#ETHUnderPressure

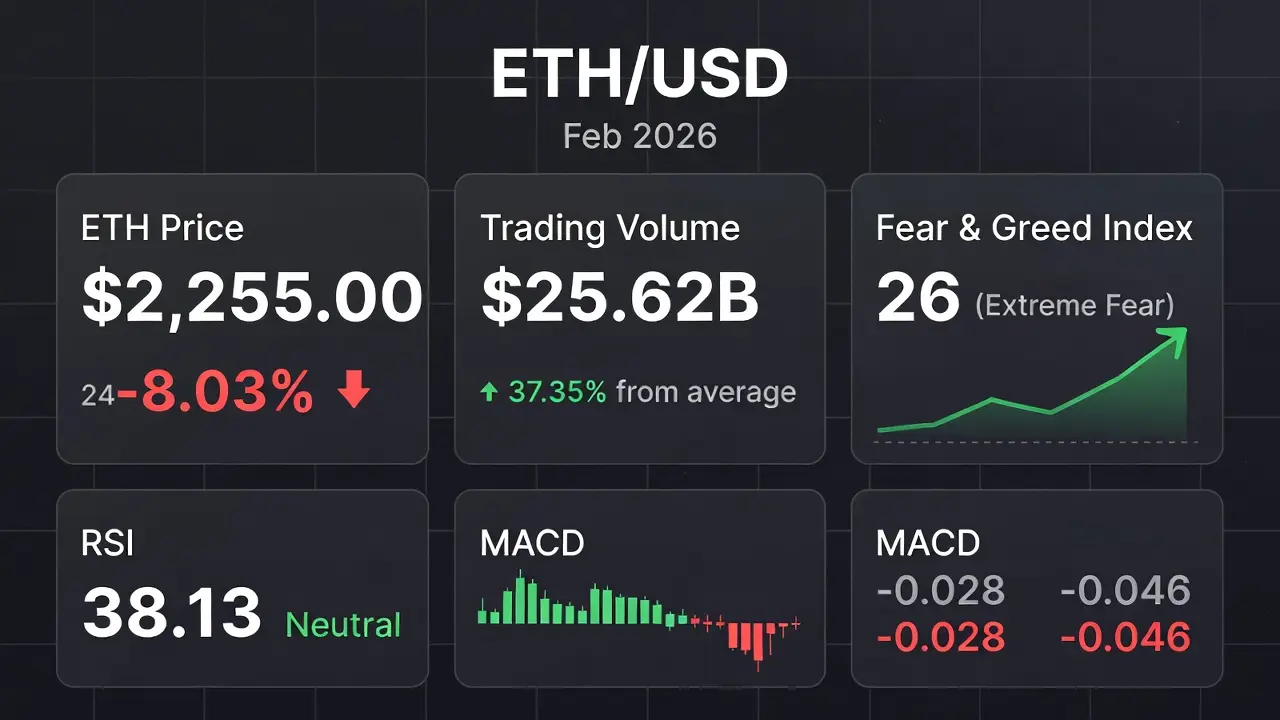

Ethereum is currently trading near $2,255 (ETH/USDT), down nearly 8% in the last 24 hours. The market is experiencing high volatility, strong selling pressure, and extremely bearish sentiment, while some technical oversold signals suggest a short-term relief may be possible.

