Asiftahsin

No content yet

Asiftahsin

XRP Technical Outlook: Price Holds Cycle Base as Downtrend Structure Remains Intact

XRP continues to trade within a well-defined corrective downtrend after failing to reclaim the $2.70–$2.95 supply region, which aligns with the 0.5–0.618 Fibonacci retracement zone. Persistent rejection from the descending trend channel and repeated failures below key moving averages confirm that the medium-term structure remains bearish.

Price is currently consolidating near the $1.75–$1.80 cycle base, where selling pressure has slowed. However, the lack of impulsive upside continuation suggests stabilization

XRP continues to trade within a well-defined corrective downtrend after failing to reclaim the $2.70–$2.95 supply region, which aligns with the 0.5–0.618 Fibonacci retracement zone. Persistent rejection from the descending trend channel and repeated failures below key moving averages confirm that the medium-term structure remains bearish.

Price is currently consolidating near the $1.75–$1.80 cycle base, where selling pressure has slowed. However, the lack of impulsive upside continuation suggests stabilization

XRP0,05%

- Reward

- 1

- 1

- Repost

- Share

Ryakpanda :

:

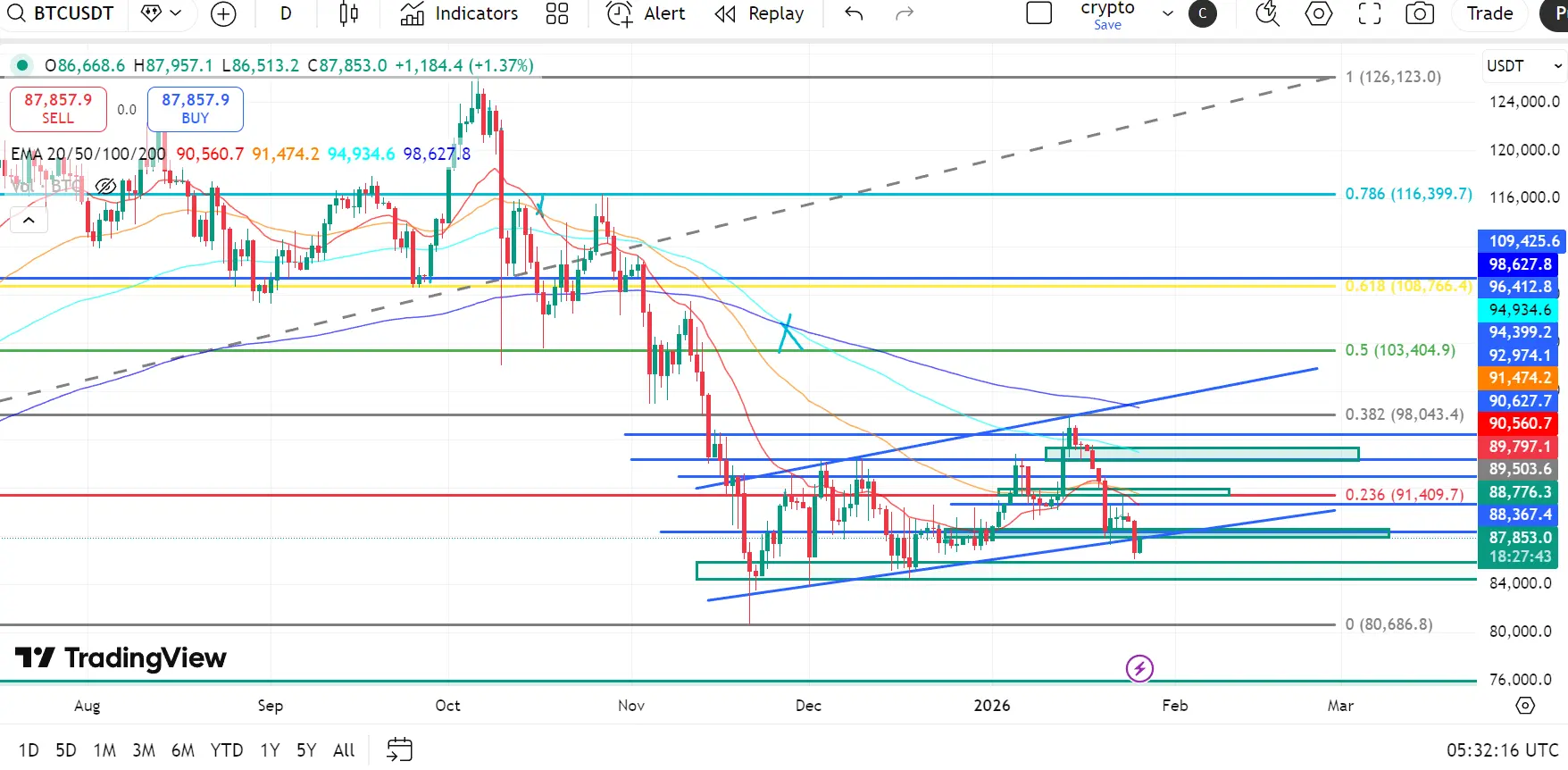

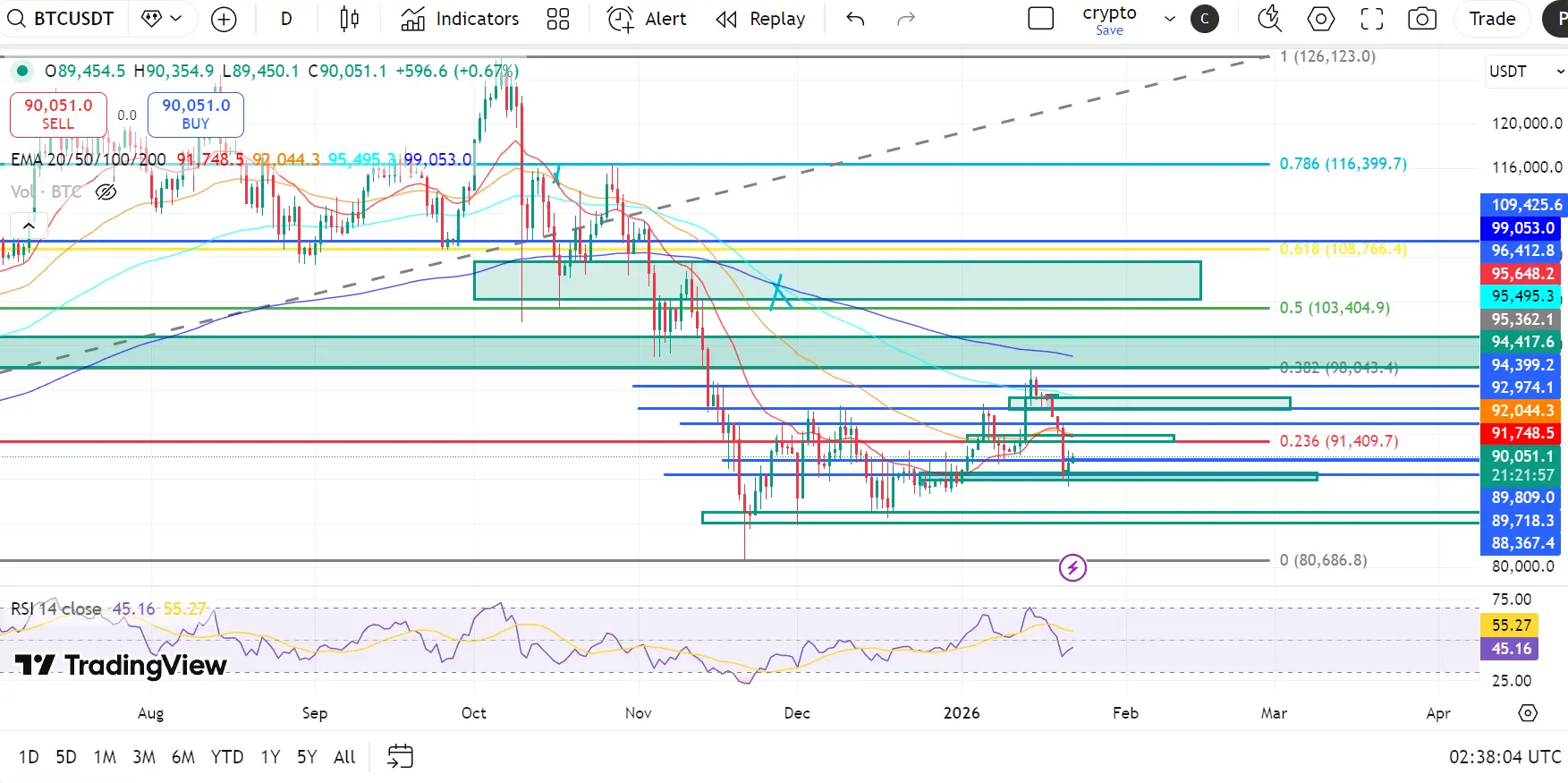

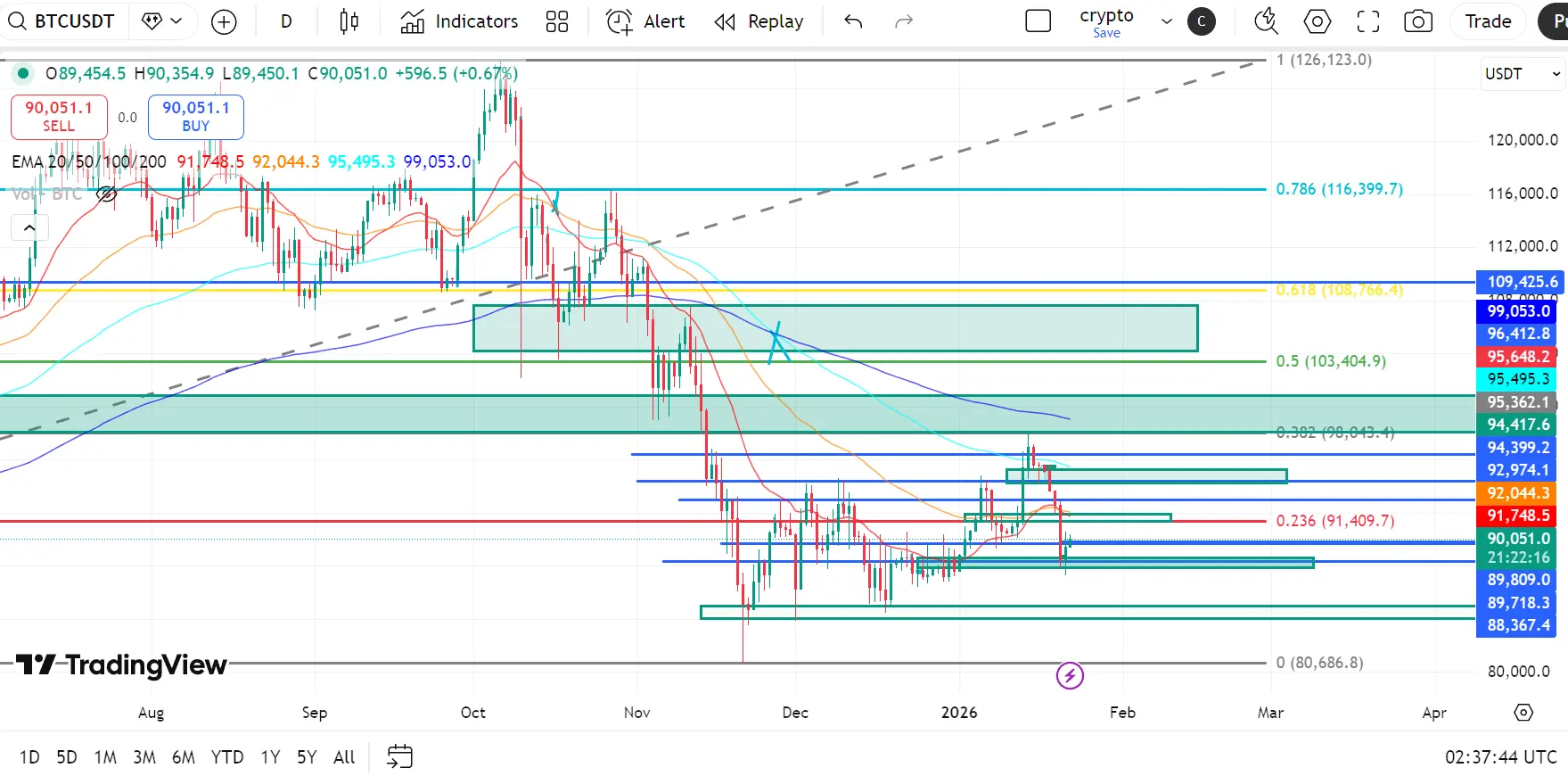

Hold on tight, we're about to take off 🛫BTC Technical Outlook: Breakdown From Local Range, Retesting Macro Demand

Bitcoin remains within a broader corrective structure after the rejection from the $108K–$116K macro supply zone (0.618–0.786 Fib). That rejection marked a distribution top, followed by a strong bearish continuation into late Q4.

