Neesa04

No content yet

neesa04

Stepping into the New Year at Gate Square with pure joy in the air ✨

The lights were brighter, the smiles warmer, and every moment felt like a fresh beginning. Grateful for the memories we made and excited for everything that’s coming next.

Here’s to new dreams, new energy, and a year full of beautiful surprises. 🥂

#CelebratingNewYearOnGateSquare 🎆

The lights were brighter, the smiles warmer, and every moment felt like a fresh beginning. Grateful for the memories we made and excited for everything that’s coming next.

Here’s to new dreams, new energy, and a year full of beautiful surprises. 🥂

#CelebratingNewYearOnGateSquare 🎆

- Reward

- 2

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? 📉🤔

Markets pulled back… but is this a discount or a warning sign?

Some see opportunity — lower prices, long-term upside, classic dip-buying moment.

Others see risk — uncertainty, macro pressure, and more downside ahead.

Timing the market is tough. Strategy matters more than impulse.

Are you accumulating, holding cash, or staying on the sidelines? 💭📊

Markets pulled back… but is this a discount or a warning sign?

Some see opportunity — lower prices, long-term upside, classic dip-buying moment.

Others see risk — uncertainty, macro pressure, and more downside ahead.

Timing the market is tough. Strategy matters more than impulse.

Are you accumulating, holding cash, or staying on the sidelines? 💭📊

- Reward

- 2

- 1

- Repost

- Share

QueenOfTheDay :

:

To The Moon 🌕#AIAgentProjectsI’mWatching 🤖✨

AI agents are moving from hype to real impact. I’m keeping an eye on projects that can plan, reason, collaborate, and actually get things done — from autonomous research assistants to workflow automators and creative copilots.

The next wave isn’t just smarter models… it’s smarter systems.

AI agents are moving from hype to real impact. I’m keeping an eye on projects that can plan, reason, collaborate, and actually get things done — from autonomous research assistants to workflow automators and creative copilots.

The next wave isn’t just smarter models… it’s smarter systems.

