MingDragonX

No content yet

MingDragonX

#PartialGovernmentShutdownEnds PostShutdownMarketOutlook

The conclusion of the partial U.S. government shutdown marks a pivotal moment for both traditional and digital markets, shifting the environment from heightened uncertainty to greater clarity. With federal operations fully restored, investor confidence and liquidity conditions are beginning to normalize, creating more predictable frameworks for capital deployment across asset classes.

Bitcoin and Ethereum have already reflected early stabilization, with prices consolidating around $67,000–$68,000 and $1,950–$2,000 respectively. These ran

The conclusion of the partial U.S. government shutdown marks a pivotal moment for both traditional and digital markets, shifting the environment from heightened uncertainty to greater clarity. With federal operations fully restored, investor confidence and liquidity conditions are beginning to normalize, creating more predictable frameworks for capital deployment across asset classes.

Bitcoin and Ethereum have already reflected early stabilization, with prices consolidating around $67,000–$68,000 and $1,950–$2,000 respectively. These ran

- Reward

- 2

- 6

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

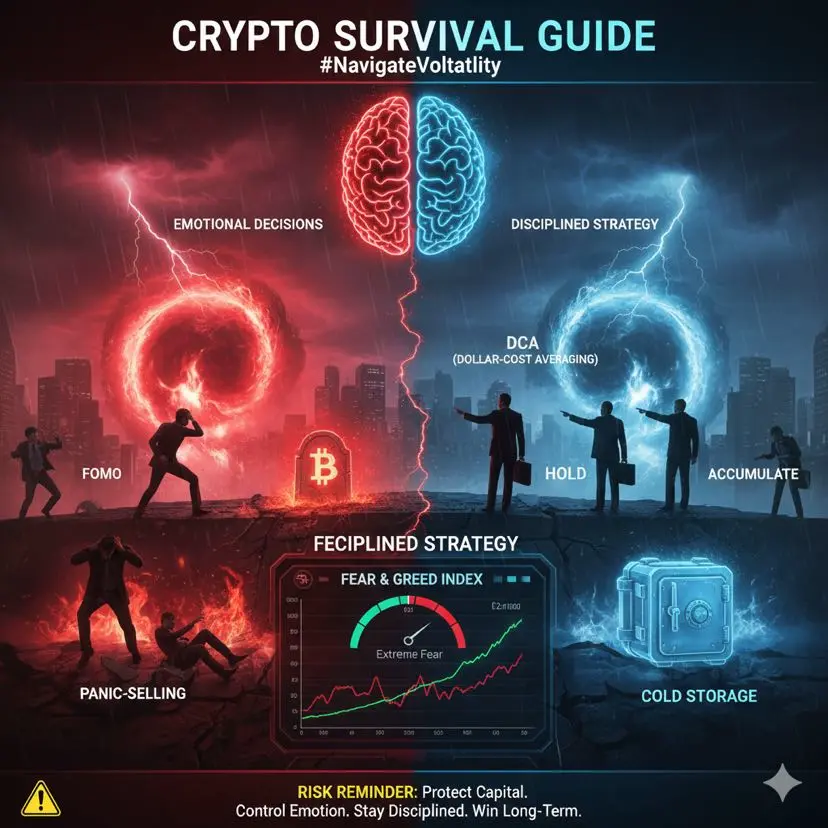

#CryptoSurvivalGuide FutureCryptoSurvivalMindset

The crypto market of the future will remain unforgiving, volatile, and emotionally demanding. Comfort will never be part of the equation. What will continue to separate winners from quitters is not intelligence or prediction skill, but patience, discipline, and the ability to adapt when conditions change. Long-term success will belong to those who treat survival as a strategy, not an afterthought.

Understanding the market environment will remain the first filter for every decision. Future cycles will still rotate between strong trends, deep corr

The crypto market of the future will remain unforgiving, volatile, and emotionally demanding. Comfort will never be part of the equation. What will continue to separate winners from quitters is not intelligence or prediction skill, but patience, discipline, and the ability to adapt when conditions change. Long-term success will belong to those who treat survival as a strategy, not an afterthought.