1. Current Price Overview

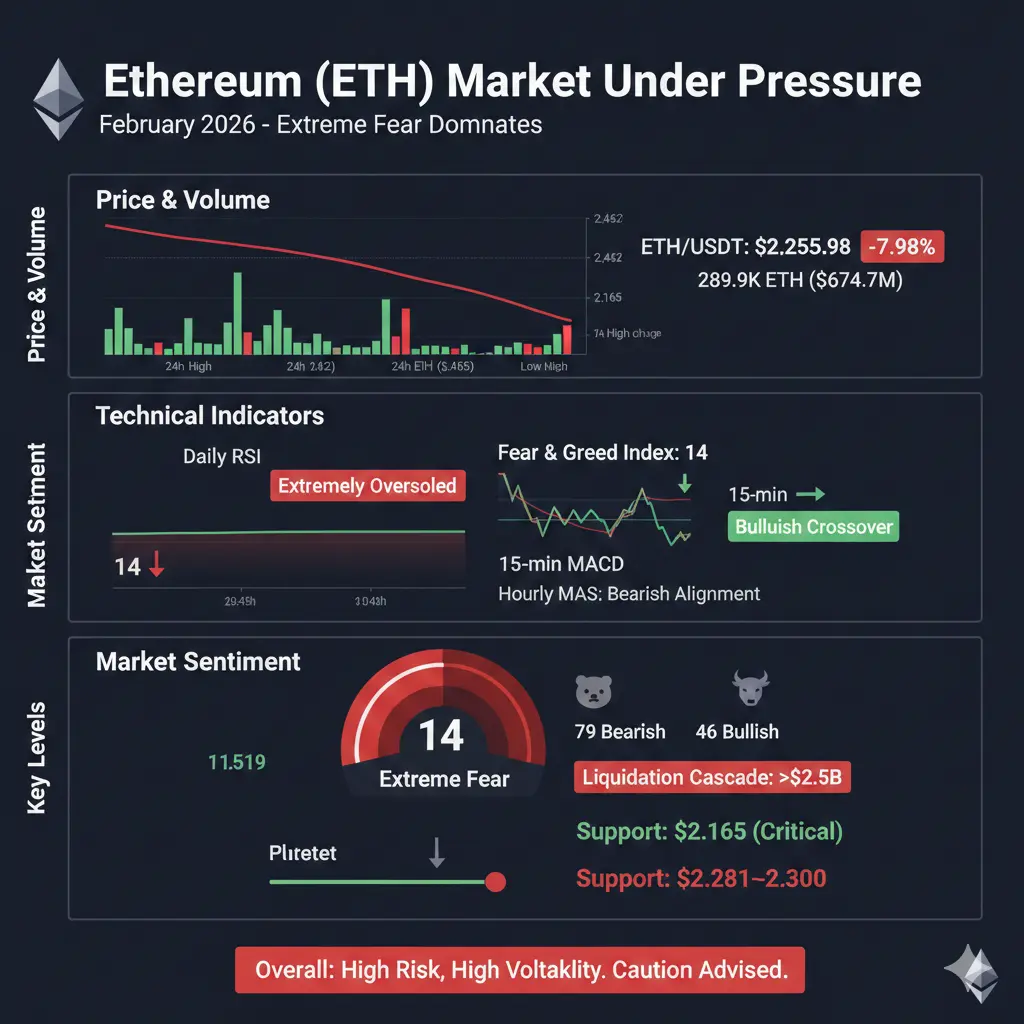

Price (ETH/USDT): $2,255.98

24h Change: -7.98%

24h High/Low: $2,452.46 / $2,165.00

24h Volume: 289,939 ETH (~$674.7M)

Fear & Greed Index: 14 → “Extreme Fear”

ETH is hovering near critical support zones, around $2,165–$2,280. Breaches below these levels could trigger further liquidation cascades. The daily volume remains high, indicating panic selling is ongoing, while short-term buyers or contrarian traders may look to scale in at lower levels.

