JunaidDar

No content yet

JunaidDar

🚨 US–Iran Tensions Escalating

Here’s what’s happening:

• The US is increasing its military presence in the Middle East

• Fighter jets, carriers, and missile systems are being positioned

• Nuclear talks with Iran are stalled

• Some officials warn action could come soon (not confirmed)

• Multiple countries have advised citizens to leave Iran

Market impact so far:

• Oil prices are rising

• Gold & Silver moving higher

• Stocks & Crypto showing weakness

If the situation escalates further, global markets could see sharp volatility.

Stay alert. Geopolitical risk is heating up. 🌍

Here’s what’s happening:

• The US is increasing its military presence in the Middle East

• Fighter jets, carriers, and missile systems are being positioned

• Nuclear talks with Iran are stalled

• Some officials warn action could come soon (not confirmed)

• Multiple countries have advised citizens to leave Iran

Market impact so far:

• Oil prices are rising

• Gold & Silver moving higher

• Stocks & Crypto showing weakness

If the situation escalates further, global markets could see sharp volatility.

Stay alert. Geopolitical risk is heating up. 🌍

- Reward

- 2

- Comment

- Repost

- Share

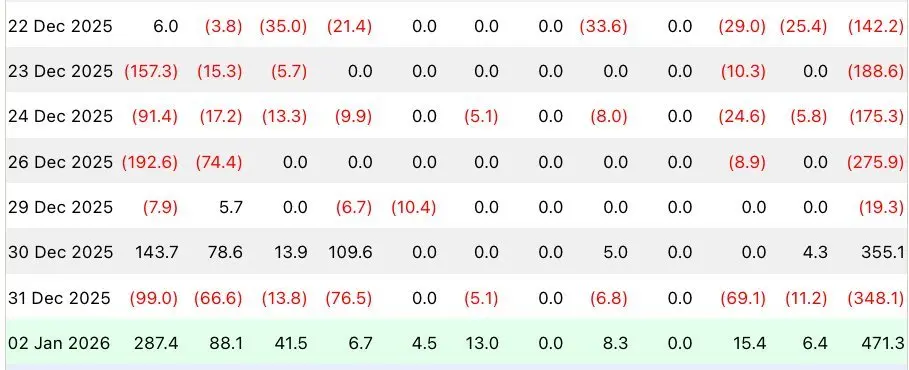

🚨 Strange Pattern During US Hours… Again?

Yesterday’s price action was aggressive.

S&P 500 opened -1% around $600B erased in minutes.

Then… full recovery.

Same across Nasdaq, Dow, Russell.

Sell hard. Reclaim fast.

Bitcoin followed equities lower.

Now consider this:

• Jane Street disclosed 20.3M shares of BlackRock’s $IBIT.

• For months, there’s been talk of large desks selling into the US open to flush leverage then accumulating lower.

Nothing proven. Just observation.

But the repetition is hard to ignore.

Into today’s US session

another liquidity sweep and bounce?

Or does the structure fin

Yesterday’s price action was aggressive.

S&P 500 opened -1% around $600B erased in minutes.

Then… full recovery.

Same across Nasdaq, Dow, Russell.

Sell hard. Reclaim fast.

Bitcoin followed equities lower.

Now consider this:

• Jane Street disclosed 20.3M shares of BlackRock’s $IBIT.

• For months, there’s been talk of large desks selling into the US open to flush leverage then accumulating lower.

Nothing proven. Just observation.

But the repetition is hard to ignore.

Into today’s US session

another liquidity sweep and bounce?

Or does the structure fin

- Reward

- 1

- Comment

- Repost

- Share

🚨 MASSIVE: $550 BILLION US - JAPAN DEAL

The U.S. and Japan have officially launched a $550B investment deal.

Japan commits capital into major U.S. projects, including:

• 🇺🇸 Texas - LNG infrastructure

• 🇺🇸 Ohio - Large-scale gas power generation

• 🇺🇸 Georgia - Critical minerals processing

Energy security. Supply chain strength. Strategic resources.

This is not just a headline; it’s long-term capital flowing into U.S. infrastructure and industrial capacity.

#Macro #Energy #Infrastructure #Markets #US #Japan

The U.S. and Japan have officially launched a $550B investment deal.

