MarketMaestro

No content yet

MarketMaestro

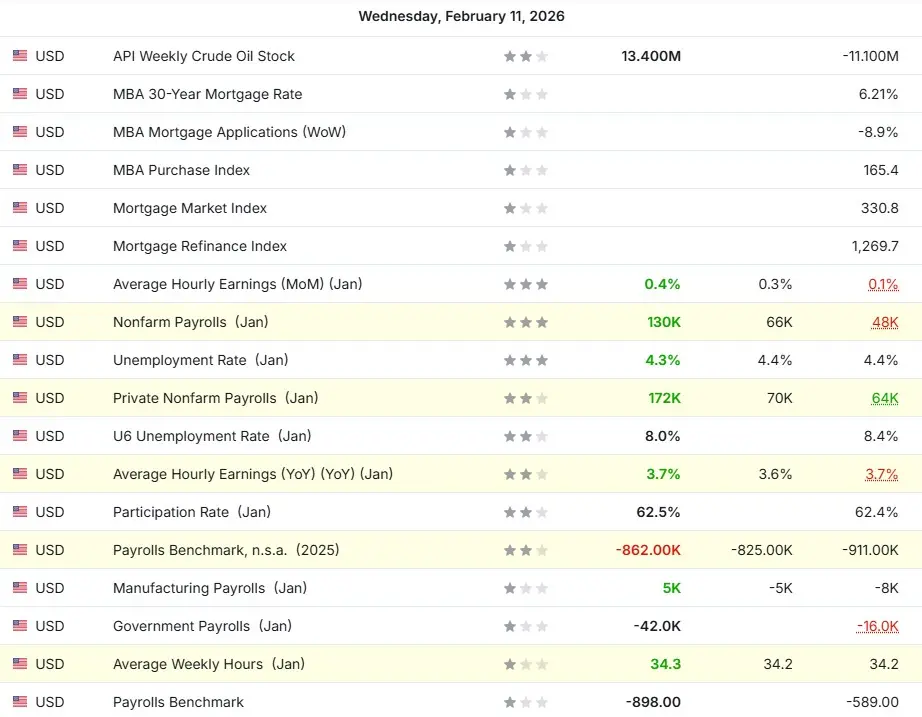

Higher for Longer

But, that’s good news for today

But, that’s good news for today

- Reward

- like

- Comment

- Repost

- Share

$AREC

They made the REE setups look similar. The good news is that $MP, $UUUU, and $USAR are trying to recover, and they could shift this structure from a double top into a cup+handle

The key here is not losing the supports

They made the REE setups look similar. The good news is that $MP, $UUUU, and $USAR are trying to recover, and they could shift this structure from a double top into a cup+handle

The key here is not losing the supports

MP-2,21%

- Reward

- like

- Comment

- Repost

- Share

$NVTS

There’s no issue with the chart. It’s trying to reversal and push higher, but because of the index it hasn’t been able to catch that window, so it’s getting tossed around by the wind. Short interest is also high

There’s no issue with the chart. It’s trying to reversal and push higher, but because of the index it hasn’t been able to catch that window, so it’s getting tossed around by the wind. Short interest is also high

- Reward

- like

- Comment

- Repost

- Share

$NAIL

It broke the red diagonal resistance 💥 Above green line, the upside can accelerate

nice setup

It broke the red diagonal resistance 💥 Above green line, the upside can accelerate

nice setup

- Reward

- 1

- Comment

- Repost

- Share

$RCAT

The path I marked with the arrow is possible. Wicky candles on the way down are also possible, but the main narrative is like this

The path I marked with the arrow is possible. Wicky candles on the way down are also possible, but the main narrative is like this

- Reward

- like

- Comment

- Repost

- Share

$FLNC

It’s holding the $18.94 level-EMA26 and the equilibrium support.

In this correction phase, the lower support band can hold firmly, meaning this depth should be enough

It’s holding the $18.94 level-EMA26 and the equilibrium support.

In this correction phase, the lower support band can hold firmly, meaning this depth should be enough

- Reward

- like

- Comment

- Repost

- Share

$ODFL

It’s one of the old legends, but revenue growth is close to stalling now. With that setup, it doesn’t get a sustainable uptrend. And because growth is fading, the stock also looks expensive.

There are two unretested FVG areas below. It got rejected at $203 (fibo78). Despite all that, the upside intent is still there

It’s one of the old legends, but revenue growth is close to stalling now. With that setup, it doesn’t get a sustainable uptrend. And because growth is fading, the stock also looks expensive.