2. Technical Analysis

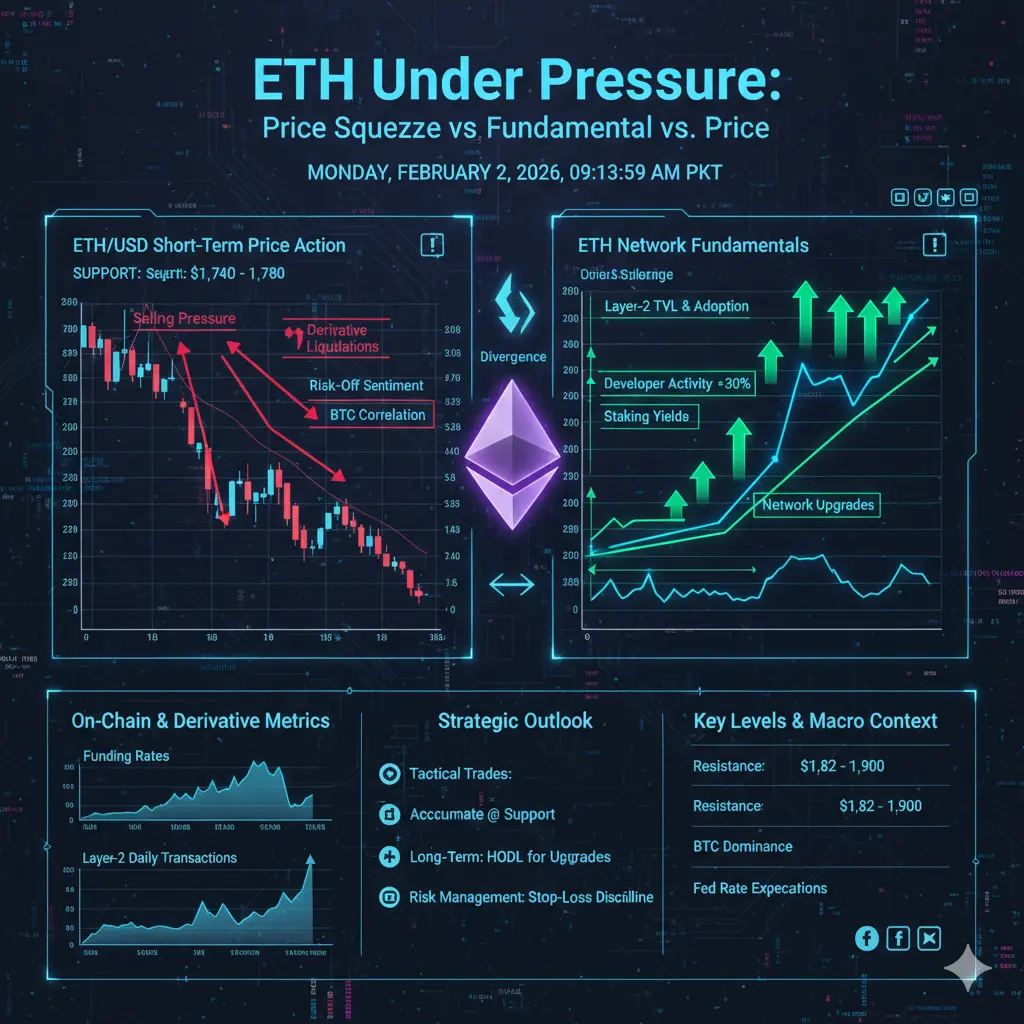

Hourly MA alignment: Bearish. ETH shows a clear downtrend with lower highs and lower lows. Moving averages (MA5, MA10, MA20, MA50) are stacked in bearish alignment.

15-minute MACD: Bullish crossover signals minor short-term momentum, possibly a small technical bounce.

Daily RSI: Extremely oversold. RSI near 0–10 is rare, suggesting potential for a short-term rebound, but this is counter-trend in a strong downtrend.

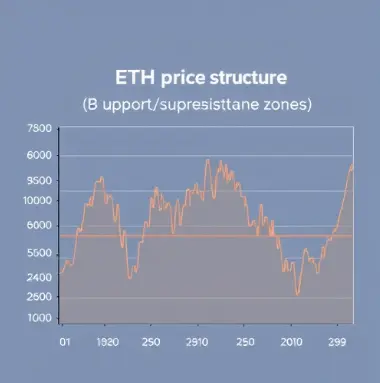

Support & Resistance:

Support: $2,165 (critical for near-term floor)

Resistance: $2,281–$2,300 (first hurdle for any recovery)

Observation: While oversold conditions hint at tactical opportunities, ETH remains in a structurally weak position, and trend-following traders should remain cautious.