Japan commits capital into major U.S. projects, including:

• 🇺🇸 Texas - LNG infrastructure

• 🇺🇸 Ohio - Large-scale gas power generation

• 🇺🇸 Georgia - Critical minerals processing

Energy security. Supply chain strength. Strategic resources.

This is not just a headline; it’s long-term capital flowing into U.S. infrastructure and industrial capacity.

#Macro #Energy #Infrastructure #Markets #US #Japan

- Reward

- like

- Comment

- Repost

- Share

Uncertainty is now at record levels.

Above 2008.

Above 2020.

When fear peaks, narratives shift.

And when narratives shift, trends are born.

The real moves don’t happen during panic

They happen right after it.

Be alert. The reset phase is where opportunity lives.

Above 2008.

Above 2020.

When fear peaks, narratives shift.

And when narratives shift, trends are born.

The real moves don’t happen during panic

They happen right after it.

Be alert. The reset phase is where opportunity lives.

- Reward

- like

- Comment

- Repost

- Share

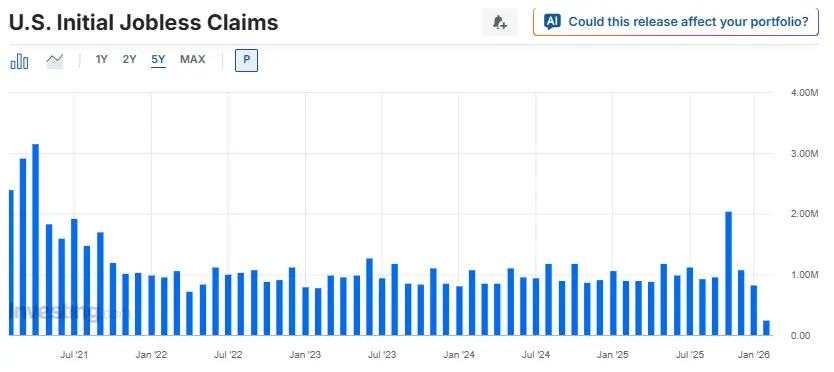

U.S. Initial Jobless Claims today at 9:30 AM ET /

14:30 UTC

Forecast: 225K

Previous: 231K

Markets are sensitive right now.

If claims come in higher, → Rate cut expectations may increase.

If claims come in lower → Risk assets could face pressure.

Expect volatility. Stay alert.

#Macro #Fed #Markets #Crypto

14:30 UTC

Forecast: 225K

Previous: 231K

Markets are sensitive right now.

If claims come in higher, → Rate cut expectations may increase.

If claims come in lower → Risk assets could face pressure.

Expect volatility. Stay alert.

#Macro #Fed #Markets #Crypto

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

📅 THE WEEK AHEAD: CPI, FED & EARNINGS

Macro & Markets

🔥 Inflation

• January CPI (Fri) main volatility driver

👷 Labor Data

• January Jobs Report (Wed)

• Weekly Jobless Claims (Thu)

📊 Earnings to Watch

• Robinhood ($HOOD) – Tue

• Coinbase ($COIN) – Thu

🏦 Fed Watch

• 5 Fed speakers scheduled this week

• More signals expected around the government shutdown

Crypto Watch

• White House hosts 2nd crypto + banking meeting -Feb 10

• $PENDLE: sPENDLE buybacks go live

• LayerZero ($ZRO): Major announcement expected Feb 10

⚠️ Bottom line: This is a CPI-driven week.

Earnings + Fed commentary = volatil

Macro & Markets

🔥 Inflation

• January CPI (Fri) main volatility driver

👷 Labor Data

• January Jobs Report (Wed)

• Weekly Jobless Claims (Thu)

📊 Earnings to Watch

• Robinhood ($HOOD) – Tue

• Coinbase ($COIN) – Thu

🏦 Fed Watch

• 5 Fed speakers scheduled this week

• More signals expected around the government shutdown

Crypto Watch

• White House hosts 2nd crypto + banking meeting -Feb 10

• $PENDLE: sPENDLE buybacks go live

• LayerZero ($ZRO): Major announcement expected Feb 10

⚠️ Bottom line: This is a CPI-driven week.