Recent price action shows BTC losing the $88K–$90K range base and now moving lower into the $83K–$80K macro demand zone, where buyers previously stepped in aggressively. Momentum has weakened again, and the higher-timeframe trend remains bearish.

EMA Structure (Bearish Bias, Breakdown Phase)

20

Bitcoin remains within a broader corrective structure after the rejection from the $108K–$116K macro supply zone (0.618–0.786 Fib). That rejection marked a distribution top, followed by a strong bearish continuation into late Q4.

Recent price action shows BTC losing the $88K–$90K range base and now moving lower into the $83K–$80K macro demand zone, where buyers previously stepped in aggressively. Momentum has weakened again, and the higher-timeframe trend remains bearish.

EMA Structure (Bearish Bias, Breakdown Phase)

20

BTC0,76%

- Reward

- 5

- 4

- 1

- Share

NewName :

:

Thank you for information! View More

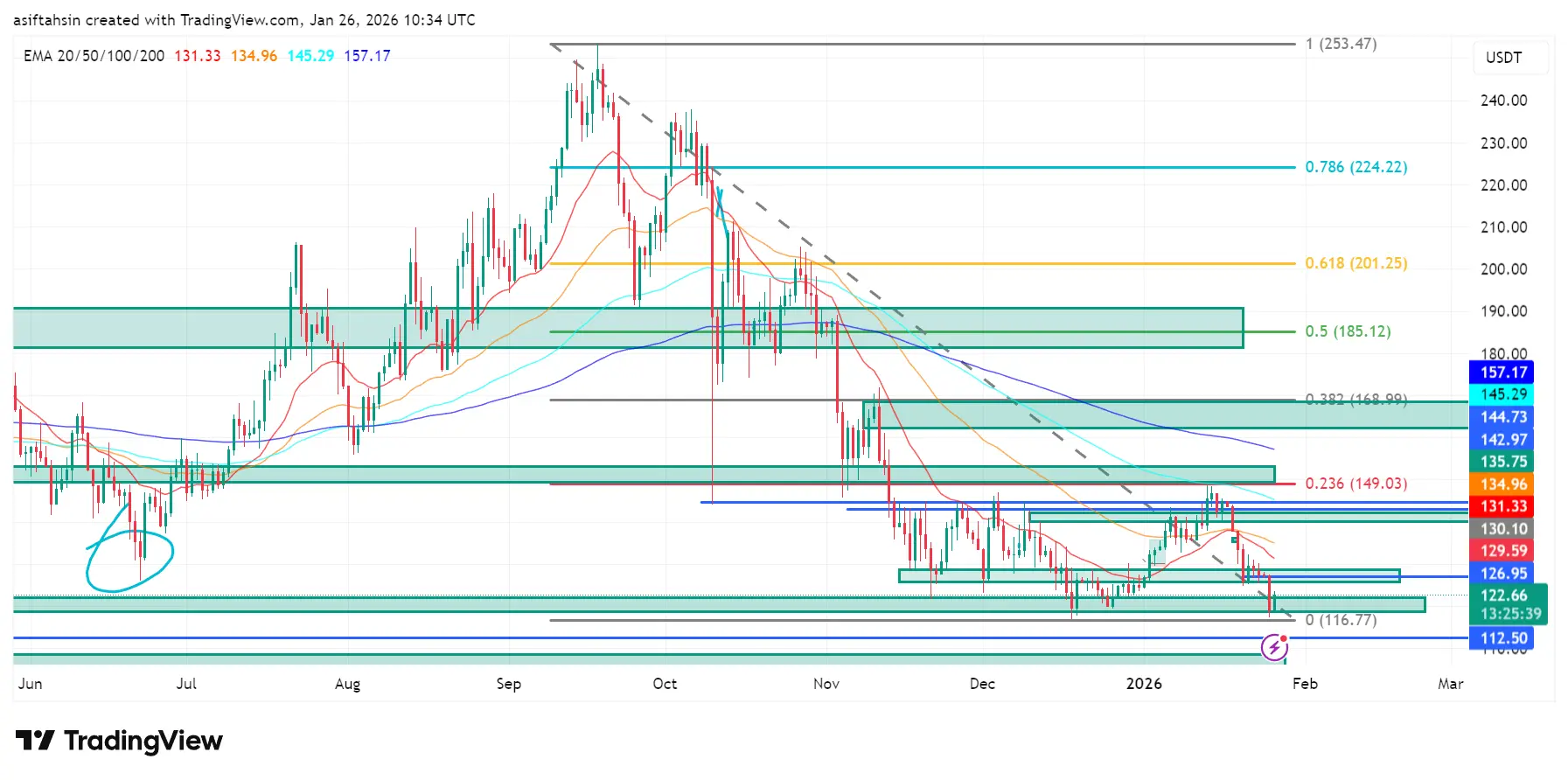

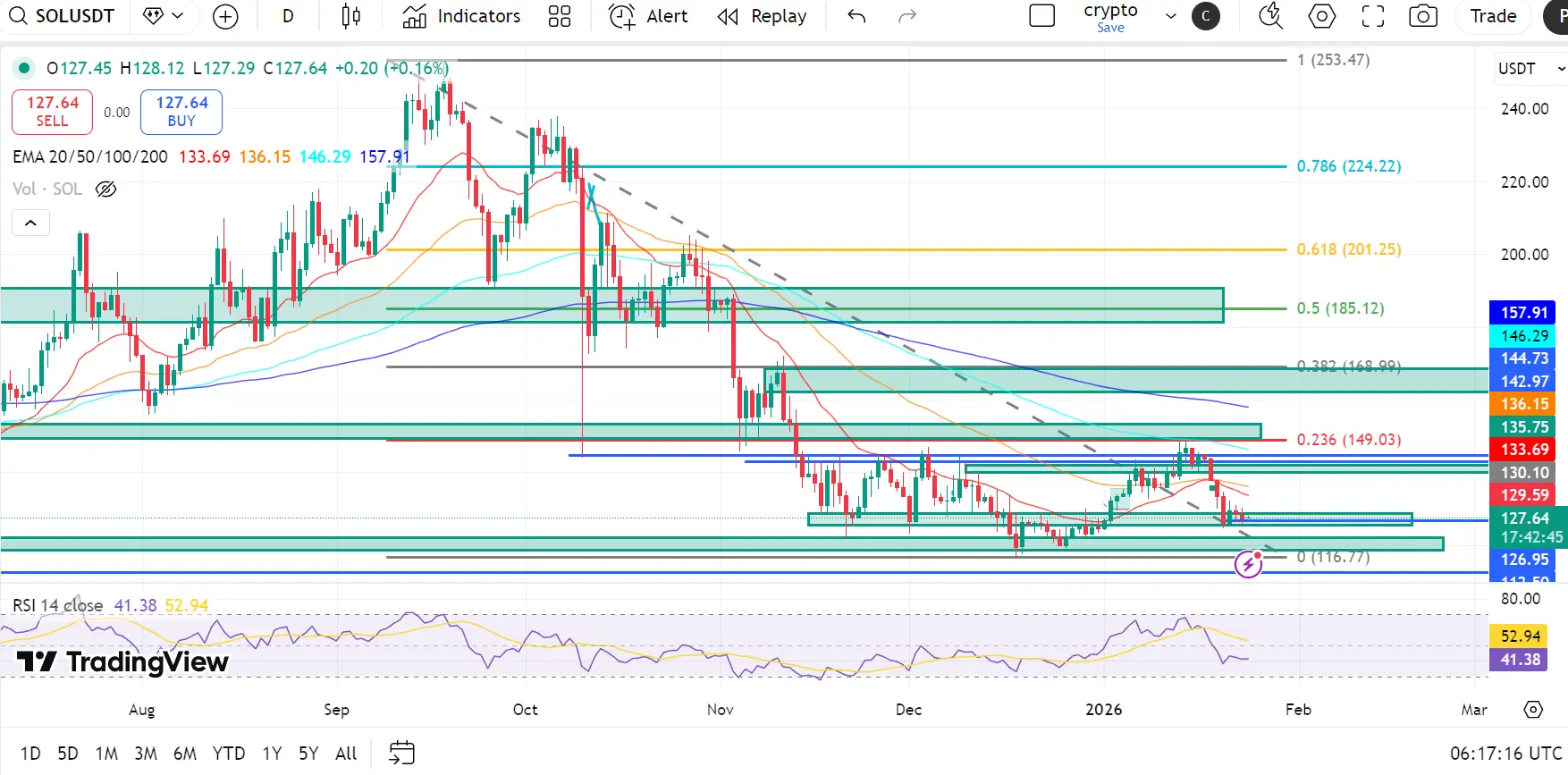

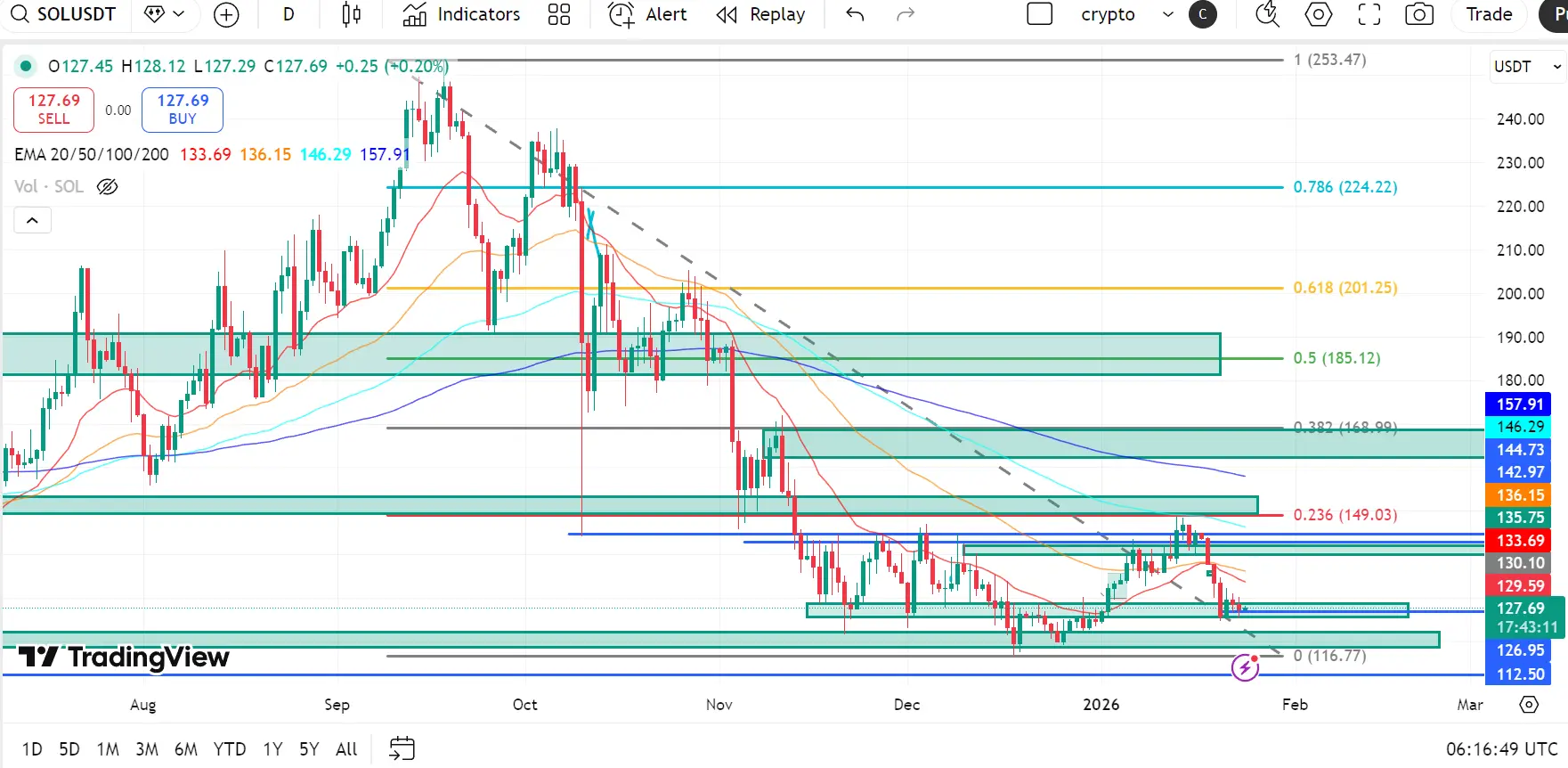

SOL Technical Outlook: Price Holds Cycle Base as Broader Corrective Structure Persists

Solana remains in a prolonged corrective phase after failing to sustain acceptance above the $185–$200 supply zone, which coincides with the 0.5–0.618 Fibonacci retracement area. Repeated rejections from the descending trendline and continued inability to reclaim key moving averages confirm that the medium-term structure remains neutral-to-bearish.

