RichChillacc

No content yet

RichChillacc

How much did OpenAI acquire OpenClaw for?

Feel free to give use subtle hints .@steipete 😉

Feel free to give use subtle hints .@steipete 😉

- Reward

- 1

- Comment

- Repost

- Share

is .@elonmusk included in the x revenue sharing program?

if yes i wonder how much he makes lol, he probably has billions of impressions a month

if yes i wonder how much he makes lol, he probably has billions of impressions a month

- Reward

- 1

- Comment

- Repost

- Share

tbh i used to hate apple for their overpriced products, locking ppl into their eco, overvalued stock

but now seeing how they handled the ai race i am impressed

not only did they not become irrelevant from not going all in on ai, they now have $100b+ to acquire whatever

based

but now seeing how they handled the ai race i am impressed

not only did they not become irrelevant from not going all in on ai, they now have $100b+ to acquire whatever

based

- Reward

- like

- Comment

- Repost

- Share

Pigs get fat, hogs get slaughtered

- Reward

- like

- Comment

- Repost

- Share

In the past the government had superior technologies for years or even decades before that tech was released to the public.

Today the U.S. military is literally using the same AI model as a random kid in his mom's basement to kidnap a foreign president.

Should this be a concern?

Today the U.S. military is literally using the same AI model as a random kid in his mom's basement to kidnap a foreign president.

Should this be a concern?

- Reward

- like

- Comment

- Repost

- Share

short tinder is the move here?

- Reward

- like

- Comment

- Repost

- Share

listening 3 podcasts right now

> lex friedman x peter steinberger on openclaw

> dwarkesh patel x dario amodei on anthropic

> smac x nexus on crypto trading

banger combo imo

> lex friedman x peter steinberger on openclaw

> dwarkesh patel x dario amodei on anthropic

> smac x nexus on crypto trading

banger combo imo

- Reward

- like

- Comment

- Repost

- Share

Inside you are two wolves

1. accept creator fees for a random memecoin from a bunch of random internet monkeys

- get ~6 figs and ruin your reputation

2. keep building, improve the product, make yourself impossible to ignore

- get acquired by a tycoon

1. accept creator fees for a random memecoin from a bunch of random internet monkeys

- get ~6 figs and ruin your reputation

2. keep building, improve the product, make yourself impossible to ignore

- get acquired by a tycoon

MEME-0,46%

- Reward

- like

- Comment

- Repost

- Share

1.5 SOL and a dream

SOL-1,44%

- Reward

- like

- Comment

- Repost

- Share

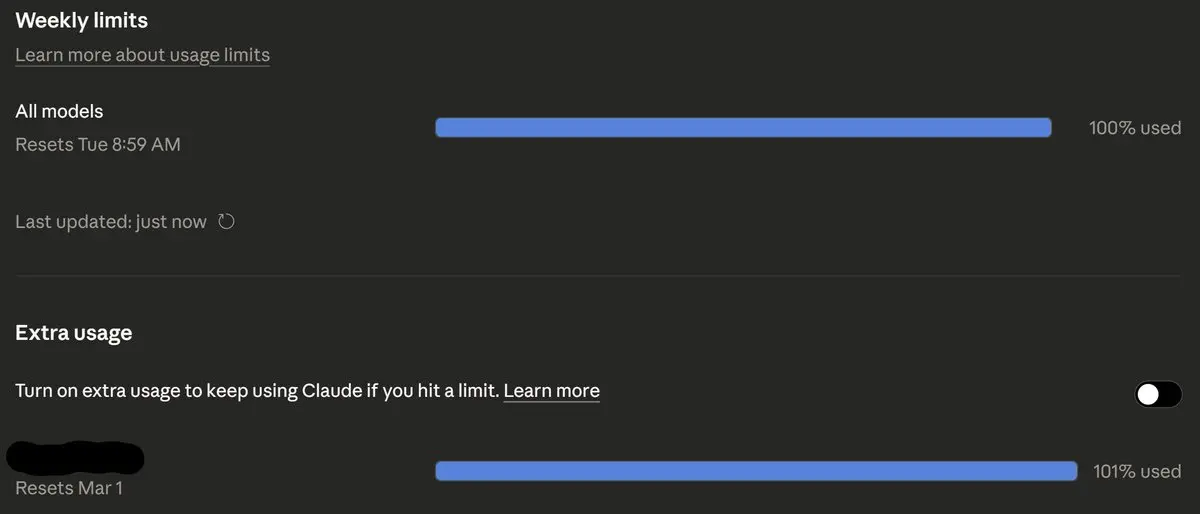

The lion doesn't concern himself with token counting

- Reward

- like

- Comment

- Repost

- Share

Feels like a fumble that OpenClaw is going to OpenAi and not Anthropic

Any reason in particular .@steipete?

Any reason in particular .@steipete?

- Reward

- 1

- Comment

- Repost

- Share

signing up, connecting my credit card, and doing a couple chats on every single new chinese ai lab in hopes of an airdrop

- Reward

- 1

- Comment

- Repost

- Share

signing up and connecting my credit to every single new chinese ai lab in hopes of an airdrop

- Reward

- 2

- Comment

- Repost

- Share

just opened my x fyp and every single post is a video

what happened to 280 character bangers? 😭😭🥀🥀

what happened to 280 character bangers? 😭😭🥀🥀

- Reward

- like

- Comment

- Repost

- Share