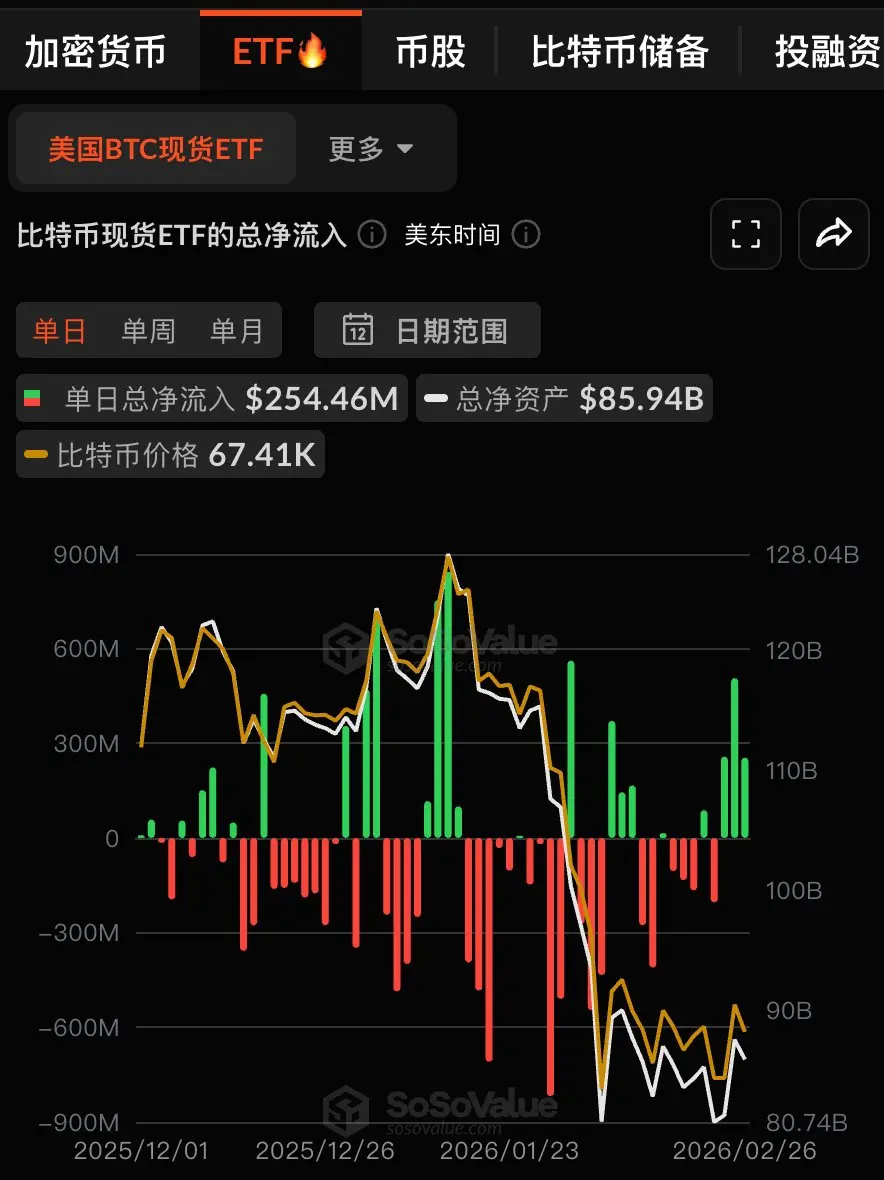

Bitcoin and Ethereum Spot ETFs Experience Net Inflows for Three Consecutive Days

Bitcoin Spot ETF

· Single-day total net inflow: $254 million (net inflow for 3 consecutive days)

· Highest net inflow: BlackRock IBIT, $276 million

· Total assets under management: $85.937 billion

· Cumulative net inflow: $54.828 billion

Ethereum Spot ETF

· Single-day total net inflow: $6.5742 million (net inflow for 3 consecutive days)

· Highest net inflow: BlackRock ETHA, $15.3368 million

· Total assets under management: $11.599 billion

· Cumulative net inflow: $11.648 billion

#BTC #ETH #ETF

Bitcoin Spot ETF

· Single-day total net inflow: $254 million (net inflow for 3 consecutive days)

· Highest net inflow: BlackRock IBIT, $276 million

· Total assets under management: $85.937 billion

· Cumulative net inflow: $54.828 billion

Ethereum Spot ETF

· Single-day total net inflow: $6.5742 million (net inflow for 3 consecutive days)

· Highest net inflow: BlackRock ETHA, $15.3368 million

· Total assets under management: $11.599 billion

· Cumulative net inflow: $11.648 billion

#BTC #ETH #ETF