Understanding the market environment will remain the first filter for every decision. Future cycles will still rotate between strong trends, deep corr

- Reward

- 3

- 8

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#BuyTheDipOrWaitNow? FutureDecisionFrameworkBuyTheDipOrWait

As Bitcoin continues to trade within a tight and volatile range, the question of whether to buy the dip or wait for confirmation will remain a recurring dilemma in future market cycles. This phase reflects a transition zone where fear-driven selling meets cautious accumulation, and price action becomes more about positioning than clear trend direction.

Going forward, consolidation around major psychological levels like $70,000 will likely act as a battlefield between short-term traders and long-term investors. These zones tend to prod

As Bitcoin continues to trade within a tight and volatile range, the question of whether to buy the dip or wait for confirmation will remain a recurring dilemma in future market cycles. This phase reflects a transition zone where fear-driven selling meets cautious accumulation, and price action becomes more about positioning than clear trend direction.

Going forward, consolidation around major psychological levels like $70,000 will likely act as a battlefield between short-term traders and long-term investors. These zones tend to prod

BTC-2,26%

- Reward

- 2

- 6

- Repost

- Share

Peacefulheart :

:

DYOR 🤓View More

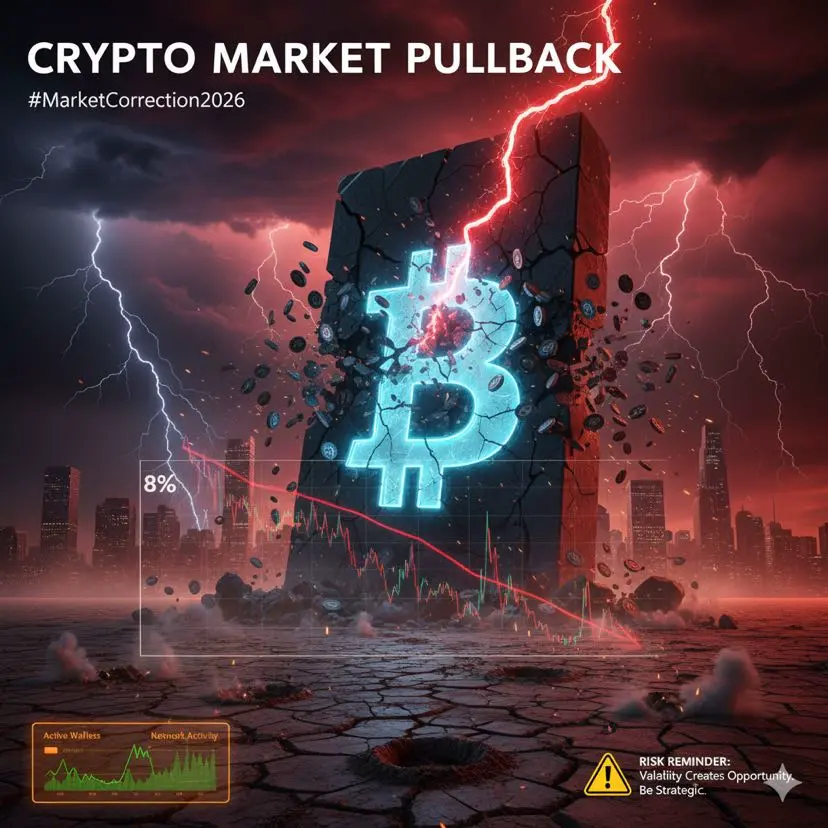

#CryptoMarketPullback FutureOutlookAfterCryptoMarketPullback

As crypto markets continue to mature, pullbacks like the recent one are expected to become a normal and recurring part of the cycle rather than a sign of systemic weakness. Rapid drops in total market capitalization following strong rallies reflect overheated conditions resetting, allowing price discovery to realign with liquidity, risk appetite, and macro realities.

Bitcoin will likely remain the primary driver of market-wide direction in future corrections. As the benchmark asset, its movements will continue to influence altcoins,

As crypto markets continue to mature, pullbacks like the recent one are expected to become a normal and recurring part of the cycle rather than a sign of systemic weakness. Rapid drops in total market capitalization following strong rallies reflect overheated conditions resetting, allowing price discovery to realign with liquidity, risk appetite, and macro realities.

