# WhyAreGoldStocksandBTCFallingTogether?

2.03K

HighAmbition

#WhyAreGoldStocksandBTCFallingTogether?

Why Are Gold Stocks and Bitcoin Falling Together in Early 2026?

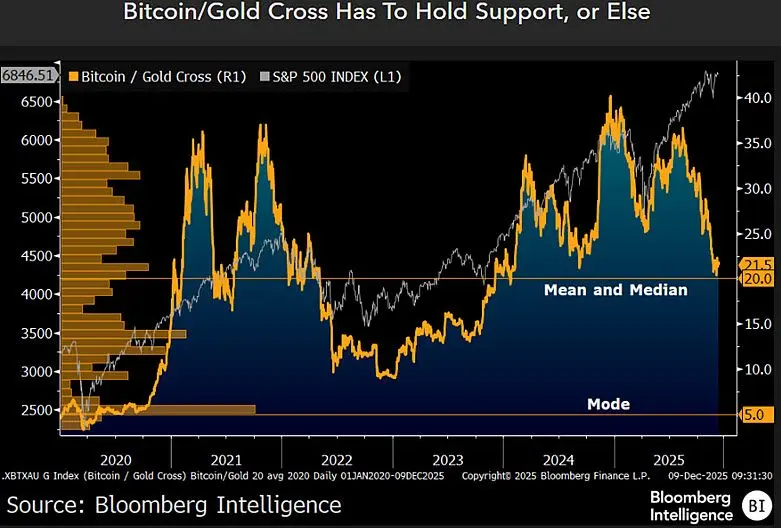

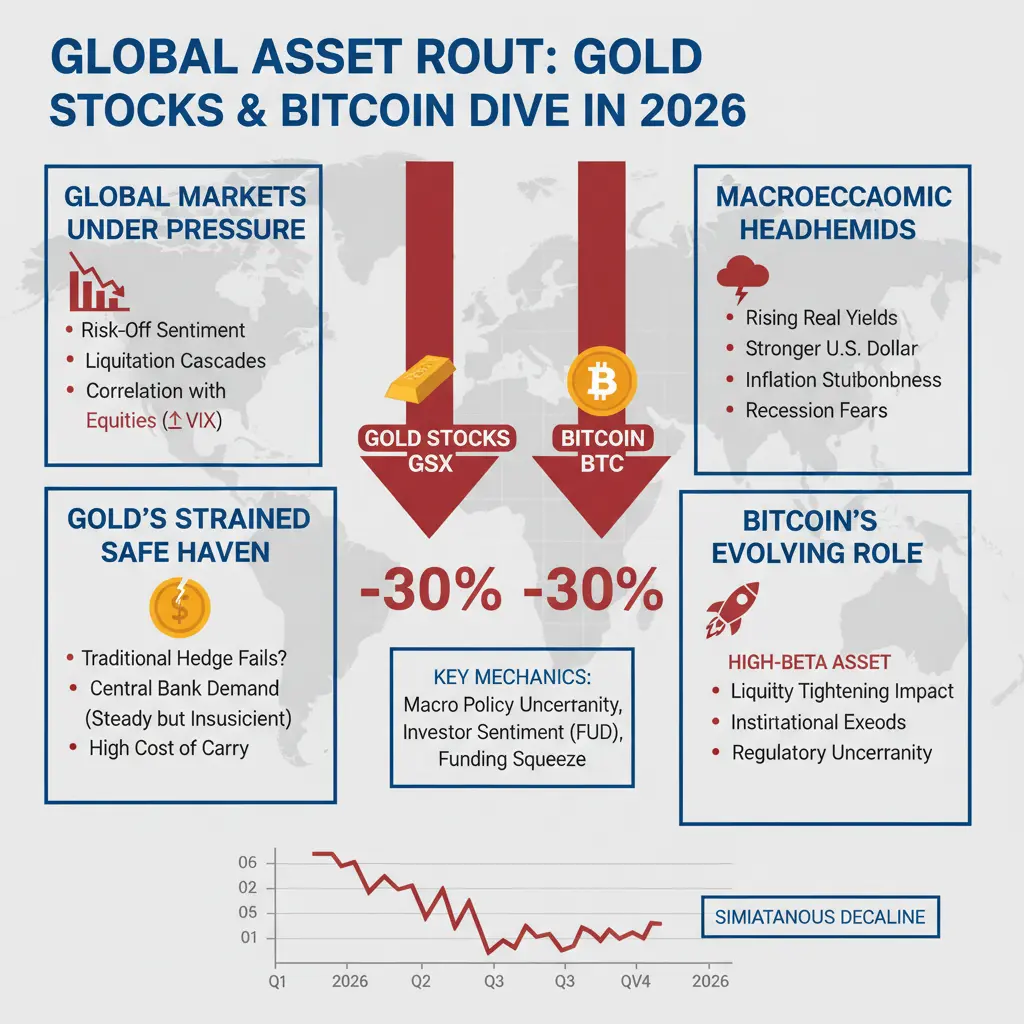

In early February 2026, gold mining stocks (e.g., GDX ETF and major miners like Newmont, Barrick) and Bitcoin (BTC) are experiencing sharp, simultaneous declines. This creates confusion because physical gold continues to act as a traditional safe haven with strong institutional support, while Bitcoin is often promoted as "digital gold." However, both are highly leveraged, liquid, and risk-sensitive assets that get sold aggressively during broader market stress and forced deleveraging.

1. Ma

Why Are Gold Stocks and Bitcoin Falling Together in Early 2026?

In early February 2026, gold mining stocks (e.g., GDX ETF and major miners like Newmont, Barrick) and Bitcoin (BTC) are experiencing sharp, simultaneous declines. This creates confusion because physical gold continues to act as a traditional safe haven with strong institutional support, while Bitcoin is often promoted as "digital gold." However, both are highly leveraged, liquid, and risk-sensitive assets that get sold aggressively during broader market stress and forced deleveraging.

1. Ma

BTC-8,07%

- Reward

- 5

- 6

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

#WhyAreGoldStocksandBTCFallingTogether?