Price is currently consolidating just above the $118–$123 cycle base, where selling pressure has slowed. However, the absence of strong impulsive upside follow-th

Solana remains in a prolonged corrective phase after failing to sustain acceptance above the $185–$200 supply zone, which coincides with the 0.5–0.618 Fibonacci retracement area. Repeated rejections from the descending trendline and continued inability to reclaim key moving averages confirm that the medium-term structure remains neutral-to-bearish.

Price is currently consolidating just above the $118–$123 cycle base, where selling pressure has slowed. However, the absence of strong impulsive upside follow-th

SOL2,85%

- Reward

- 7

- 5

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

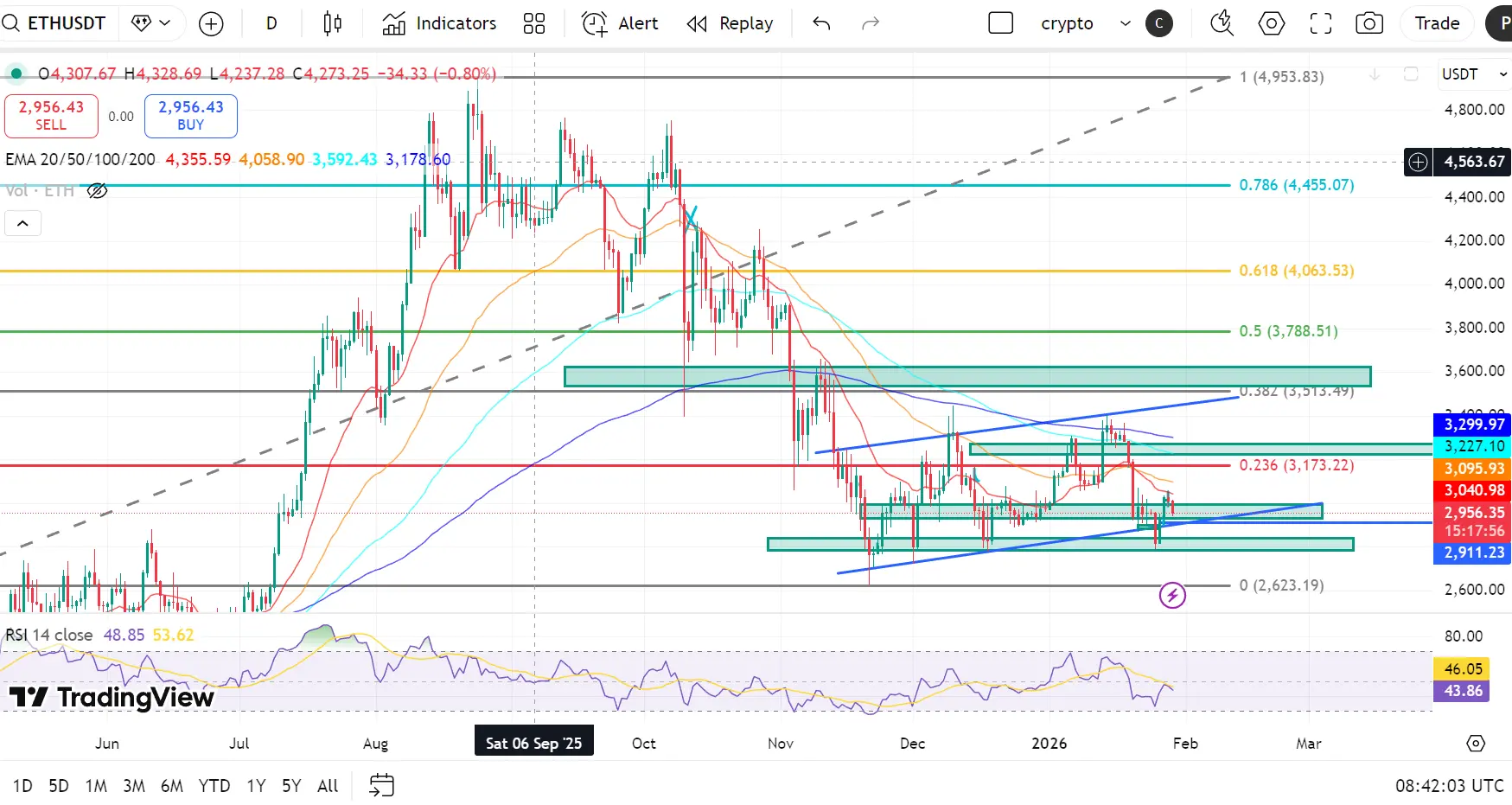

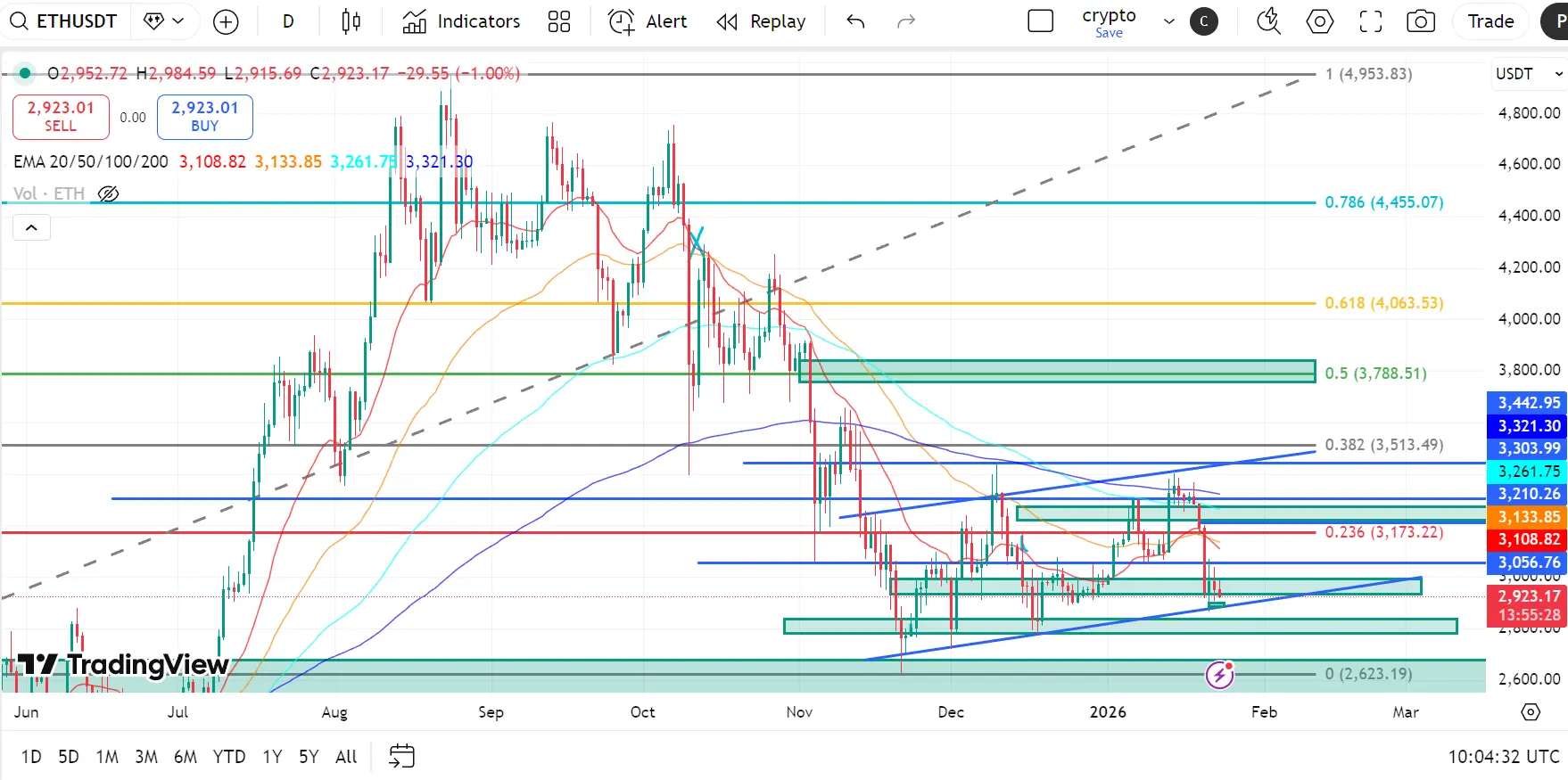

ETH Technical Outlook: Ethereum Consolidates Near Structural Base as Corrective Pressure Persists

Ethereum remains under sustained corrective pressure after repeated failures to reclaim the $3,170–$3,230 resistance zone, which aligns with the 0.236 Fibonacci retracement and the declining EMA structure. Rejection from this region continues to reinforce a neutral-to-bearish medium-term structure, with upside attempts remaining corrective in nature.

Price is currently consolidating around the $2,900–$3,000 region, holding above the rising base support while failing to attract strong follow-throug

Ethereum remains under sustained corrective pressure after repeated failures to reclaim the $3,170–$3,230 resistance zone, which aligns with the 0.236 Fibonacci retracement and the declining EMA structure. Rejection from this region continues to reinforce a neutral-to-bearish medium-term structure, with upside attempts remaining corrective in nature.

Price is currently consolidating around the $2,900–$3,000 region, holding above the rising base support while failing to attract strong follow-throug

ETH-0,8%

- Reward

- 7

- 4

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

XRP Technical Outlook: Price Compresses Near Cycle Lows as Bearish Structure Persists

XRP remains under broad corrective pressure after failing to reclaim the $2.70–$2.95 resistance region, which aligns with the 0.5–0.618 Fibonacci retracement cluster. The sustained rejection from the descending trendline and repeated failures below key EMAs continue to reinforce a neutral-to-bearish medium-term structure.

