#FranklinAdvancesTokenizedMMFs

Institutional Finance Meets Blockchain

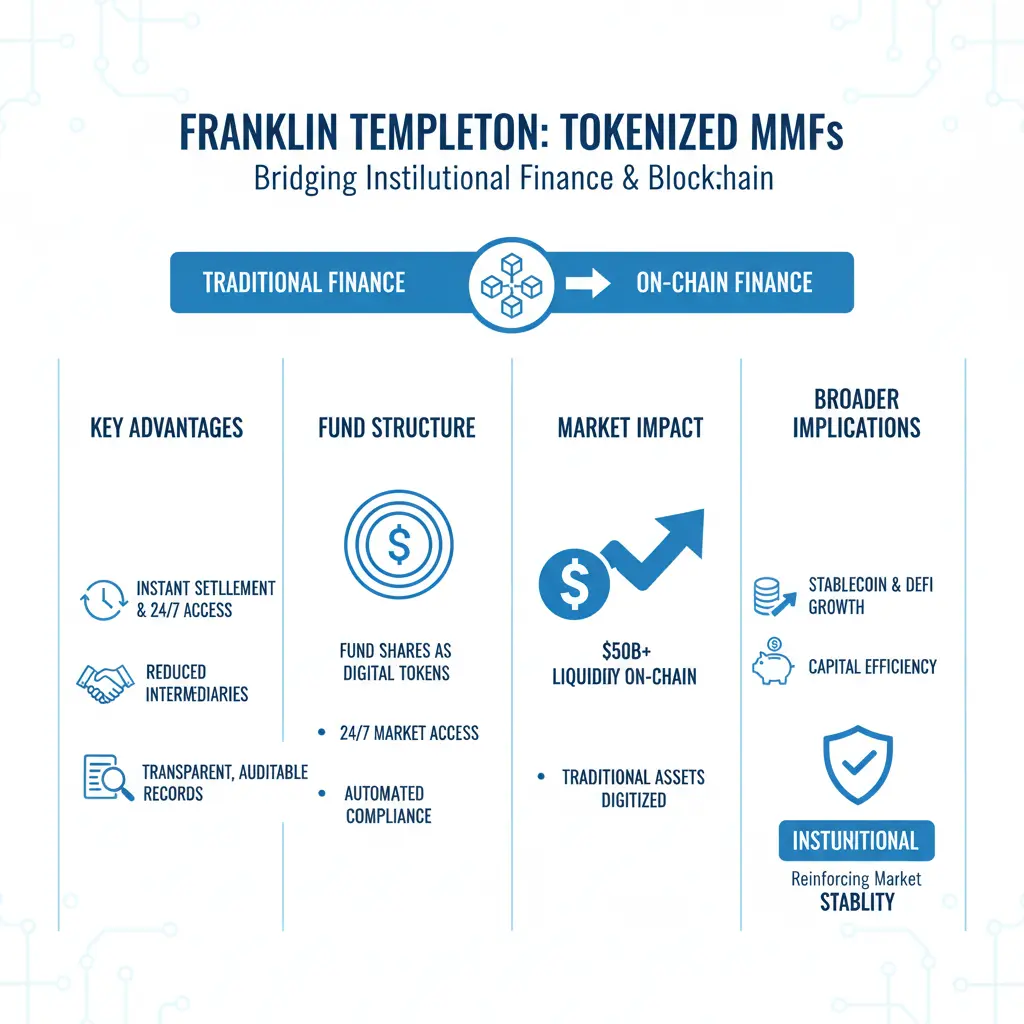

Franklin Templeton’s expansion of tokenized Money Market Funds (MMFs) represents a pivotal moment in institutional adoption of blockchain technology. This isn’t just digital novelty—it signals the integration of legacy finance into on-chain ecosystems, creating tangible, high-liquidity bridges between traditional capital and crypto markets.

1️⃣ Blockchain-Based MMF Expansion

Franklin Templeton is deploying its MMFs on distributed ledger infrastructure, replacing traditional T+1/T+2 settlement cycles with instant, transparent, on-chain operations.

Key Benefits:

Real-time settlement: Investor transactions occur instantly, boosting liquidity.

Reduced intermediaries: Less reliance on banks or custodians.

Transparent audit trails: On-chain data ensures full accountability.

Fractional ownership: Even smaller investors can participate efficiently.

Market Implication:

This on-chain efficiency could unlock $50B–$150B in institutional liquidity initially, with the potential to scale into the hundreds of billions as adoption grows.

2️⃣ Fund Shares as Digital Tokens

Tokenization converts fund shares into blockchain-based assets, giving investors:

24/7 accessibility

Near-instant transfers

Automated compliance via smart contracts

This reduces operational bottlenecks, lowers costs (~0.1–0.2% fee efficiency gain per transaction vs legacy), and modernizes the MMF model for digital finance.

Volume & Price Impact:

On-chain MMF transfers can generate $10–15B daily transaction volume for major networks like Ethereum.

Stable, low-risk inflows support price stability for BTC, ETH, and regulated stablecoins by absorbing short-term volatility.

3️⃣ Traditional Finance Moves On-Chain

By tokenizing MMFs, Franklin Templeton bridges low-risk, high-liquidity capital markets with blockchain ecosystems. Institutional investors now gain a secure, regulated entry into DeFi and digital assets.

Market Effects:

Liquidity: Even a 1% allocation from the $5T+ U.S. MMF market could increase on-chain liquidity by $50B.

Network Depth: Higher liquidity strengthens order books, reduces spreads, and improves market efficiency.