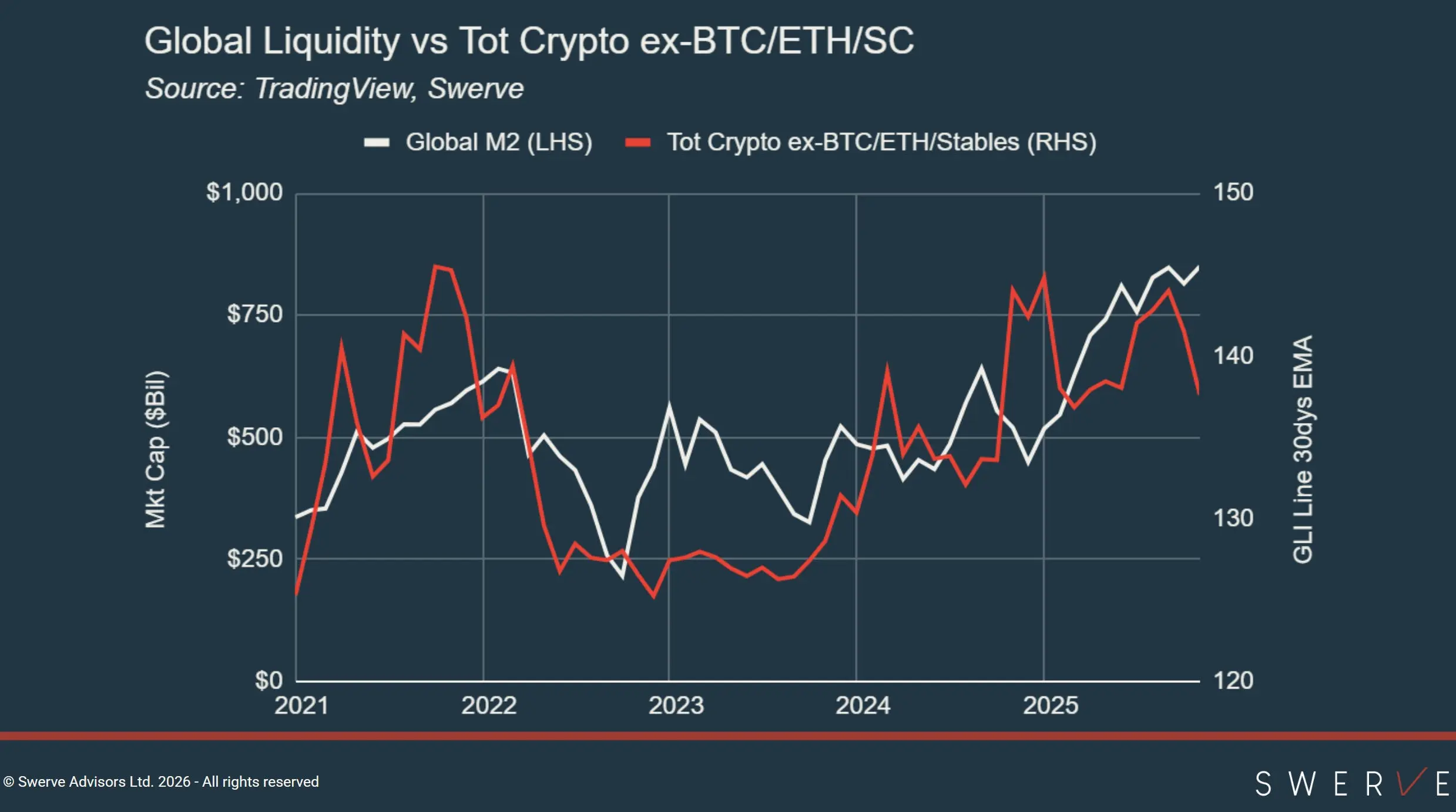

Markets are under pressure: global risk-off sentiment is impacting equities, crypto, and precious metals simultaneously. Recent sessions have seen tech stocks slide, forcing investors to rotate into cash or ultra-safe assets. This has created a rare scenario where both Bitcoin and gold-related equities are falling together.

Key Drivers Behind the Move:

Risk-off sentiment & forced liquidations: Leveraged positions unwind quickly, amplifying declines in crypto and gold stocks.

Equity correlation & macro pressures: Bitcoin increasingly moves with tech and g

Markets are under pressure: global risk-off sentiment is impacting equities, crypto, and precious metals simultaneously. Recent sessions have seen tech stocks slide, forcing investors to rotate into cash or ultra-safe assets. This has created a rare scenario where both Bitcoin and gold-related equities are falling together.

Key Drivers Behind the Move:

Risk-off sentiment & forced liquidations: Leveraged positions unwind quickly, amplifying declines in crypto and gold stocks.

Equity correlation & macro pressures: Bitcoin increasingly moves with tech and g

BTC-8,07%

- Reward

- 6

- 15

- Repost

- Share

ybaser :

:

2026 Go Go Go 👊View More

#WhyAreGoldStocksandBTCFallingTogether?

Gold, stocks, and Bitcoin falling at the same time feels confusing especially because these assets are often seen as very different from each other. Gold is viewed as a safe haven, stocks represent growth and corporate confidence, while Bitcoin is often called digital gold. Yet markets don’t always behave according to labels. Sometimes, liquidity and sentiment override narratives.