Earnings + Fed commentary = volatil

- Reward

- like

- Comment

- Repost

- Share

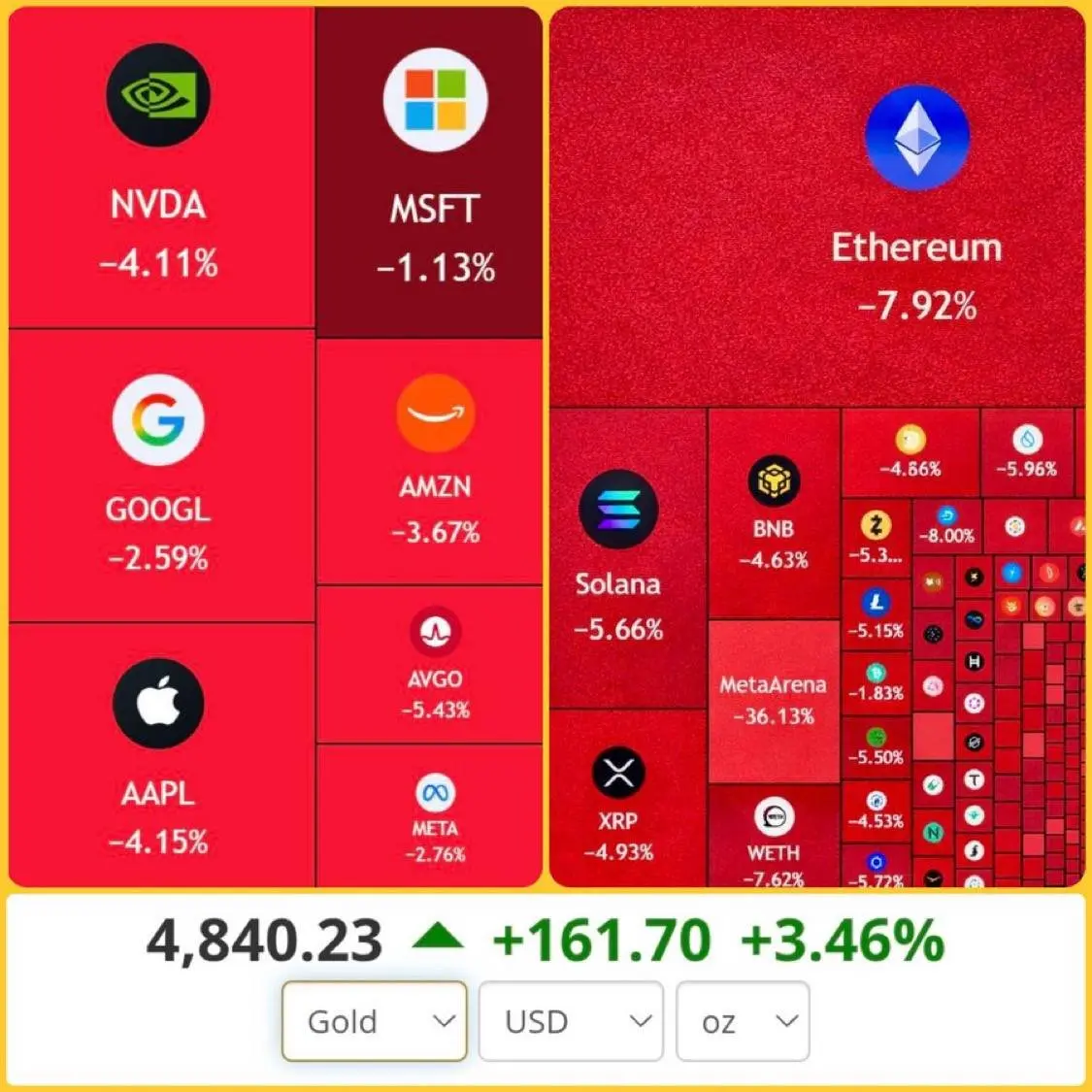

🚨 GLOBAL MARKET BLOODBATH

Over $1.5 TRILLION wiped out as markets spiral into panic.

President Trump’s aggressive stance on Greenland acquisition and potential 10–25% import tariffs has reignited trade war fears, prompting investors to firmly adopt a risk-off approach.

Here’s what just happened 👇

📉 US Stocks~$1.4T erased as Dow & Nasdaq plunge sharply.

📉 $160 B in crypto wiped out in 24 hours. Bitcoin breaks below $91,000, losing a key psychological level.

🟡 Safe Haven RushGold surges against the chaos, printing a new all-time high at $4,850.

Capital is fleeing risk. Fear is

Over $1.5 TRILLION wiped out as markets spiral into panic.

