#WhiteHouseTalksStablecoinYields

#WhiteHouseTalksStablecoinYields:

💥 White House Talks Stablecoin Yields — Crypto Market Alert 🚨

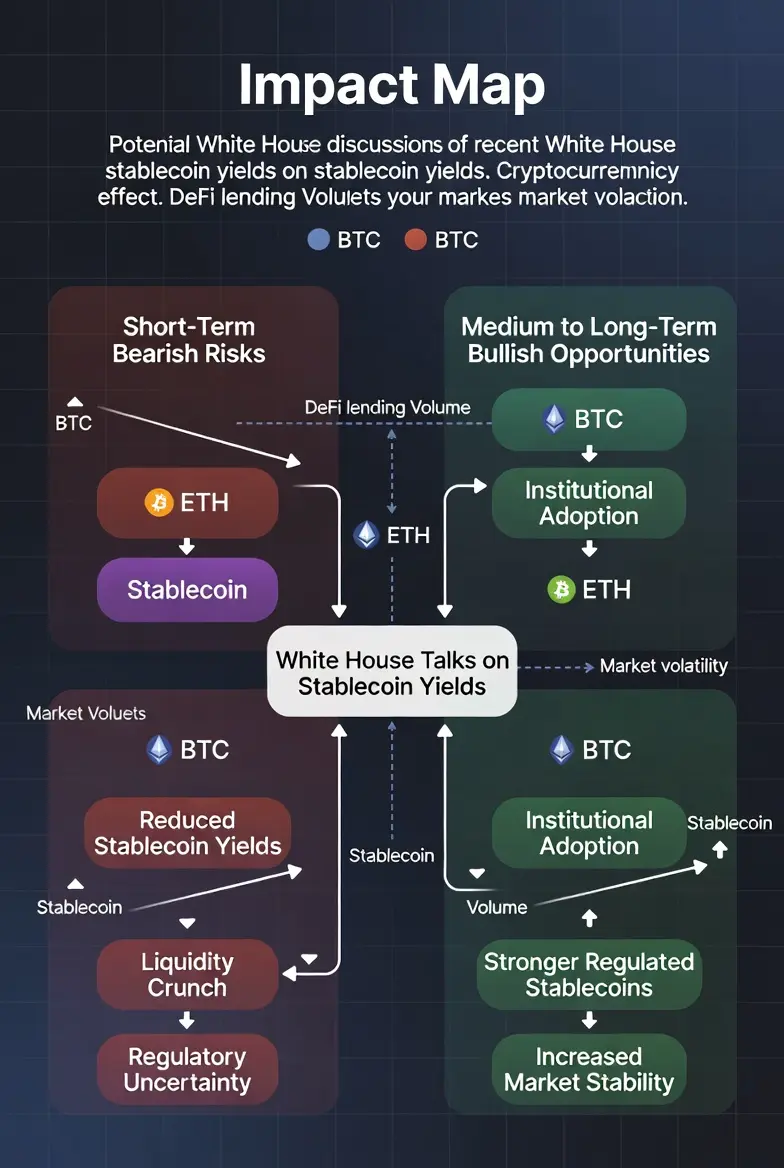

The White House is reviewing stablecoin yields — the interest paid on USD-backed coins like USDC and USDT. This isn’t just policy talk; it could shake DeFi, crypto liquidity, and market sentiment globally.