- Reward

- 1

- Comment

- Repost

- Share

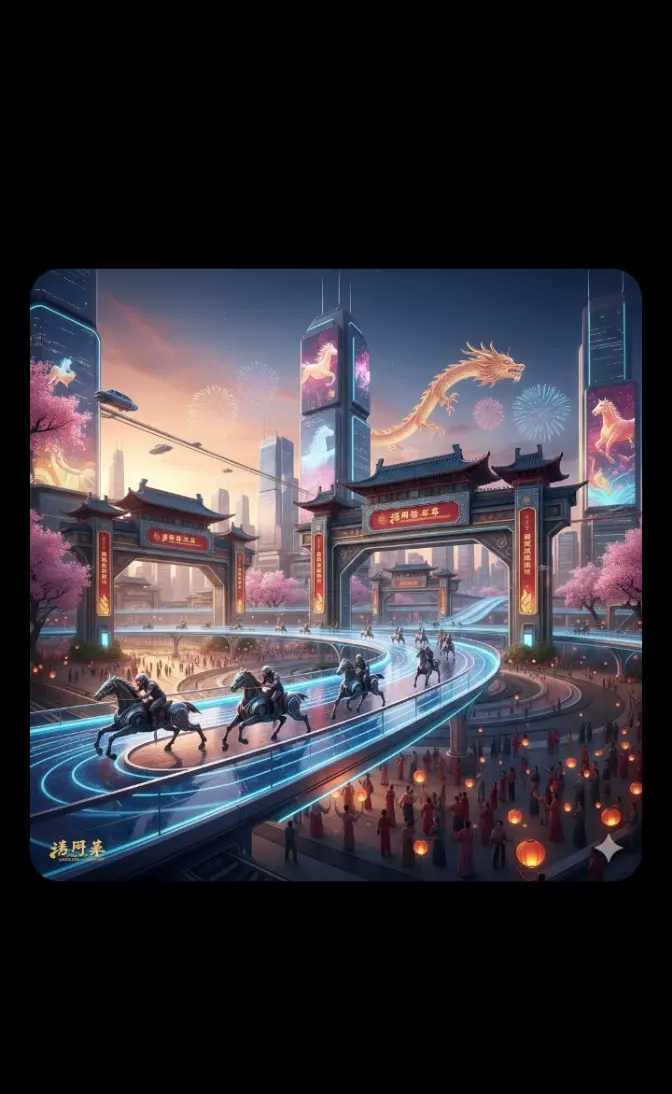

🏮 Happy Chinese New Year’s Eve! 🏮

Celebrate the Year of the Horse with Gate Plaza and get ready to “Get Rich Immediately!” 🐎💰

🔔 The New Year bell is about to ring…

💸 A $50,000 Red Envelope Rain is pouring down!

Post now and unlock your first fortune of the Year of the Horse! 🧧✨

🧨 New Year Limited – Triple Wealth Opportunities:

1️⃣ Good Start Bonus

🎁 New users have a 100% chance to win

💰 Rewards up to 28U

2️⃣ Koi Luck Draw

Post with #我在Gate广场过新年

🏆 1 lucky winner gets 50 GT + a Spring Festival Gift Box

3️⃣ Grand Gift Contest

⚽ Inter Milan jerseys

🧥 Red Bull co-branded jackets

🏕️ VIP

Celebrate the Year of the Horse with Gate Plaza and get ready to “Get Rich Immediately!” 🐎💰

🔔 The New Year bell is about to ring…

💸 A $50,000 Red Envelope Rain is pouring down!

Post now and unlock your first fortune of the Year of the Horse! 🧧✨

🧨 New Year Limited – Triple Wealth Opportunities:

1️⃣ Good Start Bonus

🎁 New users have a 100% chance to win

💰 Rewards up to 28U

2️⃣ Koi Luck Draw

Post with #我在Gate广场过新年

🏆 1 lucky winner gets 50 GT + a Spring Festival Gift Box

3️⃣ Grand Gift Contest

⚽ Inter Milan jerseys

🧥 Red Bull co-branded jackets

🏕️ VIP

GT0,27%

- Reward

- 2

- 1

- Repost

- Share

bullifyXH :

:

nice🏮 Happy Chinese New Year’s Eve! 🏮

Celebrate the Year of the Horse with Gate Plaza and get ready to “Get Rich Immediately!” 🐎💰

🔔 The New Year bell is about to ring…

💸 A $50,000 Red Envelope Rain is pouring down!

Post now and unlock your first fortune of the Year of the Horse! 🧧✨

🧨 New Year Limited – Triple Wealth Opportunities:

1️⃣ Good Start Bonus

🎁 New users have a 100% chance to win

💰 Rewards up to 28U

2️⃣ Koi Luck Draw

Post with #我在Gate广场过新年

🏆 1 lucky winner gets 50 GT + a Spring Festival Gift Box

3️⃣ Grand Gift Contest

⚽ Inter Milan jerseys

🧥 Red Bull co-branded jackets

🏕️ VIP

Celebrate the Year of the Horse with Gate Plaza and get ready to “Get Rich Immediately!” 🐎💰

🔔 The New Year bell is about to ring…

💸 A $50,000 Red Envelope Rain is pouring down!

Post now and unlock your first fortune of the Year of the Horse! 🧧✨

🧨 New Year Limited – Triple Wealth Opportunities:

1️⃣ Good Start Bonus

🎁 New users have a 100% chance to win

💰 Rewards up to 28U

2️⃣ Koi Luck Draw

Post with #我在Gate广场过新年

🏆 1 lucky winner gets 50 GT + a Spring Festival Gift Box

3️⃣ Grand Gift Contest

⚽ Inter Milan jerseys

🧥 Red Bull co-branded jackets

🏕️ VIP

GT0,27%

- Reward

- 1

- Comment

- Repost

- Share

🏇 Excitement is in the Air at the Gate Spring Festival! 🏮

The Gate Spring Festival Horse Racing Event is officially live! Join us for a thrilling celebration where speed, strategy, and luck collide on the blockchain. 🚀

🎉 Highlights of the event:

Fast-Paced Horse Races – Cheer for your favorite and watch them race to victory!

