JakeO

No content yet

JakeO

Feels apt….

- Reward

- like

- Comment

- Repost

- Share

Genuine question: why does everyone believe crypto bottoms when metals top?

- Reward

- like

- Comment

- Repost

- Share

With central bank independence now a live political/legal battle, every print - especially inflation, becomes a test of whether the Fed can actually respond to the data.

Hot inflation + compromised Fed = unanchored expectations.

Median Estimates for today:

Headline: 2.7%

Core: 2.7%

Trump + the DOJ have made CPI prints great again.

Hot inflation + compromised Fed = unanchored expectations.

Median Estimates for today:

Headline: 2.7%

Core: 2.7%

Trump + the DOJ have made CPI prints great again.

- Reward

- like

- Comment

- Repost

- Share

It's worth getting familiar with the CLARITY Act as I expect it becomes an important narrative early Q1.

The bill passed the House in July but stalled in the Senate. Sacks confirmed a Jan markup is coming, but three issues remain unresolved: DeFi treatment, stablecoin yield, and Trump family ethics provisions.

Consensus is that April is the last realistic deadline for a Senate floor vote (before midterm politics take over) and for that to happen - the markup needs to be agreed by the SEC + CFTC by the end of Jan. This likely gets politicised so expect headlines throughout the month as things p

The bill passed the House in July but stalled in the Senate. Sacks confirmed a Jan markup is coming, but three issues remain unresolved: DeFi treatment, stablecoin yield, and Trump family ethics provisions.

Consensus is that April is the last realistic deadline for a Senate floor vote (before midterm politics take over) and for that to happen - the markup needs to be agreed by the SEC + CFTC by the end of Jan. This likely gets politicised so expect headlines throughout the month as things p

- Reward

- like

- Comment

- Repost

- Share

Powell's term ends May 15, 2026, but Bessent already floated the "shadow Fed chair" concept last year: announce early, make Powell a lame duck and let forward guidance work it's way through rates.

The announcement is expected this month (91% priced before Jan 30th) with Warsh + Hassett neck and neck.

The announcement is expected this month (91% priced before Jan 30th) with Warsh + Hassett neck and neck.

- Reward

- like

- Comment

- Repost

- Share

Perps have undeniably found such strong PMF that they're directly impacting traditional markets.

This is a great discussion on what it takes to roll out these products on RWA's - worth a listen for anyone interested in micro structure challenges. Kudos @choffstein

This is a great discussion on what it takes to roll out these products on RWA's - worth a listen for anyone interested in micro structure challenges. Kudos @choffstein

- Reward

- like

- Comment

- Repost

- Share

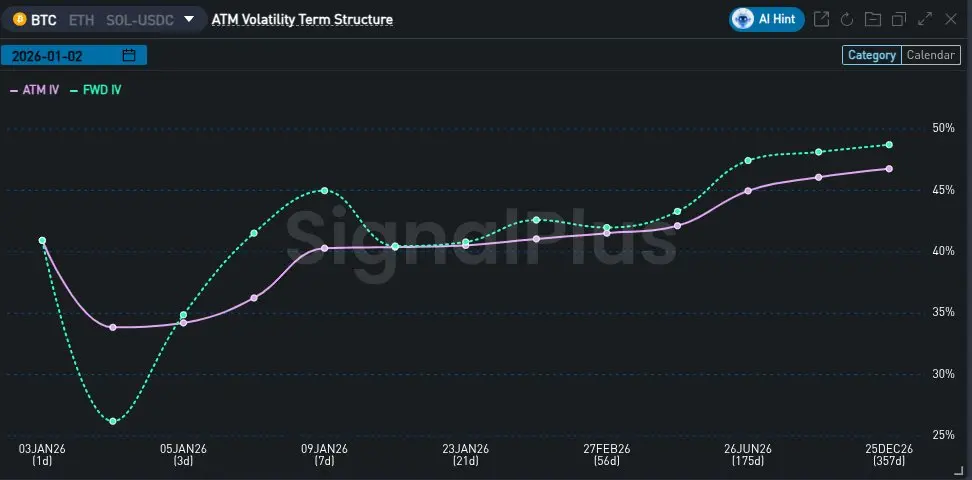

With the holiday calendar leaving 1 session before the weekend, most of the activity is expected later in the month.

