# BTC

37.69M

Dark_Angel

📉⚡ #BuyTheDipOrWaitNow

BTC: 66,501.8 (-0.60%)

Mark Price: 66,503.1

Index: 66,531.2

24H High: 68,385.9

24H Low: 65,068.0

24H Turnover: 6.98B USDT

Open Interest: 64.08K BTC

Funding Rate: +0.0016%

Bitcoin is sitting near mid-range support after tapping 65K lows.

Volatility is active. Liquidity is rotating. The big question:

🧠 Is This a Dip to Buy — or a Trap Before Lower?

🔎 Bullish Signals:

• Funding slightly positive → no extreme long overcrowding

• Strong 24H volume (6.98B USDT) → active participation

• Holding above 65K key support zone

⚠️ Bearish Risks:

• Failed to hold 68K momentum

• Lowe

BTC: 66,501.8 (-0.60%)

Mark Price: 66,503.1

Index: 66,531.2

24H High: 68,385.9

24H Low: 65,068.0

24H Turnover: 6.98B USDT

Open Interest: 64.08K BTC

Funding Rate: +0.0016%

Bitcoin is sitting near mid-range support after tapping 65K lows.

Volatility is active. Liquidity is rotating. The big question:

🧠 Is This a Dip to Buy — or a Trap Before Lower?

🔎 Bullish Signals:

• Funding slightly positive → no extreme long overcrowding

• Strong 24H volume (6.98B USDT) → active participation

• Holding above 65K key support zone

⚠️ Bearish Risks:

• Failed to hold 68K momentum

• Lowe

BTC-1,23%

- Reward

- 4

- 8

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

#BuyTheDipOrWaitNow? – The Complete Crypto Dip Guide

Crypto dips spark the same question for every trader: “Is this the dip to buy, or should I wait?” The reality is, timing the market bottom is extremely difficult — even seasoned traders often miss it.

Here’s a structured approach to navigate dips strategically:

1️⃣ Market Cycles & Capital Rotation

BTC leads, absorbing institutional capital and setting market direction.

Large-cap altcoins (ETH, SOL, ADA) follow with amplified moves.

Mid/low-cap altcoins are highly speculative; expect rapid swings.

Current context: BTC $66,120 (24h vol ~$35B,

Crypto dips spark the same question for every trader: “Is this the dip to buy, or should I wait?” The reality is, timing the market bottom is extremely difficult — even seasoned traders often miss it.

Here’s a structured approach to navigate dips strategically:

1️⃣ Market Cycles & Capital Rotation

BTC leads, absorbing institutional capital and setting market direction.

Large-cap altcoins (ETH, SOL, ADA) follow with amplified moves.

Mid/low-cap altcoins are highly speculative; expect rapid swings.

Current context: BTC $66,120 (24h vol ~$35B,

- Reward

- 6

- 6

- Repost

- Share

ybaser :

:

LFG 🔥View More

Bitcoin Market Analysis

Bitcoin market shows mixed momentum 📈📉

Key levels are being tested as volatility builds.

What’s your BTC outlook from here?

#BitcoinAnalysis #BTC #MarketWatch

Bitcoin market shows mixed momentum 📈📉

Key levels are being tested as volatility builds.

What’s your BTC outlook from here?

#BitcoinAnalysis #BTC #MarketWatch

BTC-1,23%

- Reward

- 1

- Comment

- Repost

- Share

the bottom in or are we just catching a falling knife? 📉

Bitcoin has pulled back significantly from its 2025 highs, but long-term data shows a “reset” rather than a “crash.” While the Fear & Greed Index is in the single digits, institutional accumulation hasn’t stopped.

All eyes on the $65,000 support zone. If this level holds, the rebound could be legendary.

What’s your move: Buying the dip or waiting for $60k? 👇

#BTC #CryptoMarket #Gateio #BuyTheDip

$BTC #GateSquare$50KRedPacketGiveaway

Bitcoin has pulled back significantly from its 2025 highs, but long-term data shows a “reset” rather than a “crash.” While the Fear & Greed Index is in the single digits, institutional accumulation hasn’t stopped.

All eyes on the $65,000 support zone. If this level holds, the rebound could be legendary.