Price is currently consolidating around the $1.90–$2.00 zone, hovering just above the cycle base support near $1.77, indicating indecision as selling momentum slows but conviction buying rem

XRP remains under broad corrective pressure after failing to reclaim the $2.70–$2.95 resistance region, which aligns with the 0.5–0.618 Fibonacci retracement cluster. The sustained rejection from the descending trendline and repeated failures below key EMAs continue to reinforce a neutral-to-bearish medium-term structure.

Price is currently consolidating around the $1.90–$2.00 zone, hovering just above the cycle base support near $1.77, indicating indecision as selling momentum slows but conviction buying rem

XRP0,05%

- Reward

- 41

- 29

- 1

- Share

MKamran :

:

"Discover seamless crypto trading on Gate.io – fast, secure, and user-friendly! Start today!"View More

BTC Technical Outlook: Stabilizing Above Macro Demand After Distribution Rejection

Bitcoin remains within a broader corrective structure after the sharp rejection from the $108K–$116K macro supply zone (0.618–0.786 Fib). That rejection marked a distribution top, followed by an extended bearish move into November–December.

Recent price action shows BTC defending the $88K–$90K macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet turned bullish.

EMA Structure (Bearish Bias, Short-Term Stabili

Bitcoin remains within a broader corrective structure after the sharp rejection from the $108K–$116K macro supply zone (0.618–0.786 Fib). That rejection marked a distribution top, followed by an extended bearish move into November–December.

Recent price action shows BTC defending the $88K–$90K macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet turned bullish.

EMA Structure (Bearish Bias, Short-Term Stabili

BTC0,76%

- Reward

- 19

- 9

- Repost

- Share

Mohibi :

:

thank you for sharing thisView More

XRP Technical Outlook: Stabilizing Near Macro Demand Base After Extended Decline

XRP remains within a broader corrective structure after the sharp rejection from the $3.25–$3.66 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by a continued bearish trend inside a descending channel.

Recent price action shows XRP defending the $1.77–$1.90 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet turned bullish.

EMA Structure (Bearish Bias, Short-Term Stabiliza

XRP remains within a broader corrective structure after the sharp rejection from the $3.25–$3.66 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by a continued bearish trend inside a descending channel.