3. Market Sentiment

Fear dominates: Fear & Greed Index at 14 = extreme fear, similar to major previous capitulation events.

Community and on-chain sentiment: bearish bias dominates, with roughly 79 bearish vs 46 bullish voices among active traders and KOLs.

Liquidation pressure: Over $2.5B recently liquidated, reflecting a classic “capitulation” where weak hands exit positions and volatility spikes.

This sentiment environment suggests short-term downside is feared, but contrarian opportunities exist, particularly for disciplined traders scaling into oversold conditions.

4. Macro & Fundamental Context

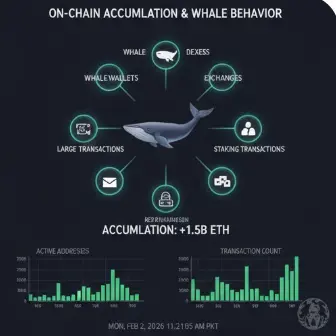

Institutional ETH holders report unrealized losses, e.g., wallets of Bitmine and other funds show stress, increasing potential for forced selling or portfolio rebalancing.

Broader crypto market is weak: BTC, SOL, and other large-cap assets also face selling pressure.

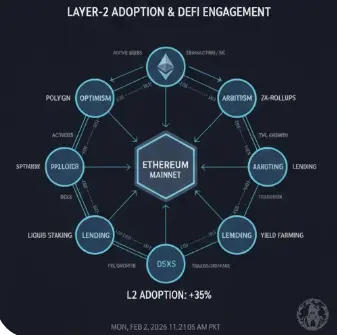

News & technical developments (e.g., ERC-8004 rollout) provide long-term bullish narratives, but short-term price impact is muted by current macro fear.

5. Order Flow & Volume Dynamics

Classic “price down, volume up” pattern: panic sellers dominate, forcing liquidation of leveraged positions.

Large sell walls observed near $2,281; buying interest emerges near $2,165, suggesting this zone is critical for support.

Daily trading volume (~289K ETH) indicates high liquidity stress, with aggressive sellers outweighing buyers.

6. Liquidity & Volatility Considerations

ETH is in a high-volatility phase: daily swings of 12–13% are being observed.

Forced liquidations may trigger sharp price drops within minutes.

Capital protection and position sizing are crucial, as even small adverse moves can cause significant losses in such an environment.

7. Investment Guidance

Short-Term Strategy:

Avoid chasing aggressive trades.

Tactical bounces can be considered only by experienced traders with tight stops.

Longer-Term Strategy:

Extreme oversold conditions and fear suggest downside is limited, but another wave lower is possible if macro sentiment worsens.

Wait for confirmed reversal signals: reclaiming hourly resistance zones or shift in order flow from sellers to buyers.

Best Practices:

Track ETH price relative to key support/resistance zones.

Combine technical signals with macro sentiment, on-chain data, and order book liquidity.

Avoid panic selling; discipline and patience are critical.

Ethereum is under multi-layered pressure:

Structural downtrend on hourly/daily charts.

Extreme fear and heavy liquidation in the market.

High daily volume and volatility (~12–13% swings).

Yet, oversold conditions and short-term bullish signals (MACD, RSI) suggest a potential relief bounce. ETH remains high-risk, high-volatility, so trading requires discipline, small position sizing, and constant monitoring.

Key Levels to Watch:

Support: $2,165

Resistance: $2,281–$2,300

Short-term upside potential: tactical rebounds to $2,300 if buying pressure sustains.

Ethereum is currently trading near $2,255 (ETH/USDT), down nearly 8% in the last 24 hours. The market is experiencing high volatility, strong selling pressure, and extremely bearish sentiment, while some technical oversold signals suggest a short-term relief may be possible.