President Trump’s aggressive stance on Greenland acquisition and potential 10–25% import tariffs has reignited trade war fears, prompting investors to firmly adopt a risk-off approach.

Here’s what just happened 👇

📉 US Stocks~$1.4T erased as Dow & Nasdaq plunge sharply.

📉 $160 B in crypto wiped out in 24 hours. Bitcoin breaks below $91,000, losing a key psychological level.

🟡 Safe Haven RushGold surges against the chaos, printing a new all-time high at $4,850.

Capital is fleeing risk. Fear is

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

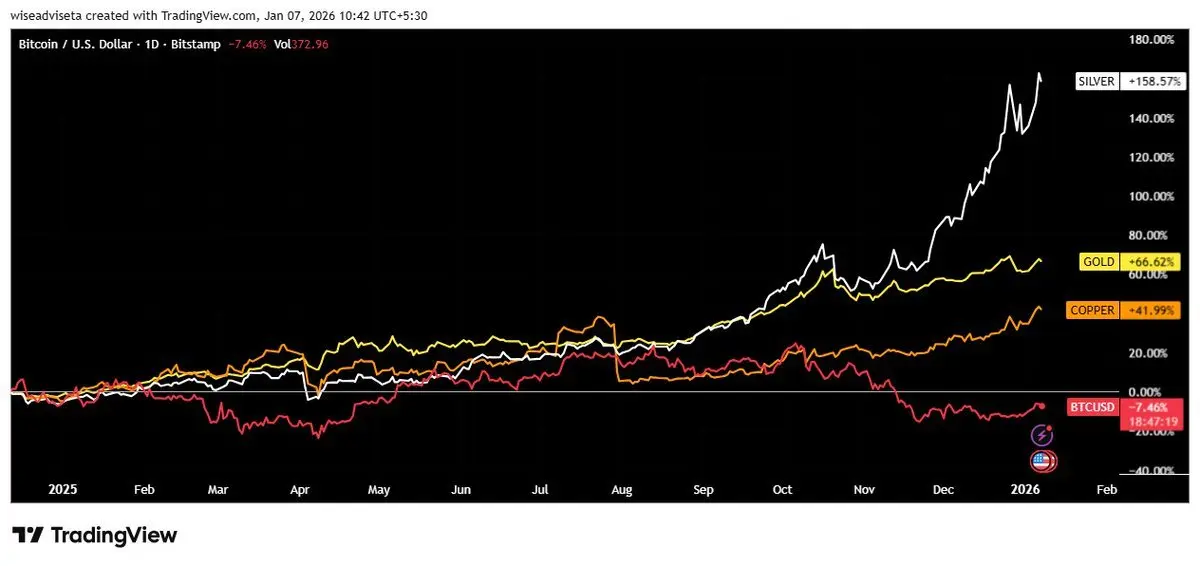

Bitcoin dumps below $92,000.

As crypto pulls back, capital is flooding into hard assets.

Gold and Silver have just hit new all-time highs.

Only 20 days into 2026:

Silver is up 30%.

Gold is up 9%.

Since the start of the year, precious metals have absorbed nearly $4 trillion in market value.

Today alone:

Gold added ~$787B.

Silver added ~$160B.

Gold has now printed a record $4,700.

Risk-off is back on the table and the rotation is visible.

As crypto pulls back, capital is flooding into hard assets.

Gold and Silver have just hit new all-time highs.

Only 20 days into 2026:

Silver is up 30%.

Gold is up 9%.

Since the start of the year, precious metals have absorbed nearly $4 trillion in market value.

Today alone:

Gold added ~$787B.

Silver added ~$160B.

Gold has now printed a record $4,700.

Risk-off is back on the table and the rotation is visible.

