Kingbest

No content yet

Kingbest

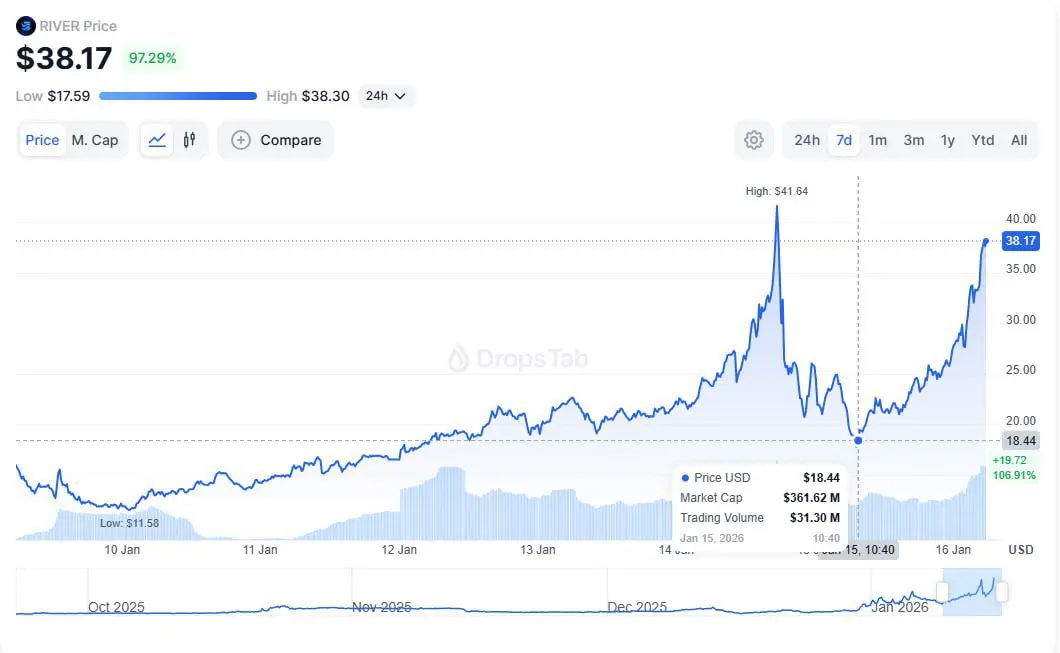

Someone on telegram said “ River resurrected faster than Jesus”

Looking at the chart, it is hard to argue.

Yesterday we saw a sharp cool off to $17 today it is back trading at $38.

$RIVER keeps flowing. 1B market cap looks possible.

Looking at the chart, it is hard to argue.

Yesterday we saw a sharp cool off to $17 today it is back trading at $38.

$RIVER keeps flowing. 1B market cap looks possible.