Exclusive Rewards – Earn special prizes and bonuses during the festival.

Community Fun – Connect with fellow enthusiasts and celebrate the Year of the Horse together! 🐴

Don’t miss your chance to ride into fortune and festive fun at the #GateSpringFestivalHorseRacingEv

The Gate Spring Festival Horse Racing Event is officially live! Join us for a thrilling celebration where speed, strategy, and luck collide on the blockchain. 🚀

🎉 Highlights of the event:

Fast-Paced Horse Races – Cheer for your favorite and watch them race to victory!

Exclusive Rewards – Earn special prizes and bonuses during the festival.

Community Fun – Connect with fellow enthusiasts and celebrate the Year of the Horse together! 🐴

Don’t miss your chance to ride into fortune and festive fun at the #GateSpringFestivalHorseRacingEv

- Reward

- like

- Comment

- Repost

- Share

🧧✨ New Year’s Eve Vigil 2026 ✨🧧

As the firecrackers fade and a new year begins, celebrating with Gate Square!

Through every bull and bear market, we’ve moved forward together — here’s to another year of growth and success.

🎁 New Year Share Gift:

Shared the post and dropped my crypto wishes for the year ahead!

50 lucky winners will each receive 6.6 USDT New Year’s Eve Fortune Gold — may luck be on our side!

Wishing everyone prosperity, success, and unstoppable good fortune in the year ahead. 🧨💰

📅 Event Time: February 16, 19:00 — February 18, 18:00 (UTC+8)

As the firecrackers fade and a new year begins, celebrating with Gate Square!

Through every bull and bear market, we’ve moved forward together — here’s to another year of growth and success.

🎁 New Year Share Gift:

Shared the post and dropped my crypto wishes for the year ahead!

50 lucky winners will each receive 6.6 USDT New Year’s Eve Fortune Gold — may luck be on our side!

Wishing everyone prosperity, success, and unstoppable good fortune in the year ahead. 🧨💰

📅 Event Time: February 16, 19:00 — February 18, 18:00 (UTC+8)

- Reward

- like

- Comment

- Repost

- Share

🧧✨ Happy Chinese New Year’s Eve! ✨🧧

Celebrating at Gate Plaza as the New Year’s bell rings and the lucky red envelope rain begins! 🐴💰

Just opened my first fortune of the Year of the Horse — new year, new luck!

🔥 Triple Wealth Chances:

🎁 Posted and grabbed my red envelope — new users can win up to $28!

🍀 Joined the draw with #ICelebrateCNYAtGatePlaza — hoping for 50 GT + a Spring Festival gift box

🏆 Eyeing those premium prizes… Inter Milan jerseys, Red Bull jackets, and more!

Wishing everyone prosperity, success, and big wins this year! 🧨🥂

Celebrating at Gate Plaza as the New Year’s bell rings and the lucky red envelope rain begins! 🐴💰

Just opened my first fortune of the Year of the Horse — new year, new luck!

🔥 Triple Wealth Chances:

🎁 Posted and grabbed my red envelope — new users can win up to $28!

🍀 Joined the draw with #ICelebrateCNYAtGatePlaza — hoping for 50 GT + a Spring Festival gift box

🏆 Eyeing those premium prizes… Inter Milan jerseys, Red Bull jackets, and more!

Wishing everyone prosperity, success, and big wins this year! 🧨🥂

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

To The Moon 🌕✨ Happy Chinese New Year’s Eve! 🧧

Starting the year with luck and prosperity at Gate.io Gate Plaza!

💰 The $50,000 Red Envelope Rain is LIVE — and I’ve just opened my first fortune of the year!