What’s your move: Buying the dip or waiting for $60k? 👇

#BTC #CryptoMarket #Gateio #BuyTheDip

$BTC #GateSquare$50KRedPacketGiveaway

BTC-1,23%

- Reward

- like

- Comment

- Repost

- Share

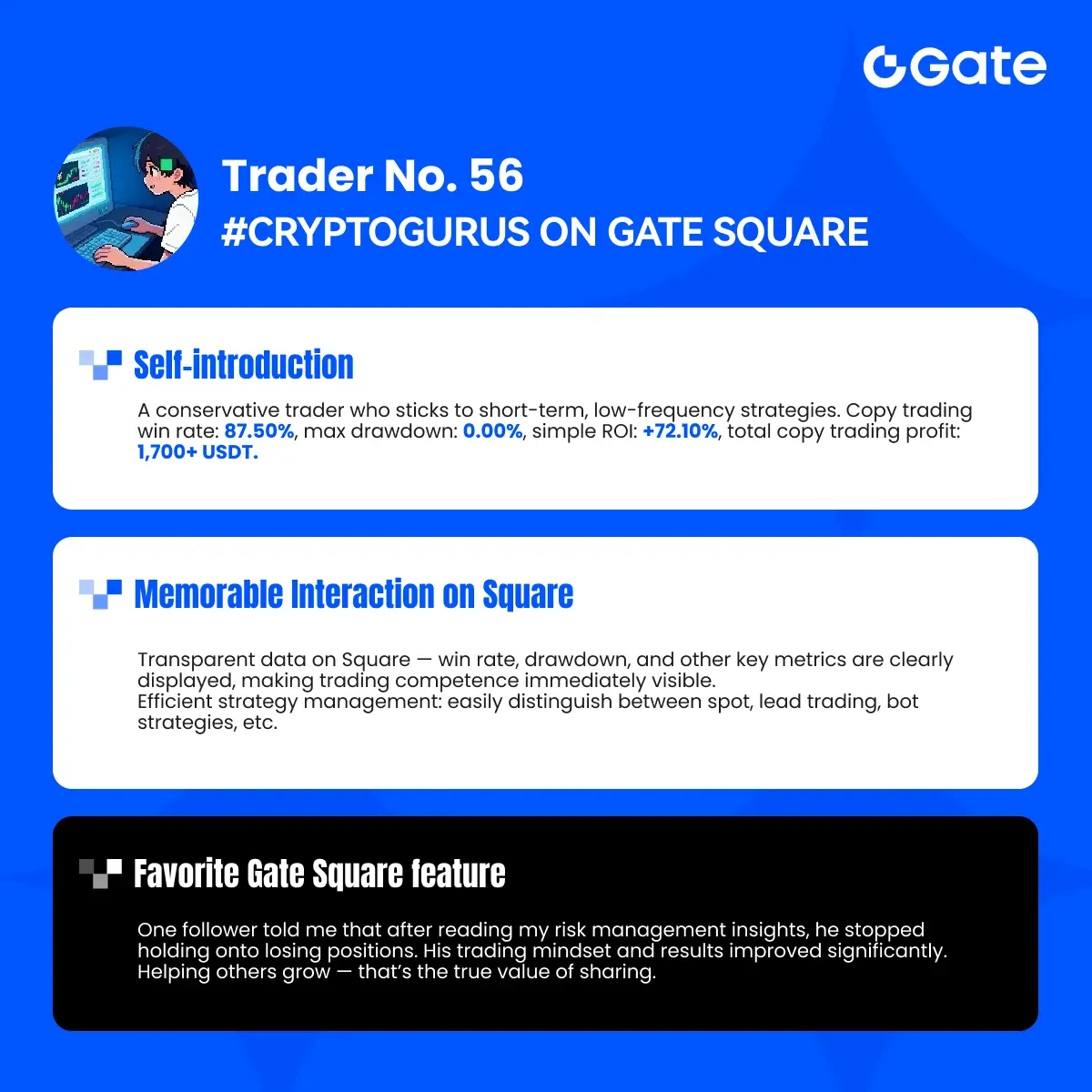

#CryptoGurusOnGateSquare – Episode 4

Today we talk about Trader No. 56.

Short-term.

Low-frequency.

Conservative.

Simple ROI: +72.10%

Copy trading profit: 1,700+ USDT

Win rate: 87.50%

Most people will look at the 87.50% win rate and clap.

I won’t.

Because high win rate means nothing if risk management is trash.

But this trader proves something more important — discipline beats excitement.

Let’s break it down like professionals.

He is not overtrading.

He is not chasing every pump.

He is not revenge trading after losses.

Low frequency means patience.

Short-term means controlled exposure.

Conserva

Today we talk about Trader No. 56.

Short-term.

Low-frequency.

Conservative.

Simple ROI: +72.10%

Copy trading profit: 1,700+ USDT

Win rate: 87.50%

Most people will look at the 87.50% win rate and clap.

I won’t.

Because high win rate means nothing if risk management is trash.

But this trader proves something more important — discipline beats excitement.

Let’s break it down like professionals.

He is not overtrading.

He is not chasing every pump.

He is not revenge trading after losses.

Low frequency means patience.

Short-term means controlled exposure.

Conserva

- Reward

- 2

- 1

- Repost

- Share

repanzal :

:

thank you for information about crypto- Reward

- 1

- 4

- Repost

- Share

GateUser-9a01c836 :

:

happy new yearView More

📊 Bitcoin risk-reward has shifted after recent selloff: on-chain analyst

Bitcoin’s recent price decline has prompted market analysts to assess whether a price floor is forming, with one prominent on-chain researcher stating the risk-reward profile has shifted following the selloff.