- Reward

- like

- Comment

- Repost

- Share

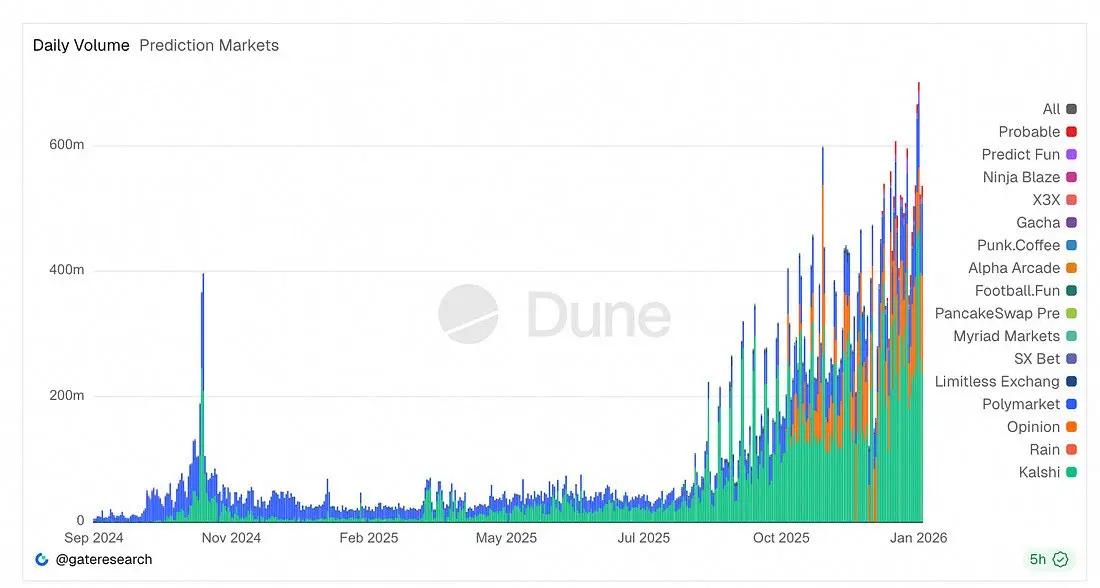

Daily trading activity across prediction markets has hit record highs, around $700 million in a single day!

It is impressive to watch prediction markets evolve from niche bets on sports and politics into a major financial primitive that Wall Street, hedge funds, and regulators now have to take seriously.

When big players pay attention, it is worth paying attention too.

@xodotmarket introduces a unique model where anyone can create and trade beliefs on real world events while turning collective insight into clear market signals.

I placed a trade today on XO Market and it clicked. Prediction ma

It is impressive to watch prediction markets evolve from niche bets on sports and politics into a major financial primitive that Wall Street, hedge funds, and regulators now have to take seriously.

When big players pay attention, it is worth paying attention too.

@xodotmarket introduces a unique model where anyone can create and trade beliefs on real world events while turning collective insight into clear market signals.

I placed a trade today on XO Market and it clicked. Prediction ma

- Reward

- like

- Comment

- Repost

- Share

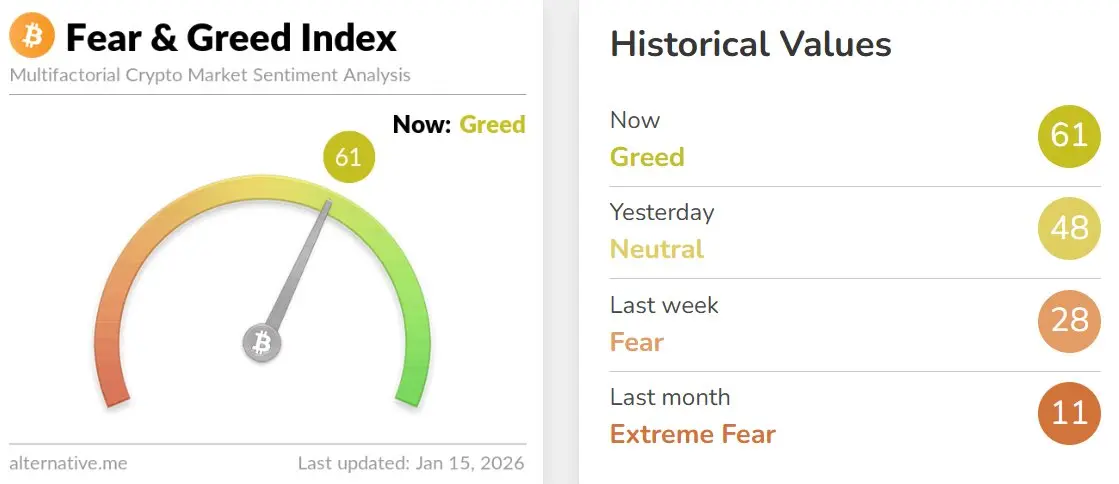

Sentiment flipping back to “greed” would usually be a warning.

This time, the structure doesn’t agree.

+ Price pushed from $89K to $97K while participation fell.

+ Exchange balances are at a 7-month low.

+ Non-empty wallets are declining, not growing.

+ October already cleared $19B in liquidations.

That’s not a crowd rushing in. It’s weak hands finishing their exit.

What matters is the order of operations: capitulation happened first → supply left exchanges → price stabilized → sentiment recovered.

That sequence is important. Early recoveries form when price rises with less activity, not more.

This time, the structure doesn’t agree.

+ Price pushed from $89K to $97K while participation fell.

+ Exchange balances are at a 7-month low.

