800B+ global banking giant Standard Chartered has revised its end-2026 Bitcoin (BTC) price forecast downward to $100,000, a 33% cut from its previous $150,000 target (and a significant reduction from the $300,000 projection it held late last year).

In a client note released on February 12, 2026, the bank's head of digital assets research, Geoffrey Kendrick, highlighted risks of further near-term downside, with BTC potentially sliding to $50,000 (or just below) amid ongoing capitulation before any mea

BTC3,62%

- Reward

- like

- Comment

- Repost

- Share

📉⚡ #BuyTheDipOrWaitNow

BTC: 66,501.8 (-0.60%)

Mark Price: 66,503.1

Index: 66,531.2

24H High: 68,385.9

24H Low: 65,068.0

24H Turnover: 6.98B USDT

Open Interest: 64.08K BTC

Funding Rate: +0.0016%

Bitcoin is sitting near mid-range support after tapping 65K lows.

Volatility is active. Liquidity is rotating. The big question:

🧠 Is This a Dip to Buy — or a Trap Before Lower?

🔎 Bullish Signals:

• Funding slightly positive → no extreme long overcrowding

• Strong 24H volume (6.98B USDT) → active participation

• Holding above 65K key support zone

⚠️ Bearish Risks:

• Failed to hold 68K momentum

• Lowe

BTC: 66,501.8 (-0.60%)

Mark Price: 66,503.1

Index: 66,531.2

24H High: 68,385.9

24H Low: 65,068.0

24H Turnover: 6.98B USDT

Open Interest: 64.08K BTC

Funding Rate: +0.0016%

Bitcoin is sitting near mid-range support after tapping 65K lows.

Volatility is active. Liquidity is rotating. The big question:

🧠 Is This a Dip to Buy — or a Trap Before Lower?

🔎 Bullish Signals:

• Funding slightly positive → no extreme long overcrowding

• Strong 24H volume (6.98B USDT) → active participation

• Holding above 65K key support zone

⚠️ Bearish Risks:

• Failed to hold 68K momentum

• Lowe

BTC3,62%

- Reward

- 4

- 8

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

#BitcoinMarketAnalysis 💢 Will Crypto Survive the AI Scare Trade?

The AI scare trade has rattled multiple industries, and crypto hasn’t been immune. Market narratives around AI-powered disruption have triggered panic selling across stocks — and BTC followed suit.

🔹 How It Spread:

• First hit software — S&P Software Index down 18% YTD

• Rippled into private credit, insurance, real estate, precious metals, and more

• Crypto’s volatility mirrored these sectors, with BTC dipping to $65,000

🔹 What’s Driving Fear:

Even if AI tools don’t yet exist to disrupt entire industries, expectations alone ar

The AI scare trade has rattled multiple industries, and crypto hasn’t been immune. Market narratives around AI-powered disruption have triggered panic selling across stocks — and BTC followed suit.

🔹 How It Spread:

• First hit software — S&P Software Index down 18% YTD

• Rippled into private credit, insurance, real estate, precious metals, and more

• Crypto’s volatility mirrored these sectors, with BTC dipping to $65,000

🔹 What’s Driving Fear:

Even if AI tools don’t yet exist to disrupt entire industries, expectations alone ar

BTC3,62%

- Reward

- 7

- 10

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

2026 Go Go Go 👊View More

- Reward

- 1

- 4

- Repost

- Share

GateUser-9a01c836 :

:

happy new yearView More

📊 Bitcoin risk-reward has shifted after recent selloff: on-chain analyst

Bitcoin’s recent price decline has prompted market analysts to assess whether a price floor is forming, with one prominent on-chain researcher stating the risk-reward profile has shifted following the selloff.