One of the biggest reasons behind this synchronized decline is a global shift toward risk reduction. When uncertainty rises whether due to macroeconomic pressure, interest-r

Gold, stocks, and Bitcoin falling at the same time feels confusing especially because these assets are often seen as very different from each other. Gold is viewed as a safe haven, stocks represent growth and corporate confidence, while Bitcoin is often called digital gold. Yet markets don’t always behave according to labels. Sometimes, liquidity and sentiment override narratives.

One of the biggest reasons behind this synchronized decline is a global shift toward risk reduction. When uncertainty rises whether due to macroeconomic pressure, interest-r

BTC-8,07%

- Reward

- 5

- 9

- Repost

- Share

ybaser :

:

Ape In 🚀View More

#WhyAreGoldStocksandBTCFallingTogether? Understanding the 2026 Market Dynamics

Global markets are under pressure, and we’re witnessing a rare scenario where typically uncorrelated assets like gold stocks and Bitcoin are falling simultaneously. Major stock indices, especially technology stocks, have been sliding, creating a broader risk-off sentiment that has spilled over into cryptocurrencies and precious metals. This interconnectedness shows how fear in one asset class can quickly spread across multiple markets.

A key driver behind this unusual co-movement is heightened risk-off sentiment. In

Global markets are under pressure, and we’re witnessing a rare scenario where typically uncorrelated assets like gold stocks and Bitcoin are falling simultaneously. Major stock indices, especially technology stocks, have been sliding, creating a broader risk-off sentiment that has spilled over into cryptocurrencies and precious metals. This interconnectedness shows how fear in one asset class can quickly spread across multiple markets.