+ Non-empty wallets are declining, not growing.

+ October already cleared $19B in liquidations.

That’s not a crowd rushing in. It’s weak hands finishing their exit.

What matters is the order of operations: capitulation happened first → supply left exchanges → price stabilized → sentiment recovered.

That sequence is important. Early recoveries form when price rises with less activity, not more.

- Reward

- like

- Comment

- Repost

- Share

This feels like a quiet shift: crypto maturing past the experiment stage.

The new adds aren’t the loudest narratives; they’re the systems people will rely on when noise fades.

+ AI is moving from hype to accountability (@NousResearch, Poseidon).

+ Execution layers are moving from raw speed to reliability (@megaeth, @horizenglobal).

+ Consumer apps are moving from novelty to daily use (@Aria_Protocol, Playtron).

That pattern shows a market growing up.

Grayscale isn’t chasing trends. It’s recognizing which categories are becoming non-optional.

Infrastructure always compounds before anyone calls

The new adds aren’t the loudest narratives; they’re the systems people will rely on when noise fades.

+ AI is moving from hype to accountability (@NousResearch, Poseidon).

+ Execution layers are moving from raw speed to reliability (@megaeth, @horizenglobal).

+ Consumer apps are moving from novelty to daily use (@Aria_Protocol, Playtron).

That pattern shows a market growing up.

Grayscale isn’t chasing trends. It’s recognizing which categories are becoming non-optional.

Infrastructure always compounds before anyone calls

- Reward

- like

- Comment

- Repost

- Share

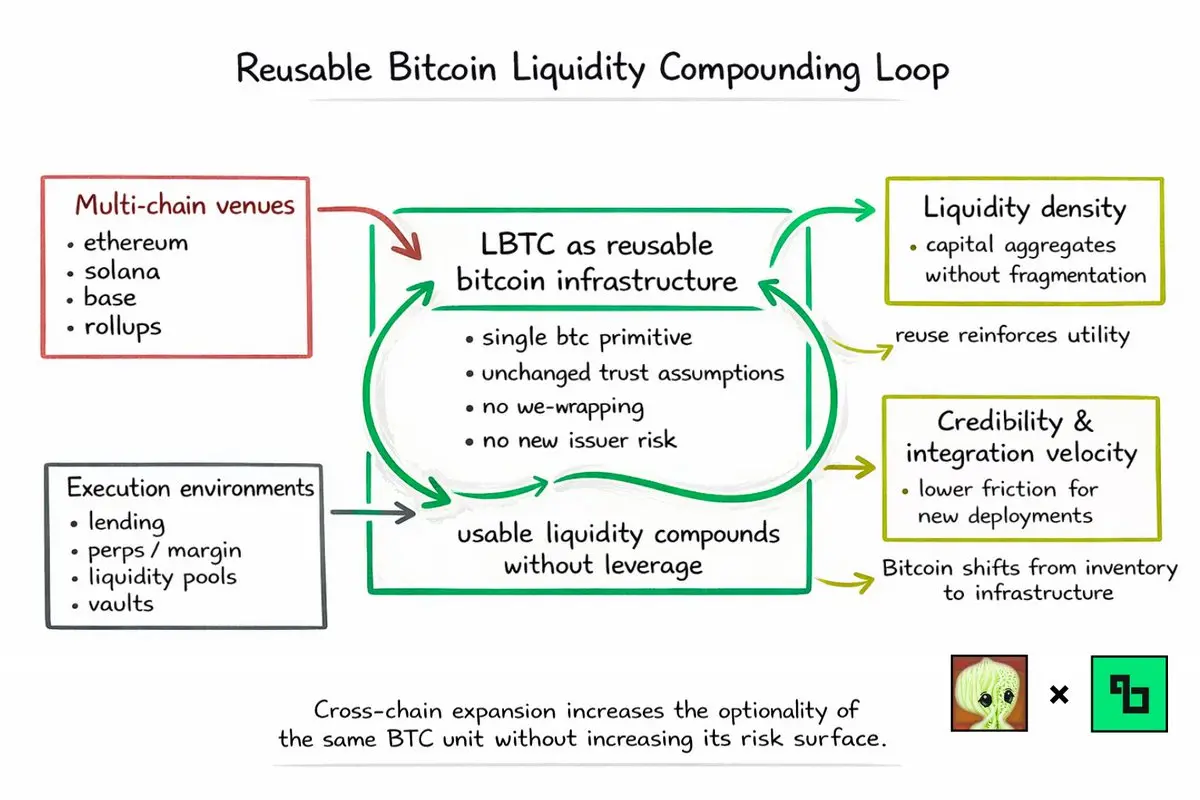

Bitcoin liquidity does not compound by sitting in one place.