Bitcoin will likely remain the primary driver of market-wide direction in future corrections. As the benchmark asset, its movements will continue to influence altcoins,

BTC-2,26%

- Reward

- 2

- 8

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#BuyTheDipOrWaitNow? #BuyTheDipOrWaitNow? Bitcoin’s price remains stuck in a tight zone near $70,600–$71,100, showing mild upward momentum but still consolidating in the low-to-mid $70k range. In the last 24 hours the price swung between roughly $68,750 and $71,500, showing continued volatility. While there’s a small recovery from recent weekend lows, the price has not yet made a clean breakout above key resistance. Over the past week, Bitcoin has fallen roughly 10–15%, reflecting a broader corrective phase following the strong run earlier in the cycle. Trading volume remains elevated — driven

BTC-2,26%

- Reward

- 2

- 8

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#CryptoSurvivalGuide FutureCryptoSurvivalFramework

As crypto markets evolve and volatility becomes a permanent feature rather than a temporary phase, survival will increasingly define success more than short-term gains. Future market cycles will continue to test discipline, patience, and emotional control, separating prepared participants from those driven by impulse and noise.

In the next phases of Bitcoin’s cycle, deep corrections and prolonged fear periods will remain normal. Price drawdowns of 30–50% after major peaks are not anomalies but structural resets that flush leverage and weak con

As crypto markets evolve and volatility becomes a permanent feature rather than a temporary phase, survival will increasingly define success more than short-term gains. Future market cycles will continue to test discipline, patience, and emotional control, separating prepared participants from those driven by impulse and noise.

In the next phases of Bitcoin’s cycle, deep corrections and prolonged fear periods will remain normal. Price drawdowns of 30–50% after major peaks are not anomalies but structural resets that flush leverage and weak con

BTC-2,26%

- Reward

- 2

- 7

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#CryptoMarketPullback FutureOutlookAfterCryptoMarketPullbacks

Market pullbacks like the current one are likely to become a recurring feature of a maturing crypto ecosystem, especially as digital assets become more tightly linked to global macro conditions and institutional capital flows. Sharp corrections following periods of strong upside will continue to act as pressure valves, resetting sentiment and valuations before the next expansion phase begins.

In the future, Bitcoin will likely maintain its role as the primary volatility transmitter across the market. As the benchmark asset, its reac

Market pullbacks like the current one are likely to become a recurring feature of a maturing crypto ecosystem, especially as digital assets become more tightly linked to global macro conditions and institutional capital flows. Sharp corrections following periods of strong upside will continue to act as pressure valves, resetting sentiment and valuations before the next expansion phase begins.

In the future, Bitcoin will likely maintain its role as the primary volatility transmitter across the market. As the benchmark asset, its reac

BTC-2,26%

- Reward

- 2

- 8

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#GateSquareValentineGiveaway #GateSquareValentineGiveaway – Spread the Love, Win Big! 💖

Valentine’s Day is all about love, surprises, and sharing happiness, and GateSquare is making this season even more special with its exclusive Valentine Giveaway. Whether you are a passionate crypto trader, a loyal platform user, or someone just starting their digital asset journey, this campaign is designed to bring excitement, rewards, and positive vibes to the entire community.

The #GateSquareValentineGiveaway is open to all registered GateSquare users. Both new and existing members are welcome to parti

Valentine’s Day is all about love, surprises, and sharing happiness, and GateSquare is making this season even more special with its exclusive Valentine Giveaway. Whether you are a passionate crypto trader, a loyal platform user, or someone just starting their digital asset journey, this campaign is designed to bring excitement, rewards, and positive vibes to the entire community.

The #GateSquareValentineGiveaway is open to all registered GateSquare users. Both new and existing members are welcome to parti

- Reward

- 2

- 8

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#GlobalTechSell-OffHitsRiskAssets FutureOfInstitutionalOnChainFinance

If CME Group moves forward with launching a CME Token, the future of global financial markets could shift decisively toward blockchain-native infrastructure, redefining how derivatives, collateral, and settlement systems operate at an institutional level. Such a step would mark a transition from crypto being a parallel market to becoming embedded within the core plumbing of traditional finance.

In the coming years, a CME Token could evolve into a foundational settlement layer for institutional trading, enabling near-instant

If CME Group moves forward with launching a CME Token, the future of global financial markets could shift decisively toward blockchain-native infrastructure, redefining how derivatives, collateral, and settlement systems operate at an institutional level. Such a step would mark a transition from crypto being a parallel market to becoming embedded within the core plumbing of traditional finance.

