11.8 Evening Analysis

Looking back on the intraday trend, Bitcoin (referred to as "Da Bing") has shown a overall oscillating downward movement. The price faced resistance around 104,100 and retreated, with the lowest touching around 101,800.

From the hourly Bollinger Bands, the bands are continuously narrowing, presenting a typical "squeeze" pattern, indicating that the current hourly bullish and bearish battle has reached an equilibrium, and market volatility is gradually decreasing.

During the decline, the price failed to effectively break below the lower band support and then oscillated narrowly around the middle band, with no clear short-term direction.

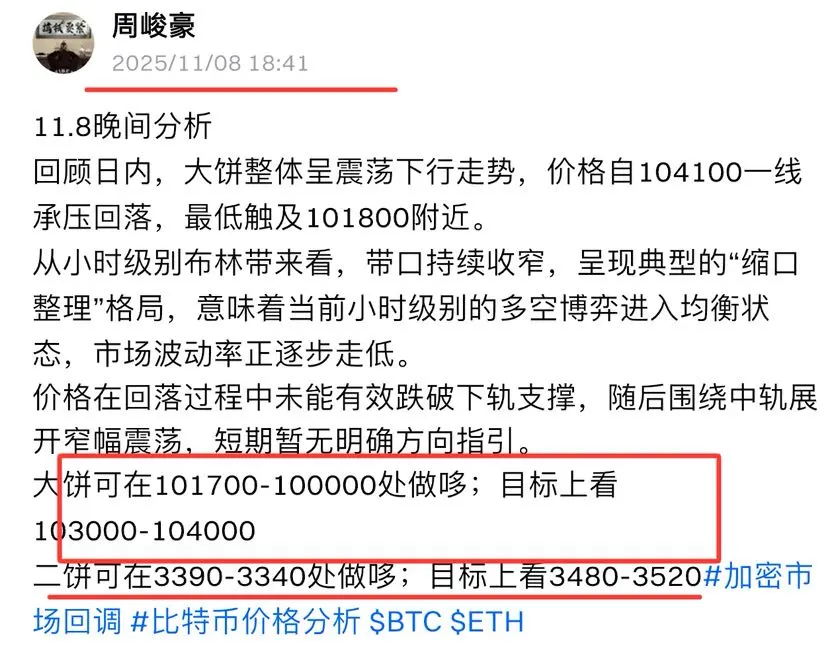

Bitcoin can be bought at 101,700-100,000; the target range is 103,000-104,000.

Altcoin ("Er Bing") can be bought at 3,390-3,340; the target range is 3,480-3,520.

Looking back on the intraday trend, Bitcoin (referred to as "Da Bing") has shown a overall oscillating downward movement. The price faced resistance around 104,100 and retreated, with the lowest touching around 101,800.

From the hourly Bollinger Bands, the bands are continuously narrowing, presenting a typical "squeeze" pattern, indicating that the current hourly bullish and bearish battle has reached an equilibrium, and market volatility is gradually decreasing.

During the decline, the price failed to effectively break below the lower band support and then oscillated narrowly around the middle band, with no clear short-term direction.

Bitcoin can be bought at 101,700-100,000; the target range is 103,000-104,000.

Altcoin ("Er Bing") can be bought at 3,390-3,340; the target range is 3,480-3,520.