It compounds by being reusable across systems without changing its trust profile.

That is the difference between wrapped BTC as inventory and LBTC as infrastructure, as implemented by @Lombard_Finance.

— 📌 The Core Mechanism

$LBTC operates across 14 chains, including Ethereum, Solana, Base, and multiple rollups. The important point is not chain count. It is composability without fragmentation.

Each chain adds:

+ a new execution environment

+ a new set of DeFi primitives

+ a new class of users and workflows

But $LBTC remains the same

It compounds by being reusable across systems without changing its trust profile.

That is the difference between wrapped BTC as inventory and LBTC as infrastructure, as implemented by @Lombard_Finance.

— 📌 The Core Mechanism

$LBTC operates across 14 chains, including Ethereum, Solana, Base, and multiple rollups. The important point is not chain count. It is composability without fragmentation.

Each chain adds:

+ a new execution environment

+ a new set of DeFi primitives

+ a new class of users and workflows

But $LBTC remains the same

- Reward

- like

- Comment

- Repost

- Share

Helium in 2025 proved that real world usage drives adoption.

The steady rise in signups shows growing demand for the network, not speculation.

With expansion into Brazil and new partnerships coming soon, @helium is moving beyond early adopters.

If this momentum continues, total signups could reach millions this year.

Most projects measure success by token price and short term hype. DePIN measures success by usage, fees, uptime, and real world demand.

The steady rise in signups shows growing demand for the network, not speculation.

With expansion into Brazil and new partnerships coming soon, @helium is moving beyond early adopters.

If this momentum continues, total signups could reach millions this year.

Most projects measure success by token price and short term hype. DePIN measures success by usage, fees, uptime, and real world demand.