James “Checkmate” Check, a former lead researcher at Glassnode and author of Check On Chain, told What Bitcoin Did host Danny Knowles that Bitcoin entered “deep value” territory across multiple mean-reversion frameworks when it dropped into recent price zones, according to statements made on the podcast. Check note

Bitcoin’s recent price decline has prompted market analysts to assess whether a price floor is forming, with one prominent on-chain researcher stating the risk-reward profile has shifted following the selloff.

James “Checkmate” Check, a former lead researcher at Glassnode and author of Check On Chain, told What Bitcoin Did host Danny Knowles that Bitcoin entered “deep value” territory across multiple mean-reversion frameworks when it dropped into recent price zones, according to statements made on the podcast. Check note

BTC3,62%

- Reward

- 1

- Comment

- Repost

- Share

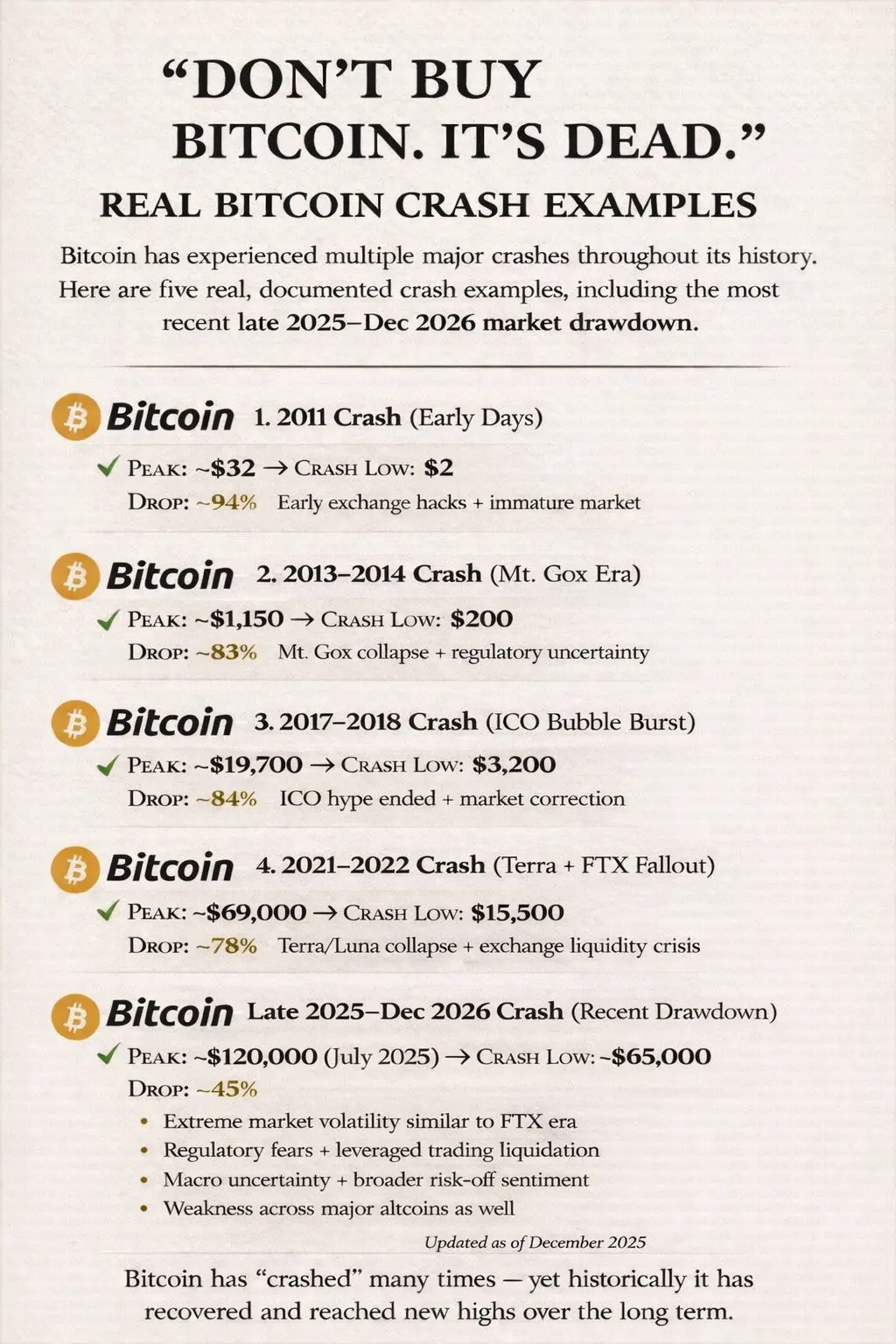

Bitcoin $BTC has crashed.

Not once.

Not twice.

But every cycle.

And each time, the same story repeats:

“It's over.”

“This time is different.”

“Crypto is dead.”

Yet history keeps leaving receipts.

📉 2011: $32 → $2

📉 2013–14: $1,150 → $200

📉 2017–18: $19,700 → $3,200

📉 2021–22: $69,000 → $15,500

📉 2025: ~$120,000 → ~$65,000

Here’s what I’ve learned:

Bitcoin doesn’t reward certainty. It rewards resilience.

Crashes aren’t anomalies, they are part of the design of an emerging asset class.

The real divide in crypto is simple:

* Some people react to volatility

* Others recogn

Not once.

Not twice.

But every cycle.

And each time, the same story repeats:

“It's over.”

“This time is different.”

“Crypto is dead.”

Yet history keeps leaving receipts.

📉 2011: $32 → $2

📉 2013–14: $1,150 → $200

📉 2017–18: $19,700 → $3,200

📉 2021–22: $69,000 → $15,500

📉 2025: ~$120,000 → ~$65,000

Here’s what I’ve learned:

Bitcoin doesn’t reward certainty. It rewards resilience.

Crashes aren’t anomalies, they are part of the design of an emerging asset class.

The real divide in crypto is simple:

* Some people react to volatility

* Others recogn

BTC3,62%

- Reward

- 8

- 8

- Repost

- Share

Hameed_Official :

:

Volatility is Bitcoin’s DNA—resilience, not fear, determines who thrives long-termView More

BTC – BREAKOUT IMMINENT: BUYERS REGROUPING

Entry: 66,900 – 67,400

Target 1: 68,300 🎯

Target 2: 69,200 🎯

Target 3: 70,500 🎯

Stop Loss: 65,800 🛑

Analysis: $BTC is carving higher lows on lower timeframes. Accumulation is visible near support. A break above 68.3K unlocks strong momentum. Lose 65.8K and volatility expands.

#Crypto #Bitcoin $BTC

Entry: 66,900 – 67,400

Target 1: 68,300 🎯

Target 2: 69,200 🎯

Target 3: 70,500 🎯

Stop Loss: 65,800 🛑

Analysis: $BTC is carving higher lows on lower timeframes. Accumulation is visible near support. A break above 68.3K unlocks strong momentum. Lose 65.8K and volatility expands.

#Crypto #Bitcoin $BTC

BTC3,62%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

63.41K Popularity

242 Popularity

188 Popularity

48.5K Popularity

72 Popularity

137.7K Popularity

224.56K Popularity

12.8K Popularity

76 Popularity

60 Popularity

64 Popularity

68 Popularity

76 Popularity

29.96K Popularity

News

View Morea16z Advisor: Predicts that only 1.3% of political contracts in the market have liquidity, recommends introducing AI agents to provide liquidity

8 m

ENS (Ethereum Name Service) increased by 15.55% in the past 24 hours

25 m

Bitcoin Treasury Company Hyperscale Data Plans to Issue Preferred Shares to Raise $35.4 Million

26 m

Two of Trump's "long-term allies" sued collectively by investors over "Patriot Pay" tokens

28 m

Gate DEX contract launches the "Valentine's On-Chain Date" event, sharing a prize pool of 20,000 USDT

39 m

Pin