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

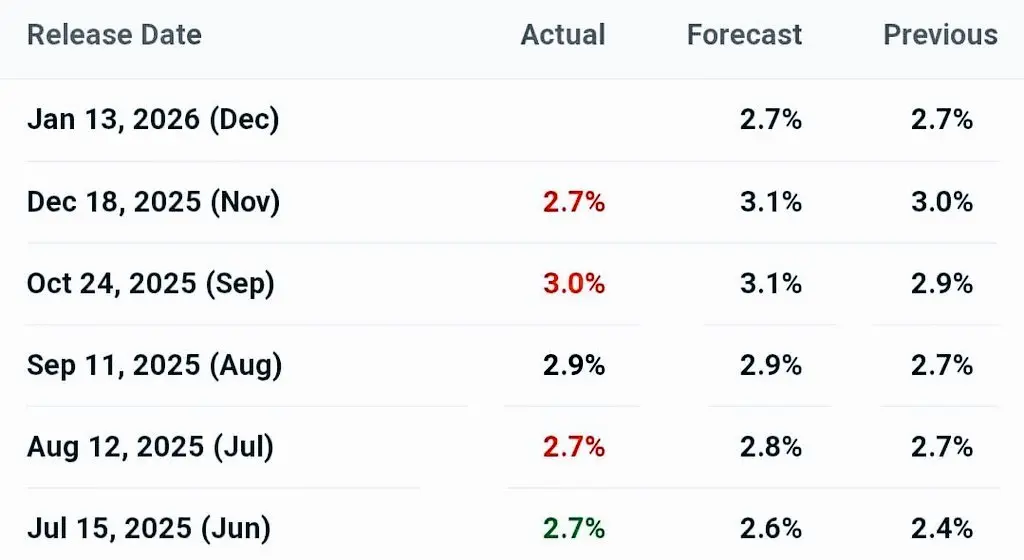

REMINDER

US CPI (December) data drops today, expect volatility 📈📉

⏰ Time:

• 1:30 PM UTC

• 8:30 AM ET

Markets will react fast. Stay alert.

US CPI (December) data drops today, expect volatility 📈📉

⏰ Time:

• 1:30 PM UTC

• 8:30 AM ET

Markets will react fast. Stay alert.

- Reward

- like

- Comment

- Repost

- Share

🚨 GEOPOLITICAL RISK IS RISING

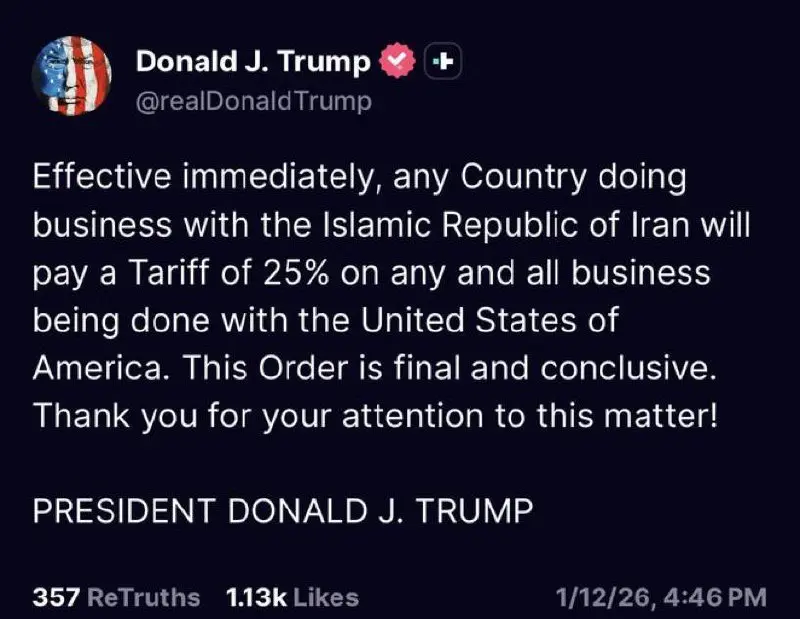

Trump just imposed a 25% tariff on any country doing business with Iran.

At the same time, Polymarket shows a 64% probability of a US / Israel strike on Iran by Jan 31.

This combo = rising uncertainty across oil, gold, and risk assets.

Markets may not be fully priced for what’s coming. 👀

Trump just imposed a 25% tariff on any country doing business with Iran.

At the same time, Polymarket shows a 64% probability of a US / Israel strike on Iran by Jan 31.

This combo = rising uncertainty across oil, gold, and risk assets.

Markets may not be fully priced for what’s coming. 👀

- Reward

- like

- 1

- Repost

- Share

GateUser-f16fdcdf :

:

Thank you for the interesting articleSomething important is happening in the market

Gold, silver, and copper are all going up at the same time.

That normally doesn’t happen.

• Copper usually rises when the economy is strong

• Gold usually rises when people are scared

• When both move together, it means something else…

It means big money is quietly moving out of risky assets and into real, safe assets.