Fronts are pricing a drop in fwd vol and momentum's hardly priced to re-emerge in the near term. There’s plenty of potential catalysts this month, however, including Fed chair announcement, Supreme court tariff ruling, MSCI’s Crypto stock index decision, FOMC meeting, government funding deadlines and Senate action on the CLARITY Act.

We look to these to re-ignite momentum as traders return from the holiday period with fresh books

Fronts are pricing a drop in fwd vol and momentum's hardly priced to re-emerge in the near term. There’s plenty of potential catalysts this month, however, including Fed chair announcement, Supreme court tariff ruling, MSCI’s Crypto stock index decision, FOMC meeting, government funding deadlines and Senate action on the CLARITY Act.

We look to these to re-ignite momentum as traders return from the holiday period with fresh books

- Reward

- like

- Comment

- Repost

- Share

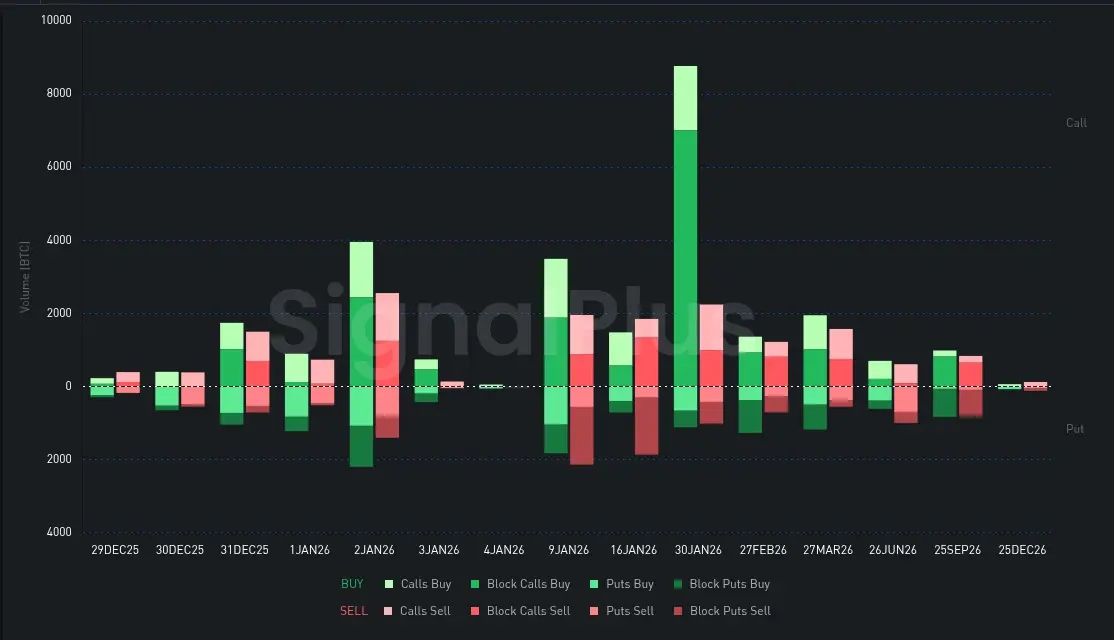

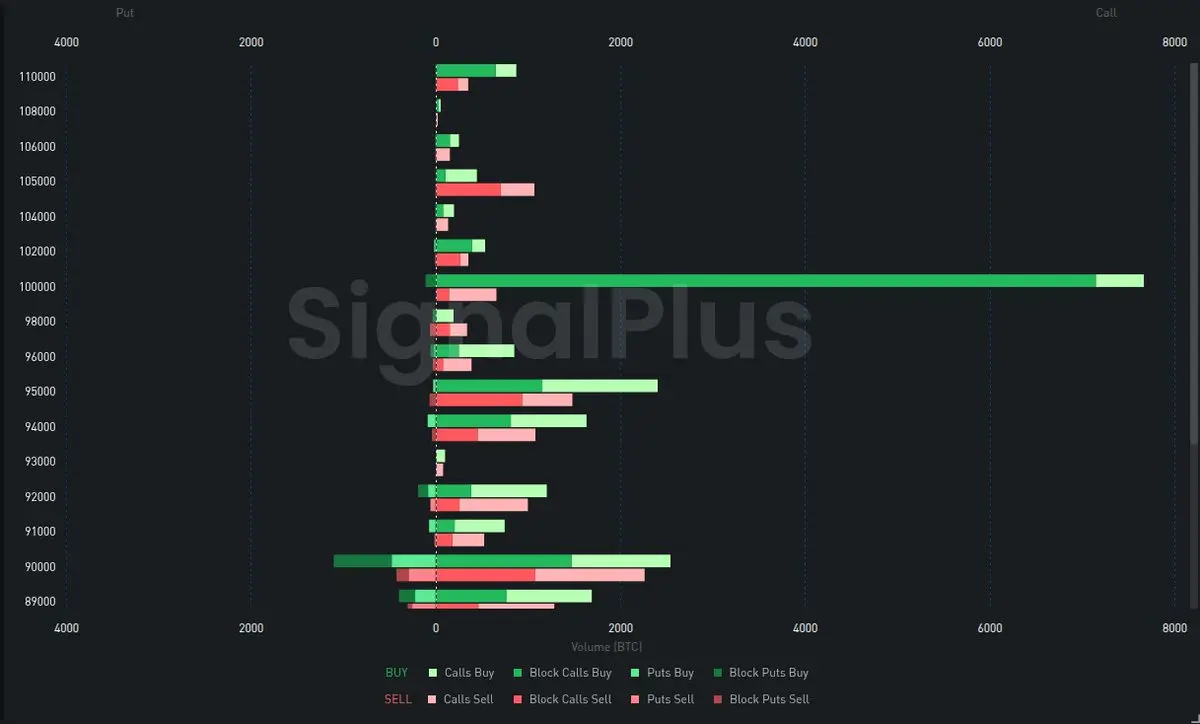

Directional desks just had P/L reset and will be looking at the market with a fresh pair of eyes. Since Dec OPEX, traders have been rolling structures with plenty of action in the $100k Jan30's where 6,300 calls have blocked.

At current spot these are ~15d. Not yet representative of huge notional but worth watching given the clear preference. Vol had tendency to lead the tape in 2025 and expect it to remain important.

At current spot these are ~15d. Not yet representative of huge notional but worth watching given the clear preference. Vol had tendency to lead the tape in 2025 and expect it to remain important.

- Reward

- like

- Comment