Don’t miss these three New Year wealth opportunities:

🎉 Good Start Bonus — Make a post and open a red envelope (100% win rate for new users, up to 28U)

🐟 Koi Luck Draw — Post with #我在Gate广场过新年 for a chance to win 50 GT + a festive gift box

🏆 Grand Prize Contest — Win premium rewards like an Inter Milan jersey, Red Bull co-branded jacket, VIP camping set, and more!

📲 Update your app to version 8.8.0

Starting the year with luck and prosperity at Gate.io Gate Plaza!

💰 The $50,000 Red Envelope Rain is LIVE — and I’ve just opened my first fortune of the year!

Don’t miss these three New Year wealth opportunities:

🎉 Good Start Bonus — Make a post and open a red envelope (100% win rate for new users, up to 28U)

🐟 Koi Luck Draw — Post with #我在Gate广场过新年 for a chance to win 50 GT + a festive gift box

🏆 Grand Prize Contest — Win premium rewards like an Inter Milan jersey, Red Bull co-branded jacket, VIP camping set, and more!

📲 Update your app to version 8.8.0

GT0,27%

- Reward

- 5

- 2

- Repost

- Share

Yunna :

:

2026 gogoView More

🚀 #What’sNextforBitcoin?

Bitcoin is navigating a pivotal moment as the crypto market evolves. With institutional interest rising, macroeconomic factors like inflation and interest rates stabilizing, and the growing adoption of blockchain technology, Bitcoin’s trajectory could see both volatility and opportunity.

Key points to watch:

1️⃣ Institutional Adoption – More funds and corporations are showing interest in BTC, potentially driving demand.

2️⃣ Regulatory Landscape – Governments worldwide, including the U.S. and Hong Kong, are shaping crypto regulations that could impact market behavior.

Bitcoin is navigating a pivotal moment as the crypto market evolves. With institutional interest rising, macroeconomic factors like inflation and interest rates stabilizing, and the growing adoption of blockchain technology, Bitcoin’s trajectory could see both volatility and opportunity.

Key points to watch:

1️⃣ Institutional Adoption – More funds and corporations are showing interest in BTC, potentially driving demand.

2️⃣ Regulatory Landscape – Governments worldwide, including the U.S. and Hong Kong, are shaping crypto regulations that could impact market behavior.