Not because a crash is happening tomorrow

but because risk is slowly building in the system.

What this means for traders right now:

• Use smaller position sizes

• Stick more to spot, less to leverage

• Don’t chase breakouts in low

Gold, silver, and copper are all going up at the same time.

That normally doesn’t happen.

• Copper usually rises when the economy is strong

• Gold usually rises when people are scared

• When both move together, it means something else…

It means big money is quietly moving out of risky assets and into real, safe assets.

Not because a crash is happening tomorrow

but because risk is slowly building in the system.

What this means for traders right now:

• Use smaller position sizes

• Stick more to spot, less to leverage

• Don’t chase breakouts in low

- Reward

- like

- Comment

- Repost

- Share

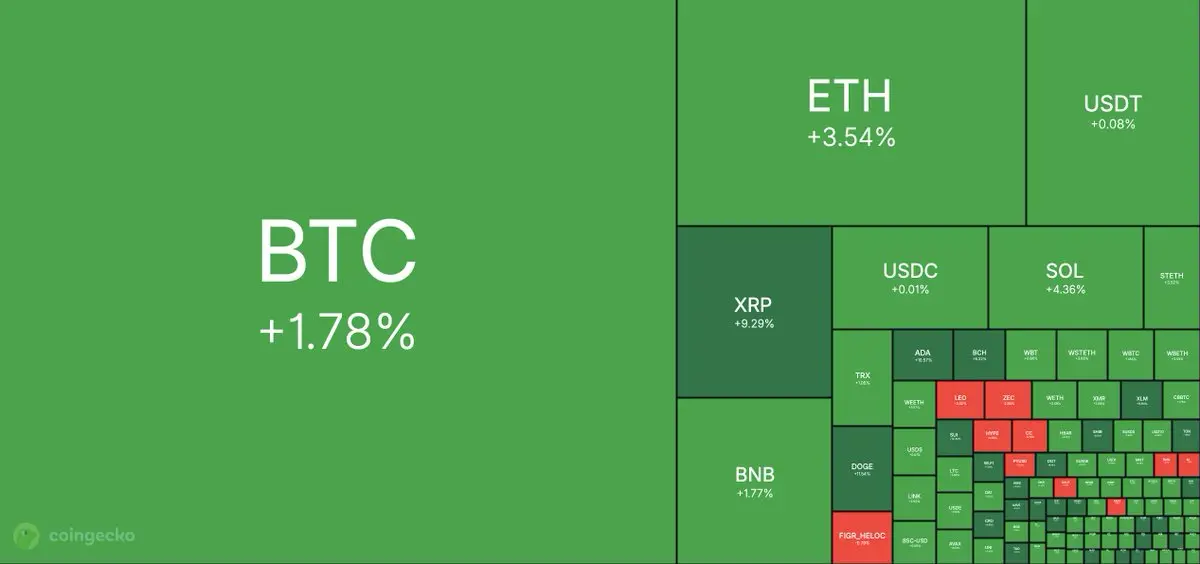

GM to the new week ☀️

Crypto is starting strong:

• Bitcoin: $93,000

• Ethereum: $3,200

• +$99B added to the market in 24 hours

• Total market cap: $3.25T

Momentum is clearly building as liquidity flows back into the market.

Now the big question…

Are you bullish or bearish from here? 📈📉

Crypto is starting strong:

• Bitcoin: $93,000

• Ethereum: $3,200

• +$99B added to the market in 24 hours

• Total market cap: $3.25T

Momentum is clearly building as liquidity flows back into the market.

Now the big question…

Are you bullish or bearish from here? 📈📉

- Reward

- like

- Comment

- Repost

- Share

GM ☀️

Crypto is starting 2026 with a full green sweep 🟢

• $130B added to total market cap in the last 24 hours

• Bitcoin: $90,000

• Ethereum: above $3,000

Momentum is clearly picking up. Now the market is watching closely is this the beginning of a new trend or just a temporary relief bounce?

Either way, volatility is back and so are the opportunities.

Have a great trading day ahead 🚀

Crypto is starting 2026 with a full green sweep 🟢

• $130B added to total market cap in the last 24 hours

• Bitcoin: $90,000

• Ethereum: above $3,000

Momentum is clearly picking up. Now the market is watching closely is this the beginning of a new trend or just a temporary relief bounce?