Recent price action shows XRP defending the $1.77–$1.90 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet turned bullish.

EMA Structure (Bearish Bias, Short-Term Stabiliza

XRP0,05%

- Reward

- 6

- 3

- Repost

- Share

User_any :

:

Happy New Year! 🤑View More

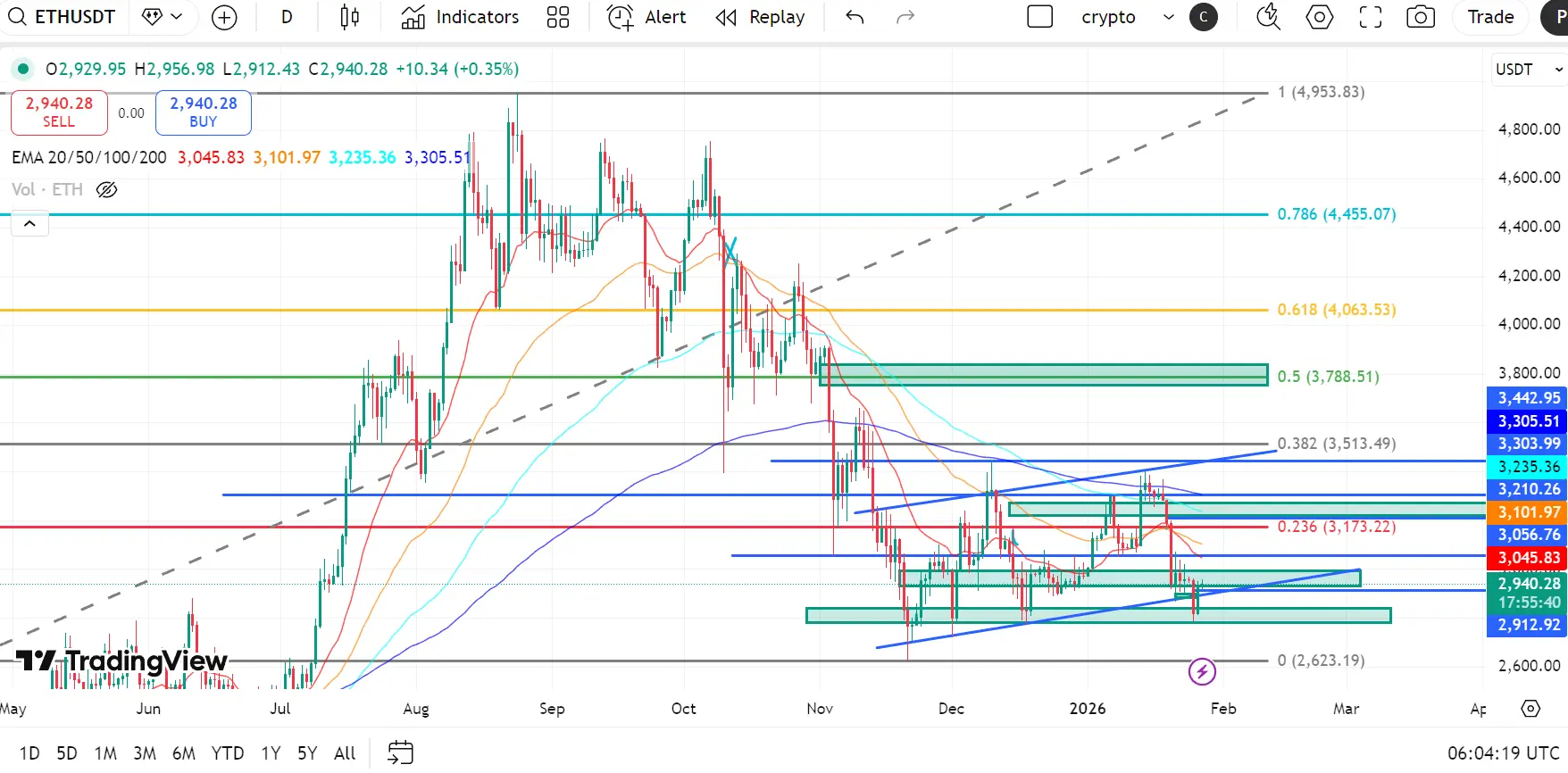

ETH Technical Outlook: Stabilizing After Prolonged Downtrend

Ethereum remains within a broader corrective structure after the sharp rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by strong bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows ETH defending the $2,620–$2,900 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

EMA Str

Ethereum remains within a broader corrective structure after the sharp rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by strong bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows ETH defending the $2,620–$2,900 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

EMA Str

ETH-0,8%

- Reward

- 14

- 7

- Repost

- Share

CRYPTODZ01 :

:

Bullish market at its peak 🐂View More

SOL Technical Outlook: Base Formation Develops After Prolonged Correction

Solana remains within a broader corrective structure after the sharp rejection from the $224–$253 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows SOL defending the $116–$123 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

E

Solana remains within a broader corrective structure after the sharp rejection from the $224–$253 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows SOL defending the $116–$123 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

E

SOL2,85%

- Reward

- 9

- 6

- Repost

- Share

ybaser :

:

Just go for it💪View More

BTC Technical Outlook: Accumulation Structure Develops Above Macro Demand

Bitcoin remains within a broader corrective structure after the sharp rejection from the $116K–$126K macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by strong bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows BTC defending the $88.5K–$90.0K macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullis

Bitcoin remains within a broader corrective structure after the sharp rejection from the $116K–$126K macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by strong bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows BTC defending the $88.5K–$90.0K macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullis

BTC0,76%

- Reward

- 9

- 10

- Repost

- Share

ybaser :

:

Just go for it💪View More

XRP Technical Outlook: Descending Channel Base Forms Near Macro Demand

XRP remains within a broader corrective structure after the sharp rejection from the $3.25–$3.65 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation and now a range-bound stabilization phase near the lower end of the structure inside a descending channel.

Recent price action shows XRP defending the $1.85–$1.77 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has

XRP remains within a broader corrective structure after the sharp rejection from the $3.25–$3.65 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation and now a range-bound stabilization phase near the lower end of the structure inside a descending channel.