In the coming years, a CME Token could evolve into a foundational settlement layer for institutional trading, enabling near-instant

- Reward

- 3

- 9

- Repost

- Share

Peacefulheart :

:

DYOR 🤓View More

#CMEGroupPlansCMEToken FutureOfInstitutionalOnChainFinance

If CME Group moves forward with launching a CME Token, the future of global financial markets could shift decisively toward blockchain-native infrastructure, redefining how derivatives, collateral, and settlement systems operate at an institutional level. Such a step would mark a transition from crypto being a parallel market to becoming embedded within the core plumbing of traditional finance.

In the coming years, a CME Token could evolve into a foundational settlement layer for institutional trading, enabling near-instant margin adju

If CME Group moves forward with launching a CME Token, the future of global financial markets could shift decisively toward blockchain-native infrastructure, redefining how derivatives, collateral, and settlement systems operate at an institutional level. Such a step would mark a transition from crypto being a parallel market to becoming embedded within the core plumbing of traditional finance.

In the coming years, a CME Token could evolve into a foundational settlement layer for institutional trading, enabling near-instant margin adju

- Reward

- 3

- 10

- Repost

- Share

Peacefulheart :

:

Watching Closely 🔍️View More

#BitwiseFilesforUNISpotETF FutureOfDeFiETFsAndInstitutionalAdoption

The filing of a proposed spot ETF linked to Uniswap signals a future where decentralized finance assets increasingly sit alongside traditional investment products, accelerating the integration of on-chain protocols into regulated financial markets. As institutional frameworks mature, exposure to DeFi governance tokens may become a normalized part of diversified portfolios rather than a niche allocation.

Looking ahead, the significance of a UNI-focused ETF extends beyond Uniswap itself. It represents a broader validation of app

The filing of a proposed spot ETF linked to Uniswap signals a future where decentralized finance assets increasingly sit alongside traditional investment products, accelerating the integration of on-chain protocols into regulated financial markets. As institutional frameworks mature, exposure to DeFi governance tokens may become a normalized part of diversified portfolios rather than a niche allocation.

Looking ahead, the significance of a UNI-focused ETF extends beyond Uniswap itself. It represents a broader validation of app

UNI-4,72%

- Reward

- 3

- 10

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#WhyAreGoldStocksandBTCFallingTogether? #FutureMarketCorrelationShift

As global markets move deeper into a macro-driven cycle, the simultaneous weakness in gold stocks and Bitcoin is likely to remain a defining feature of the next phase, challenging long-held assumptions about diversification and safe-haven behavior. In an environment dominated by liquidity, policy expectations, and real yields, traditional narratives are increasingly overridden by capital flow dynamics rather than asset-specific stories.

Rising and persistently elevated interest rates will continue to pressure non-yielding as

As global markets move deeper into a macro-driven cycle, the simultaneous weakness in gold stocks and Bitcoin is likely to remain a defining feature of the next phase, challenging long-held assumptions about diversification and safe-haven behavior. In an environment dominated by liquidity, policy expectations, and real yields, traditional narratives are increasingly overridden by capital flow dynamics rather than asset-specific stories.

Rising and persistently elevated interest rates will continue to pressure non-yielding as

BTC-2,26%

- Reward

- 3

- 10

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#TopCoinsRisingAgainsttheTrend #FutureOutperformersInWeakMarkets

As crypto markets move through cycles of uncertainty and correction, the next phase will continue to highlight a familiar pattern: while the majority of assets struggle under selling pressure, a smaller group of high-quality projects quietly builds strength and attracts long-term capital. These future outperformers will not rely on hype alone but on measurable progress, real usage, and strategic positioning within the broader blockchain economy.

Solana is likely to remain a core example of relative strength in the years ahead, dr

As crypto markets move through cycles of uncertainty and correction, the next phase will continue to highlight a familiar pattern: while the majority of assets struggle under selling pressure, a smaller group of high-quality projects quietly builds strength and attracts long-term capital. These future outperformers will not rely on hype alone but on measurable progress, real usage, and strategic positioning within the broader blockchain economy.