BTC-0,65%

- Reward

- 2

- Comment

- Repost

- Share

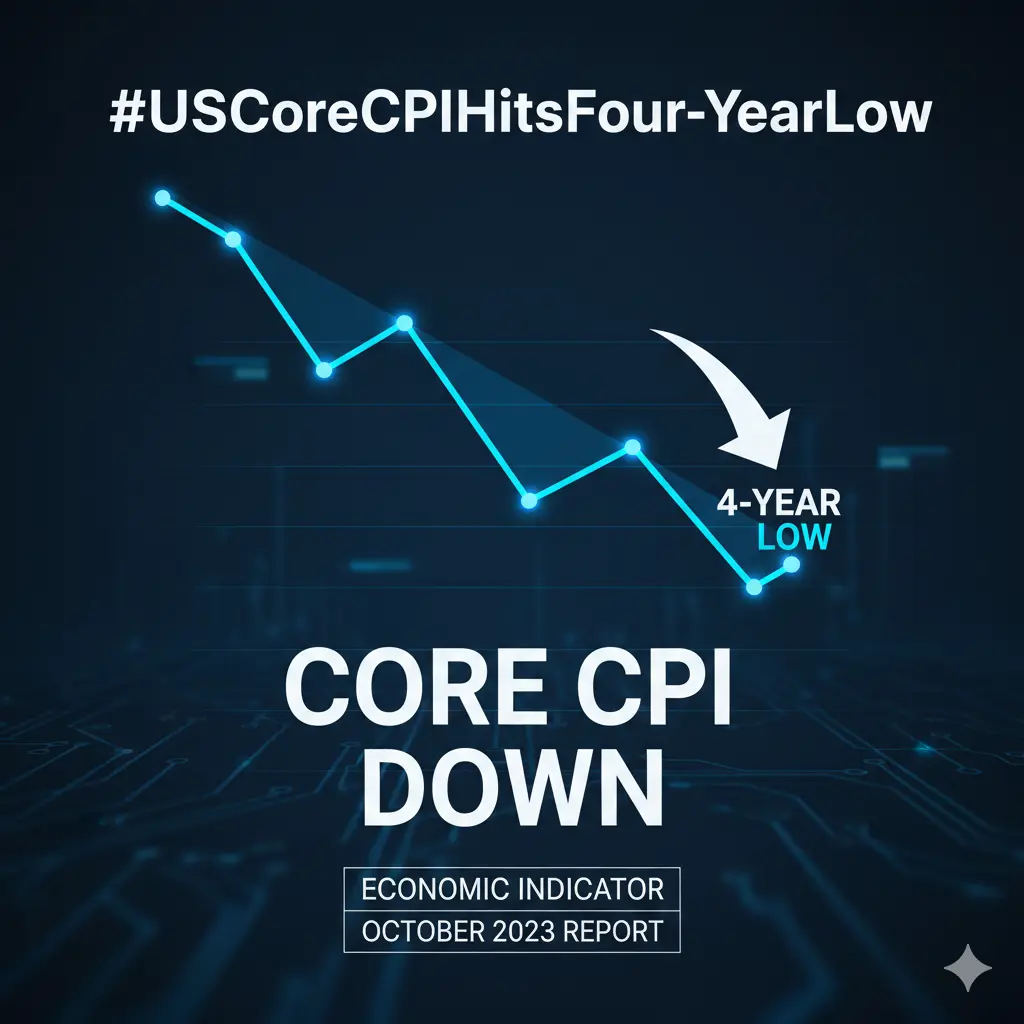

📉 US Core CPI Hits Four-Year Low!

The latest data shows core CPI (excluding food & energy) has dropped to 2.5% YoY, the lowest since 2021. Lower energy prices and cooling rents are driving this disinflation trend, signaling easing inflation pressures in the U.S. economy.

Markets are reacting, and expectations for potential Fed rate cuts later this year are rising. While this is good news for consumers, the Fed remains cautious, keeping a close eye on broader inflation measures.

#USCoreCPIHitsFourYearLow #InflationUpdate #EconomicTrends #FederalReserve #FinanceNews

The latest data shows core CPI (excluding food & energy) has dropped to 2.5% YoY, the lowest since 2021. Lower energy prices and cooling rents are driving this disinflation trend, signaling easing inflation pressures in the U.S. economy.

Markets are reacting, and expectations for potential Fed rate cuts later this year are rising. While this is good news for consumers, the Fed remains cautious, keeping a close eye on broader inflation measures.

#USCoreCPIHitsFourYearLow #InflationUpdate #EconomicTrends #FederalReserve #FinanceNews

- Reward

- like

- Comment

- Repost

- Share

🎉 $50K Red Packet Giveaway at GateSquare! 🎉

Get ready to celebrate with GateSquare’s huge Red Packet Giveaway! A total of $50,000 is up for grabs — don’t miss your chance to be part of this festive event.

💡 How to participate:

Join the GateSquare platform.

Follow the instructions for the Red Packet event.

Grab your share of the rewards before they’re gone!

📅 Event Duration: Limited time – hurry and claim your Red Packet!

🔥 Don’t miss out! This is your moment to win big and join the celebration!

#GateSquare$50KRedPacketGiveaway #CryptoRewards #RedPacketEvent #GateSquare

Get ready to celebrate with GateSquare’s huge Red Packet Giveaway! A total of $50,000 is up for grabs — don’t miss your chance to be part of this festive event.

💡 How to participate:

Join the GateSquare platform.

Follow the instructions for the Red Packet event.

Grab your share of the rewards before they’re gone!