There are two unretested FVG areas below. It got rejected at $203 (fibo78). Despite all that, the upside intent is still there

- Reward

- like

- Comment

- Repost

- Share

$EOSE

It’s stayed resilient in this stretch. Because buyers are waiting and ready, it can’t really get hit with heavy selling

The lower green box could be an opportunity

It’s stayed resilient in this stretch. Because buyers are waiting and ready, it can’t really get hit with heavy selling

The lower green box could be an opportunity

- Reward

- 1

- Comment

- Repost

- Share

$SLDP

Why hasn’t the correction ended yet? Because of stocks like SLDP. It still hasn’t been able to complete its correction. It can find a bottom in the lower green zone

Why hasn’t the correction ended yet? Because of stocks like SLDP. It still hasn’t been able to complete its correction. It can find a bottom in the lower green zone

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$KMT

Above neckline, it can continue the steep climb

Above neckline, it can continue the steep climb

- Reward

- like

- Comment

- Repost

- Share

$AIPO

As the name suggests, it holds defensive and power infrastructure stocks. I expect the upside to continue

As the name suggests, it holds defensive and power infrastructure stocks. I expect the upside to continue

- Reward

- like

- Comment

- Repost

- Share

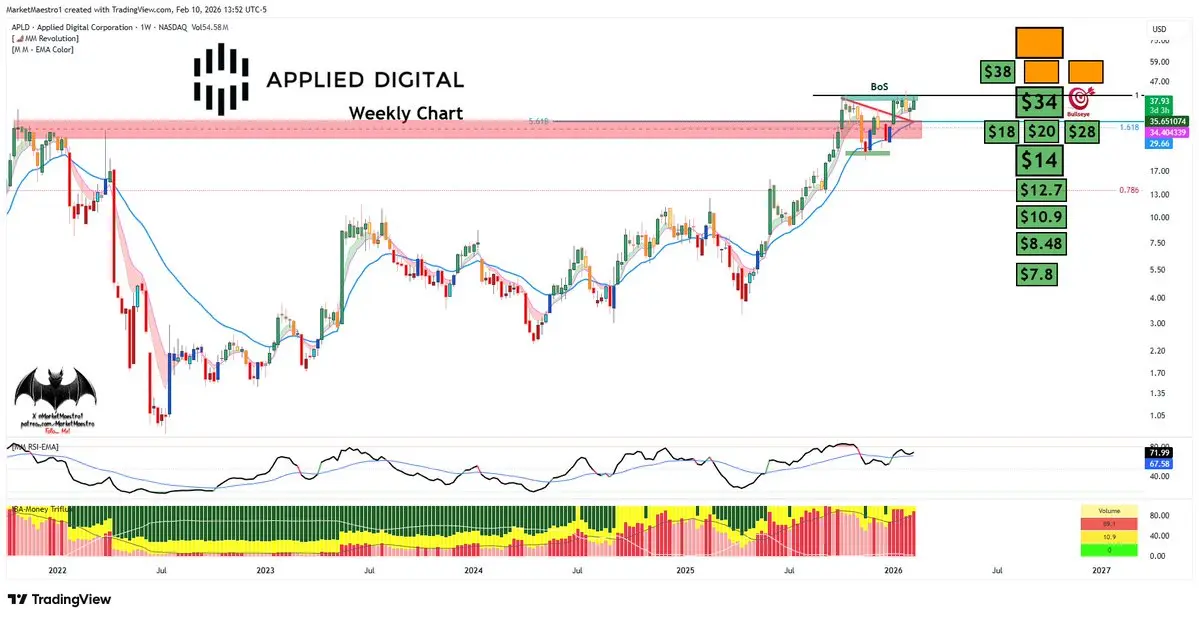

$APLD

It looks very good and strong. It broke the red diagonal resistance and already did the retest. Now the next step is a BoS breakout. If it breaks, it can start climbing

It looks very good and strong. It broke the red diagonal resistance and already did the retest. Now the next step is a BoS breakout. If it breaks, it can start climbing

- Reward

- like

- Comment

- Repost

- Share

$SMR

The path I marked with the arrow is still possible 🤞

The path I marked with the arrow is still possible 🤞

- Reward

- like

- Comment

- Repost

- Share

$DELL

I had marked the green zone as the bottom, and it’s bouncing exactly from there

Right now it’s forming a bullish structure for the next leg

I had marked the green zone as the bottom, and it’s bouncing exactly from there

Right now it’s forming a bullish structure for the next leg

- Reward

- like

- Comment

- Repost

- Share

$SPGI

S&P Global (SPGI) delivered a mixed Q4 2025 print and an underwhelming 2026 outlook. The stock sold off sharply after the release due to weaker profitability guidance and Q4 earnings coming in below expectations. Management guided FY2026 EPS to $19.40–$19.65, well below the Street consensus of $19.96. This widened investor concerns that growth momentum is slowing and margin pressure may persist.

