#USIranNuclearTalksTurmoil

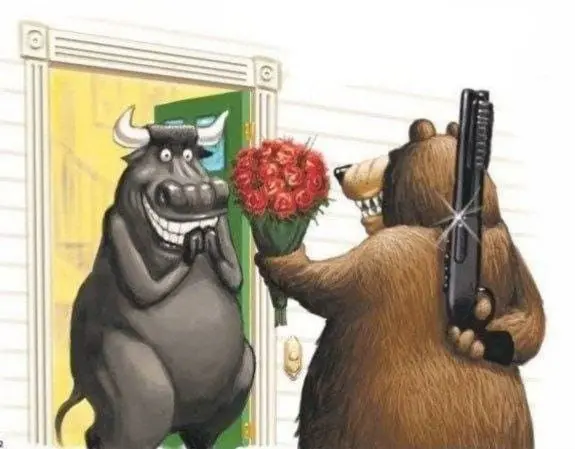

Possible Outcomes of the Oman Talks: The Muscat talks between the US and Iran (beginning today) have a very limited chance of success, largely due to differences in positions. The parties' red lines almost completely coincide.

Most Likely Scenarios (in order of probability):

Ends without any concrete agreement – “Just an exchange of views” (highest probability ~60–70%)

The talks are short, the parties reiterate their positions.

Joint statement: A diplomatic phrase such as “It was constructive, we will continue.”

In reality, progress is zero or very minimal.

Tensions in the region continue as they are.

A very limited, temporary “de-escalation” agreement (~15–25%)

Iran: May commit to suspending high-level uranium enrichment for a certain period (e.g., 6–12 months).

US: In return, some partial and temporary easing of sanctions (e.g., some exceptions regarding oil sales).

The missile program and proxy forces are definitely not on the table.

This scenario is seen as a "time-gaining" tactic.

Complete breakdown of negotiations and a new wave of crisis (~10-20%)

The US delegation (Witkoff + Kushner) does not accept Iran's "nuclear-only" insistence and walks away from the table. The Trump administration immediately announces a new sanctions package or increases military activity (aircraft carrier deployments, exercises).

Iran may retaliate by conducting new drone/missile tests or escalating Houthi actions.

An unexpected softening/framework agreement (very low probability ~<5%)

Mediators (Qatar, Egypt, Turkey) bring the parties together at the last minute. Example: A package of non-comprehensive sanctions lifting in exchange for Iran freezing enrichment for 3 years + transferring its uranium stockpile to a third country.

This seems almost impossible in the current atmosphere. Overall Assessment

Both sides are at the table not to win, but to avoid losing.

Iran has come to the table due to internal pressure (continued protests, economic issues) and external threats (Israel + US military presence). The Trump administration, however, is pursuing a "maximum pressure + diplomacy" strategy; the military option remains on the table. Statements expected today/tomorrow will likely indicate that diplomacy will continue, but no concrete progress is anticipated.

Possible Outcomes of the Oman Talks: The Muscat talks between the US and Iran (beginning today) have a very limited chance of success, largely due to differences in positions. The parties' red lines almost completely coincide.

Most Likely Scenarios (in order of probability):

Ends without any concrete agreement – “Just an exchange of views” (highest probability ~60–70%)

The talks are short, the parties reiterate their positions.

Joint statement: A diplomatic phrase such as “It was constructive, we will continue.”

In reality, progress is zero or very minimal.

Tensions in the region continue as they are.

A very limited, temporary “de-escalation” agreement (~15–25%)

Iran: May commit to suspending high-level uranium enrichment for a certain period (e.g., 6–12 months).

US: In return, some partial and temporary easing of sanctions (e.g., some exceptions regarding oil sales).

The missile program and proxy forces are definitely not on the table.

This scenario is seen as a "time-gaining" tactic.

Complete breakdown of negotiations and a new wave of crisis (~10-20%)

The US delegation (Witkoff + Kushner) does not accept Iran's "nuclear-only" insistence and walks away from the table. The Trump administration immediately announces a new sanctions package or increases military activity (aircraft carrier deployments, exercises).

Iran may retaliate by conducting new drone/missile tests or escalating Houthi actions.

An unexpected softening/framework agreement (very low probability ~<5%)

Mediators (Qatar, Egypt, Turkey) bring the parties together at the last minute. Example: A package of non-comprehensive sanctions lifting in exchange for Iran freezing enrichment for 3 years + transferring its uranium stockpile to a third country.

This seems almost impossible in the current atmosphere. Overall Assessment

Both sides are at the table not to win, but to avoid losing.

Iran has come to the table due to internal pressure (continued protests, economic issues) and external threats (Israel + US military presence). The Trump administration, however, is pursuing a "maximum pressure + diplomacy" strategy; the military option remains on the table. Statements expected today/tomorrow will likely indicate that diplomacy will continue, but no concrete progress is anticipated.