A key driver behind this unusual co-movement is heightened risk-off sentiment. In

BTC-8,07%

- Reward

- 6

- 7

- Repost

- Share

ybaser :

:

Hold on tight, we're about to take off 🛫View More

#WhyAreGoldStocksandBTCFallingTogether? Understanding the 2026 Market Dynamics

Global markets are under pressure, and we’re witnessing a rare scenario where typically uncorrelated assets like gold stocks and Bitcoin are falling simultaneously. Major stock indices, especially technology stocks, have been sliding, creating a broader risk-off sentiment that has spilled over into cryptocurrencies and precious metals. This interconnectedness shows how fear in one asset class can quickly spread across multiple markets.

A key driver behind this unusual co-movement is heightened risk-off sentiment. In

Global markets are under pressure, and we’re witnessing a rare scenario where typically uncorrelated assets like gold stocks and Bitcoin are falling simultaneously. Major stock indices, especially technology stocks, have been sliding, creating a broader risk-off sentiment that has spilled over into cryptocurrencies and precious metals. This interconnectedness shows how fear in one asset class can quickly spread across multiple markets.

A key driver behind this unusual co-movement is heightened risk-off sentiment. In

BTC-8,07%

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#WhyAreGoldStocksandBTCFallingTogether?

Global Markets Under Pressure: A Broad Risk-Off Wave:

Financial markets worldwide are experiencing synchronized weakness, with equities, cryptocurrencies, precious metals, and related stocks all under notable selling pressure. Recent sessions have seen major stock indices slide, led by technology stocks, creating broader market risk-off sentiment. This environment has spilled over into Bitcoin (BTC) and gold and gold-related equities, producing a rare scenario where assets typically seen as hedges or diversifiers are falling together. The interconnected

Global Markets Under Pressure: A Broad Risk-Off Wave:

Financial markets worldwide are experiencing synchronized weakness, with equities, cryptocurrencies, precious metals, and related stocks all under notable selling pressure. Recent sessions have seen major stock indices slide, led by technology stocks, creating broader market risk-off sentiment. This environment has spilled over into Bitcoin (BTC) and gold and gold-related equities, producing a rare scenario where assets typically seen as hedges or diversifiers are falling together. The interconnected

BTC-8,07%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 8

- 11

- Repost

- Share

ybaser :

:

2026 Go Go Go 👊View More

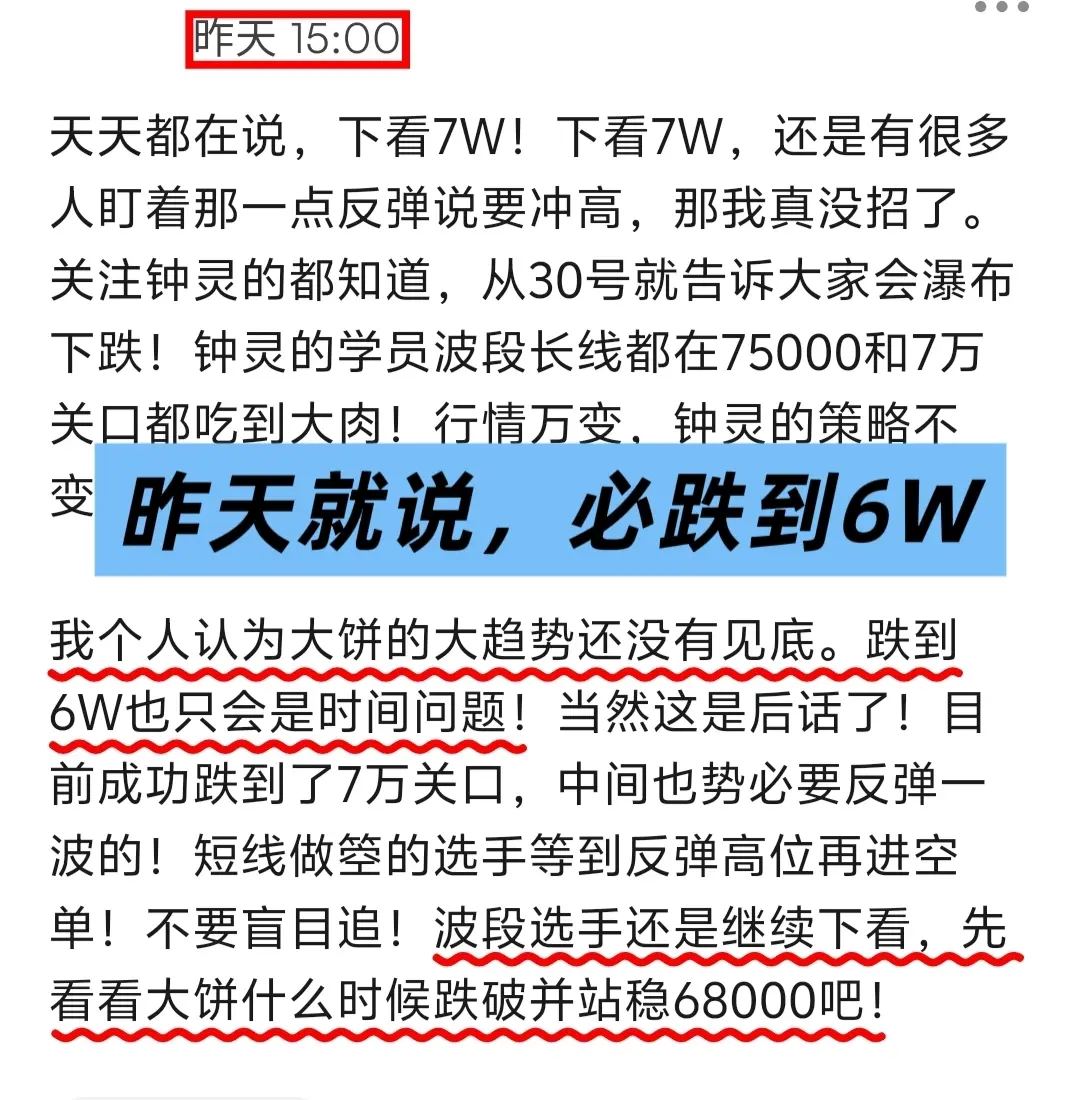

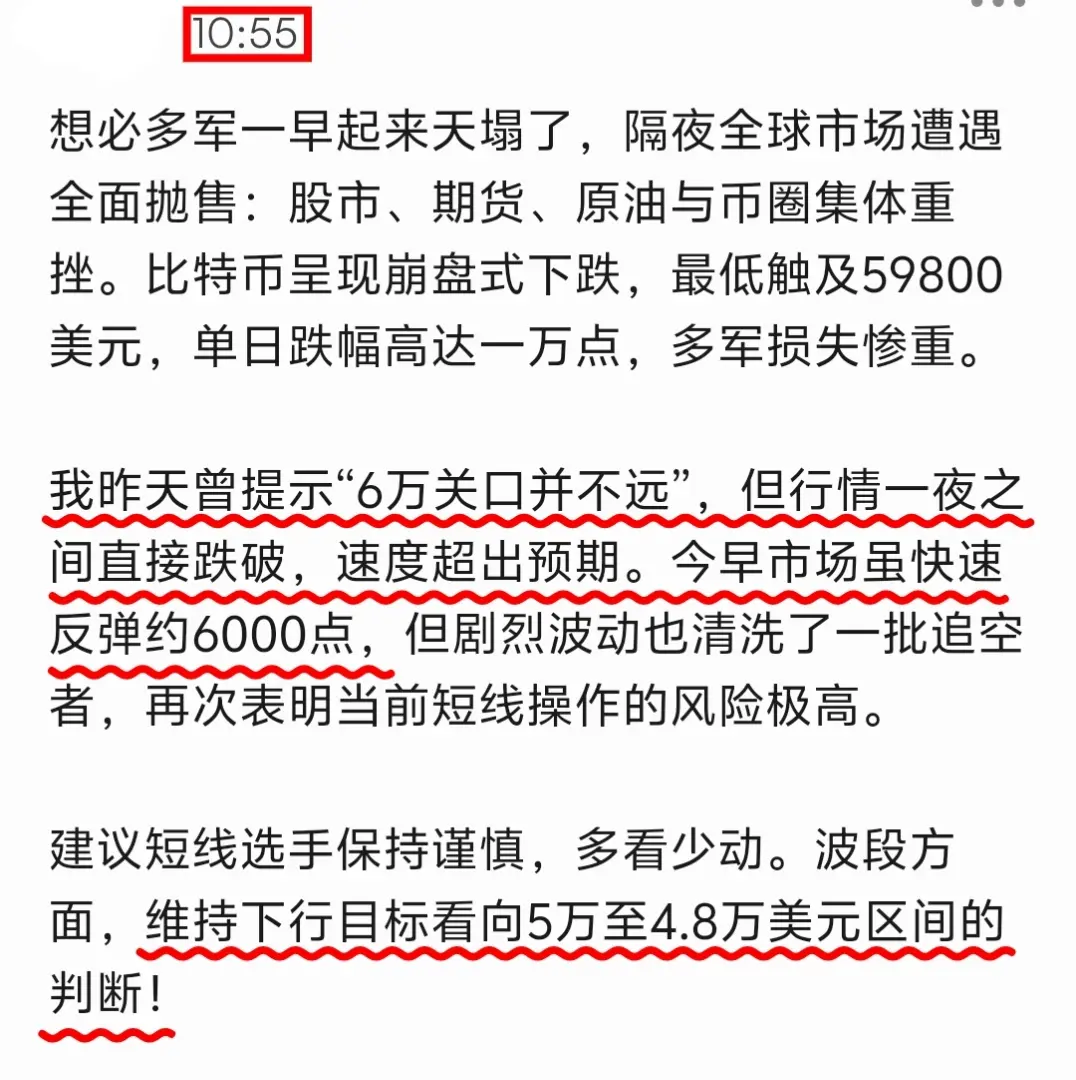

Bitcoin is nowhere near the bottom of the long-term bear market. A major bear market is unimaginable. First of all, Bitcoin is currently at 60,000. It’s impossible for Bitcoin to drop directly to 40,000 in one go. Currently, 60,000 is not the bottom of the long-term bear market. If in the next few days it crashes to around 50,000~48,000, then this level would be the lowest point of the long-term cycle.

$BTC $ETH $SOL #当前行情抄底还是观望? #加密市场回调 #比特币跌破六万五美元 #黄金美股比特币为何齐跌? #美伊核谈判风波

View Original$BTC $ETH $SOL #当前行情抄底还是观望? #加密市场回调 #比特币跌破六万五美元 #黄金美股比特币为何齐跌? #美伊核谈判风波

- Reward

- like

- Comment

- Repost

- Share

#黄金美股比特币为何齐跌? Global Asset "Escape": Why Are US Stocks, Gold, Bitcoin, and Oil Falling Together?

Recently, a rare event occurred in the financial markets: US stocks, gold, Bitcoin, and oil—assets that usually move independently—suddenly declined simultaneously. Some netizens joked, "Check the account and see, everything's in eco-friendly colors (down), saving electricity and eye protection." What exactly happened? How long will this "everything falls" situation last?

1. How bad is the decline?

Rare simultaneous drop across multiple assets:

US Stocks: Dow Jones drops over 500 points in a single