HNT-0,21%

- Reward

- like

- Comment

- Repost

- Share

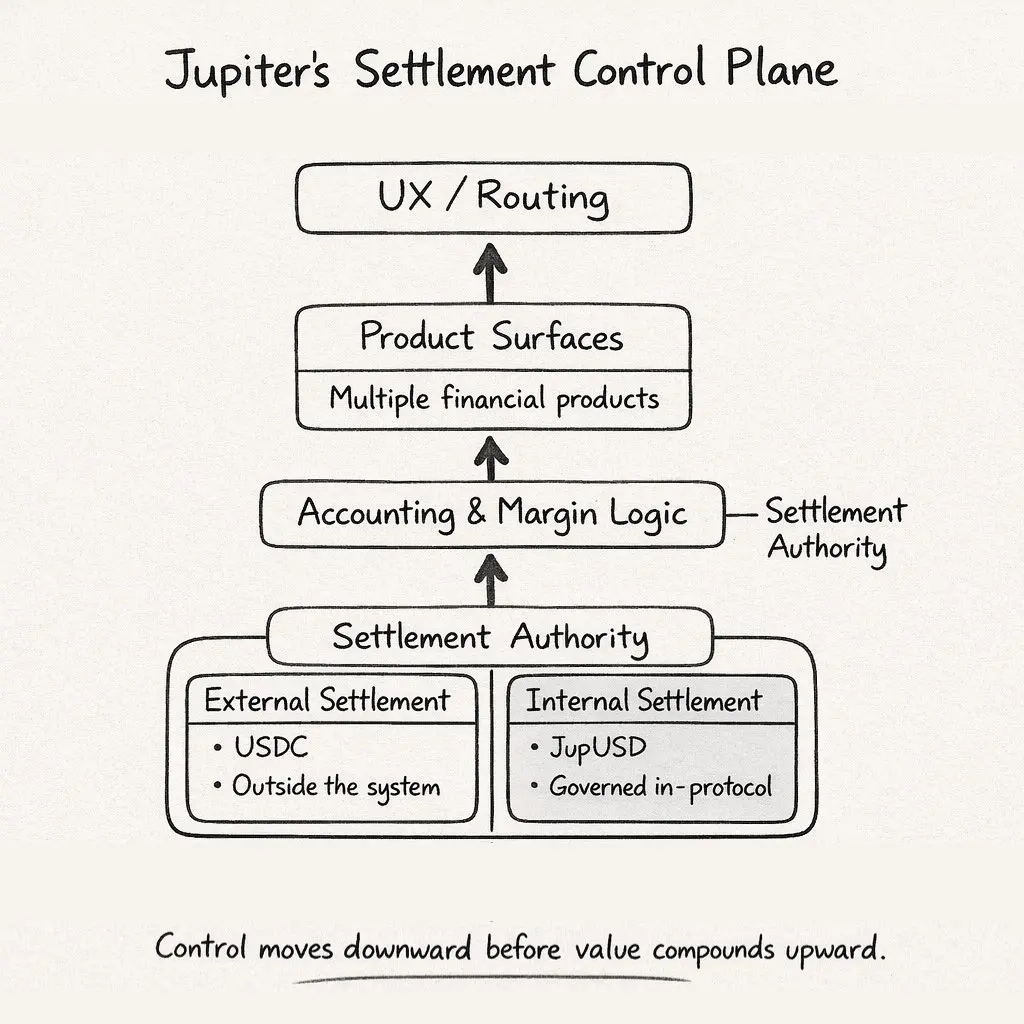

$JupUSD shouldn’t be analyzed as “another dollar on Solana.”

From my perspective, it’s a control-plane decision about where settlement authority lives inside a multi-product financial system.

That distinction is structural, not cosmetic, and it matters more than the stablecoin itself.

— 📌 How @JupiterExchange Collapsed Its Monetary Stack

Before $JupUSD, Jupiter’s stack was horizontally integrated but monetarily fragmented.

• Spot executed against $USDC liquidity

• Perps collateralized in $USDC

• Lending positions tracked separately

• Prediction markets settled externally

Each product worked i

From my perspective, it’s a control-plane decision about where settlement authority lives inside a multi-product financial system.

That distinction is structural, not cosmetic, and it matters more than the stablecoin itself.

— 📌 How @JupiterExchange Collapsed Its Monetary Stack

Before $JupUSD, Jupiter’s stack was horizontally integrated but monetarily fragmented.

• Spot executed against $USDC liquidity

• Perps collateralized in $USDC

• Lending positions tracked separately

• Prediction markets settled externally

Each product worked i

- Reward

- 3

- 1

- Repost

- Share

PumpSpreeLive :

:

Rush 2026 🚀I don’t think the market is celebrating. I think it’s repositioning.

Early-year price action usually tells you less about narrative and more about intent.

$BTC holding the high-$80Ks to $90K range isn’t a breakout to me. It’s acceptance. Price is staying elevated without leverage stress, without liquidation cascades, and without volatility expanding. That reads as control, not exhaustion.

$ETH holding above $3,000 is even more significant in my view. When $ETH moves alongside $BTC, the market is pricing usage and settlement demand, not just macro beta. That’s typically how healthier phases sta

Early-year price action usually tells you less about narrative and more about intent.

$BTC holding the high-$80Ks to $90K range isn’t a breakout to me. It’s acceptance. Price is staying elevated without leverage stress, without liquidation cascades, and without volatility expanding. That reads as control, not exhaustion.

$ETH holding above $3,000 is even more significant in my view. When $ETH moves alongside $BTC, the market is pricing usage and settlement demand, not just macro beta. That’s typically how healthier phases sta

- Reward

- like

- Comment

- Repost

- Share

Stablecoin yield has not disappeared.

What disappeared is undisciplined yield.

I ran stablecoin yield through @Infinit_Labs Intelligence and removed leverage loops, emissions, and experimental protocols.

What’s left isn’t farming. It’s credit and fee markets, expressed onchain.

— 📌 Private Credit Is the Core Yield Source

The highest stablecoin yields currently available are coming from onchain private credit, where yield is paid directly by borrowers.