- Repost

- Share

Rollover trades have been dominating post-expiry volume in a very slow market.

Signal to noise here is trash and will be until liquidity normalises. Avoid over-indexing flow data right now: 99.9% is noise.

Happy NYE!

Signal to noise here is trash and will be until liquidity normalises. Avoid over-indexing flow data right now: 99.9% is noise.

Happy NYE!

- Reward

- like

- Comment

- Repost

- Share

FWIW, I don't think tax-loss harvesting has been a major driver of PA in alts. Yes, there are plenty of harvestable losses in majors/assets with ETF wrappers, but U.S. tax law doesn't yet apply the standard IRS wash sale rule (the 30-day repurchase limit) to Crypto directly.

Therefore TLH is essentially a round-trip trade: coins sold to realise loss, then re-bought in the same session. Assuming OBs are balanced the result is market neutral.

Therefore TLH is essentially a round-trip trade: coins sold to realise loss, then re-bought in the same session. Assuming OBs are balanced the result is market neutral.

- Reward

- like

- Comment

- Repost

- Share

The OCC letter from early-Dec has been re-circulating the last few days and allows banks to engage in "riskless principal" Crypto trades.

This flow differs from a prop desk. In plain English: a bank buys Crypto from Customer A and immediately offsets the position to an LP. The bank technically takes legal ownership for a split second (long enough to complete both legs of the trade) but never holds inventory or assumes price risk.

This is ultimately a broker model - economically they match buyers and sellers but cannot warehouse positions or run a prop book.