James “Checkmate” Check, a former lead researcher at Glassnode and author of Check On Chain, told What Bitcoin Did host Danny Knowles that Bitcoin entered “deep value” territory across multiple mean-reversion frameworks when it dropped into recent price zones, according to statements made on the podcast. Check note

Bitcoin’s recent price decline has prompted market analysts to assess whether a price floor is forming, with one prominent on-chain researcher stating the risk-reward profile has shifted following the selloff.

James “Checkmate” Check, a former lead researcher at Glassnode and author of Check On Chain, told What Bitcoin Did host Danny Knowles that Bitcoin entered “deep value” territory across multiple mean-reversion frameworks when it dropped into recent price zones, according to statements made on the podcast. Check note

BTC-1,23%

- Reward

- like

- Comment

- Repost

- Share

Digital Financial Market Overview in the Last 24 Hours, as of the morning of February 13, 2026:

📉 Market Overview: Bitcoin Struggling to Find Support After Strong Volatility

The cryptocurrency market in the last 24 hours witnessed significant volatility as Bitcoin (BTC) fluctuated within a wide range, reflecting the cautious sentiment of investors ahead of new economic data.

1. Bitcoin (BTC): Fluctuating Around $66K

24-Hour Volatility: BTC had a turbulent trading day, sweeping through price ranges from a low of $65,110 to a high of $68,400.

Current Status: Entering this morning (February 13),

📉 Market Overview: Bitcoin Struggling to Find Support After Strong Volatility

The cryptocurrency market in the last 24 hours witnessed significant volatility as Bitcoin (BTC) fluctuated within a wide range, reflecting the cautious sentiment of investors ahead of new economic data.

1. Bitcoin (BTC): Fluctuating Around $66K

24-Hour Volatility: BTC had a turbulent trading day, sweeping through price ranges from a low of $65,110 to a high of $68,400.

Current Status: Entering this morning (February 13),

- Reward

- like

- Comment

- Repost

- Share

The market has just gone through a major liquidation in months.

It seems like it's time to reset the game. #BTC may fall even further to attract more new players into the market.

When the market goes down, it lasts for weeks or even months, but when it rises again, it's very quick. Only buy BTC, ETH, or assets like exchange coins when the price is falling. The game is still there, and crypto will certainly continue to grow; however, only your money will either stay or be lost over time.

$BTC

It seems like it's time to reset the game. #BTC may fall even further to attract more new players into the market.

When the market goes down, it lasts for weeks or even months, but when it rises again, it's very quick. Only buy BTC, ETH, or assets like exchange coins when the price is falling. The game is still there, and crypto will certainly continue to grow; however, only your money will either stay or be lost over time.

$BTC

BTC-1,23%

- Reward

- like

- Comment

- Repost

- Share

📈💼 #NFPBeatsExpectations

The latest Non-Farm Payroll (NFP) report has beat expectations, showing stronger-than-anticipated job growth in the U.S. economy.

🔎 Market Implications:

• Strong employment → potential for higher interest rates

• Risk assets like crypto and stocks may face short-term pressure

• USD strength could increase, impacting BTC and altcoin liquidity

📊 Key Levels to Watch:

• BTC Support: $67K – $68K

• BTC Resistance: $70K – $71K

• Altcoins: Watch for correlated volatility

💡 Trading Tip:

NFP surprises often trigger sharp price swings. Keep positions sized properly and watch

The latest Non-Farm Payroll (NFP) report has beat expectations, showing stronger-than-anticipated job growth in the U.S. economy.

🔎 Market Implications:

• Strong employment → potential for higher interest rates

• Risk assets like crypto and stocks may face short-term pressure

• USD strength could increase, impacting BTC and altcoin liquidity

📊 Key Levels to Watch:

• BTC Support: $67K – $68K

• BTC Resistance: $70K – $71K

• Altcoins: Watch for correlated volatility

💡 Trading Tip:

NFP surprises often trigger sharp price swings. Keep positions sized properly and watch

BTC-1,23%

- Reward

- 7

- 9

- Repost

- Share

AYATTAC :

:

LFG 🔥View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

44.31K Popularity

71.5K Popularity

16.65K Popularity

42.99K Popularity

255.58K Popularity

192.08K Popularity

9.31K Popularity

7.56K Popularity

5.56K Popularity

7.01K Popularity

122.53K Popularity

27.98K Popularity

24.16K Popularity

9.3K Popularity

4.42K Popularity

News

View MoreU.S. listed tokenized gold company Aurelion approved for 1-for-10 reverse stock split

2 m

Data: Over the past 24 hours, the entire network has been liquidated by $202 million, with long positions liquidated by $145 million.

4 m

Telegram founder: Has provided Bot API for developers of chatbots and mini-programs

12 m

The Trump administration is preparing to nominate Jerome Powell as Federal Reserve Chair.

23 m

Jiuzi Holdings receives $60 million investment, to be injected in the form of equivalent cryptocurrency assets

46 m

Pin