The clearest concentration appears on Wildcat Protocol.

Across multiple $USDC and $USDT lending markets on Ethereum, Wildcat is offering yields

What disappeared is undisciplined yield.

I ran stablecoin yield through @Infinit_Labs Intelligence and removed leverage loops, emissions, and experimental protocols.

What’s left isn’t farming. It’s credit and fee markets, expressed onchain.

— 📌 Private Credit Is the Core Yield Source

The highest stablecoin yields currently available are coming from onchain private credit, where yield is paid directly by borrowers.

The clearest concentration appears on Wildcat Protocol.

Across multiple $USDC and $USDT lending markets on Ethereum, Wildcat is offering yields

- Reward

- 1

- Comment

- Repost

- Share

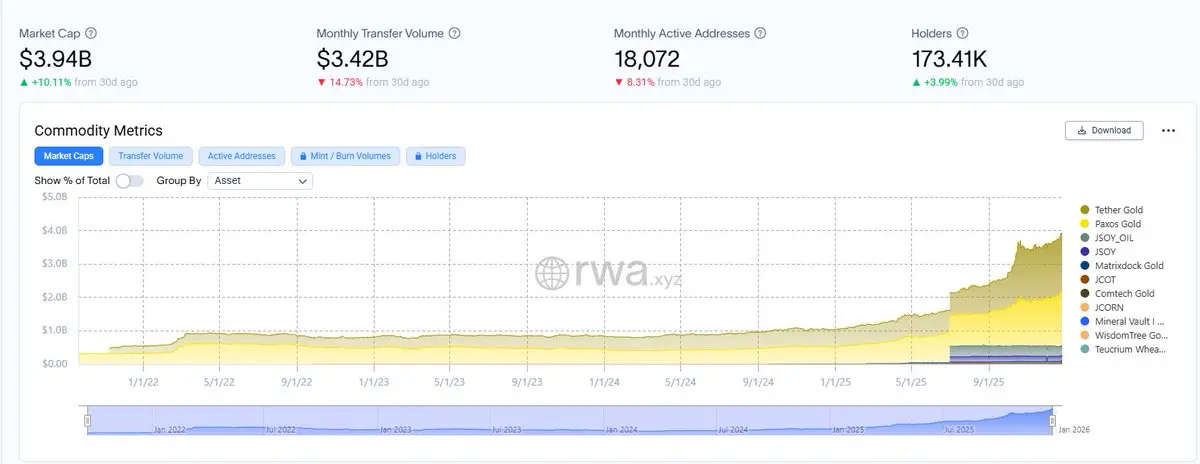

This is what a real narrative shift looks like.

The move toward $4B in tokenized commodities isn’t a crypto inflow.

It’s a stress response.

Gold at ATHs. Silver and platinum breaking out. Tokenized gold supply expanding in parallel. That’s not CT rotation. That’s capital choosing portability when macro risk rises.

Key point? This flow is non-reflexive.

Onchain commodities aren’t reacting to price momentum. They’re reacting to regime signals: inflation persistence, geopolitical tail risk, and declining confidence in fiat settlement rails.

The structure makes that clear.

Nearly all tokenized com

The move toward $4B in tokenized commodities isn’t a crypto inflow.

It’s a stress response.

Gold at ATHs. Silver and platinum breaking out. Tokenized gold supply expanding in parallel. That’s not CT rotation. That’s capital choosing portability when macro risk rises.

Key point? This flow is non-reflexive.

Onchain commodities aren’t reacting to price momentum. They’re reacting to regime signals: inflation persistence, geopolitical tail risk, and declining confidence in fiat settlement rails.

The structure makes that clear.

Nearly all tokenized com

- Reward

- like

- Comment

- Repost

- Share

The 2.1M+ daily users milestone isn’t impressive because it’s big. It’s important because usage held while speculation faded.

That tells you @helium has crossed the threshold most DePIN networks never reach: people rely on it regardless of market conditions.

Mechanically, the system is doing a few things right:

+ Demand is driven by real connectivity gaps, not incentives

+ Offload scales during congestion, not just during growth phases

+ Expansion leverages existing infrastructure instead of capex-heavy rollout

+ Usage persists through risk-off periods

That combination matters. It means networ

That tells you @helium has crossed the threshold most DePIN networks never reach: people rely on it regardless of market conditions.