Either way, volatility is back and so are the opportunities.

Have a great trading day ahead 🚀

- Reward

- like

- Comment

- Repost

- Share

US Economy Just Sent a Big Signal 📈

The U.S. posted 4.3% GDP growth in Q3 2025 the fastest pace in two years. That’s a serious upside surprise and a clear sign the economy still has strong momentum.

Markets loved it. The S&P 500 pushed to a new all-time high, showing investors are willing to take on more risk when growth looks this solid.

With growth this strong, confidence for 2026 is rising. More growth usually means more spending, more profits, and more capital flowing into markets which is why traders are turning more bullish across stocks and crypto alike.

The U.S. posted 4.3% GDP growth in Q3 2025 the fastest pace in two years. That’s a serious upside surprise and a clear sign the economy still has strong momentum.

Markets loved it. The S&P 500 pushed to a new all-time high, showing investors are willing to take on more risk when growth looks this solid.

With growth this strong, confidence for 2026 is rising. More growth usually means more spending, more profits, and more capital flowing into markets which is why traders are turning more bullish across stocks and crypto alike.

- Reward

- like

- Comment

- Repost

- Share

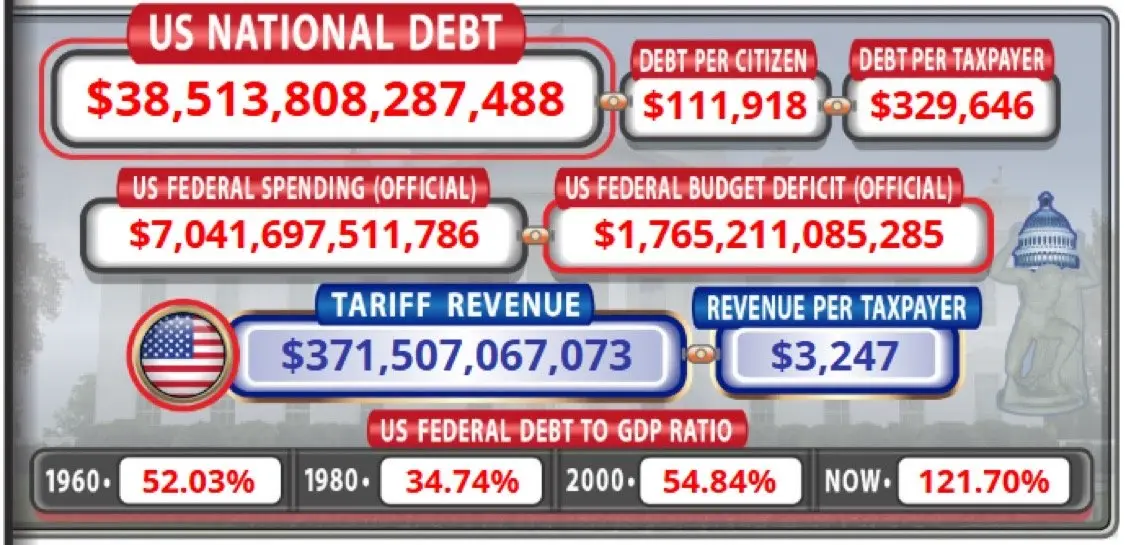

Reality Check for the US Economy 🇺🇸

$38.5 TRILLION in national debt and counting.

Debt is now bigger than the entire economy (125%+ of GDP).

The shocking part?

👉 $1 TRILLION every year goes only to interest.

No new projects.

No growth.

Just paying yesterday’s bills with tomorrow’s money.

At what point does this become unsustainable?

“Too much winning” or just kicking the can down the road? 👀

$38.5 TRILLION in national debt and counting.

Debt is now bigger than the entire economy (125%+ of GDP).

The shocking part?

👉 $1 TRILLION every year goes only to interest.

No new projects.

No growth.

Just paying yesterday’s bills with tomorrow’s money.

At what point does this become unsustainable?

“Too much winning” or just kicking the can down the road? 👀

- Reward

- like

- Comment

- Repost

- Share

The U.S. Federal Reserve is injecting $6.8 billion into the system today , a short-term liquidity boost markets are watching closely.

🕘 Time:

• 9:00 AM ET

• 13:00 UTC

🕘 Time:

• 9:00 AM ET

• 13:00 UTC

- Reward

- like

- Comment

- Repost

- Share