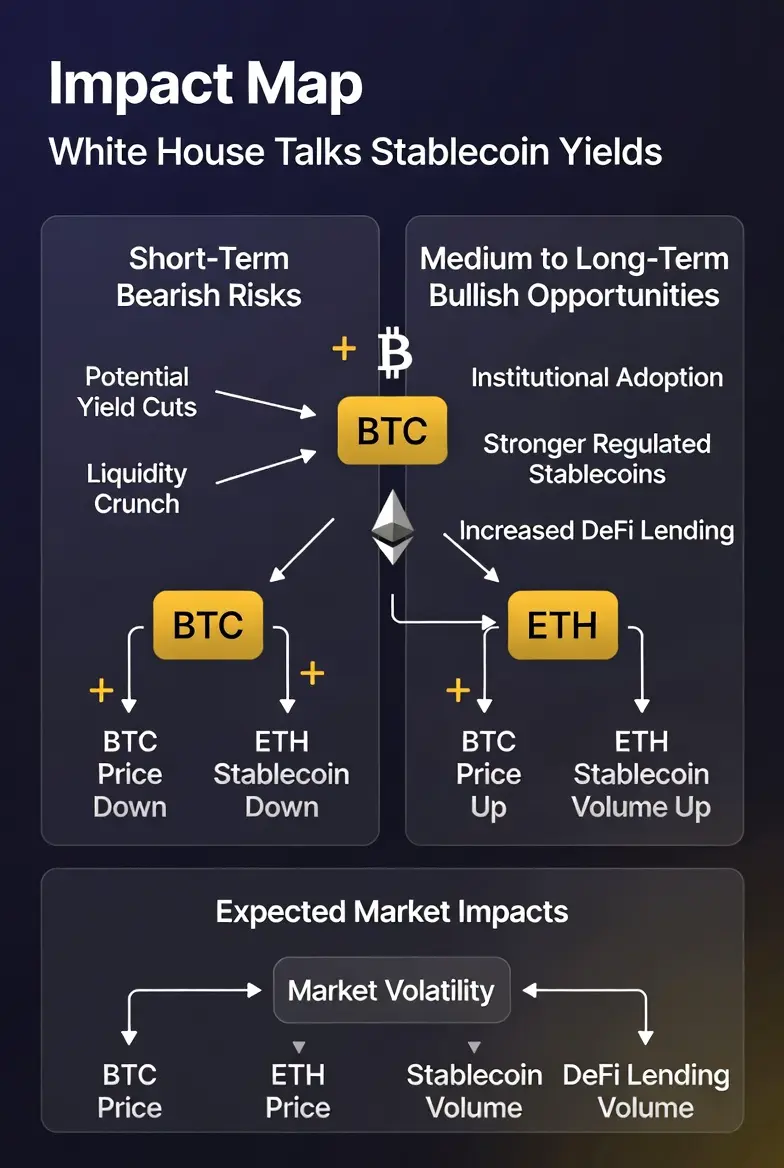

🔴 Bearish Risks — Short-Term Headwinds

Yield Cuts: If rules limit APY, platforms could reduce 5–8% returns. Expect USDC/USDT outflows → 5–10% temporary drop in trading volumes on stablecoin-heavy DeFi pools.

Liquidity Crunch: Less capital in lending/borrowing → wider spreads, slower trading execution, volatility could spike 3–8% in BTC/ETH short-term as traders reposition.

KYC & Compliance Pressure: Stricter verification may reduce retail participation → stablecoin transfers and DeFi activity may fall 10–15% temporarily.

🟢 Bullish Opportunities — Medium to Long-Term Gains

Institutional Adoption: Clear rules make stablecoins safe for banks, hedge funds, and pension funds → could inject $10B+ inflows into crypto markets in 1–3 months.

Stronger USDC & Regulated Coins: Could become the global digital dollar, driving higher stablecoin liquidity across exchanges and lending platforms (+15–20% on-chain volume).

Trust Banks & Regulated Issuers: Combining bank safety with blockchain speed → safer, faster settlements, indirectly supporting BTC/ETH price stability and growth (+3–8% potential medium-term).