Recently, a rare event occurred in the financial markets: US stocks, gold, Bitcoin, and oil—assets that usually move independently—suddenly declined simultaneously. Some netizens joked, "Check the account and see, everything's in eco-friendly colors (down), saving electricity and eye protection." What exactly happened? How long will this "everything falls" situation last?

1. How bad is the decline?

Rare simultaneous drop across multiple assets:

US Stocks: Dow Jones drops over 500 points in a single

BTC-8,07%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 3

- 9

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

101.7K Popularity

16.12K Popularity

386.9K Popularity

3.85K Popularity

2.24K Popularity

1.97K Popularity

1.54K Popularity

2.03K Popularity

1.2K Popularity

3.34K Popularity

11.58K Popularity

7.64K Popularity

19.58K Popularity

27.63K Popularity

22.92K Popularity

News

View MoreBitcoin remains resilient at the $60,000 level, but the risk of dropping to $50,000 still persists. Investors should stay cautious as market volatility continues.

4 m

INFINIT announces IN token unlock postponed by three months, temporarily easing short-term selling pressure

7 m

"Strategy Opponent" recorded a loss of over $31 million in a single day, once again injecting $8 million to replenish the "ammunition."

10 m

TAO and NEAR lead the decline of over 20%, AI crypto sector faces a systemic correction

11 m

US layoffs surge to a 17-year high! The Federal Reserve may shift to easing, signaling a Bitcoin bottom is near

15 m

Pin