Solana is likely to remain a core example of relative strength in the years ahead, dr

- Reward

- 3

- 9

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

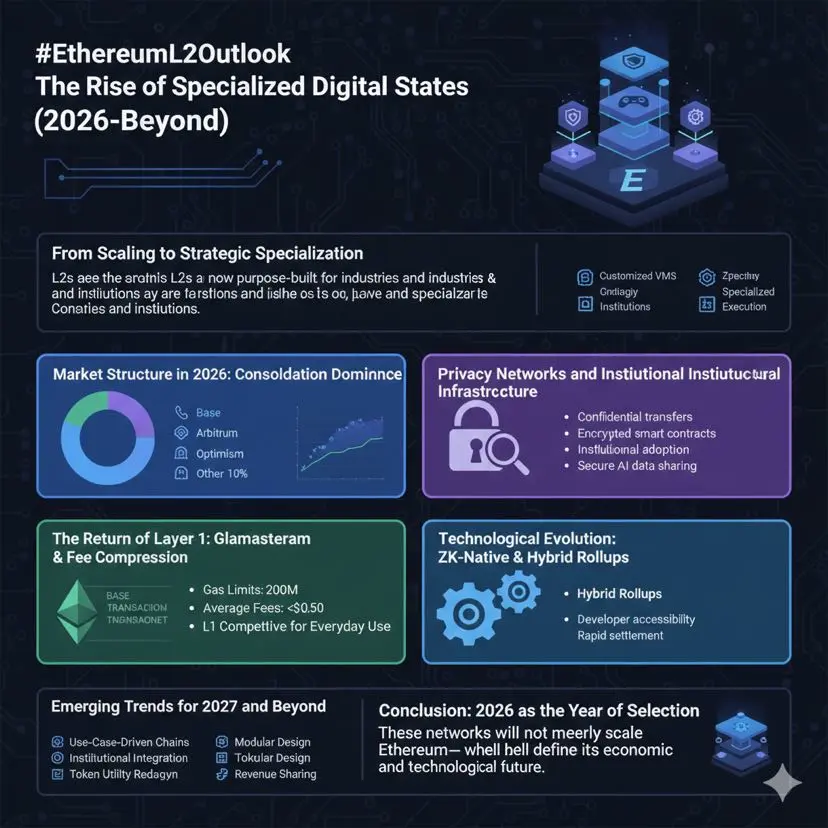

#EthereumL2Outlook EthereumL2OutlookTheRiseOfSpecializedDigitalStates2026Beyond

By2026 the Ethereum ecosystem has moved far beyond early scalability struggles what once revolved around cheaper transactions has evolved into specialized digital states where Layer2 L2 networks operate as independent economic and technological zones within Ethereum’s broader framework L2s are no longer simple extensions of mainnet they are purpose-built platforms optimized for industries user groups and institutional requirements

FromScalingToStrategicSpecialization in early 2026 Vitalik Buterin emphasized that sc

By2026 the Ethereum ecosystem has moved far beyond early scalability struggles what once revolved around cheaper transactions has evolved into specialized digital states where Layer2 L2 networks operate as independent economic and technological zones within Ethereum’s broader framework L2s are no longer simple extensions of mainnet they are purpose-built platforms optimized for industries user groups and institutional requirements

FromScalingToStrategicSpecialization in early 2026 Vitalik Buterin emphasized that sc

- Reward

- 5

- 12

- Repost

- Share

repanzal :

:

Happy New Year! 🤑View More

#CryptoMarketStructureUpdate CryptoMarketStructureUpdateStructuralEvolutionAndStrategicContext2026Outlook

The crypto market is undergoing a profound structural transformation driven by growing institutional participation shifting liquidity regimes macroeconomic pressure and unprecedented transparency in on-chain data in this environment price action alone is no longer sufficient deeper structural forces including capital rotation leverage dynamics and long-term positioning dominate trend formation Bitcoin remains the central anchor while altcoins increasingly differentiate based on real utilit

The crypto market is undergoing a profound structural transformation driven by growing institutional participation shifting liquidity regimes macroeconomic pressure and unprecedented transparency in on-chain data in this environment price action alone is no longer sufficient deeper structural forces including capital rotation leverage dynamics and long-term positioning dominate trend formation Bitcoin remains the central anchor while altcoins increasingly differentiate based on real utilit