⚡ Market Impact — Numbers You Should Know

Metric

Expected Short-Term

Expected Medium-Term

Notes

BTC Price

±3–5% swings

+3–8% potential rally

Driven by stablecoin collateral flows & DeFi liquidity

ETH Price

±4–7% swings

+4–10% potential surge

Higher beta, more sensitive to stablecoin liquidity

Stablecoin Volume

-5–15%

+15–20%

Short-term outflows, long-term adoption inflows

DeFi Lending Volume

-7–12%

+12–25%

Yield rules directly affect liquidity availability

Market Volatility

+3–8%

Reduced

Short-term spike, longer-term stabilization

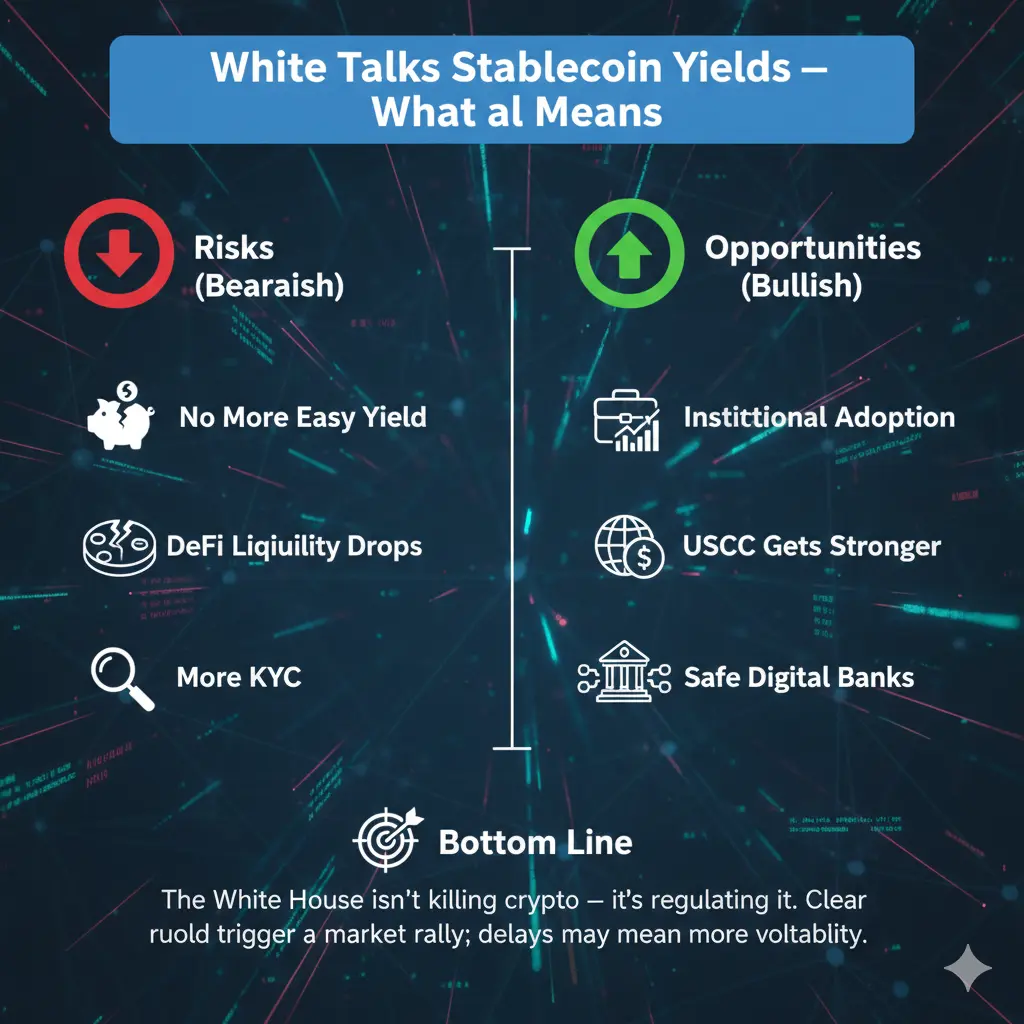

🎯 Bottom Line

Short-Term: Expect panic, dips, and volatile swings as markets digest regulatory news. Yield cuts may temporarily reduce stablecoin demand.

Medium-to-Long-Term: Clear rules = legitimacy → institutional inflows, stronger liquidity, deeper markets, bullish pressure on BTC, ETH, and DeFi.

Trader Tip: Watch USDC/USDT yields, DeFi lending volumes, and institutional participation — these are now major market catalysts.

💡 Pro Insight: Retail fear often drives short-term dips (3–8%), but institutions quietly stacking could push BTC/ETH higher once regulatory clarity hits.

#WhiteHouseTalksStablecoinYields:

💥 White House Talks Stablecoin Yields — Crypto Market Alert 🚨

The White House is reviewing stablecoin yields — the interest paid on USD-backed coins like USDC and USDT. This isn’t just policy talk; it could shake DeFi, crypto liquidity, and market sentiment globally.