This flow differs from a prop desk. In plain English: a bank buys Crypto from Customer A and immediately offsets the position to an LP. The bank technically takes legal ownership for a split second (long enough to complete both legs of the trade) but never holds inventory or assumes price risk.

This is ultimately a broker model - economically they match buyers and sellers but cannot warehouse positions or run a prop book.

- Reward

- like

- Comment

- Repost

- Share

Hard to imagine fireworks this week - most institutional desks will remain quiet until Jan 1st where traders will start the year with a clean slate with plenty of catalysts to focus on. 2026 opens with:

- Fed Chair Announcement (Exp)

- Supreme Court Tariff Ruling (Exp)

- Clarity Act Mark-up (Exp)

- SLR requirements updated

- MSCI Crypto Stock Index Decision (15th)

- FOMC Meeting (28th)

- Government funding deadline (30th)

All this following tax-loss selling (narrative!), large OPEX and short sided positioning.

- Fed Chair Announcement (Exp)

- Supreme Court Tariff Ruling (Exp)

- Clarity Act Mark-up (Exp)

- SLR requirements updated

- MSCI Crypto Stock Index Decision (15th)

- FOMC Meeting (28th)

- Government funding deadline (30th)

All this following tax-loss selling (narrative!), large OPEX and short sided positioning.

- Reward

- like

- Comment

- Repost

- Share

There's been plenty of focus on today's $27B OPEX as if it's a catalyst for spot, but pre-expiry flows have been orderly all week, with rolls already shifting into 2026.

As with all these events, it's better viewed as a positioning reset & i'd rather focus on next year's positioning/shape of the surface to guide expectations.

As with all these events, it's better viewed as a positioning reset & i'd rather focus on next year's positioning/shape of the surface to guide expectations.

- Reward

- like

- Comment

- Repost

- Share

Most traders naturally become trend followers-especially at the mercenary end of the spectrum.

The fact that all three majors (BTC, ETH, SOL) are trading below their moving averages is enough for tourists to write them off. That said, the same logic applies in reverse: once these levels are regained, capital flows back systematically and momentum will return.

The fact that all three majors (BTC, ETH, SOL) are trading below their moving averages is enough for tourists to write them off. That said, the same logic applies in reverse: once these levels are regained, capital flows back systematically and momentum will return.

- Reward

- like

- Comment

- Repost

- Share

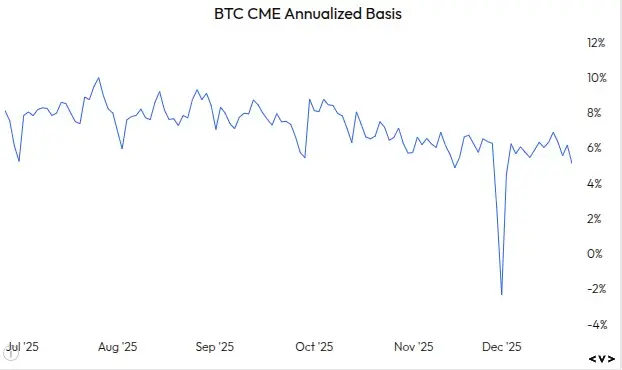

This is a direct reflection of the juice coming out of the basis trade.

Long ETF vs short CME futures annualised >10% at the beginning of the year vs ~5% today. This is close enough to risk free rates that the carry trader will throw in the towel….

Long ETF vs short CME futures annualised >10% at the beginning of the year vs ~5% today. This is close enough to risk free rates that the carry trader will throw in the towel….

- Reward

- like

- Comment

- Repost

- Share

This is a direct reflection of the juice coming out of the basis trade.

Long ETF vs short CME futures annualised >10% at the beginning of the year vs ~5% today. This is close to risk free rate and therefore the carry trader will leave….

Long ETF vs short CME futures annualised >10% at the beginning of the year vs ~5% today. This is close to risk free rate and therefore the carry trader will leave….

- Reward

- like

- Comment

- Repost

- Share

Say what you will about 2025, but the institutional shift has been undeniable... BlackRock now makes more from IBIT than any of its other 1,400 ETFs.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More219.52K Popularity

30.53K Popularity

14.13K Popularity

13.56K Popularity

6.41K Popularity

Pin