📅 Event Duration: Limited time – hurry and claim your Red Packet!

🔥 Don’t miss out! This is your moment to win big and join the celebration!

#GateSquare$50KRedPacketGiveaway #CryptoRewards #RedPacketEvent #GateSquare

- Reward

- 1

- Comment

- Repost

- Share

🇺🇸 White House Talks on Stablecoin Yields Hit a Standoff

High-level discussions between the White House, major banks, and crypto leaders are underway to resolve one of the biggest hurdles in U.S. crypto regulation: whether platforms can offer yields on stablecoins.

💡 Key Points:

Banks push for tight restrictions, fearing stablecoin rewards could drain traditional deposits.

Crypto firms insist yields are essential for liquidity and market growth.

The debate has stalled the CLARITY Act, delaying clear regulation for the digital asset space.

With deadlines approaching, the outcome will shape t

High-level discussions between the White House, major banks, and crypto leaders are underway to resolve one of the biggest hurdles in U.S. crypto regulation: whether platforms can offer yields on stablecoins.

💡 Key Points:

Banks push for tight restrictions, fearing stablecoin rewards could drain traditional deposits.

Crypto firms insist yields are essential for liquidity and market growth.

The debate has stalled the CLARITY Act, delaying clear regulation for the digital asset space.

With deadlines approaching, the outcome will shape t

- Reward

- 3

- 3

- Repost

- Share

Yunna :

:

Hold tight 💪View More

🚀 Hong Kong is stepping up its Virtual Asset game!

The Securities and Futures Commission (SFC) has unveiled new guidelines for virtual asset trading, allowing licensed brokers to offer margin and leveraged products to professional investors. This is a major step in building Hong Kong as a global VA hub while keeping investor protection strong.

💡 Key Points:

Licensed brokers can now provide VA financing to qualified clients

Frameworks for leveraged VA products are now clearer

Expanded licensing for VA custody, advisory, and management services coming in 2026

Hong Kong’s goal? Innovation, grow

The Securities and Futures Commission (SFC) has unveiled new guidelines for virtual asset trading, allowing licensed brokers to offer margin and leveraged products to professional investors. This is a major step in building Hong Kong as a global VA hub while keeping investor protection strong.

💡 Key Points:

Licensed brokers can now provide VA financing to qualified clients

Frameworks for leveraged VA products are now clearer

Expanded licensing for VA custody, advisory, and management services coming in 2026

Hong Kong’s goal? Innovation, grow

- Reward

- 4

- 4

- Repost

- Share

ybaser :

:

To The Moon 🌕View More

🚨 US SEC Advances Crypto Reform! 🚨

The U.S. Securities and Exchange Commission (SEC) is moving forward with significant reforms aimed at strengthening oversight and regulation in the cryptocurrency space. These changes could bring more clarity to the market, enhance investor protection, and pave the way for more institutional participation in digital assets.

Key highlights:

Increased transparency requirements for crypto exchanges and projects

Stricter rules on digital asset offerings and trading practices

Measures to protect investors from fraud and market manipulation

Potentially smoother p

The U.S. Securities and Exchange Commission (SEC) is moving forward with significant reforms aimed at strengthening oversight and regulation in the cryptocurrency space. These changes could bring more clarity to the market, enhance investor protection, and pave the way for more institutional participation in digital assets.

Key highlights:

Increased transparency requirements for crypto exchanges and projects

Stricter rules on digital asset offerings and trading practices

Measures to protect investors from fraud and market manipulation

Potentially smoother p

- Reward

- 3

- 2

- Repost

- Share

Yunna :

:

Hold tight 💪View More

🚀 #RussiaStudiesNationalStablecoin – Russia is exploring the launch of its own national stablecoin to modernize its financial system and streamline digital payments. This move reflects growing interest in Central Bank Digital Currencies (CBDCs) globally, aiming to provide a secure, state-backed digital alternative to traditional money.

Key points:

Potential to enhance cross-border transactions and reduce reliance on foreign currencies.