Recent price action shows XRP defending the $1.85–$1.77 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has

XRP0,05%

- Reward

- 18

- 15

- Repost

- Share

ybaser :

:

2026 Go Go Go 👊View More

ETH Technical Outlook: Base Formation Develops After Prolonged Corrective Phase

Ethereum remains within a broader corrective structure after the sharp rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows ETH defending the $2,620–$2,900 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet fl

Ethereum remains within a broader corrective structure after the sharp rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows ETH defending the $2,620–$2,900 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet fl

ETH-0,8%

- Reward

- 10

- 5

- 1

- Share

ybaser :

:

Hold on tight, we're about to take off 🛫View More

SOL Technical Outlook: Range Base Forms Inside Broader Downtrend

Solana remains within a broader corrective structure after the sharp rejection from the $220–$253 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation inside a descending channel.

Recent price action shows SOL defending the $116–$128 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

EMA Structure (Bearish Bias, Short-Term Stabilization)

20 EM

Solana remains within a broader corrective structure after the sharp rejection from the $220–$253 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation inside a descending channel.

Recent price action shows SOL defending the $116–$128 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

EMA Structure (Bearish Bias, Short-Term Stabilization)

20 EM

SOL2,85%

- Reward

- 9

- 7

- Repost

- Share

ybaser :

:

Watching Closely 🔍️View More

BTC Technical Outlook: Accumulation Structure Forms Near Macro Demand

Bitcoin remains within a broader corrective structure after the sharp rejection from the $116K–$126K macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by strong bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows BTC defending the $88.7K–$90.5K macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

Bitcoin remains within a broader corrective structure after the sharp rejection from the $116K–$126K macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by strong bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows BTC defending the $88.7K–$90.5K macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

BTC0,76%

- Reward

- 8

- 7

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

ETH Technical Outlook: Ethereum Consolidates Below Key Fib Resistance After Sharp Corrective Decline

Ethereum remains in a medium-term corrective structure following the rejection from the $4,450–$4,950 macro resistance region. The breakdown below the rising trendline and subsequent loss of the 0.382–0.5 Fibonacci cluster confirmed a transition from bullish continuation into a neutral-bearish market phase.

Price is currently stabilizing near the $2,950–$3,050 region, attempting to form a base after the impulsive selloff from the $4,000+ highs. This zone represents a critical decision area for

Ethereum remains in a medium-term corrective structure following the rejection from the $4,450–$4,950 macro resistance region. The breakdown below the rising trendline and subsequent loss of the 0.382–0.5 Fibonacci cluster confirmed a transition from bullish continuation into a neutral-bearish market phase.

Price is currently stabilizing near the $2,950–$3,050 region, attempting to form a base after the impulsive selloff from the $4,000+ highs. This zone represents a critical decision area for

ETH-0,8%

- Reward

- 7

- 4

- Repost

- Share

UnlimitedStrategy :

:

Buy To Earn 💎View More

XRP Technical Outlook: Price Compresses Near $1.90–$2.00 as Descending Channel Remains Intact

XRP continues to trade within a well-defined descending channel, reflecting a sustained corrective phase following the rejection from the $3.60 cycle high. Recent price action shows short-term stabilization near the lower boundary, but the broader structure remains bearish below key Fibonacci and EMA resistance levels.

At present, XRP is attempting to build a base above $1.88–$1.90, though upside momentum remains limited.

EMA Structure (Bearish Alignment)

20 EMA: 2.008

50 EMA: 2.048

100 EMA: 2.172

200

XRP continues to trade within a well-defined descending channel, reflecting a sustained corrective phase following the rejection from the $3.60 cycle high. Recent price action shows short-term stabilization near the lower boundary, but the broader structure remains bearish below key Fibonacci and EMA resistance levels.

At present, XRP is attempting to build a base above $1.88–$1.90, though upside momentum remains limited.

EMA Structure (Bearish Alignment)

20 EMA: 2.008

50 EMA: 2.048

100 EMA: 2.172

200

XRP0,05%

- Reward

- 7

- 4

- Repost

- Share

KatyPaty :

:

Thank you for the informationView More

XRP Technical Outlook: Price Stabilizes Near $1.90 Support as Downtrend Structure Persists

XRP continues to trade within a well-defined descending channel, following a prolonged corrective decline from the $3.60 cycle peak. While price has recently found short-term support near the $1.88–$1.90 demand zone, the broader structure remains bearish-to-neutral, with XRP still capped below key Fibonacci retracement levels and declining moving averages.

The current rebound appears corrective rather than impulsive, and confirmation of a trend shift is still lacking.

EMA Structure (Bearish Alignment)

20

XRP continues to trade within a well-defined descending channel, following a prolonged corrective decline from the $3.60 cycle peak. While price has recently found short-term support near the $1.88–$1.90 demand zone, the broader structure remains bearish-to-neutral, with XRP still capped below key Fibonacci retracement levels and declining moving averages.

The current rebound appears corrective rather than impulsive, and confirmation of a trend shift is still lacking.

EMA Structure (Bearish Alignment)

20

XRP0,05%

- Reward

- 14

- 12

- Repost

- Share

CAMPEAO :

:

It will be very goodView More

BTC Technical Outlook: Bitcoin Remains Corrective Below Key Fibonacci Resistance

Bitcoin continues to trade within a corrective structure following the rejection from the upper trend zone and the failure to hold above the $108k–$116k Fibonacci resistance cluster. The breakdown from the rising structure has shifted BTC into a neutral-to-bearish medium-term bias, with price now consolidating below major moving averages.

The recent rebound from sub-$90k levels appears corrective in nature and has so far failed to reclaim structurally important resistance.

EMA Structure (Bearish Alignment)

20 EMA:

Bitcoin continues to trade within a corrective structure following the rejection from the upper trend zone and the failure to hold above the $108k–$116k Fibonacci resistance cluster. The breakdown from the rising structure has shifted BTC into a neutral-to-bearish medium-term bias, with price now consolidating below major moving averages.

The recent rebound from sub-$90k levels appears corrective in nature and has so far failed to reclaim structurally important resistance.

EMA Structure (Bearish Alignment)

20 EMA:

BTC0,76%

- Reward

- 19

- 21

- Repost

- Share

GateUser-c59210af :

:

2026 GOGOGO 👊View More

Check in to Stream, Sprint for VIP+1 and Monthly Bonus https://www.gate.com/campaigns/3899?ref=BARCV1FY&ref_type=132

- Reward

- 7

- 4

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

Trending Topics

View More18.03K Popularity

31.93K Popularity

354.97K Popularity

33.68K Popularity

54.22K Popularity

Pin