Mechanically, the system is doing a few things right:

+ Demand is driven by real connectivity gaps, not incentives

+ Offload scales during congestion, not just during growth phases

+ Expansion leverages existing infrastructure instead of capex-heavy rollout

+ Usage persists through risk-off periods

That combination matters. It means networ

HNT-0,21%

- Reward

- like

- 1

- Repost

- Share

SpecialBecauseOfYou :

:

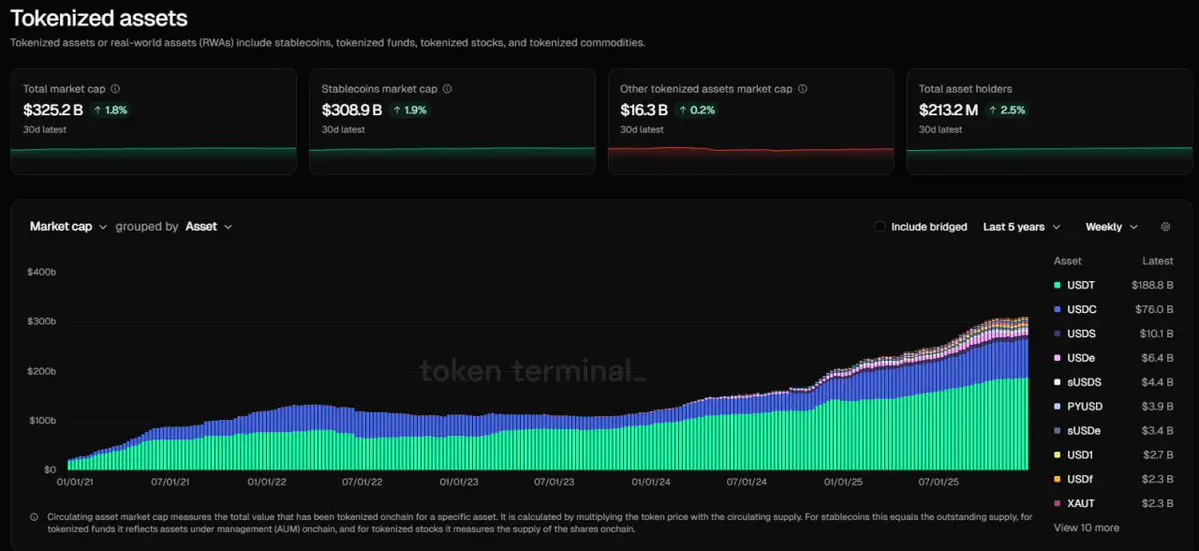

This coin is nothing.Tokenized equities did not just grow quickly in 2025.

They crossed the minimum scale where reversal becomes unlikely.

Market cap moved from $32M to $830M in under a year. The percentage gain is not the point. The point is that tokenized equities are now large enough to justify permanent infrastructure, regulatory attention, and distribution ownership.

That changes how this sector should be evaluated.

...

— 📌 Why the 2500% Figure Is the Wrong Lens

Early markets always show extreme growth rates because they start from zero. That makes percentage-based narratives noisy.

What matters instead is a

They crossed the minimum scale where reversal becomes unlikely.

Market cap moved from $32M to $830M in under a year. The percentage gain is not the point. The point is that tokenized equities are now large enough to justify permanent infrastructure, regulatory attention, and distribution ownership.

That changes how this sector should be evaluated.

...

— 📌 Why the 2500% Figure Is the Wrong Lens

Early markets always show extreme growth rates because they start from zero. That makes percentage-based narratives noisy.