Could integrate with Russia’s digital payment infrastructure for faster, more transparent transactions.

Part of a broader trend where countries are actively re

Key points:

Potential to enhance cross-border transactions and reduce reliance on foreign currencies.

Could integrate with Russia’s digital payment infrastructure for faster, more transparent transactions.

Part of a broader trend where countries are actively re

- Reward

- 4

- 2

- Repost

- Share

Yunna :

:

Hold tight 💪View More

🚀 Apollo is making a major move! 🚀

#ApollotoBuy90MMORPHOin4Years – Apollo plans to purchase 90 million MORPHO tokens over the next 4 years, showing strong confidence in long-term growth and the MORPHO ecosystem.

💡 Why it matters:

Strategic long-term accumulation

Potential market impact

Boosts investor confidence

Stay tuned as Apollo shapes the future of MORPHO! 🌐

#CryptoNews #MORPHO #ApolloInvestments #LongTermVision

#ApollotoBuy90MMORPHOin4Years – Apollo plans to purchase 90 million MORPHO tokens over the next 4 years, showing strong confidence in long-term growth and the MORPHO ecosystem.

💡 Why it matters:

Strategic long-term accumulation

Potential market impact

Boosts investor confidence

Stay tuned as Apollo shapes the future of MORPHO! 🌐

#CryptoNews #MORPHO #ApolloInvestments #LongTermVision

MORPHO1,49%

- Reward

- 3

- 3

- Repost

- Share

Yunna :

:

Hold tight 💪View More

🚀 #GrayscaleEyesAVESpotETFConversion

Grayscale is exploring the conversion of its AVE fund into a spot ETF, a potential game-changer for crypto investors. This move could open the doors for mainstream access to AVE, allowing traditional investors to participate directly in the underlying asset rather than just the trust shares.

Key points to watch:

Regulatory approval will be crucial — the SEC’s stance on spot ETFs remains a major factor.

Market impact could be significant, potentially narrowing the premium/discount gap that exists in Grayscale trusts.

Investor accessibility improves as ETFs

Grayscale is exploring the conversion of its AVE fund into a spot ETF, a potential game-changer for crypto investors. This move could open the doors for mainstream access to AVE, allowing traditional investors to participate directly in the underlying asset rather than just the trust shares.

Key points to watch:

Regulatory approval will be crucial — the SEC’s stance on spot ETFs remains a major factor.

Market impact could be significant, potentially narrowing the premium/discount gap that exists in Grayscale trusts.

Investor accessibility improves as ETFs

- Reward

- 1

- 1

- Repost

- Share

QueenOfTheDay :

:

To The Moon 🌕🚀 #GateHKEventsKickOff

The excitement begins! Gate Hong Kong is officially kicking off its 2026 events, bringing the community together for a series of live streams, interactive sessions, and exclusive on-chain experiences.

🎯 Event Highlights:

🔹 Live market insights and sector trends

🔹 Exclusive rewards and giveaways

🔹 Networking with top traders and crypto enthusiasts

🔹 Behind-the-scenes access to Gate HK initiatives

Join us as we ignite the year with innovation, insights, and community celebrations. Don’t miss out on the action—be part of the journey from day one!

💬 Share your experie

The excitement begins! Gate Hong Kong is officially kicking off its 2026 events, bringing the community together for a series of live streams, interactive sessions, and exclusive on-chain experiences.

🎯 Event Highlights:

🔹 Live market insights and sector trends

🔹 Exclusive rewards and giveaways

🔹 Networking with top traders and crypto enthusiasts

🔹 Behind-the-scenes access to Gate HK initiatives

Join us as we ignite the year with innovation, insights, and community celebrations. Don’t miss out on the action—be part of the journey from day one!

💬 Share your experie

- Reward

- 2

- 2

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

Trending Topics

View More153.86K Popularity

29.5K Popularity

26.23K Popularity

71.78K Popularity

12.46K Popularity

Pin