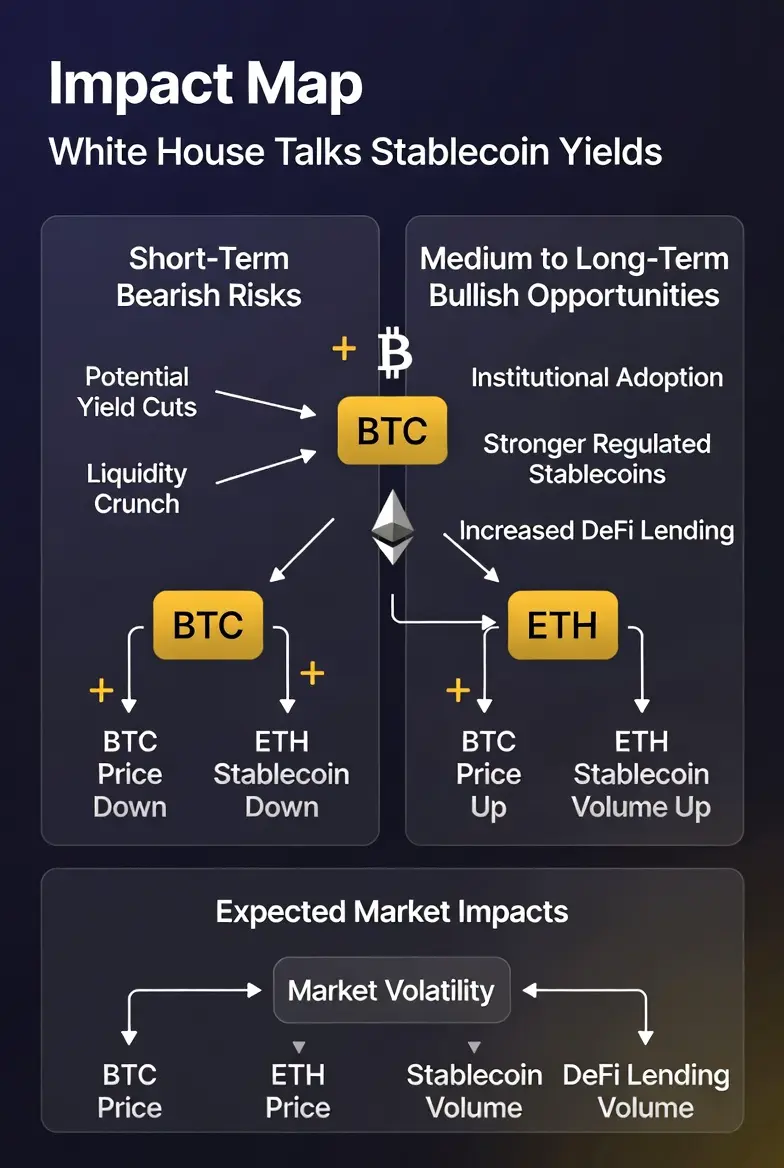

🔴 Bearish Risks — Short-Term Headwinds

Yield Cuts: If rules limit APY, platforms could reduce 5–8% returns. Expect USDC/USDT outflows → 5–10% temporary drop in trading volumes on stablecoin-heavy DeFi pools.

Liquidity Crunch: Less capital in lending/borrowing → wider spreads, slower trading execution, volatility could spike 3–8% in BTC/ETH short-term as traders reposition.

KYC & Compliance Pressure: Stricter verification may reduce retail participation → stablecoin transfers and DeFi activity may fall 10–15% temporarily.

🟢 Bullish Opportunities — Medium to Long-Term Gains

Institutional Adoption: Clear rules make stablecoins safe for banks, hedge funds, and pension funds → could inject $10B+ inflows into crypto markets in 1–3 months.

Stronger USDC & Regulated Coins: Could become the global digital dollar, driving higher stablecoin liquidity across exchanges and lending platforms (+15–20% on-chain volume).

Trust Banks & Regulated Issuers: Combining bank safety with blockchain speed → safer, faster settlements, indirectly supporting BTC/ETH price stability and growth (+3–8% potential medium-term).

⚡ Market Impact — Numbers You Should Know

Metric

Expected Short-Term

Expected Medium-Term

Notes

BTC Price

±3–5% swings

+3–8% potential rally

Driven by stablecoin collateral flows & DeFi liquidity

ETH Price

±4–7% swings

+4–10% potential surge

Higher beta, more sensitive to stablecoin liquidity

Stablecoin Volume

-5–15%

+15–20%

Short-term outflows, long-term adoption inflows

DeFi Lending Volume

-7–12%

+12–25%

Yield rules directly affect liquidity availability

Market Volatility

+3–8%

Reduced

Short-term spike, longer-term stabilization

🎯 Bottom Line

Short-Term: Expect panic, dips, and volatile swings as markets digest regulatory news. Yield cuts may temporarily reduce stablecoin demand.

Medium-to-Long-Term: Clear rules = legitimacy → institutional inflows, stronger liquidity, deeper markets, bullish pressure on BTC, ETH, and DeFi.

Trader Tip: Watch USDC/USDT yields, DeFi lending volumes, and institutional participation — these are now major market catalysts.

💡 Pro Insight: Retail fear often drives short-term dips (3–8%), but institutions quietly stacking could push BTC/ETH higher once regulatory clarity hits.