- Reward

- 4

- 13

- Repost

- Share

MrThanks77 :

:

hold tightView More

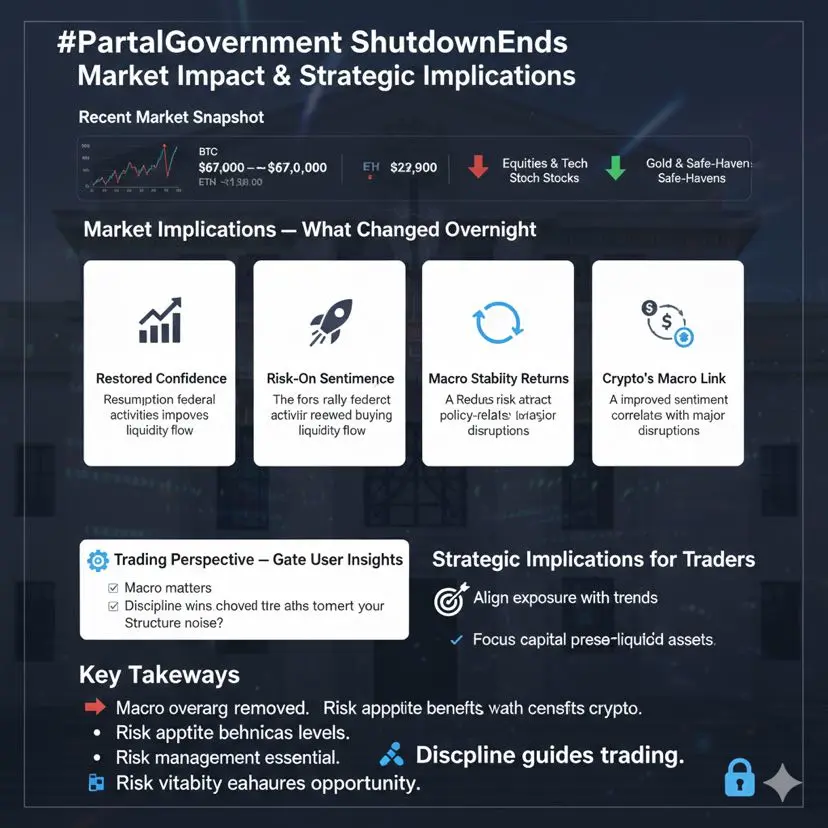

#PartialGovernmentShutdownEnds PartialGovernmentShutdownEndsMarketImpactAndStrategicImplications

The recent partial government shutdown in the United States has officially concluded restoring normal federal operations and removing a key source of macro uncertainty while the direct economic impact was limited its resolution has already influenced investor psychology and capital flows particularly across risk assets such as equities and crypto

RecentMarketSnapshot Bitcoin BTC trades around 67000 to 68000 showing moderate recovery after recent volatility Ethereum ETH ranges near 1950 to 2000 stab

The recent partial government shutdown in the United States has officially concluded restoring normal federal operations and removing a key source of macro uncertainty while the direct economic impact was limited its resolution has already influenced investor psychology and capital flows particularly across risk assets such as equities and crypto

RecentMarketSnapshot Bitcoin BTC trades around 67000 to 68000 showing moderate recovery after recent volatility Ethereum ETH ranges near 1950 to 2000 stab

- Reward

- 6

- 11

- Repost

- Share

MrThanks77 :

:

1000x vibesView More

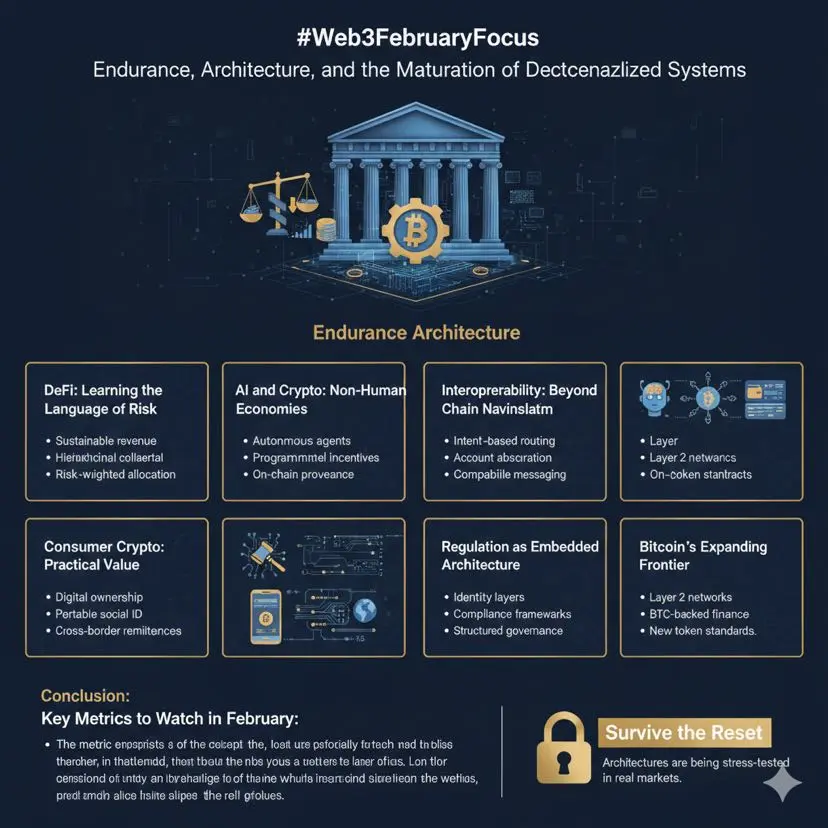

#Web3FebruaryFocus Web3FebruaryFocusEnduranceArchitectureAndTheMaturationOfDecentralizedSystems

Web3 has entered a phase that appears quiet on the surface yet represents a critical inflection point beneath it the era where narratives hype and viral attention could sustain entire ecosystems is fading the central question is no longer whether ideas are novel but whether they can withstand regulatory technical economic and human scrutiny February is less about another speculative cycle and more about endurance testing whether architectures built over the last decade can function as durable infras

Web3 has entered a phase that appears quiet on the surface yet represents a critical inflection point beneath it the era where narratives hype and viral attention could sustain entire ecosystems is fading the central question is no longer whether ideas are novel but whether they can withstand regulatory technical economic and human scrutiny February is less about another speculative cycle and more about endurance testing whether architectures built over the last decade can function as durable infras

- Reward

- 2

- 9

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#FedLeadershipImpact FedLeadershipImpactMonetarySignalsAndCryptoMarketDynamics

Recent developments surrounding Federal Reserve leadership and monetary policy guidance continue to shape global financial markets changes in tone policy direction or leadership structure influence interest rates liquidity conditions and investor confidence factors that directly affect risk assets including cryptocurrencies as crypto becomes more integrated with traditional financial systems understanding the Federal Reserve’s role is no longer optional it is now a core component of effective market analysis and ris

Recent developments surrounding Federal Reserve leadership and monetary policy guidance continue to shape global financial markets changes in tone policy direction or leadership structure influence interest rates liquidity conditions and investor confidence factors that directly affect risk assets including cryptocurrencies as crypto becomes more integrated with traditional financial systems understanding the Federal Reserve’s role is no longer optional it is now a core component of effective market analysis and ris

- Reward

- 4

- 9

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#BuyTheDipOrWaitNow? BuyTheDipOrWaitNowEthereumL2PowerShiftAndMarketPositioning2026Outlook

The Ethereum Layer 2 ecosystem in 2026 is no longer defined by experimentation or speculative growth it is now shaped by distribution power institutional infrastructure and settlement-layer efficiency for investors and traders this reframes the core question is this a dip worth buying or a phase requiring patience and structural confirmation understanding the evolving L2 hierarchy is essential before making allocation decisions

TheBaseTakeoverWhenDistributionWins while Arbitrum and Optimism spent years c

The Ethereum Layer 2 ecosystem in 2026 is no longer defined by experimentation or speculative growth it is now shaped by distribution power institutional infrastructure and settlement-layer efficiency for investors and traders this reframes the core question is this a dip worth buying or a phase requiring patience and structural confirmation understanding the evolving L2 hierarchy is essential before making allocation decisions

TheBaseTakeoverWhenDistributionWins while Arbitrum and Optimism spent years c

- Reward

- 4

- 7

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More