In Q4, the company reported adjusted EPS of $4.30, missing the $4.34 analyst expectation by $0.04. On the other hand, total revenue rose 9.2% Y/Y to $3.92B, beating the $3.91B estimate by $10M. S

S&P Global (SPGI) delivered a mixed Q4 2025 print and an underwhelming 2026 outlook. The stock sold off sharply after the release due to weaker profitability guidance and Q4 earnings coming in below expectations. Management guided FY2026 EPS to $19.40–$19.65, well below the Street consensus of $19.96. This widened investor concerns that growth momentum is slowing and margin pressure may persist.

In Q4, the company reported adjusted EPS of $4.30, missing the $4.34 analyst expectation by $0.04. On the other hand, total revenue rose 9.2% Y/Y to $3.92B, beating the $3.91B estimate by $10M. S

- Reward

- like

- Comment

- Repost

- Share

$MSCI

It collided with the correction band and the supertrend (black sell) right in the resistance band area. It’s a tough zone and it got rejected

It collided with the correction band and the supertrend (black sell) right in the resistance band area. It’s a tough zone and it got rejected

- Reward

- like

- Comment

- Repost

- Share

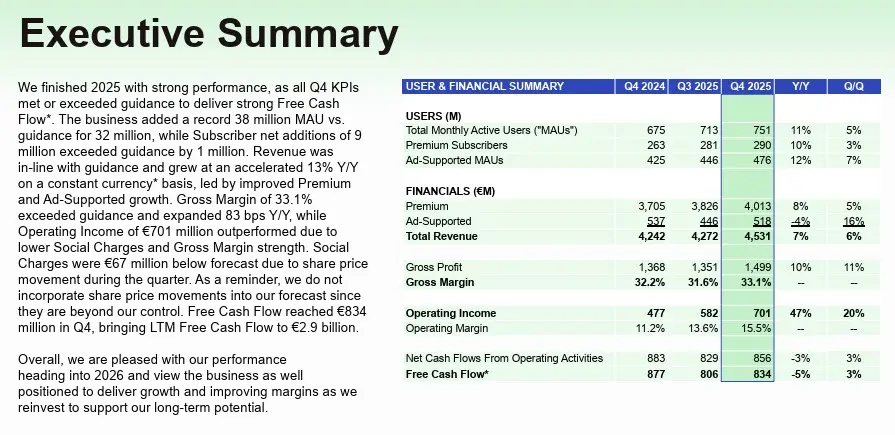

$SPOT

Spotify delivered a very strong performance in Q4 2025, clearly beating expectations on both user growth and profitability.

GAAP EPS of €4.43 beat expectations by €1.65; net income jumped to €1.17B while revenue rose to €4.53B, up 7.9% Y/Y (FX pressured growth by ~580 bps).

Premium revenue increased to €4.01B, up 8% Y/Y (14% in constant currency), while ad revenue declined 4% on a reported basis (up 4% in constant currency).

Operationally, Spotify added 38M net MAUs to reach 751M total; Premium subscribers hit 290M (+10% Y/Y) and ARPU of €4.70 beat expectations.

For Q1 2026, management g

Spotify delivered a very strong performance in Q4 2025, clearly beating expectations on both user growth and profitability.

GAAP EPS of €4.43 beat expectations by €1.65; net income jumped to €1.17B while revenue rose to €4.53B, up 7.9% Y/Y (FX pressured growth by ~580 bps).

Premium revenue increased to €4.01B, up 8% Y/Y (14% in constant currency), while ad revenue declined 4% on a reported basis (up 4% in constant currency).

Operationally, Spotify added 38M net MAUs to reach 751M total; Premium subscribers hit 290M (+10% Y/Y) and ARPU of €4.70 beat expectations.

For Q1 2026, management g

- Reward

- like

- Comment

- Repost

- Share

$RIVN

Rivian reportedly testing R2 in cold weather

Feb. 09, 2026

Rivian Automotive (RIVN) is reportedly testing its new R2 SUV in frigid temperatures, ensuring that the electric vehicle can perform in sub-zero conditions before its anticipated launch in the first half of this year.

According to a Reddit post, the vehicle was spotted in Fairbanks, Alaska over the weekend.

Cold weather testing is crucial to assure an EV’s battery capability and could help establish the more affordable R2 as a competitor to Tesla’s (TSLA) Model Y.

Moreover, with a starting price near $45,000, the Rivian R2 qual

Rivian reportedly testing R2 in cold weather

Feb. 09, 2026

Rivian Automotive (RIVN) is reportedly testing its new R2 SUV in frigid temperatures, ensuring that the electric vehicle can perform in sub-zero conditions before its anticipated launch in the first half of this year.

According to a Reddit post, the vehicle was spotted in Fairbanks, Alaska over the weekend.

Cold weather testing is crucial to assure an EV’s battery capability and could help establish the more affordable R2 as a competitor to Tesla’s (TSLA) Model Y.

Moreover, with a starting price near $45,000, the Rivian R2 qual

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More230.88K Popularity

52.75K Popularity

22.13K Popularity

17.21K Popularity

16.88K Popularity

Pin