Volatility Dampening: Large, low-risk capital inflows reduce speculative swings, indirectly stabilizing crypto prices.

4️⃣ Stablecoin and DeFi Dynamics

Tokenized MMFs compete with or complement stablecoins, offering regulated, yield-bearing alternatives.

Could boost demand for USDC, USDT, and other institutional-grade stablecoins.

DeFi protocols may see 10–20% additional liquidity inflows, improving lending, staking, and yield farming efficiency.

5️⃣ Institutional Confidence & Market Structure

Seeing respected institutions like Franklin tokenizing MMFs signals credibility for digital assets.

Encourages cautious institutional entry, further stabilizing crypto markets.

Expected gradual BTC/ETH price support of 3–6% in mid-term from liquidity absorption and on-chain institutional flows.

6️⃣ Strategic & Long-Term Significance

Tokenized MMFs are a blueprint for hybrid finance, combining regulated capital with blockchain efficiency.

Supports sustainable ecosystem growth, stronger liquidity, and predictable volume.

Encourages other asset managers to explore on-chain offerings, potentially tripling institutional capital inflow in 2–3 years.

💡 Key Takeaways

Franklin Templeton is modernizing MMFs via blockchain.

Tokenized shares improve settlement speed, efficiency, and transparency.

Institutional capital inflows deepen liquidity, stabilize markets, and enhance network reliability.

Stablecoins and DeFi benefit indirectly from predictable, low-risk inflows.

Long-term structure reduces volatility, fostering broader adoption of digital finance.

Final Reflection:

This move shows blockchain and institutional finance are converging. Tokenized MMFs don’t just increase volume—they stabilize markets, improve liquidity, and create professional-grade, high-confidence capital flows. The impact is structural, not speculative, and signals a maturing crypto ecosystem.

Institutional Finance Meets Blockchain

Franklin Templeton’s expansion of tokenized Money Market Funds (MMFs) represents a pivotal moment in institutional adoption of blockchain technology. This isn’t just digital novelty—it signals the integration of legacy finance into on-chain ecosystems, creating tangible, high-liquidity bridges between traditional capital and crypto markets.

1️⃣ Blockchain-Based MMF Expansion

Franklin Templeton is deploying its MMFs on distributed ledger infrastructure, replacing traditional T+1/T+2 settlement cycles with instant, transparent, on-chain operations.

Key Benefits:

Real-time settlement: Investor transactions occur instantly, boosting liquidity.

Reduced intermediaries: Less reliance on banks or custodians.

Transparent audit trails: On-chain data ensures full accountability.

Fractional ownership: Even smaller investors can participate efficiently.

Market Implication:

This on-chain efficiency could unlock $50B–$150B in institutional liquidity initially, with the potential to scale into the hundreds of billions as adoption grows.

2️⃣ Fund Shares as Digital Tokens

Tokenization converts fund shares into blockchain-based assets, giving investors:

24/7 accessibility

Near-instant transfers

Automated compliance via smart contracts

This reduces operational bottlenecks, lowers costs (~0.1–0.2% fee efficiency gain per transaction vs legacy), and modernizes the MMF model for digital finance.

Volume & Price Impact:

On-chain MMF transfers can generate $10–15B daily transaction volume for major networks like Ethereum.

Stable, low-risk inflows support price stability for BTC, ETH, and regulated stablecoins by absorbing short-term volatility.

3️⃣ Traditional Finance Moves On-Chain

By tokenizing MMFs, Franklin Templeton bridges low-risk, high-liquidity capital markets with blockchain ecosystems. Institutional investors now gain a secure, regulated entry into DeFi and digital assets.

Market Effects:

Liquidity: Even a 1% allocation from the $5T+ U.S. MMF market could increase on-chain liquidity by $50B.

Network Depth: Higher liquidity strengthens order books, reduces spreads, and improves market efficiency.

Volatility Dampening: Large, low-risk capital inflows reduce speculative swings, indirectly stabilizing crypto prices.

4️⃣ Stablecoin and DeFi Dynamics

Tokenized MMFs compete with or complement stablecoins, offering regulated, yield-bearing alternatives.

Could boost demand for USDC, USDT, and other institutional-grade stablecoins.

DeFi protocols may see 10–20% additional liquidity inflows, improving lending, staking, and yield farming efficiency.

5️⃣ Institutional Confidence & Market Structure

Seeing respected institutions like Franklin tokenizing MMFs signals credibility for digital assets.

Encourages cautious institutional entry, further stabilizing crypto markets.

Expected gradual BTC/ETH price support of 3–6% in mid-term from liquidity absorption and on-chain institutional flows.

6️⃣ Strategic & Long-Term Significance

Tokenized MMFs are a blueprint for hybrid finance, combining regulated capital with blockchain efficiency.

Supports sustainable ecosystem growth, stronger liquidity, and predictable volume.

Encourages other asset managers to explore on-chain offerings, potentially tripling institutional capital inflow in 2–3 years.

💡 Key Takeaways

Franklin Templeton is modernizing MMFs via blockchain.

Tokenized shares improve settlement speed, efficiency, and transparency.

Institutional capital inflows deepen liquidity, stabilize markets, and enhance network reliability.

Stablecoins and DeFi benefit indirectly from predictable, low-risk inflows.

Long-term structure reduces volatility, fostering broader adoption of digital finance.

Final Reflection:

This move shows blockchain and institutional finance are converging. Tokenized MMFs don’t just increase volume—they stabilize markets, improve liquidity, and create professional-grade, high-confidence capital flows. The impact is structural, not speculative, and signals a maturing crypto ecosystem.