1. Current Price Overview

Price (ETH/USDT): $2,255.98

24h Change: -7.98%

24h High/Low: $2,452.46 / $2,165.00

24h Volume: 289,939 ETH (~$674.7M)

Fear & Greed Index: 14 → “Extreme Fear”

ETH is hovering near critical support zones, around $2,165–$2,280. Breaches below these levels could trigger further liquidation cascades. The daily volume remains high, indicating panic selling is ongoing, while short-term buyers or contrarian traders may look to scale in at lower levels.

2. Technical Analysis

Hourly MA alignment: Bearish. ETH shows a clear downtrend with lower highs and lower lows. Moving averages (MA5, MA10, MA20, MA50) are stacked in bearish alignment.

15-minute MACD: Bullish crossover signals minor short-term momentum, possibly a small technical bounce.

Daily RSI: Extremely oversold. RSI near 0–10 is rare, suggesting potential for a short-term rebound, but this is counter-trend in a strong downtrend.

Support & Resistance:

Support: $2,165 (critical for near-term floor)

Resistance: $2,281–$2,300 (first hurdle for any recovery)

Observation: While oversold conditions hint at tactical opportunities, ETH remains in a structurally weak position, and trend-following traders should remain cautious.

3. Market Sentiment

Fear dominates: Fear & Greed Index at 14 = extreme fear, similar to major previous capitulation events.

Community and on-chain sentiment: bearish bias dominates, with roughly 79 bearish vs 46 bullish voices among active traders and KOLs.

Liquidation pressure: Over $2.5B recently liquidated, reflecting a classic “capitulation” where weak hands exit positions and volatility spikes.

This sentiment environment suggests short-term downside is feared, but contrarian opportunities exist, particularly for disciplined traders scaling into oversold conditions.

4. Macro & Fundamental Context

Institutional ETH holders report unrealized losses, e.g., wallets of Bitmine and other funds show stress, increasing potential for forced selling or portfolio rebalancing.

Broader crypto market is weak: BTC, SOL, and other large-cap assets also face selling pressure.

News & technical developments (e.g., ERC-8004 rollout) provide long-term bullish narratives, but short-term price impact is muted by current macro fear.

5. Order Flow & Volume Dynamics

Classic “price down, volume up” pattern: panic sellers dominate, forcing liquidation of leveraged positions.

Large sell walls observed near $2,281; buying interest emerges near $2,165, suggesting this zone is critical for support.

Daily trading volume (~289K ETH) indicates high liquidity stress, with aggressive sellers outweighing buyers.

6. Liquidity & Volatility Considerations

ETH is in a high-volatility phase: daily swings of 12–13% are being observed.

Forced liquidations may trigger sharp price drops within minutes.

Capital protection and position sizing are crucial, as even small adverse moves can cause significant losses in such an environment.

7. Investment Guidance

Short-Term Strategy:

Avoid chasing aggressive trades.

Tactical bounces can be considered only by experienced traders with tight stops.

Longer-Term Strategy:

Extreme oversold conditions and fear suggest downside is limited, but another wave lower is possible if macro sentiment worsens.

Wait for confirmed reversal signals: reclaiming hourly resistance zones or shift in order flow from sellers to buyers.

Best Practices:

Track ETH price relative to key support/resistance zones.

Combine technical signals with macro sentiment, on-chain data, and order book liquidity.

Avoid panic selling; discipline and patience are critical.

Ethereum is under multi-layered pressure:

Structural downtrend on hourly/daily charts.

Extreme fear and heavy liquidation in the market.

High daily volume and volatility (~12–13% swings).

Yet, oversold conditions and short-term bullish signals (MACD, RSI) suggest a potential relief bounce. ETH remains high-risk, high-volatility, so trading requires discipline, small position sizing, and constant monitoring.

Key Levels to Watch:

Support: $2,165

Resistance: $2,281–$2,300

Short-term upside potential: tactical rebounds to $2,300 if buying pressure sustains.