What matters instead is a

- Reward

- like

- Comment

- Repost

- Share

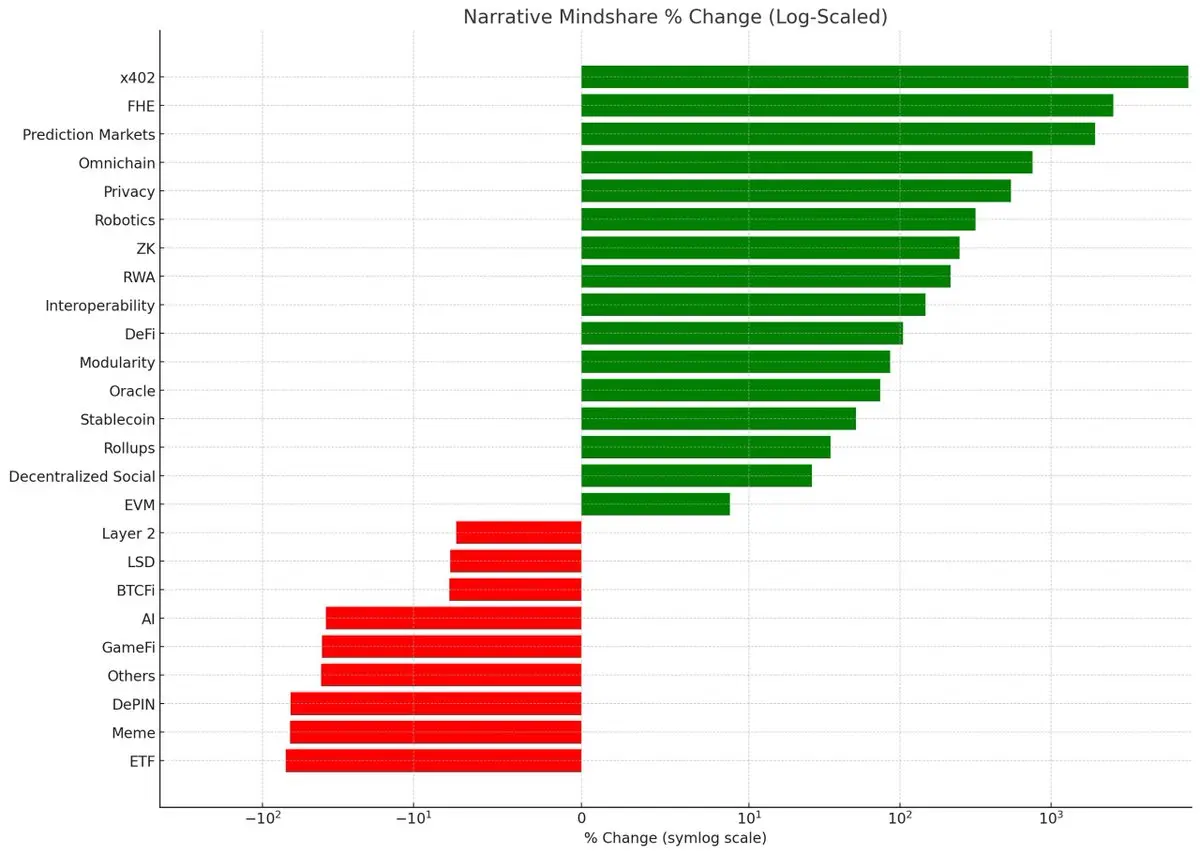

Why some crypto narratives are shrinking while others are quietly taking over

A lot of people look at crypto right now and think, “interest is dying.”

It’s not.

What’s actually happening is attention is being compressed in some areas and expanded in others.

Think of attention like water.

It doesn’t disappear. It just flows to wherever it’s useful.

— 📌 The Narratives That Are Shrinking

Over the past year, some of the loudest crypto narratives have lost attention fast:

• AI

• Memes

• ETFs

• GameFi

These narratives were easy to talk about.

They promised big futures.

They were exciting, simple, a

A lot of people look at crypto right now and think, “interest is dying.”

It’s not.

What’s actually happening is attention is being compressed in some areas and expanded in others.

Think of attention like water.

It doesn’t disappear. It just flows to wherever it’s useful.

— 📌 The Narratives That Are Shrinking

Over the past year, some of the loudest crypto narratives have lost attention fast:

• AI

• Memes

• ETFs

• GameFi

These narratives were easy to talk about.

They promised big futures.

They were exciting, simple, a

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More22.12K Popularity

34.01K Popularity

17.57K Popularity

1.44K Popularity

1.1K Popularity

Pin